Table of Contents

Quant aims to enhance manipulations spanning multiple blockchains and support the growth of decentralized applications. It is created by a team dedicated to advancing the Overledger operating system, which enhances blockchain interoperability.

The native cryptocurrency associated with the Quant project is QNT. This piece will delve into the core of Quant, exploring eventual QNT price projections for the subsequent decade to fifteen years.

What is Quant?

Quant, a multi-functional platform based in the UK, aims to enhance blockchain interoperability without having its native blockchain. The patented technology is immutable, preventing alterations by external developers.

The platform’s concept revolves around providing any application in need of blockchain net ingress to the most suitable blockchain for its purpose.

Quant Network, headquartered in London, seeks to transform blockchain technology through the development of its blockchain operating system, Overledger. The proficient team strives to fulfill the internet’s original vision by establishing a secure and dependable open network for individuals, devices, and data.

Quant (QNT) Overview

The enterprise, founded in 2018, is guided by Gilbert Verdian, a skilled technical manager specializing in healthcare platform compatibility, which sparked the inception of Quant.

Quant’s key software, the Overledger Network, is the enterprise`s solution that employs an API gateway to bandage blockchain projects with different blockchains. Moreover, blockchain developers can create multi-chain applications (MAPPS) utilizing the Overledger platform.

Overledger supports application development on any blockchain in 12 programming languages, fosters asset interoperability across networks, enables secure smart contract execution, and provides for the development of custom stablecoins or payment solutions.

In terms of concept and technology, Quant’s competitors are Polkadot and Cosmos. Polkadot introduced its parachain system, while Cosmos pioneered the modular blockchain concept. When focusing on Quant’s collaboration with banks in the Central Bank Digital Currency (CBDC) sector, Ripple emerges as a direct competitor.

Quant is tailored to integrate with any distributed ledger architecture, not limited to blockchain but also including DAG. Unlike Tier 2 solutions, implementing Quant does not necessitate modifications to an employed DAG or blockchain infrastructure – the REST API offers a straightforward connection to the blockchain.

The Quant coin (QNT) is an ERC-20 format utility token that businesses and developers need to purchase and commit to a payment channel for platform usage. Its primary role is to cover fees for utilizing Overledger technology. Quant also features its own integrated marketplace where the QNT token can be used for app and license purchases.

All Overledger transactions are carried out through Treasury, a set of Ethereum smart contracts. Treasury serves as an intermediary in each transaction, levying a small fee that is transferred to the Quant Network. While all transactions are conducted using the QNT token, they are denominated in US dollars. An internal price oracle determines the required amount of QNT for a transaction.

Quant Price Analysis

Esteemed cyber security guru Gilbert Verdian introduced the project, bringing over two decades of expertise from both government and enterprise sectors.

Recognizing the prospective of blockchain in enhancing cyber defense while acknowledging blockchain fragmentation, Gilbert founded Quant Network. The project’s ICO was launched in May 2018, raising $11 million.

After the presale, QNT debuted at an initial price of $0.2524 as reported by CoinMarketCap.

Over the years, the price of QNT gradually increased, leading to a significant surge in 2021 where it peaked at $428.38 before experiencing a market-wide decline.

Quant experienced a drop to $44.36 in 2022 but gained momentum despite the bearish market, soaring to $193.36 in October 2022.

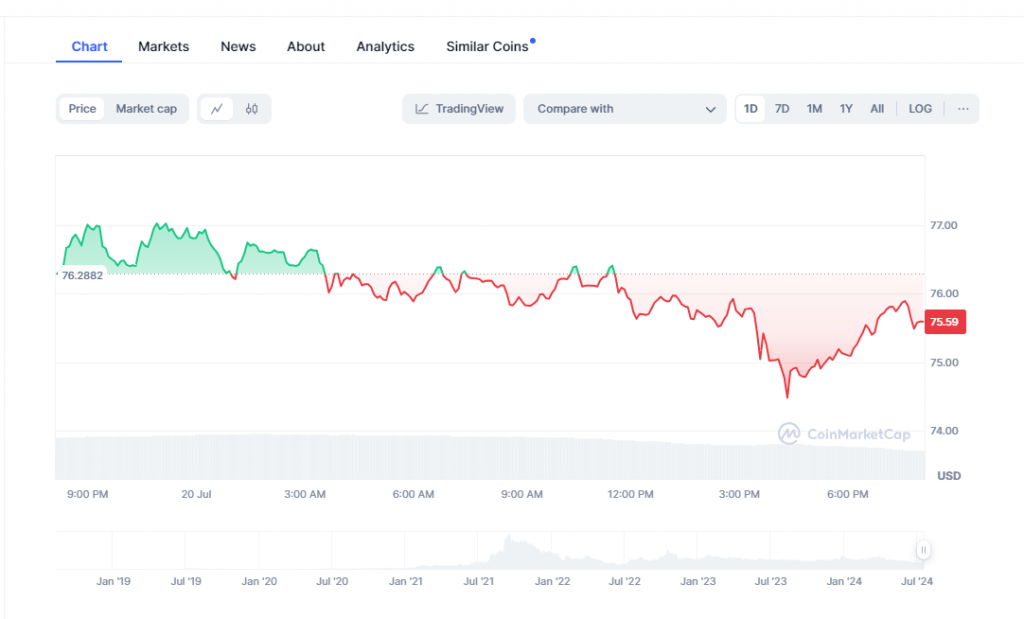

Since then, the price of QNT has shown a downward trend, currently trading at $75.66 with a market cap of $913,457,525 as of July 20, 2024.

Despite the market’s unpredictability, Quant’s future outlook remains optimistic. The innovative Overledger technology, enabling smooth interaction among different blockchain networks, keeps drawing attention from businesses seeking to leverage blockchain benefits without being tied to a specific platform. This technological edge establishes Quant as a significant player in the ever-changing realm of digital finance.

Quant Live Chart

As of July 20, 2024, the live quotation of Quant is $75.59, with a 24-hour trading volume of $11,036,394. Currently ranked at #77 on CoinMarketCap, Quant holds a live market cap of $912,633,023. The highest recorded value for QNT was $428.38 on September 11, 2021, while the lowest value of $0.1636 was noted on August 23, 2018 (6 years ago).

Quant (QNT) Fundamental and Technical Analysis

Quant (QNT) serves as a blockchain platform to link different distributed ledger technologies (DLTs) to ensure smooth interoperability. The core offering of Quant is Overledger, an operational environment compatible with various DLTs, allowing for the formation of multi-chain applications (mApps). This distinguishing feature positions Quant uniquely within the blockchain landscape by fostering communication among diverse blockchains, thereby boosting the effectiveness and efficiency of decentralized networks.

From a foundational viewpoint, Quant’s value proposition lies in its capacity to address the fragmentation challenge in the blockchain sphere. By enabling interoperability, Quant not only improves the functionality of applied DLTs but also expands the manifold of potential applications for decentralized apps (dApps). This expansion could lead to increased recognition by enterprises and developers, consequently fueling uptake for the QNT tokens.

When it comes to the technical aspects, analyzing price trends and market behaviors of QNT can offer valuable insights into its future performance. Utilizing key technical predictors such as moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence) can help traders identify patterns and make well-informed decisions. For example, a strong upward trend in moving averages might indicate a bullish outlook, whereas an overbought RSI could suggest a potential price correction.

Furthermore, gauging the market sentiment through volume analysis and trading patterns can yield valuable insights. Elevated trading volumes typically indicate significant investor interest, influencing price fluctuations. Conversely, sudden spikes in volume might suggest external factors or news events impacting the vend.

To sum up, a comprehensive understanding of Quant (QNT) necessitates both fundamental and technical analyses. While fundamental analysis highlights the project’s value proposition and its significance in the blockchain environment, technical analysis provides actionable information on market trends and investor tendencies. By integrating both methodologies, investors and traders can make well-informed decisions, potentially maximizing returns while managing risks effectively.

Quant Price Prediction

Are you captivated by Quant (QNT) and its prospective future valuation?

While Quant crypto price predictions may be enticing, it’s crucial to approach them with caution and a discerning eye. This guide is designed to provide you with the necessary knowledge to make well-informed decisions about QNT, emphasizing the importance of conducting thorough research on your own.

Factors that dominate the price of QNT include

- Market Dynamics: Supply and demand forces are key influencers, with increased demand potentially driving up the price.

- Regulatory Landscape: Government regulations affecting cryptocurrency adoption and overall market sentiment can impact the price of QNT.

- Technological Advancements: Innovations in blockchain technology could further enhance the value proposition of QNT, potentially leading to price appreciation.

- Adoption Rate: Higher adoption of Overledger by businesses and institutions can have a significant manion the demand for QNT, potentially driving the price higher.

Keep in mind that various platforms offer price forecasts for QNT in the 2030-2040 timeframe. These projections are not guaranteed, and the actual price may vary significantly, but let’s explore estimates from reputable agencies.

Quant Price Prediction 2024

Most experts concur that Quant’s price forecast for 2024 demonstrates a potential high of $100.08, indicating moderate growth shortly. CoinCodex predicts Quant to fluctuate between $62.50 and $110.64. As per Changelly‘s proximate analysis, Quant’s prices in 2024 are not expected to exceed $96.71. Technopedia‘s Quant price prediction anticipates a low of $200 and a high of $300 by the conclusion of 2024. In accordance with the price forecast from Traders Union, QNT keep current positions around the $75.010369 mark by the beginning of 2025.

Quant Price Prediction 2025

CoinCodex‘s QNT price prediction 2025 ranges from $62.50 to $393.91. Changelly anticipates a potential peak QNT price of around $148.88 by 2025. In contrast, Technopedia’s forecast indicates a high of $440 for QNT in the same year.

Quant Price Prediction 2030

Numerous QNT crypto price predictions for 2030 suggest that QNT could surpass the $1,000 mark by 2030, signaling long-term growth potential. The CoinCodex`s QNT price forecast 2030 varies from $106.73 at the lowest to $477.83 at the highest. Changelly suggests that QNT will range between $777.43 and $963.18 in 2030. Technopedia’s anticipation for 2030 sets QNT’s highest price at $550. Coinmarketcap’s quant 2030 price prediction indicates an utmost fee of $1,063.26.

Quant Price Prediction 2040

The Changelly team’s optimistic quantitative price outlook for 2040 anticipates a peak in the QNT price at $54,502. On the other hand, Coinmarketcap predicts that prices could surge to a new record in the subsequent year, with the QNT Coin reaching a peak height of approximately $3,147.05.

Quant Price Prediction 2050

As stated by the Changelly team, they predict that the paramount QNT price could reach $76,655 by the year 2050. By contrast, Coinmarketcap’s long-term Quant price prediction assumes that the upper bound price might hit $6,606.07 by 2050.

Conclusion

Quant offers a sought-after service to the market by significantly lowering the cost of incorporating blockchain technology into businesses. Additionally, Quant addresses the primary issue with current networks by guaranteeing their interoperability. Although the quotation of the QNT token has surged since June 2022, it remains five times lower than its peak. Despite occasional fluctuations, Quant’s price has recently been on the rise, indicating potential for further growth compared to the overall market rate. Fundamentally, Quant’s vision of a future-proof, interoperable blockchain and digital asset ecosystem is consistently supported by its initiatives.

FAQ

How do I acquire Quant tokens?

To obtain Quant tokens, you must initially establish a digital wallet that is compatible with Ethereum-based tokens like MetaMask, Trust Wallet, or MyEtherWallet.

Buying Quant has never been simpler. You can purchase it on various exchanges such as Binance, Bilaxy, Bittrex, Uniswap (V2), and Hotbit. Alternatively, you can use the Godex exchange service to exchange it swiftly and anonymously for one of over 300 different coins.

What are the essential factors to assess when considering Quant (QNT) as an investment?

Quant concentrates on fields like tokenization, digital currencies, and more. These emerging focus areas hold significant promise. While Quant boasts advanced technology for enterprise blockchain interoperability, investing in it remains speculative. Quant has demonstrated significant potential, establishing itself as a key player in the market with its innovative technology and skilled team. Nevertheless, it’s crucial to remember that investing in cryptocurrencies involves risks.

Are there any collaborations or advancements that might influence Quant’s future trajectory (QNT)?

Quant’s Overledger updates in 2022 added Polygon support, reducing Ethereum transaction costs. A strategic partnership with Avalanche in 2023 promises improved speed and lower costs. Leading the SATP working group, Quant aims to secure asset transfers. The project’s focus on CBDCs, asset tokenization, blockchain connectivity, and partnerships reflects a forward-thinking advance that appeals to investors who are crypto experts. Moreover, Quantum has ascertained strategic alliances with prominent firms such as SIA, Oracle, and Deloitte. These collaborations broaden Quantum’s ecosystem and open avenues for leveraging the platform across diverse industries.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Peter Moore

Peter Moore

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]