Table of Contents

Trading Bitcoin for Monero has become increasingly popular among privacy-conscious crypto users in 2025. While Bitcoin offers transparency and wide adoption, Monero provides the financial privacy that many consider essential in today’s surveillance-heavy environment.

If you’re looking to swap BTC to XMR, you’re likely seeking enhanced privacy, better fungibility, or simply diversifying your cryptocurrency portfolio. However, not all exchange methods are created equal. The wrong approach can compromise your anonymity, cost you money through hidden fees, or leave your funds vulnerable to market volatility.

This comprehensive guide breaks down seven essential tips to help you execute secure, anonymous BTC to Monero swaps while avoiding common pitfalls that catch both beginners and experienced traders off guard.

Why Swap Bitcoin for Monero? Understanding the Motivation

The BTC to XMR swap trend reflects fundamental differences between these cryptocurrencies. Bitcoin operates on a completely transparent blockchain where every transaction is publicly visible and traceable. While this transparency ensures network security, it also means your financial activity can be monitored, analyzed, and potentially used against you.

Monero takes the opposite approach. Built with privacy as its core principle, XMR uses advanced cryptographic techniques like ring signatures, stealth addresses, and RingCT to make transactions completely untraceable. When you swap BTC to XMR, you’re essentially moving from a public financial system to a private one.

Beyond privacy, fungibility plays a crucial role. Bitcoin’s transparent nature means some coins carry “tainted” histories from previous illegal activities. Monero’s privacy features ensure all coins are fungible – one XMR is always equal to another XMR, regardless of history. This fungibility protection becomes increasingly valuable as blockchain analysis tools grow more sophisticated.

Many users also swap BTC to XMR as a strategic portfolio move. With regulatory pressure mounting on centralized exchanges and governments implementing stricter surveillance measures, privacy coins like Monero represent a hedge against financial overreach.

Tip 1: Choose Non-Custodial Platforms Over Centralized Exchanges

The first and most critical decision in your BTC to XMR swap journey involves platform selection. Traditional centralized exchanges might seem convenient, but they’re fundamentally incompatible with privacy-focused trading.

Major exchanges like Binance, Coinbase, and Kraken require extensive KYC verification, collect personal data, and maintain detailed transaction records. Even worse, many have delisted Monero entirely due to regulatory pressure. Those that still support XMR often implement additional monitoring and reporting requirements that defeat the purpose of using a privacy coin.

Non-custodial platforms offer a superior alternative. These services never hold your funds, eliminating counterparty risk while preserving anonymity. Instead of storing coins in exchange wallets, non-custodial platforms facilitate direct wallet-to-wallet transfers.

The key benefits include immediate transaction finality (your XMR goes directly to your wallet), zero custody risk (no exchange can freeze your funds), complete privacy preservation (no personal data collection), and faster processing times without internal transfer delays.

When evaluating non-custodial options, prioritize platforms with proven track records, transparent fee structures, and strong security measures. Avoid services that require email registration, log IP addresses, or maintain transaction databases.

Tip 2: Master Address Verification to Prevent Costly Mistakes

Address verification represents the single most important security practice when swapping BTC to XMR. Unlike centralized exchanges with customer support to recover mistaken transactions, non-custodial swaps are irreversible. Send funds to the wrong address, and they’re gone forever.

Both Bitcoin and Monero use complex address formats that are prone to human error. Bitcoin addresses can start with 1, 3, or bc1, while Monero addresses begin with 4 and contain 95 characters. A single typo in any of these lengthy strings means permanent fund loss.

Implement a systematic verification process. Never manually type addresses – always copy and paste them. After pasting, visually verify the first four and last four characters against the original. For extra security, use the verification features built into many wallets that highlight address format errors.

Consider using QR codes when available. Most modern wallets generate QR codes for receiving addresses, eliminating transcription errors entirely. However, always verify that QR codes match the displayed text addresses to guard against malicious code substitution.

For large swaps, consider using a small test transaction first. Send a minimal amount to verify the entire process works correctly before committing significant funds. While this adds time and modest fees, it’s invaluable protection against catastrophic losses.

Double-check that you’re using the correct network. Some exchanges support multiple blockchain networks for popular cryptocurrencies. Sending Bitcoin to a Bitcoin Cash address or Monero to a MoneroV address will result in permanent loss.

Tip 3: Understand Fixed vs. Floating Rates and When to Use Each

Exchange rate mechanisms significantly impact your swap outcomes, yet many users don’t understand the critical differences between fixed and floating rate systems. Your choice can mean the difference between profitable swaps and costly surprises.

Fixed rates lock in your exchange rate at the moment you initiate the transaction. If you start a swap when 1 BTC equals 350 XMR, you’ll receive exactly that amount regardless of market movements during processing. This protection is crucial during volatile periods when prices can swing dramatically within minutes.

The main advantage of fixed rates is predictability. You know exactly how much Monero you’ll receive before sending your Bitcoin. This certainty allows for precise portfolio planning and eliminates slippage risk. Fixed rates also protect against sudden market crashes that could occur while your transaction processes.

However, fixed rates typically include slightly higher spreads to compensate exchanges for assuming volatility risk. During highly volatile periods, some platforms may temporarily disable fixed rates or reduce available limits.

Floating rates, conversely, use current market prices at the time your Bitcoin transaction confirms. While this might result in better rates during favorable market movements, it also exposes you to downside risk. A 5% market drop during transaction processing means 5% less Monero in your wallet.

For most users, especially those new to crypto swaps, fixed rates provide superior protection and peace of mind. Consider floating rates only during stable market conditions or when you’re confident about short-term price directions.

Tip 4: Time Your Swaps to Minimize Network Congestion Fees

Network timing significantly impacts both your transaction costs and completion speed. Bitcoin and Monero networks experience varying congestion levels throughout the day and week, directly affecting fees and confirmation times.

Bitcoin fees fluctuate based on mempool congestion. During peak usage periods, fees can spike from a few dollars to over $50 per transaction. Monitor fee estimation websites like mempool.space to identify optimal timing. Generally, weekends and early morning UTC hours see lower congestion and cheaper fees.

Monero fees remain relatively stable due to its different fee structure, but network congestion can still cause delays. XMR transactions require 10 confirmations before funds become available, meaning slow network periods can significantly extend your swap completion time.

Plan ahead for large swaps. If you’re not under time pressure, wait for favorable network conditions. Setting up price alerts can help you identify good trading opportunities during low-congestion periods.

Consider the interaction between Bitcoin and Monero network conditions. An efficient swap requires good conditions on both networks. Fast Bitcoin confirmation means nothing if the Monero network is congested.

Some advanced users employ fee estimation tools to optimize their transactions. Bitcoin wallets often allow custom fee settings – higher fees for urgent swaps, lower fees when time isn’t critical. However, avoid setting fees too low, as this can cause transactions to remain unconfirmed for hours or days.

Tip 5: Secure Your Wallets Before Starting Any Swap

Proper wallet security forms the foundation of safe BTC to XMR swaps. Compromised wallets can result in total fund loss, regardless of how carefully you execute the swap itself. Implement comprehensive security measures before handling significant amounts.

Hardware wallets provide the gold standard for cryptocurrency security. Devices like Ledger, Trezor, and Coldcard store private keys offline, making them immune to online attacks. For substantial amounts, hardware wallets are non-negotiable.

If using software wallets, choose reputable options with strong security track records. For Bitcoin, Electrum and Bitcoin Core offer excellent security. For Monero, the official Monero GUI wallet or mobile options like Cake Wallet provide robust protection.

Enable all available security features. Use strong, unique passwords for each wallet. Enable two-factor authentication where supported. For Monero wallets, secure your 25-word mnemonic seed phrase offline – this phrase is your ultimate backup and recovery method.

Verify wallet software authenticity before installation. Download only from official sources and verify cryptographic signatures when provided. Malicious wallet software represents one of the most dangerous threats in cryptocurrency.

Keep wallets updated with the latest security patches. Both Bitcoin and Monero regularly release updates that fix vulnerabilities and improve performance. Outdated wallet software may contain known exploits.

Consider operational security beyond just wallet software. Use dedicated devices for large transactions, avoid public WiFi for sensitive operations, and consider using VPN connections to protect your IP address and location information.

Why Godex Stands Out for BTC to XMR Swaps

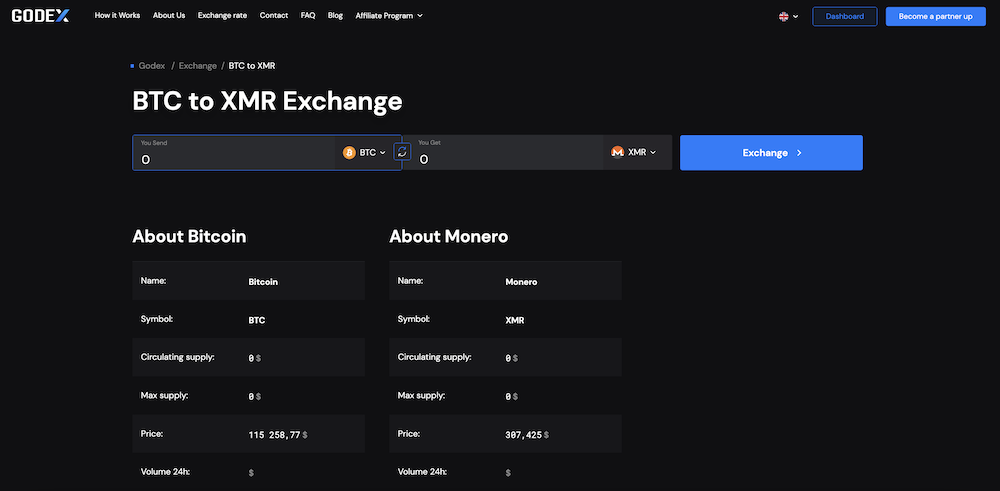

Among the various platforms available for Bitcoin to Monero exchanges, Godex has established itself as the premier choice for privacy-conscious traders since 2018. The platform’s unwavering commitment to user anonymity and streamlined exchange process makes it ideally suited for BTC to XMR swaps.

Godex requires absolutely no registration, KYC verification, or personal data collection. You simply select your trading pair, enter your Monero receiving address, and receive a Bitcoin deposit address. Once your Bitcoin transaction confirms, Godex automatically processes the swap and sends Monero directly to your wallet.

The platform’s fixed-rate system provides crucial protection against volatility during the swap process. When you initiate a BTC to XMR exchange, Godex locks in the rate for 30 minutes, ensuring market fluctuations don’t affect your final Monero amount. This feature proves invaluable during volatile market periods when prices can swing significantly.

Security remains paramount in Godex’s design. As a truly non-custodial service, your Bitcoin never sits in Godex wallets waiting to be processed. The platform uses advanced routing to execute swaps through optimal liquidity sources while maintaining complete transaction privacy.

Godex supports over 919 cryptocurrencies, including various Monero variations and Bitcoin network options. Whether you’re swapping legacy Bitcoin, SegWit Bitcoin, or Lightning Network Bitcoin for standard Monero or other XMR implementations, Godex handles the technical complexities seamlessly.

The platform’s processing times typically range from 5-30 minutes, depending on network conditions and confirmation requirements. During normal network conditions, most BTC to XMR swaps complete within 15 minutes, making Godex one of the faster anonymous exchange options available.

Customer support operates 24/7 without requiring user identification. If issues arise during your swap, Godex support can assist using only your transaction ID, maintaining your privacy while resolving problems quickly.

For users prioritizing maximum privacy in their BTC to XMR swaps, Godex offers an optimal combination of security, speed, and anonymity that’s difficult to match elsewhere in the current market.

Tip 6: Implement Proper OpSec for Maximum Privacy Protection

Operational security, or OpSec, encompasses the practices and procedures that protect your privacy beyond just using anonymous exchanges. Even the most private swap can be compromised by poor OpSec practices that leak identifying information.

Start with network-level protection. Your internet service provider, government agencies, and other third parties can monitor your online activity. Use a reputable VPN service that doesn’t log user activity. Connect to VPN servers in privacy-friendly jurisdictions to add additional legal protection.

Consider using Tor browser for accessing swap platforms. Tor routes your internet connection through multiple encrypted layers, making it extremely difficult to trace your online activity back to your real identity. Many privacy-focused exchanges, including some swap services, offer .onion addresses specifically for Tor users.

Be mindful of timing correlations. Large Bitcoin transactions followed immediately by Monero transactions can create patterns that sophisticated analysis might connect to your identity. Consider introducing random delays between related transactions to break these patterns.

Manage your Bitcoin inputs carefully. If you’re swapping Bitcoin that came directly from a KYC exchange like Coinbase, that creates a direct link between your identity and the swap. Consider using Bitcoin mixing services or multiple intermediate transactions to obscure the connection.

Use different Bitcoin addresses for different purposes. Many Bitcoin wallets automatically generate new addresses for each transaction, but some users manually reuse addresses for convenience. Address reuse makes it easier to cluster your transactions and identify patterns.

Consider the privacy implications of your Monero usage patterns as well. While XMR transactions are private by default, using centralized exchanges that have your identity information can still create connections between your real identity and your Monero holdings.

Tip 7: Have Contingency Plans for Failed or Stuck Transactions

Despite careful preparation, blockchain transactions sometimes fail or become stuck due to network issues, incorrect parameters, or platform problems. Having contingency plans ready can mean the difference between minor delays and significant fund loss.

Understand the common failure modes. Bitcoin transactions can become stuck in the mempool due to insufficient fees, network congestion, or wallet software bugs. Monero transactions might fail due to incorrect destination addresses, network synchronization issues, or exchange platform problems.

Keep detailed records of every swap attempt. Record the transaction IDs, addresses used, amounts, exchange platform, and timing. This information becomes crucial if you need to contact customer support or trace problems later.

Know how to use blockchain explorers effectively. For Bitcoin, blockchain.info, blockchair.com, and mempool.space provide detailed transaction information. For Monero, xmrchain.net offers the limited transparency possible with privacy-focused blockchains. These tools help you determine whether problems lie with the blockchain networks or exchange platforms.

Understand transaction replacement options. Bitcoin supports Replace-by-Fee (RBF) mechanisms that allow you to increase fees on stuck transactions. Some wallets make this process user-friendly, while others require manual transaction crafting. Learn these procedures before you need them urgently.

Establish communication channels with your chosen exchange platform. Even anonymous platforms typically offer customer support through email, live chat, or messaging systems. Know how to contact support and what information they need to help resolve issues while maintaining your privacy.

Plan for extended delays. Network congestion or platform issues can sometimes cause swaps to take hours or even days instead of the usual minutes. Don’t panic if transactions don’t complete immediately – most issues resolve themselves given sufficient time.

Consider backup platforms for urgent swaps. If your primary platform experiences technical issues, having verified alternatives available can prevent situations where you’re unable to complete time-sensitive transactions.

Conclusion: Master Anonymous BTC to Monero Swaps

Successfully swapping Bitcoin for Monero requires more than just picking a platform and sending funds. The seven tips outlined in this guide provide a comprehensive framework for executing anonymous, secure, and efficient BTC to XMR swaps while avoiding the common pitfalls that trap unwary users.

Privacy-focused trading demands attention to detail at every step, from wallet security and platform selection to operational security and contingency planning. By implementing these practices consistently, you can enjoy the benefits of Monero’s enhanced privacy without compromising your security or funds.

Remember that the cryptocurrency landscape continues evolving rapidly. Regulatory changes, technical developments, and market conditions all influence the optimal approaches to privacy-focused trading. Stay informed about developments in both Bitcoin and Monero ecosystems, and be prepared to adapt your strategies as conditions change.

The investment in time and effort required to master secure BTC to XMR swaps pays dividends in protected privacy, reduced risk, and better trading outcomes. Whether you’re making your first privacy-focused swap or refining existing practices, these principles provide a solid foundation for navigating the intersection of Bitcoin’s transparency and Monero’s privacy.

FAQ

Q: How long do BTC to XMR swaps typically take? A: Most non-custodial swaps complete within 5-30 minutes, depending on Bitcoin network confirmation times and Monero’s 10-confirmation requirement. During network congestion, swaps might take several hours.

Q: Are there limits on how much Bitcoin I can swap for Monero? A: Limits vary by platform. Anonymous exchanges like Godex typically impose no volume restrictions, while others may have daily or transaction limits. Always check platform specifications before starting large swaps.

Q: Can I reverse a BTC to XMR swap if I make a mistake? A: No, blockchain transactions are irreversible once confirmed. This makes proper address verification and small test transactions crucial for large swaps. Always double-check all details before confirming transactions.

Q: How long does a typical BTC/XMR swap take to complete? A: Most BTC/XMR swaps complete within 30-60 minutes, though this depends on network congestion and confirmation requirements. Bitcoin typically needs 1-3 confirmations while Monero requires exactly 10 confirmations for security.

Q: What’s the minimum amount for BTC/XMR exchanges? A: Minimum amounts vary by platform, typically ranging from 0.001 to 0.01 BTC. Some cryptocurrency exchange services offer lower minimums for privacy coin swaps to accommodate smaller transactions.

Q: Are there any countries where BTC/XMR swaps are restricted? A: Several countries have restrictions on privacy coins like Monero. Always verify local regulations before attempting to swap BTC/XMR, as compliance requirements vary significantly by jurisdiction.

Q: How can I verify that my BTC/XMR swap was successful? A: You can track Bitcoin transactions using blockchain explorers, but Monero transactions remain private. Verify completion through your wallet balance changes and the exchange platform’s confirmation messages.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]