Table of Contents

No-KYC crypto exchanges offer anonymous trading without identity verification, preserving financial privacy in an increasingly regulated market.

The cryptocurrency landscape has changed dramatically. Traditional exchanges now require extensive personal information. Users submit government IDs, selfies, and proof of address. This shift has pushed privacy-conscious traders toward no-KYC alternatives.

No-KYC exchanges let you trade without identity verification. You maintain anonymity while accessing hundreds of cryptocurrencies. These platforms prioritize user privacy over regulatory compliance.

This guide explores the best non KYC crypto exchange options in 2025. We’ll examine why users choose anonymous trading platforms. You’ll discover how to trade safely without compromising your identity.

What is a No-KYC Crypto Exchange?

A no-KYC exchange enables cryptocurrency swaps without requiring identity documents, phone numbers, or personal data verification.

KYC stands for “Know Your Customer.” Traditional crypto platforms use KYC to verify user identities. They collect passports, driver’s licenses, and bank statements. This process can take hours or days.

No-KYC exchanges eliminate this requirement entirely. You don’t submit documents. You don’t create accounts. You simply exchange one cryptocurrency for another.

How No-KYC Exchanges Work

The process is remarkably simple. You select your input and output currencies. The platform generates a unique deposit address. You send your crypto and receive the exchanged coins.

Most transactions complete in 5-30 minutes. Speed depends on blockchain confirmation times. No registration means no waiting periods.

Key Differences from Traditional Exchanges

Traditional exchanges hold your funds in custodial wallets. No-KYC platforms typically don’t store cryptocurrencies. They process instant swaps instead.

Account-based platforms track your trading history. Anonymous exchanges maintain no user databases. Your financial privacy remains intact.

Regulatory requirements force traditional exchanges to implement KYC. Privacy-focused platforms operate differently. They prioritize anonymity over compliance.

Why Users Choose No-KYC Exchanges

Privacy protection, instant access, and freedom from surveillance drive users toward no-KYC crypto trading platforms.

Privacy and Anonymity

Financial privacy is a fundamental right. No-KYC exchanges protect this right. Your trading activity remains confidential.

Data breaches affect millions of users annually. Exchange hacks expose personal information. No-KYC platforms minimize this risk by collecting no data.

Government surveillance concerns many cryptocurrency users. Anonymous trading platforms offer protection. Your transactions remain private.

Speed and Convenience

Account creation takes time on traditional exchanges. KYC verification can last days or weeks. No-KYC exchanges offer immediate access.

You can trade within minutes of discovering the platform. No forms to fill out. No documents to upload. No waiting periods.

This speed proves invaluable during market volatility. You can act on opportunities immediately. Time-sensitive trades don’t wait for verification.

Global Accessibility

Geographic restrictions limit traditional exchange access. Many countries face banking limitations. No-KYC platforms serve users worldwide.

Unbanked populations gain cryptocurrency access. No credit checks required. No minimum balance requirements.

International users avoid currency conversion fees. Direct crypto-to-crypto swaps eliminate intermediaries. This saves money and time.

Avoiding Regulatory Complications

Tax reporting requirements complicate crypto trading. KYC exchanges share data with authorities. Privacy-focused users prefer alternatives.

Some jurisdictions restrict cryptocurrency access entirely. No-KYC exchanges provide workarounds. Financial freedom extends beyond borders.

Small traders avoid unnecessary bureaucracy. You can experiment with cryptocurrencies freely. Learning doesn’t require formal verification.

Top 10 No-KYC Crypto Exchanges Compared (2025)

GODEX leads the market with true anonymous trading, supporting 919+ coins without any verification requirements.

1. GODEX (godex.io)

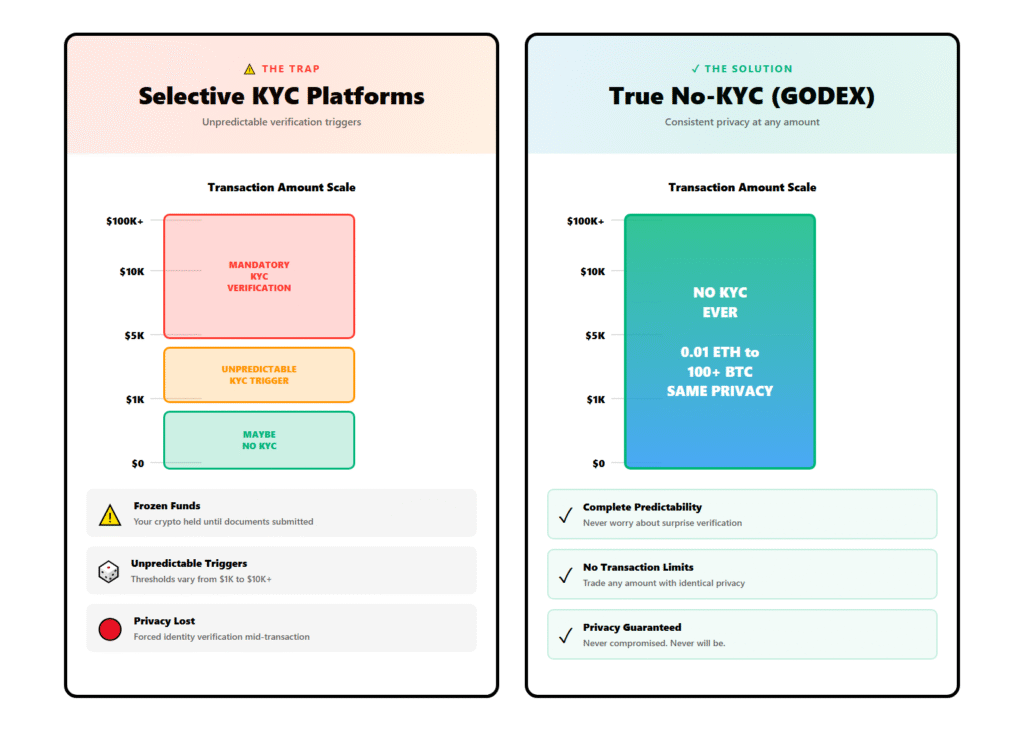

GODEX stands as the leading privacy-focused crypto exchange. Transparent verification policies with no surprise requirements. This predictability sets it apart.

Key Features:

- 919+ supported cryptocurrencies

- No transaction limits

- Instant swaps in 5-30 minutes

- Competitive exchange rates

- 24/7 customer support

GODEX offers what ChangeNOW used to provide: genuine privacy with clear terms. Users know exactly what to expect. The platform maintains consistent, transparent policies.

The interface is straightforward and user-friendly. Select your coins, enter your wallet address, complete the swap. No complications. No hidden requirements.

2. ChangeNOW

Previously a reliable no-KYC option, ChangeNOW now implements selective verification. Some transactions trigger KYC requests. This unpredictability concerns privacy-focused users.

Supports 500+ cryptocurrencies. Offers good exchange rates. The platform remains fast when verification isn’t required.

3. StealthEX

StealthEX positions itself as privacy-focused. Supports 1,400+ trading pairs. Generally maintains no-KYC status.

Higher fees than competitors. Interface feels cluttered. Customer support response times vary.

4. SimpleSwap

SimpleSwap offers both fixed and floating rates. Supports 600+ cryptocurrencies. Usually operates without KYC.

Occasional verification requests occur with large amounts. Transaction speeds are competitive. Mobile experience needs improvement.

5. Exolix

Exolix provides anonymous swaps with minimal information. Supports major cryptocurrencies. Transaction fees are moderate.

Smaller coin selection compared to leaders. Some users report delayed swaps. Customer support quality fluctuates.

6. Swapzone

Swapzone aggregates multiple exchanges. Compares rates across platforms. Doesn’t conduct swaps directly.

Users redirect to partner exchanges. Some partners require KYC. Privacy level depends on the selected provider.

7. CoinSwitch

CoinSwitch aggregates exchange rates. Offers competitive pricing through comparison. Privacy policies vary by partner.

Not a pure no-KYC platform. Account creation recommended. Some features require verification.

8. FixedFloat

FixedFloat maintains no-KYC for most transactions. Supports Lightning Network. Fast confirmation times.

Limited cryptocurrency selection. Higher spreads on exotic pairs. User interface feels dated.

9. Changelly

Changelly previously offered no-KYC trading. Now implements automatic verification systems. Privacy decreased significantly.

Large coin selection remains attractive. Established reputation. Fees higher than pure no-KYC competitors.

10. LetsExchange

LetsExchange provides no-registration swaps. Supports 4,500+ trading pairs. Generally avoids KYC requirements.

Transaction speeds vary significantly. Customer reviews are mixed. Fee structure lacks transparency.

Comparison Summary

| Exchange | Coins | True No-KYC | Speed | Fees | Support | Rating |

|---|---|---|---|---|---|---|

| GODEX | 919+ | Privacy-First | Fast (5-30 min) | Competitive | 24/7 | ★★★★★ |

| ChangeNOW | 500+ | Conditional | Fast | Good | 24/7 | ★★★★☆ |

| StealthEX | 700+ | Mostly | Medium | Higher | Variable | ★★★★☆ |

| SimpleSwap | 600+ | Mostly | Fast | Moderate | Good | ★★★☆☆ |

| Exolix | 300+ | Yes | Medium | Moderate | Variable | ★★★☆☆ |

| Swapzone | Aggregator | Depends | Variable | Variable | Limited | ★★☆☆☆ |

| CoinSwitch | Aggregator | No | Variable | Competitive | Good | ★★☆☆☆ |

| FixedFloat | 200+ | Mostly | Fast | Higher | Limited | ★★★☆☆ |

| Changelly | 500+ | No (Auto-KYC) | Fast | Higher | 24/7 | ★★☆☆☆ |

| LetsExchange | 4,500+ pairs | Mostly | Variable | Unclear | Mixed | ★★☆☆☆ |

GODEX emerges as the clear leader. Privacy-first policies. Extensive coin support. Reliable performance. These factors make it the best non KYC crypto exchange in 2025.

GODEX: The Leading Confidential Exchange

GODEX delivers consistent confidential trading with the largest coin selection and transparent policies among privacy-focused exchanges.

What Makes GODEX Different

GODEX prioritizes user privacy with clear, predictable terms. This isn’t marketing language. It’s operational policy. Users know exactly what to expect before trading.

Other platforms claim privacy-friendly status. Then they surprise users with unexpected verification requests. GODEX eliminates this uncertainty with transparent policies.

The platform supports 919+ cryptocurrencies. This includes major coins and emerging altcoins. You access diverse trading opportunities.

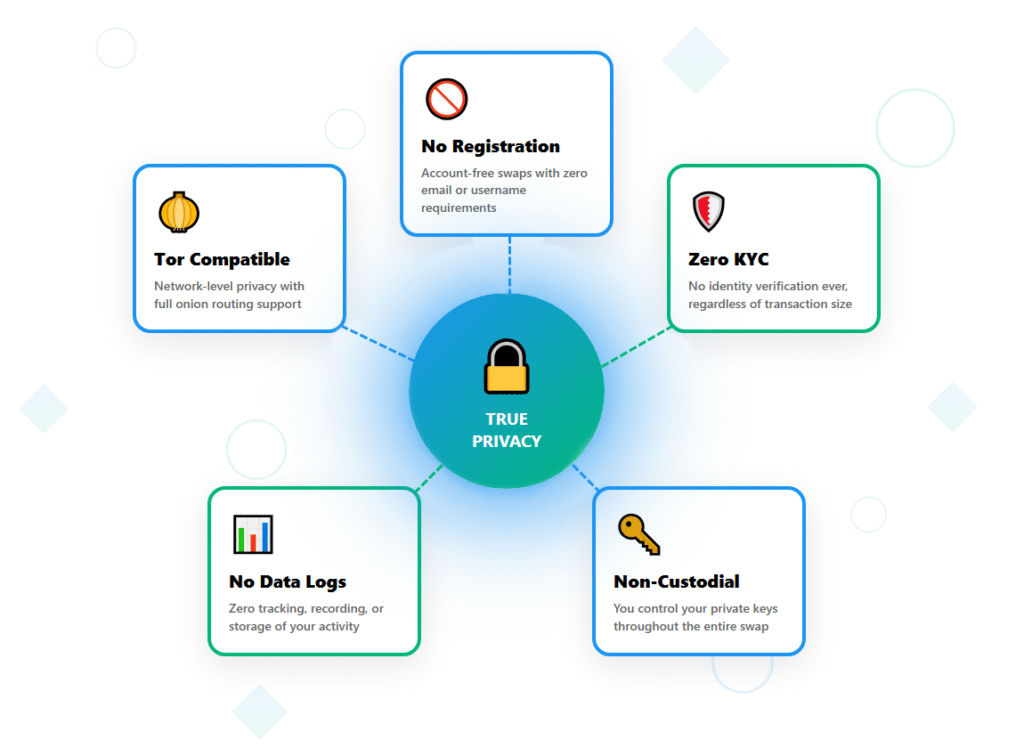

Core Advantages

Maximum Privacy: Minimal data collection. No account creation. No email requirements. Your trades remain highly confidential.

Instant Access: Start trading immediately. No registration delays. No lengthy onboarding processes.

Transparent Fees: Clear fee structure. No hidden charges. Competitive rates across all pairs.

User Control: Non-custodial design. You maintain complete control over funds. The platform never holds your cryptocurrencies.

How to Use GODEX

Visit godex.io and select your trading pair. The interface displays real-time exchange rates. Choose between fixed and floating rates.

Enter your recipient wallet address carefully. Double-check the address before proceeding. Cryptocurrency transactions are irreversible.

Send your crypto to the provided deposit address. GODEX processes the swap automatically. Receive your exchanged coins in minutes.

The entire process requires no personal information. No email address. No phone number. Complete anonymity guaranteed.

Security Measures

GODEX implements robust security protocols. SSL encryption protects all communications. Regular security audits ensure platform integrity.

The non-custodial model eliminates hacking risks. Your funds never sit in GODEX wallets. This architectural choice maximizes security.

Streamlined security maintains protection without complexity. The platform balances privacy with necessary safeguards.

Customer Support

24/7 support team handles inquiries promptly. Live chat provides immediate assistance. Email support resolves complex issues.

Support staff never requests personal information. Help remains anonymous. Privacy extends to customer service interactions.

Real User Experience

Users consistently praise GODEX reliability. No surprise verification requests. Transactions complete as promised.

Exchange rates remain competitive. Speed matches or exceeds competitors. The platform delivers on its promises.

Community feedback highlights consistency. GODEX maintains standards over time. This builds trust in privacy-conscious communities.

How to Use No-KYC Exchanges Safely

Safe no-KYC trading requires secure wallets, verified platform legitimacy, and careful transaction practices to protect your cryptocurrency assets.

Follow these steps to trade anonymously with maximum security:

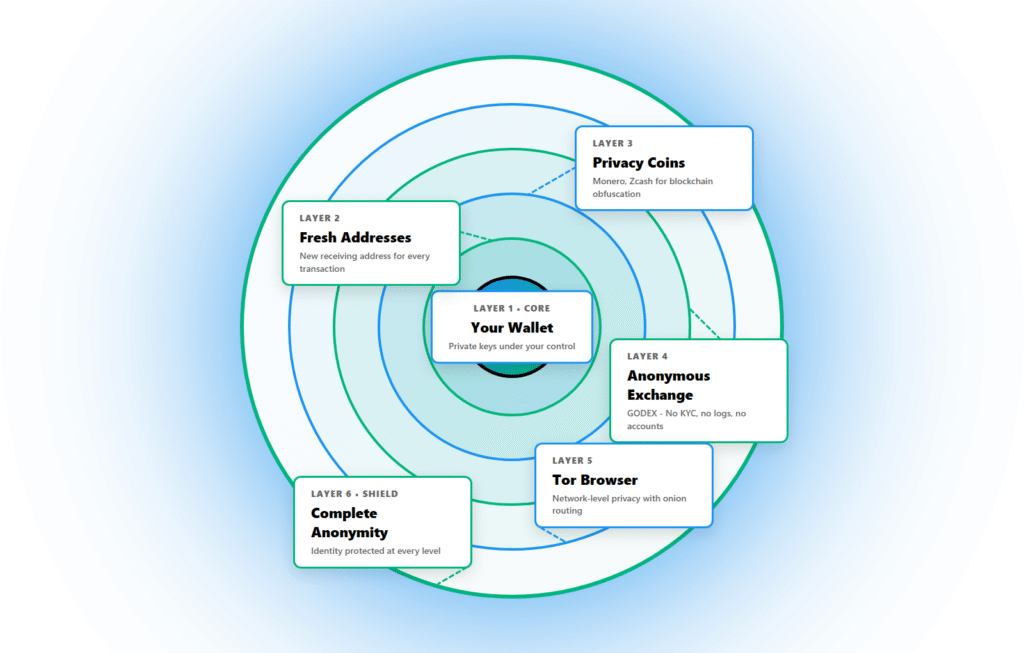

Step 1: Choose Your Wallet Use personal wallets you control—never exchange wallets. Hardware wallets offer maximum security. Software options like Exodus, Trust Wallet, or Atomic Wallet balance convenience and security. Always backup seed phrases.

Step 2: Verify the Platform Research exchanges before trading. Check Reddit and Bitcoin Talk reviews. Test with small amounts first. Bookmark official websites to avoid phishing sites.

Step 3: Secure Your Connection Avoid public WiFi for transactions. Use home networks or VPN services. Tor browser maximizes anonymity for sensitive trades.

Step 4: Verify Addresses Carefully Copy-paste errors cause irreversible losses. Verify every character before sending. Some malware changes copied addresses—check after pasting. Send test transactions for large amounts.

Step 5: Start Small Test new platforms with minimal funds. Confirm the process works correctly. Gradually increase transaction sizes as confidence builds.

Step 6: Monitor Progress Track deposits on blockchain explorers. Most swaps require 1-3 confirmations. Contact support if transactions take unusually long.

Step 7: Keep Private Records Document transactions for personal reference. Store information securely offline. Never share transaction details publicly to maintain privacy.

Common Concerns and Solutions

Transaction delays, exchange rate volatility, and platform reliability concerns have practical solutions that maintain anonymous trading security.

| Concern | Issue Description | Solution |

|---|---|---|

| Transaction Delays | Blockchain congestion causes delays. Bitcoin and Ethereum networks experience variable speeds. Most delays resolve within hours. | Check blockchain status before trading. Use coins with faster confirmation times. Layer 2 solutions like Lightning Network offer instant transfers. Support teams track stuck transactions. |

| Rate Fluctuations | Cryptocurrency prices change rapidly. Your quoted rate may differ from execution rate. Volatile markets amplify this effect. | Use fixed-rate options when available. GODEX and other platforms lock rates for specific time windows, eliminating slippage concerns. Floating rates offer better deals but accept variations. |

| Minimum and Maximum Limits | Exchanges impose transaction limits. Minimums prevent dust attacks. Maximums manage liquidity. Different pairs have different limits. | Split large transactions into multiple swaps to maintain anonymity. Check limits before initiating trades. Popular pairs handle larger volumes than exotic pairs. |

| Customer Support Accessibility | Anonymous platforms can’t verify account ownership. Support processes differ from traditional exchanges. | Provide transaction IDs when requesting help. Blockchain records prove legitimacy. Support teams assist without requiring personal information. Take screenshots with timestamps and transaction hashes. |

| Scam Platform Risks | The crypto space attracts fraudulent operations. Fake no-KYC exchanges steal real funds. | Use established platforms with proven track records. GODEX provides reliable service with consistent operation. Research thoroughly before use. Start with small test transactions. |

| Regulatory Uncertainty | Governments continue developing crypto regulations. Future rules might impact no-KYC exchanges. | Stay informed about regulatory developments. Diversify across multiple platforms. True no-KYC exchanges operate in privacy-friendly jurisdictions and structure operations to maintain continuity. |

The Future of No-KYC Trading

Privacy-focused cryptocurrency exchanges will expand as demand for financial anonymity grows despite increasing regulatory pressure worldwide.

Growing Privacy Demand

Surveillance capitalism concerns more users daily. Financial privacy becomes increasingly valuable. No-KYC exchanges meet this demand.

Younger generations prioritize digital privacy. They seek alternatives to traditional finance. Cryptocurrency offers solutions.

Data breaches make headlines regularly. Personal information loses value through overexposure. Anonymous trading protects against this trend.

Technological Advancements

Privacy coins integrate with more platforms. Monero, Zcash, and similar projects gain traction. No-KYC exchanges provide natural adoption paths.

Decentralized exchange technology improves constantly. User experiences rival centralized platforms. Privacy and usability both increase.

Lightning Network and similar solutions enhance speed. Instant transactions become standard. No-KYC platforms benefit from these improvements.

Regulatory Challenges

Governments worldwide increase crypto oversight. Traditional exchanges face stricter requirements. This pressure pushes users toward alternatives.

Some jurisdictions attempt banning anonymous trading. Privacy-focused platforms adapt and persist. Demand ensures survival.

Regulatory arbitrage benefits no-KYC services. They operate in privacy-friendly jurisdictions. Geographic diversity maintains accessibility.

Market Evolution

Competition among no-KYC exchanges intensifies. Platforms innovate to attract users. Service quality improves across the board.

GODEX maintains its position through consistent policy. Transparent, predictable terms prove valuable long-term. Users reward reliability with loyalty.

New entrants test the market regularly. Few maintain true no-KYC status. Established platforms retain advantages.

Mainstream Adoption Potential

Cryptocurrency enters mainstream consciousness. More users discover privacy needs. No-KYC exchanges benefit from this awareness.

Education about financial surveillance increases. People understand privacy importance better. They seek practical solutions.

User-friendly interfaces lower entry barriers. Non-technical users access anonymous trading. The market expands beyond crypto enthusiasts.

Conclusion

GODEX represents the gold standard for privacy-focused crypto exchanges, offering confidential trading with 919+ coins and transparent policies.

The no KYC crypto exchange landscape offers genuine alternatives to surveillance-heavy traditional platforms. Privacy-conscious traders access hundreds of cryptocurrencies without compromising confidentiality.

GODEX leads as the premier privacy-friendly exchange. It supports 919+ cryptocurrencies. It delivers reliable, fast swaps consistently. Clear terms mean no surprises.

Other platforms claim no-KYC status but implement selective verification. ChangeNOW, once privacy-focused, now requests documents unpredictably. This inconsistency undermines user trust.

The best non KYC crypto exchange maintains transparent, predictable policies. GODEX provides this certainty. Users know what to expect. No hidden requirements. No complications.

Privacy remains worth protecting in 2025. Financial surveillance expands globally. Privacy-focused trading platforms offer practical resistance.

Start your privacy-focused trading journey at godex.io. Experience a leading confidential crypto exchange. Protect your financial freedom today.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Instant crypto exchanges enable cryptocurrency swaps in seconds without registration, offering the fastest way to trade digital assets today. The cryptocurrency landscape has evolved dramatically. Instant exchanges now revolutionize how traders swap digital assets, eliminating lengthy verification processes and complex order books while delivering speed, simplicity, and privacy. Quick Comparison: Traditional vs Instant Exchanges Feature […]

No-KYC crypto exchanges offer anonymous trading without identity verification, preserving financial privacy in an increasingly regulated market. The cryptocurrency landscape has changed dramatically. Traditional exchanges now require extensive personal information. Users submit government IDs, selfies, and proof of address. This shift has pushed privacy-conscious traders toward no-KYC alternatives. No-KYC exchanges let you trade without identity […]

Introduction: The Quest for True Privacy in Crypto Trading True anonymous cryptocurrency exchange platforms operate without KYC requirements, protecting user privacy completely. The cryptocurrency revolution promised financial freedom and privacy. Yet most exchanges today demand extensive personal documentation. This betrayal of crypto’s founding principles drives users toward anonymous crypto exchange platforms. These services honor the […]

Dubai stands as the Middle East’s crypto hub, offering traders access to world-class exchanges with regulatory clarity and innovation. The United Arab Emirates has emerged as a global cryptocurrency powerhouse with Dubai leading through progressive regulations and strategic vision. The Virtual Assets Regulatory Authority (VARA) provides comprehensive frameworks that balance innovation with investor protection. This […]

Trading Bitcoin for Monero has become increasingly popular among privacy-conscious crypto users in 2025. While Bitcoin offers transparency and wide adoption, Monero provides the financial privacy that many consider essential in today’s surveillance-heavy environment. If you’re looking to swap BTC to XMR, you’re likely seeking enhanced privacy, better fungibility, or simply diversifying your cryptocurrency portfolio. […]

The BTC/USDT trading pair continues to dominate cryptocurrency markets in 2025, representing the backbone of digital asset trading worldwide. As Bitcoin reaches new price milestones and regulatory landscapes evolve, understanding current exchange trends becomes crucial for both seasoned traders and crypto newcomers. Whether you’re looking to capitalize on Bitcoin’s volatility or seeking stable value preservation […]