Table of Contents

Introduction

Swapping Bitcoin for Ethereum has never been more popular—or more dangerous. With crypto thefts reaching unprecedented levels in 2025, including the record-breaking $1.5 billion ByBit hack, securing your BTC to ETH exchanges requires serious preparation and the right approach.

The stakes couldn’t be higher. Every day, thousands of traders lose their digital assets to preventable security breaches, phishing attacks, and platform vulnerabilities. Whether you’re diversifying your portfolio from Bitcoin’s store-of-value stability to Ethereum’s smart contract ecosystem, or capitalizing on market opportunities, one security mistake can wipe out years of investment gains.

This comprehensive guide reveals the exact security protocols professional traders use to protect their assets during BTC/ETH swaps. You’ll discover how to identify and avoid the most dangerous threats, choose secure platforms, and execute exchanges with bank-level protection. By the end, you’ll have a bulletproof security framework that safeguards every transaction.

Understanding the Current Threat Landscape

The crypto security environment in 2025 presents unprecedented challenges for BTC/ETH traders. State-sponsored hackers, sophisticated social engineering campaigns, and evolving scam techniques have transformed the risk profile of cryptocurrency exchanges.

Major Security Threats Targeting Crypto Swaps

Exchange Platform Breaches Centralized exchanges remain prime targets for cybercriminals. Recent attacks demonstrate how quickly millions can vanish from supposedly secure platforms. The pattern typically involves compromised administrative credentials, insider threats, or sophisticated phishing campaigns targeting platform employees.

Social Engineering Attacks Scammers now use AI-powered deepfakes to impersonate exchange support staff or trusted influencers. These attacks have caused over $200 million in losses during 2025 alone. Attackers create fake emergency scenarios, claiming your account is compromised and requesting immediate action—including sharing private keys or transferring funds to “secure” wallets.

Private Key Theft and Wallet Compromise The most devastating losses occur when criminals gain access to your wallet’s private keys. This happens through malware, phishing websites that mimic legitimate exchanges, or social engineering attacks that trick users into revealing their recovery phrases.

Wrong Address Transactions Cross-chain swaps between Bitcoin and Ethereum networks create unique risks. Sending Bitcoin to an Ethereum address (or vice versa) typically results in permanent fund loss. Unlike traditional banking errors, blockchain transactions cannot be reversed or canceled once confirmed.

Cross-Chain Specific Vulnerabilities

Bitcoin and Ethereum operate on fundamentally different blockchain architectures, creating unique security considerations for swaps. Bitcoin’s UTXO model contrasts sharply with Ethereum’s account-based system, and bridges between these networks introduce additional attack vectors.

Smart contract vulnerabilities on Ethereum-based trading platforms can expose funds to exploitation. Oracle manipulation attacks can also affect exchange rates during swaps, potentially causing significant financial losses during volatile market periods.

Choosing Secure Platforms for BTC/ETH Exchanges

Platform selection forms the foundation of secure cryptocurrency trading. The choice between centralized exchanges, decentralized protocols, and hybrid solutions significantly impacts your security posture and risk exposure.

Security-First Platform Evaluation

Regulatory Compliance and Licensing Legitimate platforms maintain proper licensing in their operational jurisdictions. However, compliance requirements vary significantly between regions. Some platforms prioritize user privacy while maintaining operational security, offering alternative approaches to traditional KYC procedures.

Cold Storage Implementation Secure platforms store the majority of user funds in offline cold wallets, limiting exposure to online attacks. Industry best practices suggest platforms should maintain less than 5% of total funds in hot wallets for operational purposes.

Security Infrastructure Assessment Look for platforms implementing multi-signature wallet architecture, regular security audits, and transparent fund management practices. Professional-grade platforms often publish proof-of-reserves reports, demonstrating their ability to honor withdrawal requests.

Insurance and Recovery Procedures Advanced platforms provide insurance coverage for platform-related losses and maintain clear procedures for handling security incidents. However, insurance typically doesn’t cover user errors or individual account compromises.

Platform Types and Security Trade-offs

Centralized Exchanges Traditional centralized platforms offer high liquidity and user-friendly interfaces but require users to trust the platform’s security measures. Users surrender control of private keys during trading, creating counterparty risk.

Decentralized Protocols DEX platforms maintain user custody of private keys but require higher technical knowledge. Smart contract risks and lower liquidity for large trades present different security considerations compared to centralized alternatives.

Hybrid Solutions Some platforms combine centralized efficiency with decentralized security principles, offering non-custodial trading with professional-grade user interfaces. These solutions often provide faster execution while maintaining user control over private keys.

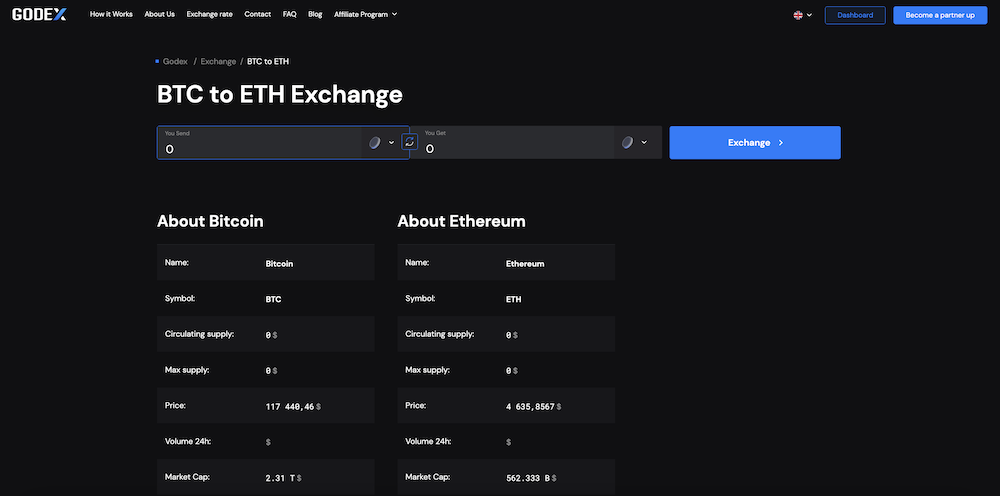

How Godex Enhances BTC/ETH Swap Security

When it comes to securing BTC to ETH exchanges, Godex represents a paradigm shift in cryptocurrency trading security. Unlike traditional exchanges that store your funds and personal information, Godex operates on a non-custodial model that eliminates many common attack vectors entirely.

Advanced Security Architecture

Non-Custodial Design Godex never holds your cryptocurrencies, eliminating the single biggest risk factor in crypto trading. Your funds move directly from your wallet to your destination address, bypassing centralized storage that hackers typically target. This architecture makes platform breaches irrelevant to your asset security.

Zero Data Collection The platform requires no personal information, email addresses, or account creation. Without stored user data, there’s nothing for criminals to steal or governments to subpoena. This approach provides inherent protection against data breaches and identity theft.

Fixed Rate Protection Godex’s fixed-rate system locks in exchange prices before transaction initiation, protecting users from sandwich attacks and front-running schemes common on automated market makers. This feature proves crucial during volatile market conditions when price manipulation attempts peak.

Technical Security Features

Direct Wallet-to-Wallet Transfers All transactions occur directly between user-controlled wallets, eliminating intermediary risks. Smart contract vulnerabilities and platform wallet compromises cannot affect your funds since they never touch Godex infrastructure during the swap process.

Hardware Wallet Integration Seamless compatibility with hardware wallets like Trezor provides additional security layers. Users can initiate swaps directly from cold storage devices, maintaining air-gapped security throughout the entire exchange process.

Tor Network Support Built-in Tor compatibility ensures transaction privacy and protects against network-level surveillance. This feature particularly benefits users in restrictive jurisdictions or those requiring enhanced privacy protection.

Operational Security Benefits

99.9% Uptime Guarantee Godex maintains exceptional operational stability through distributed infrastructure and redundant systems. High availability ensures you can execute time-sensitive trades during market volatility without platform-related delays.

Lightning-Fast Execution Most BTC to ETH swaps complete within 5-30 minutes, minimizing exposure to market volatility and reducing the attack window for potential threats. Rapid execution proves essential during crisis situations requiring immediate portfolio rebalancing.

Multi-Cryptocurrency Support With over 300 supported cryptocurrencies, users can diversify security strategies across multiple assets without platform fragmentation. Concentrated trading on single platforms creates security risks that multi-platform approaches can mitigate.

The combination of these features creates a security-first trading environment where traditional exchange vulnerabilities simply don’t apply. Users maintain complete control over their private keys while accessing professional-grade trading infrastructure.

Essential Security Practices for BTC/ETH Swaps

Implementing robust security practices transforms cryptocurrency trading from high-risk speculation into calculated portfolio management. Professional traders follow systematic security protocols that dramatically reduce vulnerability to common attack vectors.

Pre-Trade Security Preparation

Wallet Security Hardening Use dedicated trading wallets separate from long-term storage. Configure multi-signature setups where possible, requiring multiple devices or keys to authorize transactions. Enable all available security features including 2FA, PIN codes, and biometric authentication.

Network Security Measures Never execute trades on public WiFi networks. Use VPN services with proven no-logging policies, preferably those accepting cryptocurrency payments. Consider Tor browser for additional privacy layers, particularly when trading significant amounts.

Transaction Planning Plan trades during low-volatility periods to reduce exposure to price manipulation attacks. Calculate exact amounts needed for trades, including network fees, to avoid multiple transactions that increase exposure surface area.

During-Trade Protection Protocols

Address Verification Procedures Always copy-paste wallet addresses rather than typing manually. Verify the first and last characters of addresses before confirming transactions. Use address book features for frequently used destinations, reducing error probability.

Transaction Monitoring Monitor blockchain explorers in real-time during swaps. Understand expected confirmation times for both Bitcoin and Ethereum networks. Set up alerts for incoming transactions to detect any irregularities immediately.

Platform Security Verification Check SSL certificates and verify official URLs before entering any information. Look for platform status pages confirming operational stability. Never follow links from emails or social media messages claiming to be from exchanges.

Post-Trade Security Measures

Immediate Fund Verification Confirm successful receipt of exchanged cryptocurrencies in your controlled wallets. Document transaction hashes and timestamps for future reference. Never leave funds on exchange platforms longer than necessary.

Security Audit Trail Maintain detailed logs of all trading activities including timestamps, amounts, and platform details. This information proves invaluable for tax purposes and helps identify patterns if security issues emerge.

Ongoing Monitoring Set up portfolio monitoring tools to track all wallet addresses for unexpected activities. Consider using blockchain analysis tools to verify transaction legitimacy and identify potential security compromises.

Advanced Protection Strategies

Professional-grade cryptocurrency security requires layered protection strategies that anticipate sophisticated attack vectors. These advanced techniques provide institutional-level security for high-value BTC/ETH swaps.

Multi-Signature Security Implementation

Set up multi-signature wallets requiring multiple private keys to authorize transactions. This approach eliminates single points of failure and provides protection against device theft or compromise. Configure M-of-N signatures matching your security requirements and operational needs.

Hardware Security Module Integration

Dedicated hardware security modules provide tamper-resistant private key storage and transaction signing. These devices maintain security even if connected computers become compromised. Professional traders often use multiple HSM devices for different transaction categories.

Geographic Distribution Strategies

Distribute security credentials across multiple geographic locations to protect against localized threats including natural disasters, political instability, or targeted physical attacks. This strategy proves particularly important for high-net-worth individuals or institutional traders.

Emergency Response Planning

Develop comprehensive incident response procedures covering various compromise scenarios. Include steps for immediately securing remaining funds, documenting evidence, and contacting relevant authorities. Practice these procedures regularly to ensure effectiveness during actual emergencies.

Social Engineering Defense

Train yourself and associates to recognize social engineering attempts. Establish verification procedures for any requests involving fund movements or security changes. Never provide sensitive information via phone, email, or social media, regardless of apparent authority or urgency.

Conclusion

Secure BTC to ETH swapping in 2025 demands vigilance, preparation, and the right platform choices. The cryptocurrency threat landscape continues evolving, with sophisticated attackers targeting every vulnerability in traditional trading approaches.

The key principles remain constant: maintain control of your private keys, verify every transaction detail, use secure networks, and choose platforms prioritizing user security over convenience. Platforms like Godex demonstrate how proper architecture eliminates entire categories of security risks through non-custodial design and privacy-first operations.

Bottom line: Security isn’t optional in cryptocurrency trading—it’s the difference between building wealth and losing everything. Implement these practices systematically, never compromise on security fundamentals, and remember that the most expensive cryptocurrency lesson is the one learned after losing your funds.

Your cryptocurrency security is only as strong as your weakest practice. Make security your first priority, and every subsequent trade becomes an opportunity for growth rather than a roll of the dice.

FAQ

Q: What’s the safest way to swap large amounts of BTC for ETH? A: Use non-custodial platforms with fixed-rate protection, execute trades during low-volatility periods, and consider breaking large amounts into smaller transactions to reduce exposure.

Q: How can I verify an exchange platform’s security before trading? A: Check for proper licensing, review security audit reports, verify cold storage implementation, and research the platform’s incident history and response procedures.

Q: Should I use a VPN when trading cryptocurrencies? A: Yes, VPN usage provides essential network security and privacy protection, particularly important when trading from unsecured networks or restrictive jurisdictions.

Q: What should I do if I suspect my wallet has been compromised? A: Immediately move all funds to new wallets with fresh private keys, document the incident, and consider reporting to relevant authorities for investigation.

Q: Are hardware wallets necessary for cryptocurrency trading security? A: Hardware wallets provide optimal security for private key storage and transaction signing, making them highly recommended for any significant cryptocurrency holdings or trading activities.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]