Table of Contents

Everyone who has anything to do with the crypto domain, including financiers and dealers, often relies on market capitalization (MCAP). This nomenclature is quite familiar to all participants of any financial market, but for virtual assets, it has some peculiarities. Let us clarify what is a market cap in crypto.

Importance of Market Cap

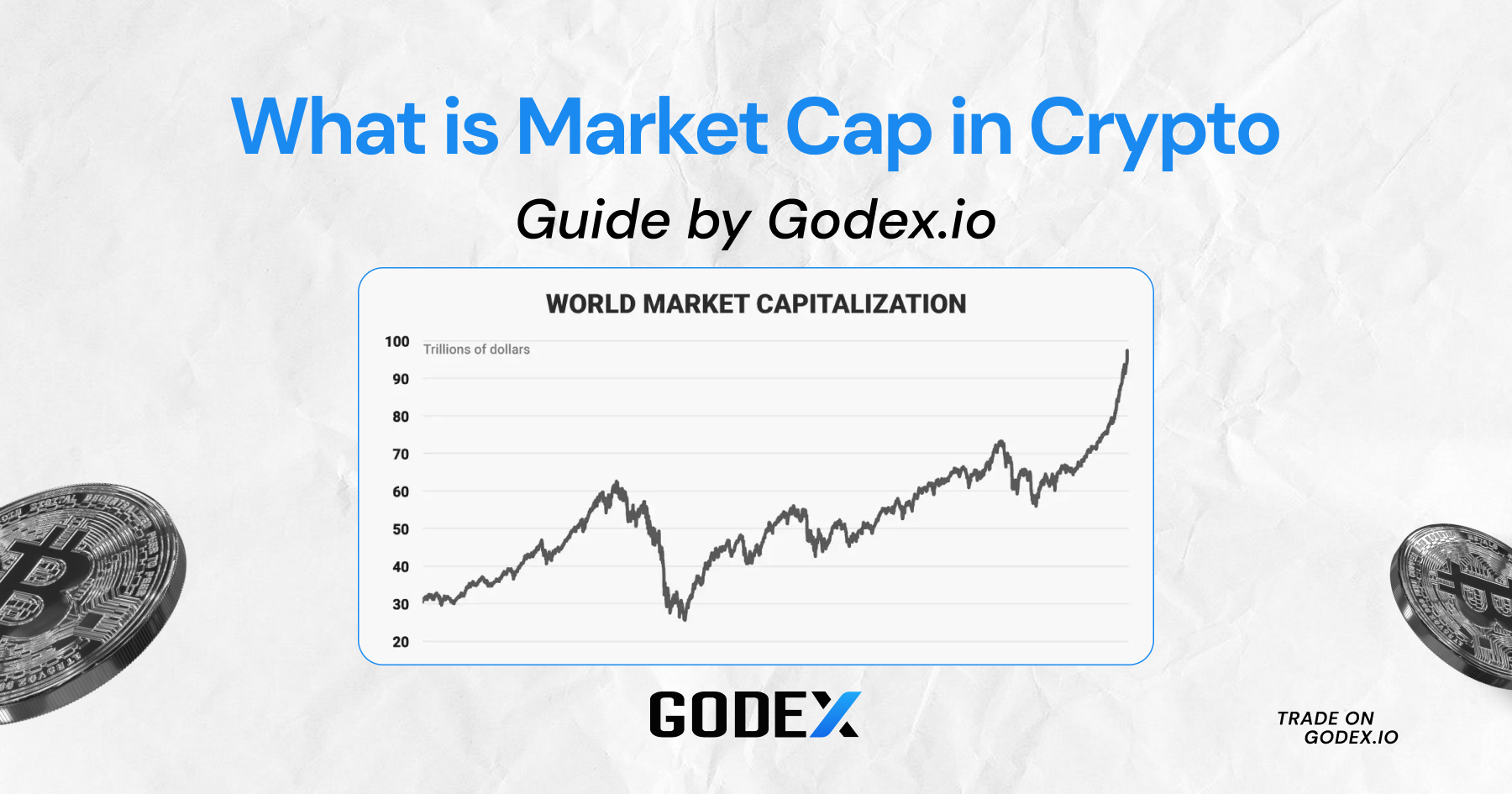

The market capitalization is a milestone in the crypto niche floating as a segment of a larger financial vend. In general, it allows for assessing the dominance, popularity, and evaluation of a certain virtual position. The mysterious emporium is continuously evolving, with new virtual currencies emerging weekly and numerous websites including CoinMarketCap range cryptocurrency orders pursuant to their market capitalization.

This dynamic landscape poses challenges in comprehending the market’s vastness due to the global presence of numerous cryptocurrency exchanges. Drivers impinging on merchantable complexity include privacy features, rapid expansion, protuberant price swings, and market illiquidity.

Utilizing Market Cap

What does market cap in crypto mean? The driver reflects not only the cumulative evaluation of the item on the market, but also its dynamics, as it correlates with the coin exchange rate: if the conversion rate rises, the capitalization becomes larger, and vice versa.

The indicator also shows how stable the asset is. Whereas variability is high, market capitalization changes rapidly and substantially, indicating the speculative nature of the asset.

A cryptocurrency moneyman who uses market cap in his strategy uses the same principle as a pilot who checks the dashboard at the first sign of trouble. Instead of panicking and looking outside, a good pilot knows that checking the latest data will help him or her reach effective decisions.

Influential Factors on Market Cap

Cryptocurrency capitalization hinges on the allowance of coins issued and the commercial appraisements of the cryptocurrency. It is by default measured in US dollars or bitcoins.

Current emission (a total volume of tokens issued)

The first indicator can be both dynamic and static. Escalating emissions are peculiar to projects that use mining, while the release of new coins is a reward for the participants of the network for ensuring its performance. Almost all major cryptocurrencies BTC, ETH, LTC, and others work according to this scheme. Static issuance is characteristic of projects in which 100% of the initial issue was made. The most famous cryptocurrency issued under this system is XRP from Ripple. The capitalization of such projects hinges entirely on the worth of a ducat.

The current value of one token

The value of coins in turn is subject to two factors:

- Global demand for the asset and the behavior of large traders.

- Information occasions concerning a particular asset and the sphere as a whole.

Calculation of Market Cap

No need to be smart as a whip. General calculation mechanism is shooting fish in a barrel: the quantity of assets is multiplied by the value. However, there are two approaches. They differ in whether they take the instant amount of assets or the quantity of spondulicks that will be in the future.

The first one concerns a flowing capitalization when only currently circulated assets are beared in view excluding the ones that will be issued hereafter. This figure demonstrates an instant tradable scale and is deemed to be more clockwork and objective.

The second type is called diluted capitalization. In its calculation, all assets are taken for granted: current and future. However, you do not need to calculate the capitalization manually all the time and leave this for exchanges and aggregator sites like CoinMarketCap and CoinGecko.

Read also Crypto whale tracker: See what crypto whales are buying

FAQ

Is cryptocurrency market capitalization an important metric?

Market capitalization is one of the classic monetary options that has been borrowed by the cryptocurrency sphere from the segment of big finance. Thus, judging by analogy, it is a dynamic quantity that, together with the value and its trading turnover over a certain period, allows us to assess the profitability of capital for investment or use.

What factors contribute to fluctuations in market capitalization?

Large-capitalization projects are less prone to sudden jumps in bids due to the actions of market speculators. Thus, for moneymen market cap is one of the indicators of fixity, as far as it is possible in the context of high volatility of the vend in general.

What does market capitalization dilution entail?

Diluted market capitalization is yet further tool that should be in every trader’s arsenal. It can be calculated as a multiplication of the ongoing exchange rate of each crypto by the total amount of anticipated delivery.

It is essential for assessing the project and its fair value before and after launch, the team’s and market’s attitude towards the project as well as exploring its issuance and estimating perspective sales pressure;

Is market capitalization the most effective gauge of a cryptocurrency’s popularity?

Informational aspects of overriding analytical facilities like CoinmarketCap highlighting that cryptocurrencies with higher market capitalization win more visibility and acceptance heavily lobby prudent investment decisions, with the project’s cumulative capitalization being fullnigh instrumental in their analytics.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]