Table of Contents

European crypto companies are currently operating in the changing regulatory environment. The amendment of the 5th Anti-Money Laundering Directive (AMLD5) has significantly changed the regulations of crypto transactions in the region. Some EU crypto exchanges even announced their plans for relocation following too high barriers put on the majority of traders in the EU. Our research will shed light on the existent EU crypto regulations, the prospects of crypto exchanges in several EU countries and analyze the popular crypto exchanges in the EU, including the anonymous ones.

Although AMLD5 is not quite crypto-specific, the law enforces crypto exchanges to comply with Know Your Customer (KYC) rules and hence abandoned the anonymity of crypto transactions. Under such circumstances, the popularity of anonymous crypto exchanges with non-EU jurisdiction raises and more EU citizens are looking for alternatives to the existent exchanges caring about personal data security.

Analysis of the European crypto market and EU crypto exchanges

Doing an examination of an EU crypto market it is important to investigate it within the framework of the world market. In 2017, Cambridge University discharged an examination that the EU market has followed the path of on the worldwide cryptocurrency trends. As indicated by the report, Europe is the district with the most cryptocurrency exchange platforms.

A large number of these digital currency stages that permit fiat exchanges likewise offer SEPA transfer as payment method. SEPA represents Single Euro Payments Area which fundamentally brings in worldwide cash move inside the EU to be proportional to household cash move inside a European nation. When utilizing SEPA move for crypto trade/exchange, it is as a rule at no expense. This makes it an alluring recommendation for some Europeans in the crypto showcase. The volume of SEPA crypto exchanges has had the option to set up the Euro as the second most utilized fiat currency in crypto exchanges after the dollar.

Like in numerous different locations, most European crypto exchange administrations are in charge of the private keys of their clients deposited on the platforms. Therefore, they are constantly an objective for scammers and cybercriminals. So as to relieve against the hazard, numerous European cryptocurrency platforms keep the greater part of their crypto deposits in cold wallets. A portion of the well known European crypto exchanges incorporates Bitsane, Bitpanda, Kraken, and Bitstamp. The major cryptocurrencies like BTC, LTC, ETH, XRP, and BCH are bolstered by numerous European crypto exchanges.

Wallet Services in EU crypto exchanges

Returning to the 2017 Cambridge investigation of the worldwide crypto market, there are more Wallet suppliers situated in Europe than anyplace else on the planet. European wallet suppliers represent 42 percent of the complete number of wallet suppliers in the worldwide crypto market. This reality isn’t in any capacity astounding seeing as the district has the most noteworthy number of crypto exchanges. Most exchange platforms additionally give wallet administrations, yet it is constantly fitting not to hold a lot of cryptos on online wallet administrations.

Regardless of the way that Europe holds the biggest number of wallet suppliers and crypto exchanges, most of the wallet clients don’t originate from Europe. Huge numbers of them originate from Asia-Pacific and the Middle East. With the sweeping boycott forced by China on trade stages, numerous Chinese had to turn to outside crypto exchanges and their wallet administrations. The European wallet clients as far as concerns them want to utilize moderately little wallet suppliers as per the Cambridge report.

Crypto regulations on European crypto exchange

The EU and the ECB have as of late been endeavoring to bring guidelines into the digital currency showcase. Since 2017, there have been endeavors on numerous fronts both national and provincial to make a progressively managed European cryptocurrency market. As usual, the assurance of the Euro is an indispensable part of the exercises of the EU and ECB. Despite the fact that not yet distinguished as a genuine danger to the solidness and estimation of the Euro, there have been moves to weaken the impact of cryptocurrency in the local market.

In 2017, the EU Parliament passed goals to bring guidelines into the cryptocurrency market. Both UK and EU money related controllers have been clamoring for progressively strong KYC and AML guidelines for the crypto transactions. The risk of cryptocurrency being utilized for unlawful and criminal operations like illegal tax avoidance, tax avoidance, and psychological militant subsidizing remains ever-present. Europe has endured various destroying psychological oppressor assaults as of late and specialists are resolved to ensure the digital currency advertise isn’t being abused by fear-based oppressors to pipe cash for their activities.

On a national level, nations like France, the UK, Portugal, and Germany have all upheld the call for stricter guidelines in the market. France has even made a working gathering that will encourage the foundation of guidelines inside the nation’s crypto regulation. Finally, The AMLD5 was released in January 2020, having a fundamental effect on the crypto business is that all EU part states must actualize AML guidelines. These trades will currently be required to follow Know Your Customer (KYC) rules for checking client exchanges and document suspicious movement reports.

Clients experience KYC forms by giving archives as evidence of personality. This will guarantee clients “are who they state they are,” former United States Treasury Anti-Money Laundering (AML) specialist Carlisle explains, “and that they’re authentic and not endeavoring to mishandle the stage for noxious purposes.”

Crypto organizations in the EU have so far had the option to offer their types of assistance with no AML and KYC controls set up. This has made a serious issue, Carlisle clarified. “It influences a great deal of the huge U.S. trades, like Coinbase, that were at that point subject to guideline somewhere else. A significant number of them as of now do, as a result, agree to AML prerequisites.”

However numerous EU organizations are not following security techniques that have for quite some time been viewed as the business standard in different areas. The new guidelines set a characterized standard over the EU that builds up a level playing field for all contenders.

The guideline will, in general, be an agony point for crypto exchanges in the short term — they should ingest new expenses to ensure they’re consistent. Be that as it may, in the medium and long run, guideline empowers reception and accomplishment for the organizations who decide to grasp it.

Finding the possibility to achieve correct trade-off between client protection and administrative security may likewise end up being a long-term challenge. It is a test that may end up being overwhelming for certain traders. As the cutoff time draws near, organizations must explore through a conceivably overpowering labyrinth of administrative varieties. For a portion of these organizations, there is a lot of work left to do, and not a ton of time remaining. At the same time, many EU customers are currently looking for an alternative to the crypto platforms they used in the previous period. Their major concern is the anonymity of crypto transactions especially when they are not newcomers to the market and trade large volumes of crypto.

Why do EU crypto traders care about anonymity?

In fact, the EU crypto markets were more anonymous than the USA and Asian ones for many years. The customers are accustomed to financial freedom and their anonymity has led to the substantial development of crypto transactions in previous years. For many European investors, crypto exchanges meant freedom from branks and any other authorities in control of their transactions.

With new regulations in place, their concerns have risen due to several factors:

- Illegal transactions – the regulators confirm that the main reason for the KYC rules implementation is the criminal activities on the crypto market, but the disclosure of personal data does not protect from cybercriminals. Ordinary investors are not ready to open their private data to the public. Under such circumstances, anonymous EU crypto exchanges like Godex seem a great alternative as they don’t provide wallet addresses for their users. Instead, users use their own personal wallets or those provided by custodial exchanges. This means the exchange itself doesn’t store any cryptocurrency, which makes it a much less appealing target for potential hackers.

- Blacklisting – there are concerns that governmental regulation will force some of the altcoins to disappear from the market. Privacy altcoins such as Monero, Dash and Zcash are in a tedious position following the concerns of the ban on crypto-to-crypto exchanges.

- Just privacy – cryptocurrency transactions have been a symbol of financial freedom for long-term periods in the EU and many investors still want to keep their data private. The pro-cryptocurrency regions such as Maltesian are in much concern of the recent regulations, taking their focus on the development of crypto startups in the region.

The anonymous EU crypto exchange seems the best possible solution to the described concerns. This approach has several advantages over others. In the first place, you do not have to subscribe to their networks and provide any personal information. In the second place, you can start trading right away. There is no verification process within such applications. It can be extremely important if you have in your portfolio some highly volatile coins and you plan to earn during the pump/dump periods.

Read more about Best anonymous crypto exchange in 2020

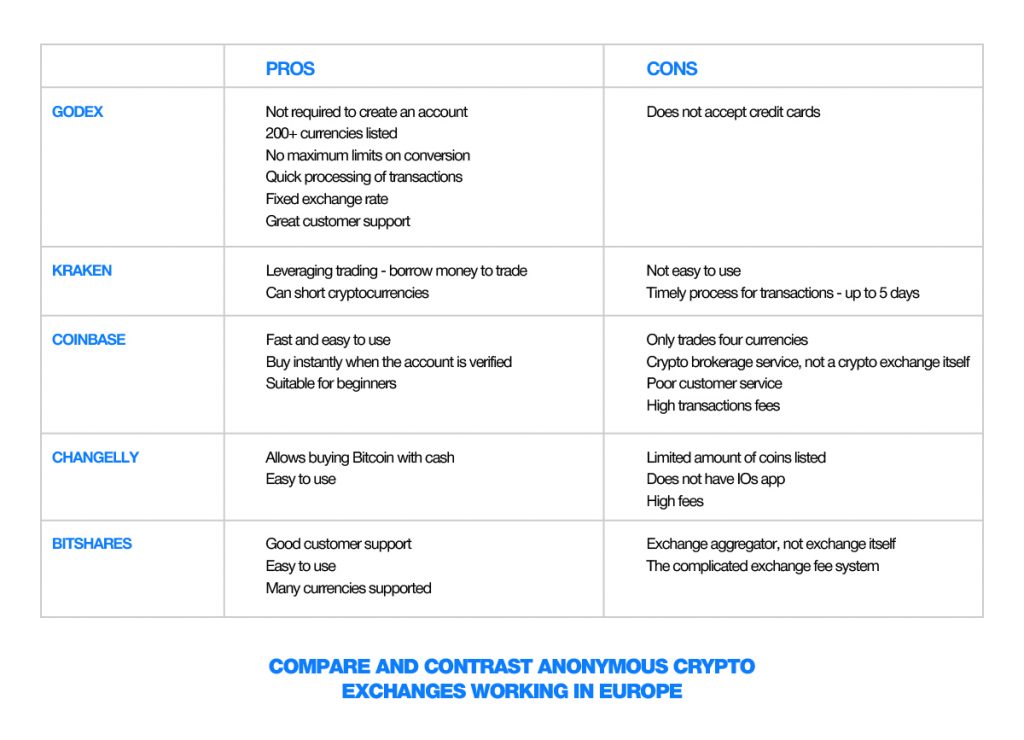

Compare and contrast anonymous crypto exchanges working in Europe

For your convenience, we prepared the comparison of the major anonymous crypto exchanges. Using this information you can easily define the one directly fitting your requirements.

Godex.io is one of the few exchangers who still believes that KYC rules contradict the original idea of anonymity in the cryptocurrency world. Seller only asks you for a recipient address to send exchanged coins, and even these data are deleted within a week. The price of the transaction is fixed being an additional advantage. The customers outline this exchange for professional service & assistance in transactions on a 24/7 basis.

Check Step by step guide how to exchange crypto fast and secure with Godex.io

Kraken is one of the most seasoned and most well known cryptographic money trades right now in the task. The trade has assembled popularity for being a protected goal for anybody keen on exchanging cryptographic forms of money and it is likewise a prevalent decision for the brokers and institutions over an assortment of areas. Kraken holds a worldwide intrigue and gives effective exchanging openings to various fiat monetary standards.

Coinbase is actually not a crypto exchange itself, but a brokerage service. But, it works very fast, allowing to make transactions right after account verification. It is perfect for beginners taking into account intuitive interface and fast transactions. At the same time, transaction fees are rather high, for example in comparison to GoDex or Kraken.

Changelly is among the more well known “instant” digital currency exchanges. Since 2015, Changelly has increased more than 1.5 million enrolled clients around the world. With more than 90 altcoins to trade or purchase, Changelly has a not insignificant rundown of exchanging sets to offer clients. It prides itself on quick exchanges, account security, top trade rates, and simple to utilize and natural interface.

BitShares is venture money with its advanced cash, BTS. With BitShares, clients can exchange and put resources into a boundless rundown of benefits while exploiting the blockchain’s security. BitShares has the highlights you anticipate from a conventional exchanging platform, yet with the additional focal points of digital money and blockchain advancements, for example, decentralization.

If you are among EU investors who are not supporting KYC rules introduction on all major crypto exchanges and care about the liquidity of your funds we recommend thinking over one of the anonymous alternatives. These exchanges will prevent the leakage of your personal information and will keep personal transactions private. Of course, it is still essential to care about individual data protection like strong passwords, special fraud protection software and keeping your crypto keys in private. At the same time, if you protect your online transactions from your side, the anonymous crypto exchange like GoDex will do everything else for you. We at Godex.io care much about these issues and our customer reviews confirm our extreme care about your online security.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]