Table of Contents

As of March 2023, the DeFi industry has witnessed remarkable growth, as the total value locked (TVL) in DeFi protocols has exceeded $200 billion. This indicates a significant surge in the DeFi business over the past few years.

Therefore, it is not surprising why crypto analysts are betting on crypto projects related to DeFi. One such project is Aave, which, thanks to its simple and reliable borrowing and lending system, has good prospects for growth and adoption of its coin.

In today’s article, we will give a brief review of the AAVE coin and future forecasts of its value from leading crypto forecasters who, having analyzed favorable and negative circumstances, will be able to assess the likelihood of a bullish or bearish trend.

What is AAVE?

AAVE is an open source decentralized and non-custodial liquidity token that enables users to lend and borrow cryptocurrencies without intermediaries. It is a deflationary ERC-20 governance and reward token that can be staked. The Aave (meaning “ghost” in Finnish) platform uses a peer-to-contract model that provides instant access to funds in a liquidity pool through smart contracts.

Lenders can earn a significant interest by depositing assets in specially created liquidity pools. Borrowers can subsequently use the cryptocurrency as collateral to obtain an instant loan from this liquidity. Automated algorithms determine the interest rate for both lenders and borrowers. The rate for borrowers is contingent on the pool’s fund availability at a given moment. Meanwhile, the rate for lenders is linked to the one set by Aave, which is secured by algorithms that guarantee steady withdrawals at all times.

Lenders and borrowers providing liquidity to the protocol receive aToken, at a rate of 1:1 to the price of AAVE. And further interest is accumulated on these aTokens, and their price grows. In other words, aToken is a certificate of deposit that accumulates interest.

Aave is now in the top 50 cryptocurrencies with a market cap of $1 013 610 713. The 24-hour trading volume was down 0.87% and amounted to $59 065 366. The token has a limited supply of 16,000,000 AAVE, and 88% of the coins are in circulation. Aave, as well as other crypto assets, is subject to the influence of Bitcoin, which has an effect on pricing throughout the market.

Project Name | Aave |

| Stock Symbol | AAVE |

| Current Price | $72.02 |

| Current Supply | 14,093,193 AAVE |

| Max Supply | 16,000,000 AAVE |

| ROI Since Launch | 13752.68% |

| Official Website | https://aave.com/ |

Aave Fundamental Analysis

The future growth of AAVE prices depends largely on whether the project’s crypto protocol will be popular in the DeFi environment and a sought-after monetary asset. A fundamental analysis of the project will help assess the prospects and make more accurate Aave price predictions.

As for now, the Aave DeFi protocol is the fifth largest protocol, with a Total Value Locked (TVL) up 8.69% over the past week to $5.6B. Besides the Ethereum network, the protocol is available in the Polygon and Avalanche ecosystems.

Aave has a reputation for regularly implementing advancements, and the most recent of these is AAVE V3, which marks the third iteration of the platform. V3 is geared towards enhancing the governance framework, managing the risks associated with DeFi operations, and addressing other pertinent issues.

Aave, a decentralized protocol, is presently facilitating cross-chain DeFi operations, with lending being one of the key areas of focus. The platform has emerged as one of the leading DeFi protocols generating significant fees, indicating its burgeoning acceptance and increasing user adoption.

AAVE’s price predictions are optimistic given the robust fundamentals currently in place. Nonetheless, to make precise projections about its future performance, one must scrutinize various aspects such as network metrics, user adoption rate, network expansion, and tokenomics. These metrics play a crucial role in determining AAVE’s price trends.

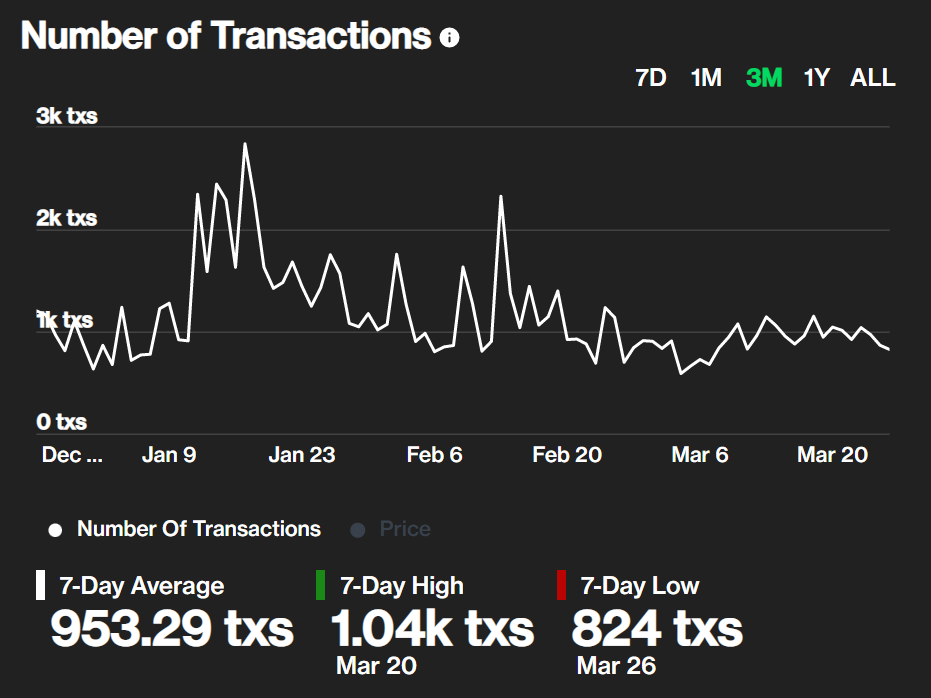

The number of transactions with AAVE over the past three months has been going up and down. The period of the greatest activity of the crypto users was from mid-January to mid-February. The average number of transactions for the last week was 953.29, which is almost three times less compared to mid-January.

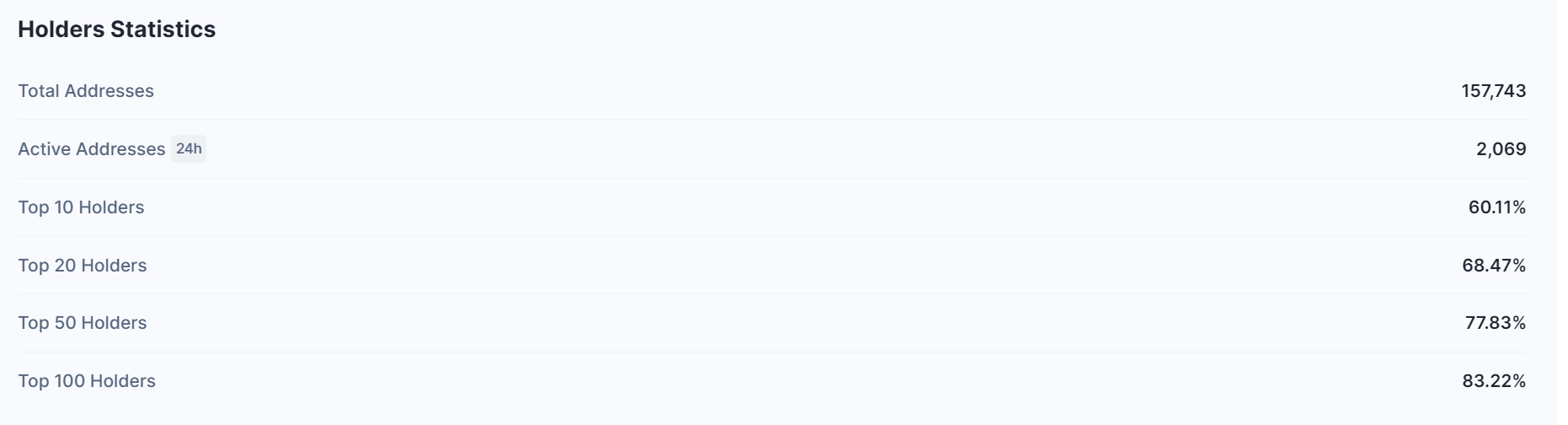

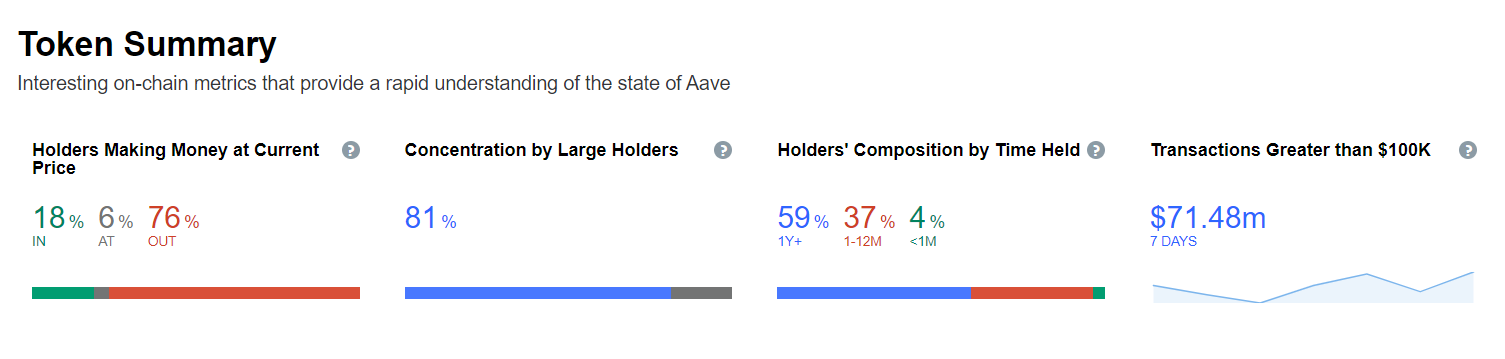

The statistics of AAVE holders give cause for concern. Since the top 100 holders own more than 83% of the token supply, this could backfire if the market dumps.

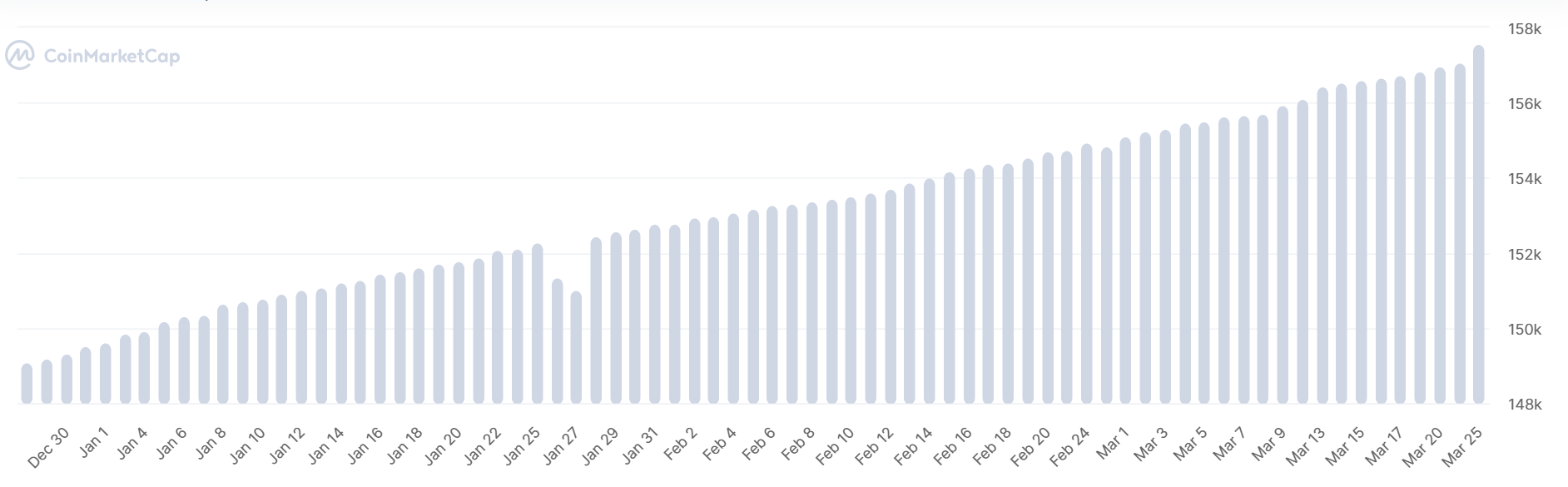

Looking at the number of active Aave addresses over the last 3 months, there is a steady increase, apart from a slight decrease in January. This means that the number of active token users is growing.

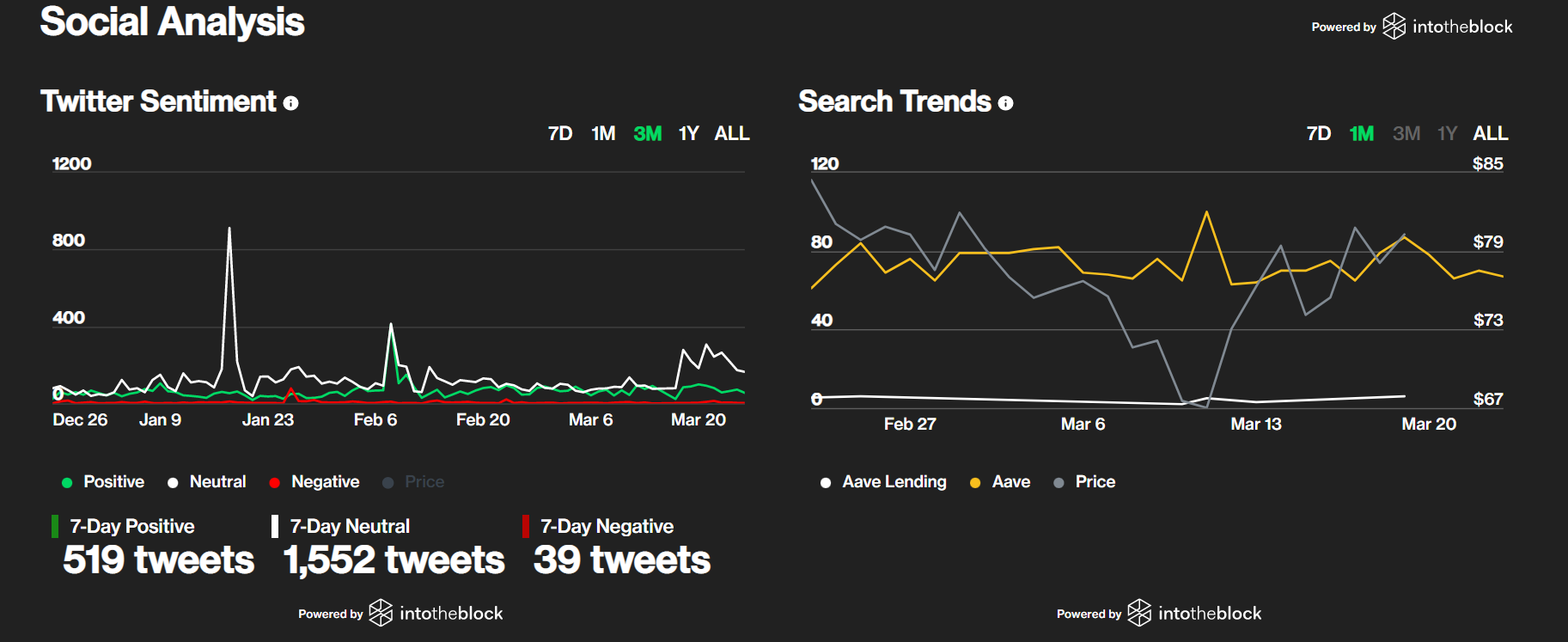

Neutral sentiment towards the AAVE coin prevails in the crypto communities, but interest in the crypto asset has almost tripled over the past 10 days.

Aave Technical Analysis

Utilizing diverse signals can aid in identifying the optimal moment to purchase or dispose of Aave cryptocurrency. The choice of an appropriate timeframe for the token is contingent on the duration of possession. If one intends to secure AAVE for an extended period, it is advisable to focus on signals displayed on weekly and monthly timeframes. Conversely, for short-term holding, chart settings ranging from 5 minutes to 2 hours are deemed more fitting.

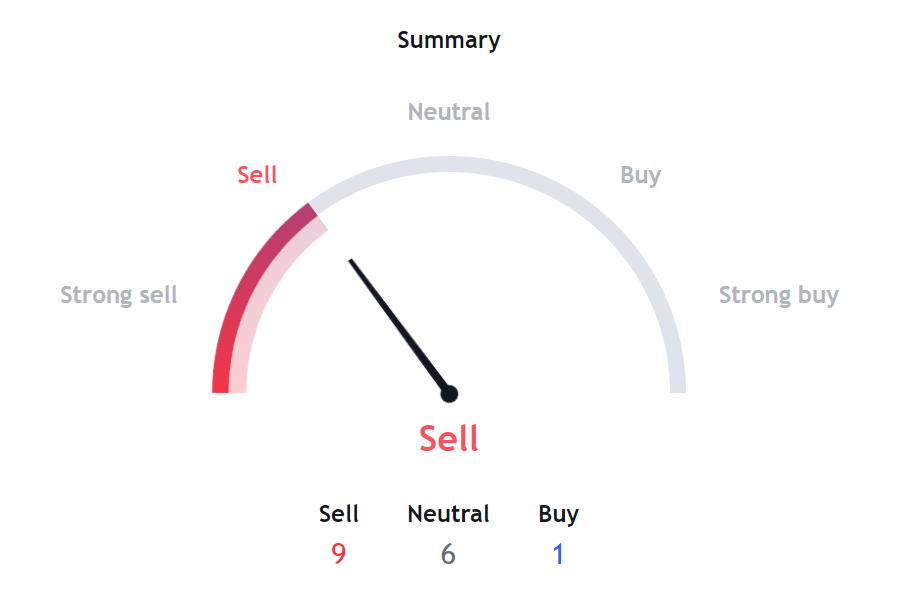

Right now, most of the signals (on a monthly timeframe) are showing Sell or Strong Sell, which indicates a bearish (sell) trend. The MACD Level, the Hull Moving Average (HMA), and the Simple Moving Average (SMA) are also showing sell signals.

AAVE/USD Technical Analysis by TradingView

AAVE Price History

Since Aave was called ETHLend before the rebrand, tracking the earliest value of the token is very difficult. According to CoinMarketCap, the token was worth $52.68 on October 5, 2020.

In just about half a year, the value of AAVE increased more than 12 times, reaching its all time high on May 18, 2021, when it was worth $666.86. However, then the cost more than halved in just a few days, and since then, the price of the token has started its downtrend.

From mid-August to mid-September 2021, the token showed attempts to grow, reaching around $415, but from November of the same year, it rushed down again. After the launch of the Aave V3 in March, the token rose by 114% to a nearly three-month high of $261.29 hit on April 1, 2022. But in July 2022, the crypto community witnessed a new low when it dropped to $49.

By mid-August 2022, AAVE was able to recover slightly, hitting just over $100, but another downtrend was on the way again. From late 2022 to early 2023, the coin traded at around $50 to $60 per token.

From the end of January to the end of March 2023, signs of an uptrend can be observed in the market, as the Aave token is trading at around $80 – $90. This has also provided the basis for some positive projections of future coin prices.

Aave Live Price Chart

AAVE/USD price chart. Source: Coinmarketcap

AAVE price prediction

Below are Aave crypto price predictions from leading forecasting platforms that, based on current market and project activity, as well as past performance, have been able to provide the most accurate assessment of the asset’s prospects.

It is worth noting that crypto analysts have very opposite expectations regarding Aave. Thus, Wallet Investor and Gov Capital do not consider the asset a good long-term investment, predicting its depreciation. At the same time, platforms such as CryptoPredictions, Crypto Politan and DigitalCoinPrice, on the contrary, predict a moderate increase in the value of the DeFi token.

AAVE coin price prediction 2023

Experts at DigitalCoinPrice foresee a possible drop in the price of the AAVE coin to $62.44, but also a maximum possible value of $151.42 in 2023. The average expected value by the end of the year will be $144.38.

Analysts at Crypto Politan have slightly more modest expectations, predicting the maximum value Aave can reach at $110.80. The expected average trading price will be around $100.

As for the Wallet Investor and Gov Capital platforms, they do not predict anything good for AAVE, except for depreciation to almost $0 per coin.

CryptoPredictions do not expect AAVE to grow significantly, but they do not depreciate it to zero dollars either. The maximum price expected by the end of 2023 is $99.893. According to analysts, the DeFi token is unlikely to drop below $67.927, and the average price will be $79.914.

AAVE price prediction 2025

DigitalCoinPrice continues to provide their optimistic forecast, according to which the cost of AAVE in 2025 has every chance of being $225, and the minimum it will be priced at is $206.26.

Fellow analysts at Crypto Politan have similar forecasts, and even more, expecting that in a few years the price of the crypto can rise to $235.03, and the average trading price will be around $203.

Gov Capital and Wallet Investor do not expect Aave to recover in 2025.

According to CryptoPredictions, AAVE will be able to provide its owners with a 95.00% return on investment, as its maximum value in 2025 could be $178,356.

AAVE price prediction 2030

There are only a handful of Aave prediction proposals for 2030. DigitalCoinPrice has high hopes for it in the long term, expecting the token to skyrocket to $734.06 in 2030. The minimum at which the asset might be valued is $681.69, and the average trading price will be around $714.

Crypto Politan presented a highly positive prediction for the potential of Aave. Their analysis factored in variables such as global regulations, market trends, and community response. According to their projections, the crypto could reach a peak value of $1,640.85, while maintaining an average trading price of $1,426.91. Despite this promising outlook, it is important to note that crypto experts also predict a potential low point for DeFi token. They estimate that by the end of 2030, it could bottom out at $1378.28.

AAVE price prediction 2040

As for the long-term forecasts for 2040, few crypto analysts dare to express their assumptions regarding the value of Aave that far in advance. While it is difficult to accurately predict how the value of any cryptocurrency will change tomorrow, several platforms have agreed that in 2040, the value of the coin is likely to exceed $1,000, and sometimes even be valued at around $2,000 per coin.

AAVE forecast: Conclusion

So far, it is difficult to predict what the future of AAVE will be. On the one hand, the crypto project has practical value, due to its applicability in the field of lending. It is also a good sign that the project is constantly evolving, introducing more and more developments and updates.

On the other hand, some important metrics that could play a role in the future performance of the token are worrisome. Analysts are also divided on the outlook for AAVE, with completely opposite assumptions.

This means that when making a decision to buy or sell AAVE coins, one should conduct personal research based on up-to-date data and metrics.

FAQs

How much can AAVE go?

There are reasonable assumptions that after 2030 one AAVE will cost at least $1,000. However, there are also opinions that it could just as well depreciate to $0 per coin.

Is AAVE worth buying?

The decision to buy an AAVE or not must be made based on personal research and an assessment of the prospects of the project. So far, the chances that the value of the token can skyrocket, generating good returns for its investors, are 50/50.

Does Aave have future?

Fundamental and technical analysis, as well as Aave price predictions, showed that the token has a good chance of success. However, the possibility of failure should not be ignored either.

Is Aave token a good investment?

Aave can be a good investment for those who know when to buy and when to dispose of an asset. For example, some investors who purchased AAVE coins at the earliest known price received an ROI of 13348.51%. Those who invested in coins when they cost more than their present value suffered losses.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]