Table of Contents

HODL, a term that has become a staple in the crypto community, is a unique phenomenon where mistakes are not just forgiven but celebrated. Its origin is rather amusing, akin to a serendipitous twist in the world of cryptocurrency jargon.

HODL Meaning

HODL, a delightful quirk in the crypto-sphere, originated from a typo in a forum post where the author meant to say “hold.” Instead of facing a virtual slap on the wrist, the crypto community embraced this typo with open arms, turning it into a rallying cry for steadfastness in the volatile world of digital assets.

HODL swiftly transcended its typo origins, with some imaginative minds attributing a deeper meaning to the seemingly random arrangement of letters. They coined it as an acronym for “hold on for dear life.” Though the letters “HODL” lack inherent significance, the crypto community breathed life into them, paralleling the way value is assigned to diverse digital assets.

The beauty of HODL lies in its lack of inherent meaning, mirroring the curious nature of cryptocurrencies themselves. Much like the way digital assets gain value through collective belief, the crypto community bestowed purpose upon this typo-gone-viral. It’s a reminder that sometimes, mistakes can lead to something unexpectedly valuable.

So, the next time someone asks, “What is HODL?” you can confidently share the tale of a typo turned into a symbol of unwavering commitment in the ever-evolving landscape of cryptocurrency. After all, in the crypto realm, holding on for dear life can be more than just a strategy—it’s a philosophy.

HODL in Cryptocurrencies Investing Strategy

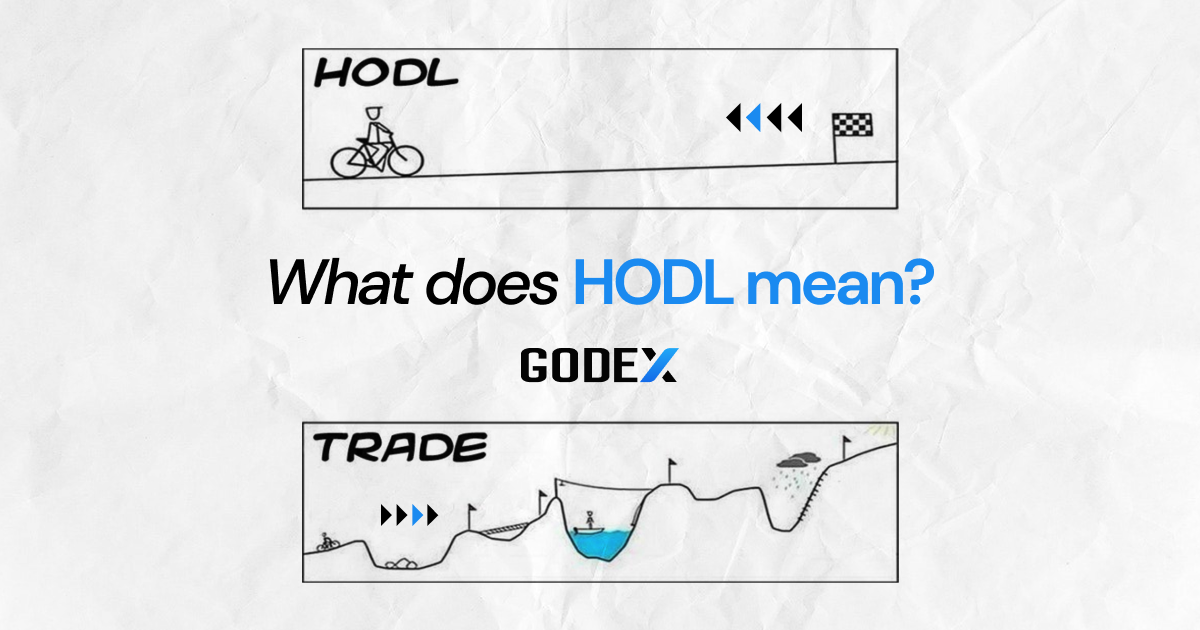

The essence of HODLing lies in procuring a cryptocurrency and resolutely retaining it for an extended timeframe, undeterred by the ebb and flow of short-term market dynamics. Unlike the rapid maneuvers of day traders, fixated on seizing immediate price opportunities, HODLers exhibit a resolute commitment, resiliently enduring the market’s tumultuous journey.

The concept of HODLing may not suit every crypto investor or every crypto asset. Proficient traders often struggle to time short-term trades, and psychological biases can cloud decision-making. Yet, for those who adopt the HODL mindset, the emphasis lies on patience and resilience.

Investors keen on employing the HODL strategy should set clear goals and stay vigilant for systemic risks within the ever-evolving crypto space. Just as in traditional stock market investing, committing funds for the foreseeable future—perhaps at least five years—can be a prudent approach. The crypto market, known for its extreme volatility, demands even greater patience, as highlighted by the impressive long-term gains witnessed in Bitcoin over the past decade. While not all cryptocurrencies are suited for the HODL strategy, those within the top 50-100 by market capitalization often present viable options for long-term storage.

Beyond the potential for financial gains, HODLing opens up additional avenues for crypto enthusiasts. Staking, a mechanism rewarding holders for supporting blockchain stability, and crypto farming, involving liquidity pool participation governed by smart contracts, are two notable features that align with the HODL strategy. These elements contribute to the evolving landscape of crypto investment, offering investors alternative ways to earn and engage in the market.

HODL and Cryptocurrency

HODLing, a widely embraced strategy in crypto, influences a digital asset’s value significantly. By steadfastly holding onto their investments, crypto enthusiasts contribute to reduced market volatility and increased scarcity. The HODL mindset fosters confidence, discouraging hasty selling during market fluctuations. This commitment to HODLing aligns with the fundamental principles of many cryptocurrencies, reinforcing the belief in long-term sustainability. As a result, HODLing becomes not just a term but a powerful force shaping the value trajectory of various cryptocurrencies, emphasizing resilience and faith in the future prospects of these digital assets.

How HODL works?

HODLing, a strategic approach, operates on the principle that market timing is tricky and prone to risk. In a zero-sum game, traders can only capitalize on your investment if you succumb to selling. Ben Gagnon, from BitFarms, emphasizes that the HODL strategy combats volatility by disregarding market fluctuations. Opting for a ‘buy and forget’ mentality, HODLers focus on long-term gains, acknowledging the chance for rapid profits and irreversible losses in the volatile crypto market. This method, exemplified by the 6300% increase in Bitcoin between 2013 and 2023, encourages investors to weather market storms, avoid impulsive decisions, and have faith in the crypto’s future potential, even during price downturns.

Pros and Cons of the HODL Strategy

Exploring the nuances of the HODL strategy, we delve into its pros and cons, dissecting the impact on long-term crypto investment and addressing key considerations for both personal and financial perspectives.

Pros:

- Long-Term Value Growth: Holding onto a crypto for an extended period can result in significant value appreciation, especially for well-established projects with long-term prospects.

- Stress Avoidance: The HODL strategy mitigates the stress associated with frequent buying and selling, particularly beneficial for novice investors navigating the volatile crypto market.

- Loss Avoidance: Unlike short-term investments susceptible to price fluctuations, HODLing shields investors from potential losses caused by market volatility.

- Simplicity for Newcomers: The approach doesn’t require extensive trading skills or constant market analysis, making it appealing and accessible for newcomers.

- Hardfork Benefits: HODLers may receive additional coins through hard forks, a bonus for patiently holding specific cryptocurrencies in secure wallets.

Cons:

- Sharp Price Drops: In the event of a sudden crypto price decline, HODLers may experience significant losses.

- Not Suitable for All Portfolios: The HODL strategy may not be appropriate for investors requiring quick access to funds or those with diverse investment portfolios.

- Potential Stagnation: The strategy may not yield maximum returns in a slow or stagnant crypto market.

- Missed Opportunities: HODLers may miss short-term earning opportunities by not actively following market developments.

- Long-Term Commitment: Successful HODLing requires patience and a commitment to holding assets for extended periods, which may not align with every investor’s goals.

- Risk of Wallet Compromise: To avoid the risk of wallet breaches, it’s advisable to store most funds in secure, cold wallets, limiting accessibility.

When to Use HODL Strategy?

While initially associated with digital currencies, the principles behind HODL can be applied to various long-term investment scenarios. Here’s a guide on when to consider employing the HODL strategy:

- Volatility Tolerance:

Use HODL when you have a high tolerance for volatility. Cryptocurrencies, in particular, are known for their price fluctuations. HODLers are individuals who can withstand market ups and downs without succumbing to panic selling.

- Long-Term Outlook:

Apply the HODL strategy when you have a long-term investment horizon. HODLing is about holding assets through market fluctuations with the expectation that their value will increase over an extended period. It may not be suitable for short-term traders.

- Belief in Fundamentals:

Consider HODLing when you have a strong belief in the fundamentals of the asset. This strategy is often linked to the belief that a particular cryptocurrency or investment has intrinsic value and will eventually gain widespread adoption or appreciation.

- Limited Market Timing Skill:

Opt for HODL if you recognize that you lack the skill or inclination to time the market accurately. Timing the market requires a deep understanding of market trends and events, which can be challenging for even ace investors. HODLing simplifies the approach by promoting a buy-and-hold mentality.

- Tax Efficiency:

Employ the HODL strategy for tax efficiency. In many jurisdictions, capital gains taxes are incurred upon selling an asset. By holding onto an investment for an extended period, you may qualify for long-term capital gains tax rates, which are often more favorable than short-term rates. This can lead to considerable tax savings over time.

- Diversification and Risk Management:

Consider HODLing as part of a balanced investment portfolio. Spreading your investments across various assets through diversification lessens the impact of underperforming investments on your overall portfolio. HODLing can be a stable, long-term component of a diversified strategy.

- Blockchain and Technological Innovation:

Embrace the HODL strategy when investing in projects tied to blockchain technology or other transformative innovations. Technologies like blockchain have the potential for widespread adoption and long-term impact on various industries. HODLers often believe in the transformative power of these technologies and hold onto their investments through market fluctuations.

- Market Cycles:

Understanding market cycles is crucial. HODLing may be appropriate during bullish cycles when prices are expected to rise over the long term. During bearish cycles, other strategies like active trading or even cashing out might be more suitable.

Alternatives to HODLing Investing Strategy

Beyond the traditional HODL approach of long-term coin holding, investors have a plethora of strategies to explore in the dynamic world of cryptocurrencies. Here are some alternative avenues:

Cryptocurrency Farming:

- Engage in cryptocurrency farming, a profitable venture where tokens are earned as a reward for converting coins into cash or other cryptocurrencies. By contributing to liquidity pools with pairs like DAI/ETH, participants can earn commissions from transactions within the pool.

Staking for Rewards:

- Embrace staking, a system rewarding cryptocurrency owners for storing assets in their wallets. This ensures blockchain stability. Staking operates on the Proof of Stake (PoS) algorithm, offering fixed and unlimited staking options, providing an alternative to traditional mining with the potential for up to 10% annual returns.

NFT-Driven Collectibles:

- Participate in the creation and sale of unique objects using NFT technology. NFTs enable the creation, collection, and sale of digital assets like graphic works, videos, and designer sneakers. Notable examples include Mike Winkelmann’s “Everydays: The First 5000 Days” and the CryptoPunks project, where avatars are bought and sold.

SPEDN and BUIDL:

- Explore alternative terms in the crypto lexicon, such as SPEDN (spend) and BUIDL (build). SPEDN encourages the use of cryptocurrencies in real-world transactions, fostering wider adoption. Meanwhile, BUIDL encourages the development of decentralized applications and tools to enhance the overall crypto ecosystem.

The decision between long-term investment and short-term speculation depends on individual preferences and risk tolerance. Conservative strategies offer stability and ease of portfolio management, while speculative trading provides opportunities for immersive industry understanding and flexible portfolio adaptation. Each approach has its merits, and investors can tailor their strategies based on their goals and preferences.

FAQ

What is the HODL Meme?

The HODL meme originated from a misspelling of “hold” in a cryptocurrency forum post. In crypto lingo, HODL means holding onto your coins despite market fluctuations, emphasizing a long-term investment mindset. It has since become a rallying cry for investors to resist the urge to sell during price volatility.

Is HODL Investing Strategy For Me?

The HODL investing strategy is suitable if you prefer a long-term approach and believe in the potential growth of your chosen assets. It’s for those who can withstand market fluctuations, avoid impulsive decisions, and aim for steady gains over an extended period. Assess your risk tolerance, investment goals, and patience before deciding if the HODL strategy is right for you.

What Other Investment Strategies Might Be Right For Me?

Explore alternative investment strategies based on your preferences; crypto farming and staking offer potential returns through active participation in blockchain networks. Additionally, consider diversifying into NFT-driven collectibles, engaging in short-term or mid-term trading, or exploring passive methods like cryptocurrency arbitrage for a range of investment options suited to different risk tolerances and goals.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]