Table of Contents

Starting exploring the crypto universe, cryptocurrencies may seem like a paradise with astronomical profits, no third parties to control your money spending, and an open and innovative community.

However, many investors soon realize that there are many problems in this decentralized paradise: equally astronomical losses, ubiquitous scams, and thousands of ‘bad bitcoins’. There is also a hidden obstacle that holds many investors back and this is transaction fees. Although everyone seems aware of their existence, the latter still takes thousands of US dollars in profits from crypto investors every day.

So, how to deal with this state of affairs? Of course, you have to find the cheapest virtual coin to transfer.

What is a crypto transaction fee?

Transaction commissions are fees that are charged when buying or selling cryptocurrencies or when transferring a certain amount of cryptocurrency from one wallet or an exchange to another. While anyone who has ever tried to buy, sell or exchange cryptocurrencies has probably heard of cryptocurrency transaction fees, not everyone knows what they are and how they are defined. Let’s take a look at what transaction fees actually entail in the crypto world.

What are the different types of cryptocurrency transaction fees?

If you are planning to invest in cryptocurrency, you should know that there are basically three types of transaction fees in crypto trading: exchange, network, and wallet fees.

Network fees are fees that are paid to the network and to the miners. They also make often the largest contribution to operational fees, as in many cases they are not fixed. They are demand-driven. If the network is congested and there are many transactions trying to push through, those with the highest network charges will go through first. This essentially means that when demand for a coin or token is high, network fees can skyrocket.

Cryptocurrency exchange fees are charged by cryptocurrency exchanges for making transactions. Exchange fees are a major source of revenue for most centralized crypto exchanges. They charge fees for things like extra security, usability, and so on. Some crypto exchanges have multiple levels of fees and allow some users to pay a reduced transaction fee if they use the platform frequently and transfer large amounts.

A crypto wallet fee is an amount you have to pay to withdraw or send crypto from one wallet to another. If it’s an exchange’s built-in wallet, there will be little if any commission. If it is an external wallet, you will have to pay a small fee.

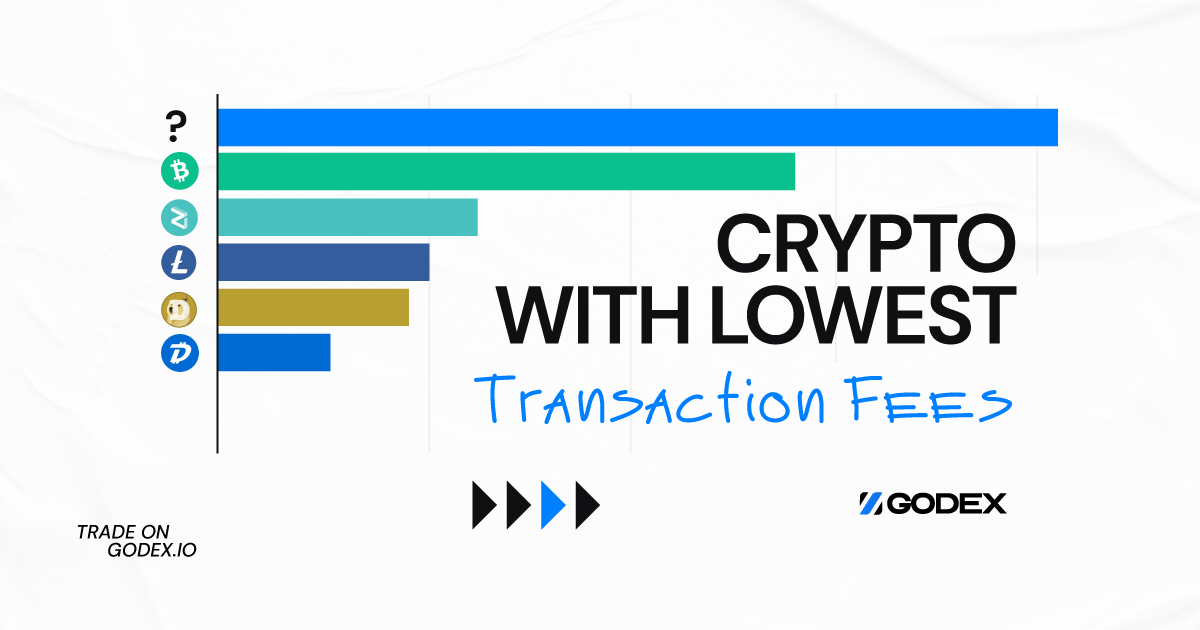

Cryptocurrency with the lowest transaction fees

However, one thing that annoys most cryptocurrency traders is the relatively high transaction fees charged by popular cryptocurrencies. Fortunately, many cryptocurrencies charge much lower transaction fees. Here are some of them below.

Solana is a cryptocurrency with low fees and fast transactions

Solana (SOL) is a truly unique project. It does not use established algorithms such as PoW or PoS but it was the first to offer a PoH (Proof of History) solution. Thanks to its algorithm the speed of transactions is setting records. According to the developers’ statistics, the average Solana can handle up to 50,000 transactions per second. That said, the average Solana blockchain fees are around 0.000005 SOL. That’s times less than a US dollar. So if you want to quickly and profitably withdraw your cryptocurrencies from one exchange to another, you can use Solana.

DigiByte: commission is $0.0005

DigiByte, or DGB, is a crypto with the lowest transaction fees in the industry. Although it uses a consensus proof-of-work mechanism, just like Bitcoin, its transaction fees are low. In addition, its confirmation time is relatively fast transactions go through in about 5 minutes.

DGB unfortunately has some inflation. This means that your funds will decrease in value over time if you plan to hold them for the long term. But it’s great for quick transfers from one exchange to another.

Bitcoin SV: commission is $0.00055

Bitcoin SV (BSV) is a fork of Bitcoin, but it does not share the high transaction fees of its ‘big brother’. On the contrary, this cryptocurrency with the cheapest crypto transaction fees on the market. With its average transaction fare starting from $0.0005, it can indeed be considered one of the cheapest cryptocurrencies to transfer. In addition, BSV regularly breaks its own transaction records, with millions of US dollars per day becoming the norm.

XRP: commission is $0.00078

Like all the other cryptocurrencies on this list, XRP is considered the lowest transaction fee cryptocurrency with an extremely fast confirmation time of 4 seconds. Although some people have written XRP off either because of an SEC lawsuit, it used to be the third most popular cryptocurrency in the world and still has a large community. Cryptocurrency is still one of the largest in the world by market capitalization.

EOS.IO: commission is $0

EOS is an open-source blockchain platform with smart contract functionality. It aims to create a scalable, evolving hub for decentralized, industrial-scale applications. Its own token, EOS, is completely free, so customers shall not pay fees when using it.

All transactions on EOS are free, making it the cheapest transaction fee crypto and an ideal one for making small payments.

FAQ

What is the lowest fee crypto exchange?

There are three main types of commissions, which may be present in almost all exchanges.

Deposit fees. Depositing cryptocurrency is usually not subject to a fee. Depositing fiat currency is another matter. The percentage of loss can be as high as 5% of the amount. The exact figure depends not only on the exchange but also on the payment system or bank, from which payment is made.

Commission for withdrawal. Obligatory for both cryptocurrencies and fiat. In the case of cryptocurrencies, it is usually set at a fixed level, which is guaranteed to cover the transaction fee of the blockchain and additionally provides profit to the exchange itself. In the case of fiat, as in the previous variant, the percentage can reach 5% and depends not only on the exchange but also on the withdrawal payment system.

Trading fees. The main expense item is the fees that are charged for each buy or sell transaction on the crypto exchange. A commission above 0.25% is considered high. Due to competition, exchanges are trying to keep fees as low as possible and allow users to reduce them further. It is also worth noting that many platforms have separate fees for a maker and a taker. The maker is the one who “makes” the market, creates limit orders, which are placed in the order book of the exchange. The taker, on the other hand, closes limit orders by creating market orders.

All cryptocurrency exchanges with low commissions offer individual terms of cooperation, which are worth paying special attention to when choosing a platform. The cryptocurrency exchanges and exchange services with the lowest commissions as of 2023 include the following.

The trading fees on Binance are some of the most favorable in the industry. For Bitcoin pairs, the fee is 0% (BTC/USD, BTC/USDT, BTC/USDC, BTC/BUSD).

Huobi Global is a cryptocurrency exchange that will offer some of the lowest trading fees. The platform charges all traders, whether they are a maker or a taker, a basic commission of 0.2%. For Huobi Global (HT) token holders, there is a discount on the trading fee, which decreases in direct proportion to how many coins are added to the exchange wallet.

Godex is a virtual interchange platform with the smallest commissions, unlimited conversion, and no hidden fees.

What is gas-fee crypto?

A gas fee (or commission) is a common term for the cost that certain users of a blockchain protocol pay to network validators each time they want to perform a function on the blockchain.

The gas incentivizes network validators to accurately record transactions and behave honestly, ensuring that the protocol functions. If there is not enough gas, the transaction will take a long time to be confirmed: several hours, days, weeks, or even indefinitely, depending on demand.

While the Ethereum and Polygon networks use the term “gas fee”, other blockchains such as Solana and Bitcoin use the term “transaction fees”. The term “gas” comes from the analogy of transaction fees to the fuel that a car needs to move around.

Gas fees often come as a surprise to blockchain users. On non-custodial services, where transactions take place directly on the blockchain, gas fees can change every minute in a completely unpredictable way.

The concept of gas was first introduced in the Ethereum blockchain. Gas is used for any computational work in a decentralized network making a transaction, launching a smart contract, signing permissions and others, and stamping (collecting) free tokens and NFTs.

What are gas-fee cryptocurrencies?

- Ethereum (ETH);

- Neo (NEO);

- Binance Coin (BNB);

- Cardano (ADA);

- Terra (LUNA);

- Cosmos (ATOM);

- Tether (USDT) and other ERC-20 tokens;

- Binance USD (BUSD) and other BEP-20 tokens.

How to buy crypto without a fee?

Whether you buy a digital asset an exchange or any other exchange service, you still have to pay a commission. Once you do, it’s easy to start trading with them. Digital currency pairs are available for all popular coins including Bitcoin (BTC), Ethereum (ETH), Monero (XMR), and many more. Usually, exchange services charge higher commissions than exchanges, but this is not the case with Godex. On this platform, you can sell one currency and buy another with minimal fees and no hidden fees.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]