Table of Contents

The BTC/USDT trading pair continues to dominate cryptocurrency markets in 2025, representing the backbone of digital asset trading worldwide. As Bitcoin reaches new price milestones and regulatory landscapes evolve, understanding current exchange trends becomes crucial for both seasoned traders and crypto newcomers.

Whether you’re looking to capitalize on Bitcoin’s volatility or seeking stable value preservation through USDT, staying informed about market dynamics, exchange innovations, and emerging trading patterns can significantly impact your crypto journey. This comprehensive analysis explores the most important trends shaping BTC to USDT exchanges today.

Bitcoin’s 2025 Price Journey and Market Dynamics

Bitcoin reached its highest price of $124,474.00 USDT on August 14, 2025, marking a significant milestone in cryptocurrency history. This surge reflects growing institutional adoption and the successful launch of Bitcoin ETFs, which brought traditional investors into the crypto space like never before.

Current market analysis shows Bitcoin trading in a dynamic range between $115,000-$117,000 USDT, with 24-hour trading volumes exceeding $46 billion. The volatility patterns we’re seeing aren’t random – they’re driven by several key factors.

Institutional participation has fundamentally changed BTC/USDT trading behavior. Bitcoin serves as the primary entry point for fiat on-ramps, attracting $4.6 trillion in inflows between July 2024 and June 2025. This massive influx creates more stable price floors while introducing new trading patterns as institutional players operate differently than retail traders.

The relationship between Bitcoin and USDT has also evolved. Traders increasingly use USDT as a safe haven during market uncertainty, creating predictable exchange patterns during high-volatility periods. This trend makes timing BTC/USDT swaps more strategic than ever before.

Exchange Platform Evolution and User Preferences

The cryptocurrency exchange landscape has dramatically transformed in 2025. Among top centralized exchanges, Binance controls 39.8% of market share, but user preferences are shifting toward platforms offering comprehensive features beyond basic trading.

Modern traders demand exchanges with integrated DeFi capabilities, AI-powered trading tools, and cross-chain functionality. Advanced security features such as multi-factor authentication, biometric login, cold wallet storage, and machine learning-based fraud detection have become essential.

Processing speed and cost efficiency remain critical factors. Users increasingly favor platforms implementing Layer-2 solutions to reduce transaction fees and processing times, especially during high-traffic periods. The most successful exchanges in 2025 combine security, speed, and user experience seamlessly.

Survey data reveals that 53% of users prefer Binance for frequent trading, while Bybit, OKX, Bitget maintain higher percentages of full-time traders. However, the gap between major platforms continues to narrow as competition drives innovation across the industry.

Trading Patterns and User Behavior Shifts

BTC/USDT trading patterns in 2025 reveal fascinating insights about user behavior. Approximately 28% of American adults, or about 65 million people, now own cryptocurrencies, representing nearly double the ownership from three years ago.

Bitcoin remains the most widely held cryptocurrency, owned by 71% of all global users, while stablecoins like USDT are particularly popular among lower-income users with 44% ownership. This creates natural trading flows between BTC and USDT as users manage portfolio risk and liquidity needs.

Demographic trends show interesting patterns. Around 60% of survey respondents were aged between 25 and 44, with 89% being male, though female participation is growing. Younger users tend toward more frequent trading, while older demographics prefer longer-term holding strategies.

The data also reveals that users mainly engage in spot trading and holding on exchanges, with only 19% trading derivatives. This suggests most BTC/USDT activity focuses on straightforward buy/sell operations rather than complex financial instruments.

Why Godex Stands Out for BTC/USDT Trading

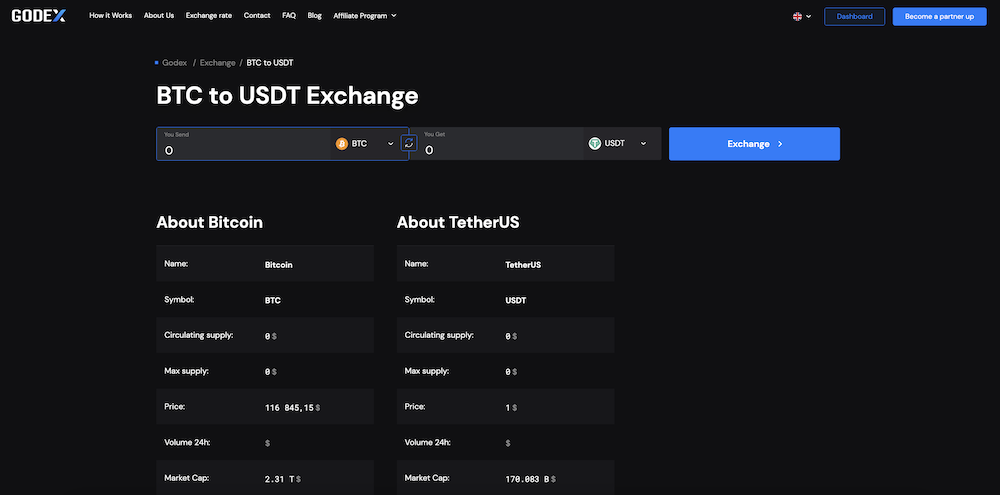

Among the numerous exchange options available, Godex has emerged as a compelling choice for BTC to USDT conversions, particularly for users prioritizing simplicity, privacy, and competitive rates. Unlike traditional exchanges that require lengthy registration processes and extensive verification, Godex streamlines the entire experience.

The platform’s approach to BTC/USDT exchanges reflects current market demands perfectly. Users can swap Bitcoin for USDT without creating accounts, providing email addresses, or undergoing KYC procedures. This privacy-first approach resonates with crypto enthusiasts who value anonymity and efficiency.

Godex’s exchange process for BTC/USDT pairs is remarkably straightforward. Users simply select Bitcoin as the input currency and USDT as the output, enter their receiving wallet address, and complete the transaction. The entire process typically takes 15-30 minutes, depending on network conditions – significantly faster than traditional exchange alternatives.

The platform supports multiple Bitcoin and USDT network variants, including BTC mainnet, Lightning Network, and various USDT implementations (ERC-20, TRC-20, BEP-20). This flexibility allows users to choose the most cost-effective or fastest option based on their specific needs and current network conditions.

What sets Godex apart in the competitive BTC/USDT space is its transparent fee structure. The platform displays real-time exchange rates with all fees included upfront, eliminating hidden costs that plague many traditional exchanges. Users know exactly how much USDT they’ll receive for their Bitcoin before confirming any transaction.

For frequent traders, Godex offers particularly attractive advantages. The platform doesn’t impose daily trading limits for non-registered users, making it ideal for those who need to make large or frequent BTC/USDT conversions without bureaucratic obstacles. This feature proves especially valuable during market volatility when quick position adjustments become crucial.

Security remains paramount in Godex’s design. The platform employs advanced encryption protocols and doesn’t store user funds, reducing exposure to exchange hacks – a growing concern as Bybit suffered a major hack in February 2025 with $1.4 billion stolen. By processing transactions immediately rather than holding assets, Godex minimizes security risks inherent in traditional exchange models.

Future Outlook and Emerging Trends

Looking ahead, several trends will likely shape BTC/USDT exchanges throughout 2025 and beyond. President Trump’s crypto-friendly stance and the SEC’s new crypto task force signal clearer regulatory frameworks, potentially reducing compliance uncertainties that have historically complicated exchange operations.

Technological innovations continue driving exchange evolution. Integration of artificial intelligence for market analysis, automated trading suggestions, and risk management tools becomes increasingly common. These features help both novice and experienced traders make more informed decisions when timing BTC/USDT conversions.

Cross-chain interoperability represents another significant trend. As blockchain ecosystems become more interconnected, exchanges facilitating seamless BTC/USDT swaps across different networks will gain competitive advantages. This development particularly benefits users seeking optimal transaction costs and processing speeds.

The growth of smaller stablecoins like EURC (89% month-over-month growth) and PYUSD (rising from $783 million to $3.95 billion) suggests the stablecoin ecosystem will continue diversifying, potentially creating new trading pairs alongside traditional BTC/USDT options.

Conclusion

The BTC/USDT exchange landscape in 2025 presents both opportunities and challenges for cryptocurrency users. Market maturation, institutional adoption, and regulatory clarity create a more stable environment for trading, while technological innovations enhance user experiences across platforms.

Success in this evolving market requires choosing exchange platforms that align with individual needs – whether prioritizing security, privacy, fees, or advanced features. As Bitcoin continues its price journey and USDT maintains its role as crypto’s primary stable value store, understanding these trends becomes essential for making informed trading decisions.

The key lies in staying informed about market developments while selecting reliable, efficient exchange platforms that can adapt to changing conditions. Whether you’re a day trader capitalizing on price movements or a long-term investor managing portfolio allocations, the right exchange partner makes all the difference.

FAQ

Q: What’s the best time to exchange BTC for USDT? A: The period between 3-4 PM GMT often provides optimal liquidity and trading volume for BTC/USDT conversions.

Q: How have BTC/USDT exchange rates changed in 2025? A: Bitcoin reached a high of 123,026 USDT per Bitcoin in August 2025, representing a 93.66% increase year-over-year.

Q: Which exchanges are most popular for BTC/USDT trading? A: Binance leads with 53% user preference, followed by Bybit and Coinbase as popular alternatives.

Q: Are there fees for BTC to USDT exchanges? A: Most platforms charge trading fees ranging from 0.1% to 0.5%, though some services like Godex include all fees in their quoted exchange rates.

Q: How long do BTC/USDT conversions typically take? A: Transaction times vary from 15-30 minutes on modern platforms to several hours on traditional exchanges, depending on network congestion and platform efficiency.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]