Table of Contents

Introduction

Privacy in cryptocurrency trading is becoming harder to find. Many popular exchanges now require identity verification for most transactions. This shift has pushed traders toward non KYC crypto exchanges that respect financial privacy.

Non KYC exchanges let you swap cryptocurrencies without uploading passports or selfies. They offer faster transactions and greater anonymity. However, the landscape has changed dramatically in 2024-2025.

Several major platforms that once championed privacy have quietly introduced verification requirements. Users report unexpected KYC requests during routine swaps. This creates confusion about which services truly protect your identity.

This guide reviews 10 non KYC exchanges available in 2025. We examine their privacy policies, coin support, and fee structures. You’ll learn which platforms maintain genuine privacy standards. We also reveal which popular services have abandoned their no-verification promises.

What Are Non KYC Crypto Exchanges?

Non KYC crypto exchanges are trading platforms that don’t require identity verification for transactions. These services let you swap cryptocurrencies using only wallet addresses.

KYC stands for “Know Your Customer.” Traditional exchanges require government ID, proof of address, and sometimes facial recognition. This process can take days. It also creates databases of personal information vulnerable to hacks.

Non KYC exchanges operate differently. They focus on the transaction, not the trader. You simply:

- Select your trading pair

- Enter your receiving wallet address

- Send your cryptocurrency

- Receive swapped coins

Why do traders prefer non KYC platforms?

| Benefit | Description |

|---|---|

| Speed | No waiting for verification approval |

| Privacy | No personal documents stored |

| Accessibility | Available to users in more regions |

| Security | Less personal data at risk |

| Simplicity | Fewer steps to complete trades |

The main tradeoff involves transaction limits. Some platforms cap trade sizes. Others may request verification for unusually large amounts or suspicious patterns.

10 Best Non KYC Crypto Exchanges in 2025

1. GODEX — Best Privacy-Focused Instant Exchange

GODEX stands as a high-privacy platform supporting over 919 cryptocurrencies without mandatory registration. Operating since 2018, this instant-access exchange has built its reputation on confidential trading practices.

The platform offers fixed-rate exchanges for 30 minutes after order creation. This protects you from market volatility during transactions. There are no upper limits on exchange amounts. Only minimum thresholds exist to cover network fees.

Key features:

- 919+ supported cryptocurrencies

- Fixed exchange rates locked for 30 minutes

- No mandatory account registration

- Fully automatic exchange system

- 24/7 customer support

- All transaction data erased from servers within one week

GODEX aggregates rates from major platforms including Binance, Bitfinex, and HitBTC. This ensures competitive pricing across all trading pairs. The identity-light approach means you can start trading immediately. Processing typically takes 5-30 minutes depending on blockchain confirmations.

For traders seeking a confidential trading platform with extensive coin support, GODEX represents what privacy-focused exchanges should be.

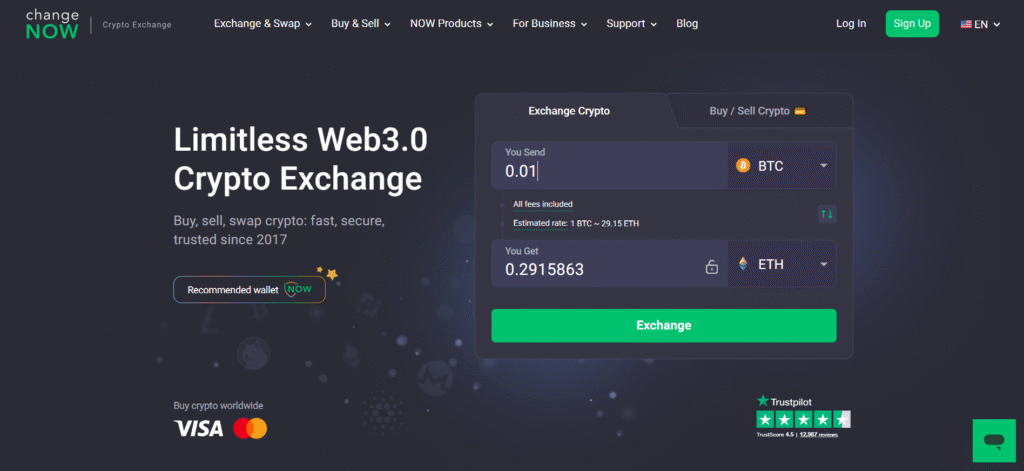

2. ChangeNOW — Popular But Now Requires Verification

ChangeNOW processes over 10 million transactions but no longer operates as a true non KYC exchange. The platform now requires identity verification for transactions flagged as suspicious.

This represents a significant policy shift. Users report unexpected verification requests during routine swaps. The official FAQ confirms KYC may be required. This contradicts their historical privacy positioning.

What changed:

- Verification required for “suspicious transactions”

- Risk-based assessment triggers KYC requests

- Some users blocked until providing documents

The exchange supports 900+ cryptocurrencies. It offers both fixed and floating rate options. The interface remains user-friendly. Processing speeds stay competitive at 5-30 minutes.

ChangeNOW still works for many traders. However, the unpredictable verification requirements create uncertainty. You might complete dozens of swaps smoothly. Then face sudden document requests on a routine transaction.

For users prioritizing guaranteed privacy, ChangeNOW’s current policies introduce risk. Those comfortable with potential verification will find a polished platform.

3. Changelly — Established Exchange With KYC Thresholds

Changelly requires KYC for transactions exceeding €10,000 within 48 hours or when activity appears suspicious. This makes it a conditional non KYC exchange rather than a true privacy platform.

Operating since 2015, Changelly has processed over 6 billion dollars in exchanges. The platform supports 500+ cryptocurrencies. Its user base includes millions of traders worldwide.

Verification triggers:

- Transactions over €10,000 in 48 hours

- Suspicious activity patterns

- High-risk jurisdictions

- Unusual transaction behavior

For smaller, routine swaps, Changelly often works without verification. The interface is clean and beginner-friendly. Exchange times average 5-30 minutes. Fees run approximately 0.25% plus network costs.

The platform integrates with hardware wallets like Ledger and Trezor. This adds security for larger holdings. Mobile apps exist for iOS and Android.

Changelly suits traders making moderate-sized swaps who accept potential verification. It’s not ideal for those requiring guaranteed anonymity or processing large volumes.

4. SimpleSwap — Large Selection With Optional Verification

SimpleSwap supports over 1,500 cryptocurrencies with optional KYC that may be requested for certain transactions. The platform balances accessibility with extensive coin coverage.

Founded in 2018, SimpleSwap has grown into a popular instant exchange. The service offers both fixed and floating rate options. No registration is required for standard swaps.

Platform highlights:

- 1,500+ supported cryptocurrencies

- Both fixed and floating rates

- No mandatory registration

- Loyalty program available

- Affiliate program for partners

The “optional KYC” policy means verification isn’t standard. However, the platform reserves the right to request documents. This typically occurs with large transactions or flagged activity.

SimpleSwap’s coin selection exceeds most competitors. If you trade obscure altcoins, you’ll likely find them here. The interface works well for beginners. Advanced users appreciate the API access.

Processing times range from 5-60 minutes depending on blockchain congestion. Customer support operates 24/7. The platform maintains a clean reputation without major security incidents.

SimpleSwap works well for diverse crypto portfolios. Just understand that complete privacy isn’t guaranteed.

5. StealthEX — Privacy-Oriented With Growing Coin Support

StealthEX markets itself as privacy-focused but maintains optional KYC for larger transactions. The platform supports 1,200+ cryptocurrencies with emphasis on privacy coins.

The exchange excels at Monero and other privacy-focused currencies. Users seeking anonymous crypto swaps often gravitate here. The interface prioritizes simplicity.

StealthEX features:

- 1,200+ cryptocurrencies

- Strong privacy coin support

- Optional KYC for large amounts

- No registration required

- Fixed and floating rates

Monero (XMR) trades represent a significant portion of StealthEX volume. The platform understands privacy-conscious users. However, the optional verification policy means large swaps may trigger requests.

Exchange times typically run 10-30 minutes. Fees stay competitive with the market. The platform offers a loyalty program for frequent traders. API access exists for automated trading.

StealthEX suits privacy coin enthusiasts making moderate-sized trades. For guaranteed anonymity on all transaction sizes, the optional KYC creates uncertainty. The Monero support and privacy focus remain genuine strengths.

6. FixedFloat — Lightning Network Support

FixedFloat distinguishes itself through Lightning Network integration for faster Bitcoin transactions. The platform supports 350+ cryptocurrencies with competitive rates.

Lightning Network swaps complete almost instantly. This appeals to Bitcoin traders frustrated by blockchain confirmation delays. The feature works for both deposits and withdrawals.

Notable features:

- Lightning Network support

- 350+ cryptocurrencies

- Fixed and floating rates

- No registration required

- Clean, modern interface

The coin selection is smaller than some competitors. However, FixedFloat covers all major cryptocurrencies. The Lightning integration compensates for fewer obscure altcoins.

Processing via Lightning takes seconds rather than minutes. Standard blockchain transactions still require normal confirmation times. The platform maintains transparent fee structures.

FixedFloat has built a solid reputation since launch. User reviews generally praise speed and reliability. Customer support responds reasonably quickly.

For Bitcoin-focused traders wanting speed, FixedFloat delivers unique value. The Lightning Network support genuinely improves user experience. Altcoin traders may prefer platforms with larger selections.

7. LetsExchange — Massive Coin Selection

LetsExchange supports over 4,500 cryptocurrencies, making it one of the largest non KYC exchanges by asset variety. The platform launched recently but has grown quickly.

The extensive coin list covers mainstream and obscure tokens alike. If you can’t find an altcoin elsewhere, LetsExchange probably supports it. This breadth appeals to diverse crypto portfolios.

Platform specifications:

- 4,500+ cryptocurrencies

- Fixed and floating rates

- No mandatory registration

- Fast processing times

- Competitive fee structure

As a newer platform, LetsExchange lacks the track record of established competitors. However, early user feedback is generally positive. The interface works smoothly across devices.

Exchange times vary by currency but typically fall within standard ranges. The platform aggregates rates from multiple sources. This helps ensure competitive pricing despite the extensive coin list.

LetsExchange suits traders with diverse altcoin needs. The massive selection is genuinely useful. The shorter operating history may concern risk-averse users. Consider starting with smaller amounts.

8. ChangeHero — Straightforward Interface

ChangeHero offers a simplified exchange experience with 200+ supported cryptocurrencies and focus on user experience. The platform emphasizes ease of use over feature complexity.

The interface strips away unnecessary elements. You select currencies, enter amounts, and complete swaps. Nothing more complicated. This appeals to beginners and those wanting quick transactions.

Core features:

- 200+ cryptocurrencies

- Fixed and floating rates

- No registration needed

- Simple, clean interface

- Responsive support

The coin selection is more limited than some alternatives. However, ChangeHero covers all popular cryptocurrencies. Most traders will find their needed pairs.

Processing typically completes within 15-30 minutes. The platform maintains stable uptime. Customer reviews mention responsive support when issues arise.

ChangeHero works well for straightforward crypto swaps. The simplified approach sacrifices some features. Traders wanting extensive altcoin options should look elsewhere. Those prioritizing simplicity will appreciate the streamlined experience.

9. Bisq — Decentralized Peer-to-Peer

Bisq operates as a decentralized exchange requiring no registration and using peer-to-peer trading. This fundamentally different approach offers genuine privacy but requires more effort.

Unlike instant exchanges, Bisq connects buyers and sellers directly. Trades involve human counterparties. This creates a different experience with distinct advantages and disadvantages.

Bisq characteristics:

- Fully decentralized architecture

- Peer-to-peer trading model

- Desktop application required

- No central servers

- Bitcoin-focused with altcoin support

The decentralized structure means no company holds your data. Bisq can’t comply with data requests because it doesn’t collect data. This represents maximum privacy.

However, trades take longer. You must wait for counterparty matching. The desktop application requires installation. The learning curve exceeds instant exchanges.

Bisq suits privacy maximalists willing to invest extra time. The decentralized model genuinely delivers on anonymity promises. Traders wanting quick, convenient swaps will find instant exchanges easier.

10. Exolix — Fast Processing With No Registration

Exolix delivers quick cryptocurrency swaps without mandatory registration or account creation. The platform supports 500+ cryptocurrencies with both fixed and floating rate options.

Processing speeds rank among the fastest in the industry. Most transactions complete within 5-15 minutes. The platform aggregates rates from multiple liquidity providers for competitive pricing.

Exolix features:

- 500+ supported cryptocurrencies

- Fixed and floating rate options

- No registration required

- Fast transaction processing

- Clean, intuitive interface

The exchange offers unlimited transaction amounts with no upper caps. Only network minimums apply. Customer support operates around the clock for issue resolution.

Exolix has built steady reputation since launch. User reviews highlight reliability and speed. The interface works smoothly on both desktop and mobile browsers.

For traders wanting straightforward swaps without complexity, Exolix delivers consistent performance. The coin selection covers all major cryptocurrencies plus popular altcoins. Processing speed makes it suitable for time-sensitive trades.

Why Privacy Matters in Cryptocurrency Trading

Financial privacy is a fundamental right that non KYC crypto exchanges help protect. Understanding the stakes clarifies why traders seek these platforms.

Privacy concerns extend beyond hiding transactions:

- Security risks — Centralized KYC databases become hacking targets. Multiple exchange breaches have exposed user documents. Stolen identity information enables fraud.

- Geographic restrictions — Many countries limit cryptocurrency access. Non KYC exchanges provide financial services to underbanked populations. This includes legitimate users in restrictive jurisdictions.

- Personal safety — Visible cryptocurrency holdings create kidnapping and extortion risks. Privacy protects physical security, especially in high-crime regions.

- Competitive protection — Businesses trading cryptocurrency may not want competitors tracking their transactions. Commercial privacy has legitimate purposes.

- Political safety — Dissidents and activists in authoritarian countries need financial privacy. Cryptocurrency enables support for human rights work.

Privacy isn’t about hiding wrongdoing. It’s about maintaining personal security and autonomy. Non KYC exchanges serve legitimate needs for millions of traders worldwide. The gradual erosion of privacy options makes remaining anonymous platforms increasingly valuable.

How to Choose the Right Non KYC Exchange

Selecting the best non KYC exchange depends on your specific trading needs and privacy requirements. Consider these factors before committing to a platform.

Step 1: Assess your coin requirements List the cryptocurrencies you trade regularly. Verify support before choosing a platform. GODEX covers 919+ coins. LetsExchange offers 4,500+. Smaller platforms may lack obscure altcoins.

Step 2: Evaluate privacy policies Read terms carefully. “Optional KYC” means verification may be requested. Truly privacy-focused platforms clearly state their policies. Look for services that don’t store transaction data.

Step 3: Check fee structures Compare rates across platforms for your typical trades. Fees vary by currency pair. Aggregator exchanges often provide better pricing through rate comparison.

Step 4: Test with small amounts Before large trades, verify the platform works correctly. Process a small swap first. Confirm coins arrive at your wallet. This identifies issues before significant funds are at risk.

Step 5: Review reputation Check user feedback across multiple sources. Long operating histories suggest reliability. Recent complaints may indicate current problems.

Non KYC Exchanges Comparison Table

Platform capabilities vary significantly across non KYC crypto exchanges. This comparison helps identify the best fit for your needs.

| Exchange | Coins | True No-KYC | Fixed Rates | Since |

|---|---|---|---|---|

| GODEX | 919+ | Privacy-focused | Yes | 2018 |

| ChangeNOW | 900+ | May require | Yes | 2017 |

| Changelly | 500+ | No (€10k limit) | Yes | 2015 |

| SimpleSwap | 1,500+ | Optional | Yes | 2018 |

| StealthEX | 1,200+ | Optional | Yes | 2018 |

| FixedFloat | 350+ | Yes | Yes | 2019 |

| LetsExchange | 4,500+ | Yes | Yes | 2021 |

| ChangeHero | 200+ | Yes | Yes | 2018 |

| Bisq | 100+ | Yes (decentralized) | No | 2014 |

| Exolix | 500+ | Yes | Yes | 2018 |

Key observations:

- Former privacy leaders now require verification

- Newer platforms maintain stricter no-KYC policies

- Coin support varies dramatically

- Fixed rates protect against volatility

The shift toward verification among established platforms creates opportunity for genuinely privacy-focused services. Traders should verify current policies before assuming any exchange remains verification-free.

Conclusion

The non KYC crypto exchange landscape has shifted dramatically in 2025. Former privacy champions now require verification for many transactions. This leaves traders searching for genuinely anonymous options.

Several platforms still respect financial privacy. GODEX maintains its position as a high-privacy instant exchange with 919+ coins. Decentralized options like Bisq offer maximum anonymity with different tradeoffs.

When choosing a non KYC exchange, verify current policies directly. Terms change without announcement. Test platforms with small transactions before committing larger amounts.

Privacy in cryptocurrency isn’t just about hiding transactions. It protects personal security, enables financial access, and preserves autonomy. As more platforms introduce verification requirements, remaining anonymous exchanges become increasingly valuable.

The best non KYC exchanges balance privacy with usability, security with convenience. They process transactions quickly without demanding personal documents. They exist because financial privacy matters.

Choose wisely. Trade safely. Your privacy depends on it.

Frequently Asked Questions

What’s a non-KYC exchange?

A non-KYC exchange is a crypto trading platform that doesn’t require identity verification. Users swap coins using only wallet addresses.

Is it illegal to buy crypto without KYC?

Buying crypto without KYC is legal in most countries. Regulations vary by jurisdiction. Always check local laws before trading.

Is there a crypto exchange without KYC?

Yes, several instant exchanges operate without mandatory verification. GODEX supports 919+ coins with a privacy-focused approach.

What are the risks of no-KYC exchanges?

Main risks include limited support options, potential scams, and fewer legal protections. Choose established platforms with proven track records.

Can I transfer crypto without KYC?

Yes. Blockchain transactions between personal wallets require no verification. Only centralized exchanges may request identity documents.

What’s the difference between KYC and non-KYC?

KYC exchanges require ID verification before trading. Non-KYC platforms let you swap crypto instantly using only wallet addresses.

Is non-KYC truly private?

Non-KYC exchanges don’t collect personal documents. However, blockchain transactions remain publicly visible unless using privacy coins.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]