Table of Contents

Introduction

The cryptocurrency landscape in 2025 presents a fascinating paradox for ETH/BTC trading. While Bitcoin continues to assert its dominance as digital gold, Ethereum is experiencing unprecedented institutional adoption that’s reshaping market dynamics. For traders looking to exchange ETH for BTC or vice versa, understanding these shifting patterns is crucial for timing, strategy, and maximizing returns.

This comprehensive guide explores the current market trends affecting ETH/BTC pairs, practical exchange strategies, and the most efficient platforms to execute your trades. Whether you’re a seasoned trader or new to crypto swaps, you’ll discover actionable insights to navigate 2025’s unique trading environment successfully.

Understanding the 2025 ETH/BTC Market Landscape

Institutional Money Is Flowing Into Ethereum

The most significant development in 2025 has been the massive institutional shift toward Ethereum. Since June, over $9.4 billion has flowed into spot Ethereum ETFs, creating a stark contrast with Bitcoin’s performance. This institutional interest stems from Ethereum’s expanding utility in decentralized finance (DeFi) and smart contracts, making it more than just a store of value.

Ethereum’s share in institutional cryptocurrency treasuries has exploded from just 0.2% to over 2%, signaling a decisive pivot among major financial players. BlackRock’s ETHA alone accumulated $500.9 million in a single day, demonstrating the level of confidence large investment firms now place in Ethereum’s long-term prospects.

The Persistent ETH/BTC Ratio Challenge

Despite this institutional enthusiasm, the ETH/BTC ratio tells a complex story. The pair has remained below 0.05 for over a year, even as Ethereum achieved new all-time highs near $4,900. This disconnect highlights Bitcoin’s enduring position as crypto’s ultimate store of value, particularly during uncertain macroeconomic conditions.

However, recent weeks have shown signs of change. The ratio has climbed to its highest level of 2025, suggesting that market sentiment may be shifting. Analysts suggest that if ETH ETF inflows exceed $9 billion quarterly and network upgrades succeed, Ethereum could finally close this valuation gap.

Macro Factors Driving Trading Opportunities

Federal Reserve policies are creating new dynamics for both cryptocurrencies. With anticipated rate cuts and increased liquidity, risk assets like ETH are becoming more attractive to institutional investors. Bitcoin’s 30-day volatility has dropped to 25%, creating a more stable environment for accumulation, while Ethereum’s utility-driven demand continues to grow.

Strategic Approaches to ETH/BTC Exchanges in 2025

Timing Your Trades With Market Cycles

Understanding when to swap between ETH and BTC requires recognizing market cycles and momentum shifts. In 2025, we’re seeing “Bitcoin fatigue” among traders as BTC approaches resistance levels around $124,000, while Ethereum breaks into price discovery territory with fresh all-time highs.

The best exchange opportunities often occur during these momentum shifts. When Bitcoin shows signs of exhaustion—characterized by stalled rallies and weak follow-through—smart traders rotate toward Ethereum, which demonstrates stronger relative strength and active dip-buying behavior.

Leveraging DeFi Growth for Better Rates

Ethereum’s DeFi ecosystem recovery is creating additional trading incentives. Total Value Locked (TVL) in DeFi protocols has witnessed substantial growth, with platforms like Pendle seeing 28% gains as institutional adoption increases. This growth translates into better liquidity pools and more favorable exchange rates for ETH/BTC swaps.

For traders exchanging larger amounts, timing swaps during periods of high DeFi activity often results in better execution prices and reduced slippage. The expanding DeFi infrastructure also provides more sophisticated trading tools and strategies for optimizing your exchanges.

Cross-Chain Efficiency Considerations

One of the biggest challenges in ETH/BTC exchanges is the cross-chain nature of the swap. Traditional centralized exchanges require KYC procedures and often have limited liquidity for large trades. Modern solutions are addressing these pain points through innovative protocols and aggregation services.

Advanced traders are increasingly using multi-chain solutions that break large swaps into smaller, streaming transactions. This approach reduces slippage and improves execution prices, especially important when dealing with substantial amounts or during periods of market volatility.

Why Godex Excels for ETH/BTC Trading in 2025

Seamless Cross-Chain Swaps Without Complications

Godex has positioned itself as the go-to platform for ETH to BTC exchanges by solving the most pressing issues traders face in 2025. Unlike traditional exchanges that require lengthy registration processes and KYC verification, Godex enables instant swaps between Ethereum and Bitcoin without any sign-up requirements.

The platform’s infrastructure is specifically designed to handle cross-chain complexity seamlessly. When you initiate an ETH to BTC swap on Godex, the system automatically manages the technical challenges of bridging between different blockchain networks, ensuring your trade executes efficiently without manual intervention.

Superior Rates Through Advanced Aggregation

What sets Godex apart in the competitive ETH/BTC exchange market is its sophisticated rate aggregation technology. The platform constantly scans multiple liquidity sources and exchange rates to offer users the most favorable conversion rates available in the market. This means you consistently get more Bitcoin for your Ethereum compared to single-source exchanges.

For example, while traditional platforms might offer standard market rates, Godex’s aggregation often delivers 1-3% better rates due to its ability to source liquidity from optimal providers. Over time, especially for frequent traders, these improved rates compound into significant additional value.

Built for 2025’s Institutional Demand

Recognizing the surge in institutional ETH/BTC trading, Godex has enhanced its platform to handle larger transaction volumes without the typical constraints of centralized exchanges. The platform supports substantial swaps while maintaining competitive rates and fast execution times, making it suitable for both retail traders and institutional players.

The platform’s privacy-first approach also appeals to institutions and traders who prefer to maintain anonymity in their trading activities. With no account creation required and no transaction history stored, Godex provides the discretion that sophisticated traders value while maintaining full regulatory compliance.

Step-by-Step ETH/BTC Exchange Process

Using Godex for your ETH/BTC exchanges is straightforward:

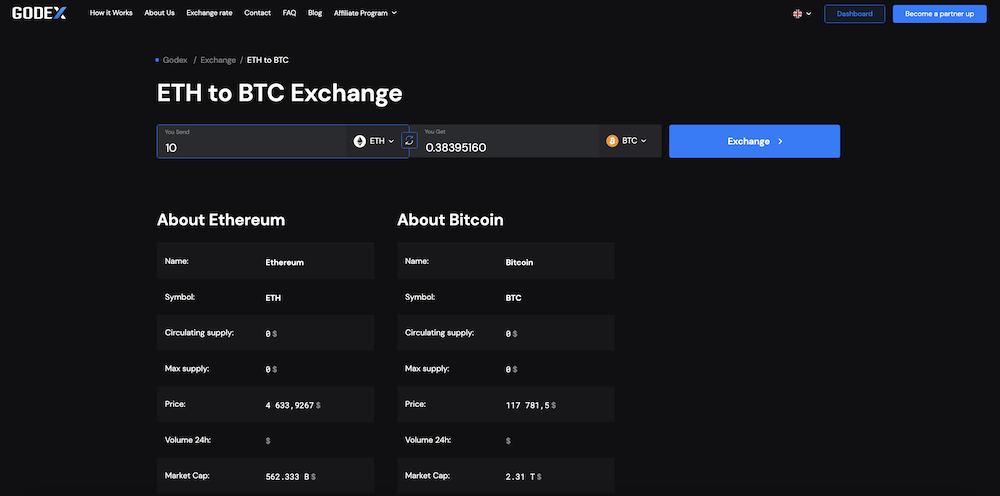

- Visit the Platform: Navigate to Godex and select ETH as your source currency and BTC as your destination

- Enter Amount: Input the amount of Ethereum you want to exchange

- Review Rates: Compare the offered exchange rate with current market conditions

- Provide Bitcoin Address: Enter your Bitcoin wallet address for receiving the converted funds

- Send Ethereum: Transfer your ETH to the provided address

- Receive Bitcoin: Your BTC arrives in your wallet typically within 10-30 minutes

The entire process requires no registration, no KYC, and no lengthy verification procedures that slow down trading on traditional exchanges.

Overcoming Common ETH/BTC Exchange Challenges

Solving the High Gas Fee Problem

Ethereum’s notorious gas fees have been a major pain point for traders throughout 2025, sometimes reaching $100 or more per transaction. This makes smaller ETH/BTC swaps economically unviable on many platforms. Smart traders are addressing this challenge through several strategies.

The most effective approach is batching transactions during periods of lower network congestion. Gas fees typically drop during weekends and off-peak hours, making these optimal times for executing swaps. Additionally, using platforms that optimize for gas efficiency can significantly reduce transaction costs.

Some traders are also utilizing Layer 2 solutions where possible, though this adds complexity for cross-chain swaps to Bitcoin. The key is finding platforms that have already optimized for gas efficiency in their infrastructure.

Managing Slippage in Volatile Markets

Slippage remains a critical concern for ETH/BTC exchanges, particularly during volatile market periods. When prices move rapidly between initiating and completing a swap, traders can receive significantly less than expected. Understanding and managing slippage is essential for successful exchanges.

Setting appropriate slippage tolerance is crucial—too low and your transactions fail frequently, too high and you’re vulnerable to unfavorable rates. For ETH/BTC pairs, a tolerance of 1-2% typically works well during normal market conditions, but volatile periods may require higher settings.

Advanced platforms now offer slippage protection through streaming swaps that break large orders into smaller parts over time. This approach reduces market impact and provides more consistent execution prices.

Navigating Cross-Chain Complexity

The technical complexity of moving assets between Ethereum and Bitcoin networks creates numerous potential failure points. Traditional solutions often require multiple steps: converting ETH to a wrapped version, bridging to the Bitcoin network, and then unwrapping to native BTC.

Modern exchange solutions eliminate this complexity by handling all technical aspects automatically. Users simply specify their desired trade, and the platform manages blockchain interactions, network fees, and timing optimization behind the scenes.

Advanced Trading Strategies for ETH/BTC Pairs

Capitalizing on Institutional Flow Patterns

The massive institutional capital flowing into Ethereum ETFs creates predictable patterns that savvy traders can exploit. These institutional flows typically occur during specific time windows and often drive price movements in the ETH/BTC pair.

Monitoring ETF flow data and institutional trading patterns can provide early signals for profitable exchange opportunities. When institutional buying accelerates, it often precedes ETH strength against Bitcoin, creating favorable conditions for BTC-to-ETH swaps.

Seasonal and Cyclical Considerations

The crypto market exhibits seasonal patterns that affect ETH/BTC trading dynamics. Historical data shows that Ethereum often performs better relative to Bitcoin during certain periods of the year, particularly during DeFi growth phases and major network upgrades.

In 2025, the upcoming Ethereum upgrades and continued DeFi expansion are creating additional catalysts for ETH strength. Traders positioning ahead of these developments often benefit from improved ETH/BTC exchange rates.

Risk Management in Volatile Conditions

Effective risk management becomes even more critical when trading ETH/BTC pairs during 2025’s increased institutional activity. Large institutional trades can create sudden price movements that affect exchange rates significantly.

Implementing proper position sizing, using stop-loss mechanisms where available, and diversifying across multiple smaller trades rather than single large exchanges can help manage these risks effectively.

Conclusion

The ETH/BTC trading landscape in 2025 presents both unprecedented opportunities and unique challenges. While Bitcoin maintains its store-of-value narrative, Ethereum’s institutional adoption and utility expansion are creating new dynamics that favor informed traders.

Success in this environment requires understanding institutional flows, managing technical challenges like gas fees and slippage, and choosing platforms that optimize for both rates and execution efficiency. The market’s evolution toward greater institutional participation is creating more sophisticated trading opportunities for those who adapt their strategies accordingly.

Key takeaways for ETH/BTC trading in 2025: monitor institutional ETF flows for timing signals, use platforms that aggregate rates for better execution, manage gas fees through strategic timing, and leverage the growing DeFi ecosystem for enhanced trading opportunities. By staying informed about these market dynamics and using efficient exchange platforms, traders can capitalize on the ongoing transformation in crypto markets.

Frequently Asked Questions

Q: What’s the best time to exchange ETH for BTC in 2025? A: Monitor for periods when Bitcoin shows momentum exhaustion around resistance levels while Ethereum demonstrates fresh strength, typically coinciding with major ETF inflows or DeFi growth.

Q: How can I minimize gas fees when exchanging ETH to BTC? A: Time your swaps during off-peak hours (weekends, early morning UTC) and use platforms that optimize gas usage or offer fixed-fee structures for cross-chain swaps.

Q: Why is the ETH/BTC ratio important for trading decisions? A: The ratio indicates relative strength between the assets; rising ratios suggest ETH outperformance, while declining ratios favor Bitcoin, helping time optimal exchange opportunities.

Q: Are institutional ETF flows affecting retail ETH/BTC exchange rates? A: Yes, large institutional flows into Ethereum ETFs create demand pressure that often improves exchange rates for retail traders swapping BTC to ETH during high-inflow periods.

Q: What slippage tolerance should I set for ETH/BTC swaps? A: For normal market conditions, 1-2% works well; increase to 3-5% during volatile periods, but be aware that higher tolerance increases vulnerability to unfavorable price movements.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]