Table of Contents

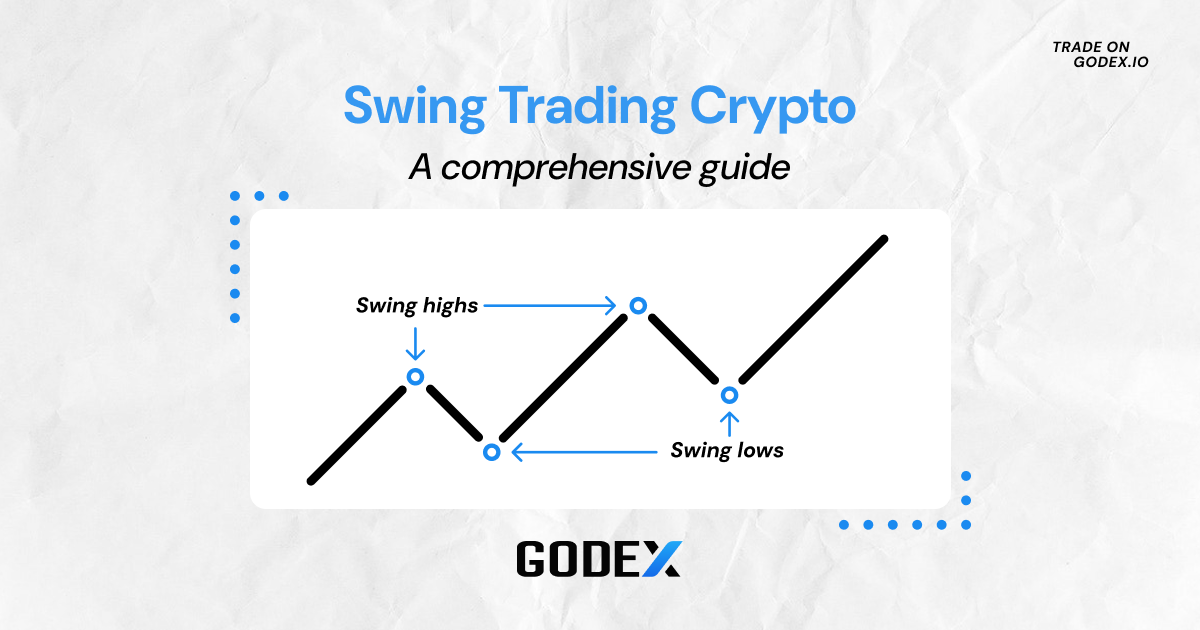

Ever wondered what is swing trading crypto all about? It’s all about taking advantage of the most potentially profitable price swings offered by the volatile crypto market. This strategy allows you to buy low and sell high within days or weeks, while using market trends and technical analysis to make informed trades, minimize risks and maximize gains. If you’re ready to make the most of the price volatility of cryptocurrencies and capture the rapid gains in the most strategic manner, swing crypto trading is your best bet. Whether you like the thrill of investing in digital currencies, fancy yourself an experienced trader or simply want to see quick returns, this trading technique is undoubtedly worth considering. Let us show you the ropes and tell you more on the subject.

Crypto Swing Trading: Pros and Cons

It would be cheating to hide the fact that crypto swing trading is not an ideal way to profit from digital currency. While it offers several benefits, it also comes with its own set of challenges. And like any trading method, it requires careful consideration and strategy to navigate its risks and rewards.

Pros of Crypto Swing Trading:

Trading period: Swing trading strikes a balance between the extremely quick pace that day trading or scalping implies and the giant magnitude of position trading. Swing traders of crypto may not need to stick to their screens to watch the market constantly, hoping to sell assets sometime. They trade in the midterm ranges. Hence, unlike position traders, they do not have to buy and store those assets for years.

Simplicity: You can try to trade in the short term with the most straightforward tool because swing trading is the way to get access to everyone. It requires not a massive number of tools and instruments; still, you have to develop and dive into fundamental analysis to determine the stock’s intrinsic value. However, here, relying solely on technical analysis tools, especially on price patterns, and using large volumes gets the best results.

Agility and Flexibility: Unlike position trading, where you’re committed to holding assets for extended periods, swing trading allows traders to make quick decisions, buying or selling for small gains or losses to optimize their strategy at any given time. This flexibility means you don’t need to hold onto assets for years; instead, a few weeks can suffice, opening up opportunities to profit from virtually any cryptocurrency.

Cons of Crypto Swing Trading:

Unsupervised Open Positions: Leaving positions open without continuous monitoring, especially during off-hours, can lead to significant risks. Market movements can be unpredictable, and sudden changes can result in unexpected losses if not promptly addressed.

After-Hours Risks: Swing traders must contend with the risks associated with overnight and weekend market activity. Market conditions can change dramatically outside of regular trading hours, potentially leading to substantial losses if a trader is not prepared.

Steep Learning Curve: Swing trading requires a deep understanding of complex candlestick patterns, numerous technical indicators, and overall market dynamics. This demands a significant investment of time and effort to master, making it challenging for beginners.

How to Start Swing Trading Crypto?

Getting started with swing trading crypto can be both exciting and rewarding, but it requires a strategic approach. First things first, you have to find a good platform. When it comes to swing trading you need a platform that not only provides security but also the maximum number of possible useful tools. Trading bots, real-time data tracking, advanced charting – all of these can be quite helpful.

Once you have your platform set up, the next step is to identify promising cryptocurrencies to trade. Swing trading crypto is based primarily on your ability to predict both price peaks and price dips. In order to pick a specific cryptocurrency that will be most beneficial to swing trade you have to learn to do both technical and fundamental analysis. Technical analysis is based on the study of charts and price indicators that help predict prices at a certain point in the future. Fundamental analysis does not deal with charting but rather all the factors that contribute to the overall value of a specific cryptocurrency. It includes evaluations of a coin’s technology, team member qualifications, market potential, etc.

After you have chosen a few cryptocurrencies you are willing to trade – add them to your watchlist on a site like CoinMarketCap. Regularly analyze news, social media trends, and price movements. Your goal as a swing trader is twofold – you need to be able to identify the current market trends and predict potential upcoming ones. You can do so by analyzing different signals that will show you the best times to get into a trade during a pullback and exit during a spike. You also need to master swing trading crypto strategies. Some of the most successful swing traders utilize a combination of different strategies.

Crypto Swing Trading Strategies

Crypto swing trading strategies offer dynamic ways to capitalize on the market’s natural ebb and flow. By understanding and leveraging these strategies, traders can maximize their profits. Here are the best ones:

Breakout Swing Strategy

It is the best crypto swing trading strategy to use when a downtrend is approaching its end. The gist is to leverage breakout moments when the price moves above a resistance level. For it to be successful, traders should apply indicators and analyze patterns that signal an upcoming uptrend. The only action they take is purchasing an asset and then selling it at a higher price. This trading strategy can provide high payoffs because the crypto market offers numerous breakouts in comparison to other markets. Nevertheless, it is also dangerous since a trader should accurately predict support and resistance levels and understand trend reversal patterns.

Breakdown Swing Strategy

This is a reversal strategy that operates on a different side but shares the same principle. Its application aims at the cessation of an uptrend at the most favorable time for a trader. Thus, they watch the price decrease below the support line and only after that, they establish a short position. Sitting is the same as for the previous strategy. When a downtrend is predicted, it is time to act, and high potential rewards are expected. Nevertheless, it is challenging in terms of a skill set and the ability to think critically to understand the main reasons.

Trend-Catching Strategy

Its relevance lies in the need not to anticipate the further changes in value. The goal of the strategy is to understand the trend that currently plays out, and for this goal, a trader makes several short hours-long trades before a u-turn. A trader should be confident that the trend is not just a price hike caused by an external factor. The strategy is highly useful, but it is challenging to predict the time for the current trade and whether a trader purchases or sells an asset. Thus, it is also risky, and payoffs can differ.

Fading Trading Strategy

It is applicable for a trader who is confident that they can countertrade comprising trade against the general market sentiment. This means that if the majority sells, a trader should purchase and vice versa. This type of trading is also applicable to the crypto market because there are many quite continuous corrections that allow traders to earn. However, in comparison to other strategies, this is the riskiest one and only very experienced traders with high self-discipline and experience can use it.

Top Tools for Crypto Swing Traders

Using the right tools in crypto swing trading is crucial for success. Imagine trying to navigate a dense forest without a map or compass — completely absurd and bound to lead to trouble, right? Similarly, trading without the proper tools can leave you lost in the volatile crypto market. Trading tools provide the insights needed to make informed decisions. They help you identify trends, analyze data, and predict possible future movements. It can provide you with predictive analytics and even take action automatically – and boost your success rate through the roof. Here are some top tools for crypto swing traders:

Analysis Tools

Analysis tools are the backbone of effective trading. There are many platforms that allow you to draw and use a plethora of charts for visualization, such as TradingView and CoinMarketCap. These tools are essential since they provide you with the historical data you need to create the strategies. Back-testing of these strategies allows you to discard the ones that failed and to develop the ones that will not fail in the future.

Technical Indicators

Technical indicators are crucial for timing your trades. Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands are some of the most popular indicators among swing traders. Moving Averages help identify the direction of a trend, RSI indicates overbought or oversold conditions, and Bollinger Bands highlight potential price volatility. Using them all together, you can have a pretty clear picture of what is waiting for you on the market.

Market Data

Accurate and real-time market data is vital for crypto swing trading. You can get it from popular sources like CoinGecko, CryptoCompare, and others. They will provide you with real-time update data of the prices of the assets, their trading volumes, and market cap. What is more, tools driven by AI can analyze the huge amounts of data from the market to forecast the most likely scenario.

Choosing the Best Cryptocurrency for Swing Trading

Picking the right crypto for swing trading is critical for your success. First and foremost, pay attention to the liquidity of the coin. High liquidity tells you that it will be easy to open and close positions, as large orders will not have a big impact on the price. The leading digital assets in this regard will be Bitcoin and Ethereum, as they have the biggest trading volumes and have been on the market for longer.

The second-most important criterion is the volatility of the cryptocurrency. Swing trading relies upon swings to realize profits, so you will want to look at how much the asset will move within a short period. Some of the altcoins that typically have the volatility swing trading thrives on are Cardano and Polkadot.

Check the news and development of a cryptocurrency. The best coins to swing trade are those with large and active dev teams, frequent updates, and a growing community. Staying active on social media and reading news sources will give you information on the current trends in a market, upcoming specific strengths and weaknesses, and possible price movements. You must also perform technical analysis. Use charting tools to examine the price action of your chosen coins on a variety of time scales. Look for cryptocurrencies that behave smoothly and consistently. This will help you make a rational judgment and improve the quality of your trades.

The final tip is to not rely on one coin. Diversify your picks and do not spend all your capital on a single coin. Use liquidity, volatility, news, technical analysis, and your wallet and the best cryptocurrencies for swing trading.

Conclusion

In crypto swing trading, you take advantage of the market’s volatility in a strategic way that optimizes profit-making. Thus, always ensure that you master the right strategies and tools required to make highly informed trades in the market. However, remember the success in this financial trading method calls for a continuous learning process, which should be backed by a keen analysis of the trends and a highly disciplined execution of trades. The point is that regardless of your experience in stock or financial trading, the benefits gained from learning and mastering the strategies make it worthwhile. So, why not get started, stay updated and trade great?

FAQ

Can Crypto Swing Trading Be Profitable?

Yes, crypto swing trading can be profitable. It leverages market volatility to capture gains from short to mid-term price movements. With the right strategies and tools, traders can maximize their profits and manage risks effectively.

What Are the Risks in Crypto Swing Trading?

The most critical risk involves a risk of loss. If the profit is not taken, then there is a probability of losing the value of the asset as the market is fluctuating. There is also a possibility of overnight and weekend changes in the market which can turn profitable positions into negative ones.

How to Evaluate the Effectiveness of a Swing Trading Strategy?

It can be evaluated by keeping track of all the trades. It is possible to calculate the win-loss ratio. Subsequently, it is also possible to calculate the overall profit percentage by comparing how much was lost and how much was gained in the process. After comparing data, it can be useful to revise the strategy according to the currently obtained results.

Are there specific timeframes that are more suitable for crypto swing trading?

Yes, 4-hour and daily charts are believed to bring better results in swing trading of cryptocurrency. They can capture the large swings without much noise that is possible to occur within shorter periods.

Are there certain cryptocurrencies that are considered more favorable for swing trading?

Aside from the high liquidity of Bitcoins and ETHs in the current market, there are no specific best swing trading coins. To begin with, these coins pose high stakes regarding predictability, while their market trends are easier to look at and access accordingly.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]