Table of Contents

Beneath the playful surface of Milady Meme Coin (LADYS) lies a complex digital asset worthy of serious analysis.

Diving beyond standard market reviews, we begin with our Milady Meme Coin price prediction 2024 before charting an ambitious course through mid-century projections.

By merging quantitative data with cultural impact metrics, we’ve crafted a revolutionary forecast model that challenges traditional crypto analysis.

Whether you’re decoding daily fluctuations or mapping decade-long trends, our distinctive approach illuminates LADYS’s journey from meme phenomenon to potential market force.

Understanding Milady Meme Coin (LADYS)

Milady Meme Coin (LADYS) represents a fresh take on cryptocurrency. It sprung from the well-known Milady NFT collection, blending internet culture with digital finance. The project stands out for its strong community focus and unique aesthetic appeal.

The LADYS ecosystem goes beyond simple trading. It includes Milady Academy for education and Milady Palace for community gatherings. Users can access digital newsletters and exclusive merchandise. This creates a rich, engaging experience for all participants.

What makes LADYS special is its genuine community growth. You won’t find celebrity endorsements here. Instead, the project thrives on real user interactions and creative input. The coin operates on secure blockchain tech, ensuring full transparency.

LADYS welcomes both crypto veterans and newcomers. It offers a perfect mix of meme culture, digital art, and financial opportunity. The project’s success stems from its authentic approach and active community participation.

What Influences Milady Meme Coin’s Price?

Several key factors drive the Milady Meme Coin (LADYS) price movements. Social media influence plays a major role. A single tweet from figures like Elon Musk can trigger dramatic price swings.This happened in May 2023, when his post caused a 5000% surge.

Market sentiment affects LADYS significantly. Positive crypto news often boosts its value, while negative events can cause quick drops. New exchange listings usually lead to price jumps.

Trading volume changes impact daily prices. Higher volumes typically mean more price action, and conversely, lower volumes can result in price stability or decline.

The overall crypto market mood matters too. When Bitcoin rises, LADYS coin often follows. The same happens during market downturns.

Community engagement directly affects prices. Active community discussions and events boost investor interest, which can lead to price increases.

External factors also count. These include:

- Regulatory news

- Economic conditions

- Competition from other meme coins

- NFT market trends

Each factor can shift LADYS prices independently or create combined effects.

Exploring Short and Long-term Forecasts

Let’s explore LADYS price projections across different time horizons. Our short-term analysis focuses on Q4 2024:

Q4 2024 Predictions (in USD):

| Month | Min | Average | Max |

| October | 0.0000000730 | 0.0000000732 | 0.0000000734 |

| November | 0.0000000751 | 0.0000000758 | 0.0000000766 |

| December | 0.0000000798 | 0.0000000822 | 0.0000000846 |

Looking further ahead, our Milady Meme Coin price prediction 2040 suggests potential values between $0.000046 and $0.000057. Market analysts expect increased adoption and technological advancements to drive growth.

For the longest horizon, our Milady meme coin price prediction 2050 indicates a range of $0.000073 to $0.000082. These projections account for market maturity and broader crypto adoption.

Key growth drivers include:

- Increased exchange listings

- Community expansion

- Technological upgrades

- Market sentiment shifts

- Global crypto adoption rates

Milady Meme Coin Price Analysis

While many crypto enthusiasts base their predictions on wishful thinking, serious investors rely on thorough market analysis and verifiable data. Our LADYS price evaluation combines rigorous fundamental research with detailed technical indicators to form an objective market perspective.

Fundamental Analysis of LADYS

LADYS shows interesting market dynamics with its current price at $0.0000000777. The project maintains a substantial circulating supply of 888,000,888,000,888 tokens, creating a market cap of $69,032,599. Recent performance reveals a -11.02% weekly decline, dropping from $0.0000000863. However, the last 24 hours showed a 0.44% recovery, indicating market volatility.

Key fundamentals include:

- Strong community presence

- Active development team

- Growing exchange listings

- Robust social media engagement

- Clear tokenomics structure

The project’s official website (milady.gg) provides comprehensive ecosystem information. Despite market volatility, fundamental indicators suggest potential for growth.

Technical Analysis and Forecasting

Current technical indicators paint an interesting picture:

Timeframe Analysis:

- 1-minute: Strong sell pressure

- 15-minute: Mixed signals

- 1-hour: Bearish trend

- 1-day: Buy signals emerging

- 1-week: Neutral stance

Current Trading Signals:

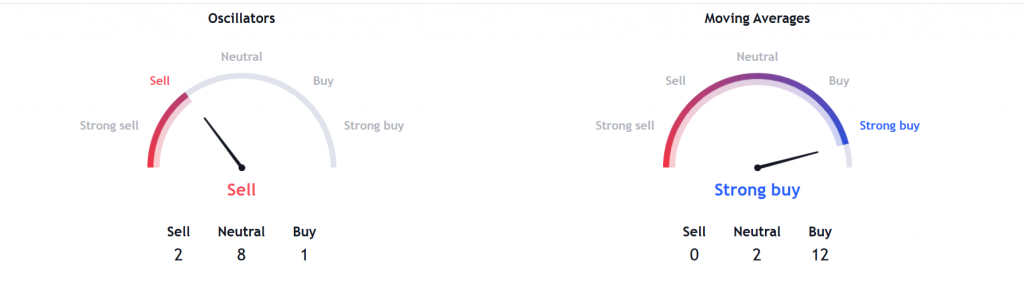

- Oscillators: Leaning bearish (2 sell, 8 neutral, 1 buy)

- Moving Averages: Strong buy signal (12 buy, 2 neutral, 0 sell)

- Overall Summary: Mixed with bullish potential

Key Technical Levels:

- Immediate Resistance: $0.00000007900

- Support Level: $0.00000007600

- Critical Break Point: $0.00000008000

The divergence between oscillators and moving averages suggests a potential trend reversal. Short-term traders should watch for breakout confirmation above resistance levels. This analysis represents a snapshot in time. For real-time decisions, learn to monitor these indicators yourself:

- Use TradingView charts for live LADYS data

- Track RSI movements for overbought/oversold conditions

- Watch moving average crossovers

- Monitor volume patterns for trend confirmation

- Check oscillator signals across multiple timeframes

Later sections will explain how to interpret these indicators independently. This helps you make informed decisions based on current market conditions rather than relying on historical analysis.

Key Observation Points:

- Price action relative to moving averages

- Volume spikes during trend changes

- RSI divergence from price movement

- Support/resistance level tests

- Timeframe signal alignment

This foundational knowledge will help you understand the detailed indicator analysis coming up in subsequent sections. Remember that successful trading requires both technical skills and market awareness.

LADYS Coin Price Prediction

Understanding LADYS’s price trajectory requires balancing technical analysis with the unique dynamics of meme-based cryptocurrencies. Our detailed forecasts combine historical data patterns, market sentiment indicators, and adoption metrics to map out potential price movements through 2030.

Predictions for 2025, 2026, 2027, 2028, 2029, and 2030

Our Milady Meme Coin price prediction 2025 suggests significant growth potential. The first quarter may see prices around $0.0000000833, showing gradual growth over the year. By December 2025, analysts expect LADYS to reach $0.000000120, with peak values potentially hitting $0.000000150.

2026 Outlook:

- Minimum: $0.000000125 (January)

- Maximum: $0.000000210 (December)

- Average: $0.000000155 Expected ROI: 162.5%

2027 Projections:

- Starting price: $0.000000188

- Mid-year estimate: $0.000000235

- Year-end target: $0.000000310 Key growth catalyst: Increased adoption

2028 Forecast:

- Base price: $0.000000280

- Peak potential: $0.000000470

- Monthly growth rate: ~3-4% Market maturity impact: Positive

2029 Expectations:

- Entry point: $0.000000406

- Highest projection: $0.000000690

- Average trading range: $0.000000500

The Milady Meme Coin price prediction 2030 indicates continued upward momentum:

- Q1 range: $0.000000603-$0.000000768

- Mid-year estimate: $0.000000735

- Year-end target: $0.000001000 Projected ROI: 1150%

Investment Potential and Risk Assessment

LADYS presents both significant opportunities and notable risks in the crypto market. The coin shows strong growth potential, supported by its active community and increasing exchange presence. Historical data suggests possible returns exceeding 1000% by 2030.

However, investors should consider key risk factors:

- High market volatility

- Regulatory uncertainties

- Meme coin market saturation

- Social media sentiment swings

- Major holder concentration

Investment strategies to consider:

- Start with small positions

- Use dollar-cost averaging

- Set clear exit points

- Monitor social trends closely

- Keep updated with exchange listings

The token’s success is highly reliant on community participation and market sentiment. While past performance shows promising upward trends, remember that meme coins carry higher risk than traditional cryptocurrencies. Never invest more than you can afford to lose, and maintain a diversified crypto portfolio.

Milady Meme Coin Market Trends

Recent market data reveals interesting LADYS dynamics. The token maintains a substantial $53.80M market cap with daily trading volume reaching $3.55M. The current price hovers around $0.077325.

Key metrics point to active market engagement. The volume-to-market cap ratio stands at 6.51%, indicating healthy trading activity. With 734.37T LADYS in circulation out of 888T total supply, scarcity isn’t a major price driver.

Despite bearish technical indicators, the Fear & Greed Index reads 69, suggesting strong market optimism. This sentiment divergence creates interesting opportunities for strategic traders watching entry and exit points.

Recent Price Performance and Patterns

LADYS demonstrates classic meme coin volatility in recent trading periods. The token dropped 11.02% over the past week, sliding from $0.0000000863 to $0.0000000777, though showing resilience with a modest 0.44% uptick in the last 24 hours.

Monthly performance reveals a steeper 22.70% decline, reflecting broader market uncertainties. However, the bigger picture remains encouraging – LADYS achieved an impressive 91.52% yearly growth, with a notable peak of $0.000000393 on March 14th.

Currently ranked #520 in the crypto ecosystem, LADYS’s price patterns suggest a consolidation phase. Traders should monitor specific candlestick formations for potential trend shifts. Bullish patterns like Hammer, Morning Star, and Three White Soldiers could signal upward momentum. Conversely, bearish formations such as Dark Cloud Cover, Evening Star, or Shooting Star might indicate downward pressure.

The recent dips, contrasted with strong yearly gains, create a typical “stair-step” pattern common in emerging cryptocurrencies – periods of sharp growth followed by consolidation phases. This formation, combined with candlestick analysis, provides crucial insights for timing market entries and exits.

These technical patterns, alongside volume and momentum indicators, merit close monitoring for potential trend reversals.

How to Interpret Milady Meme Coin Price Predictions

Interpreting LADYS price predictions demands more than just reading numbers and charts. We’ll explore the essential tools and metrics that help separate realistic forecasts from mere speculation.

Analyzing Price Prediction Indicators

Effective LADYS analysis demands mastery of specific technical metrics. The token’s 200-day Simple Moving Average, positioned at $0.0₆1284, functions as the primary trend assessment tool. This mathematical indicator helps establish definitive market phases, with price positions relative to the SMA determining directional bias.

Current technical metrics reveal nuanced market conditions. The 14-day Relative Strength Index reading of 46.84 places LADYS in equilibrium territory, neither indicating exhaustion nor excessive enthusiasm. This centralized position offers strategic advantages for both accumulation and distribution phases.

Essential analytical components include:

- Exponential Moving Average confluences

- Price action distribution patterns

- Volume-weighted momentum shifts

- Mathematical support-resistance correlations

Market interpretation requires systematic timeframe analysis:

- Microstructure: Sub-hourly price formations

- Intermediate: Multi-day trend sequences

- Macro: Extended cyclical patterns

Present data configurations suggest a pivotal market phase. Volume distribution patterns merit particular attention, as they frequently precede significant directional commitments. The correlation between social metrics and technical indicators demands specialized scrutiny in the meme token sector, where conventional analysis often requires modification to account for unique market dynamics.

This methodical approach to indicator analysis provides the framework for informed position management while acknowledging the distinctive characteristics of meme-based digital assets.

Strategies for Navigating Volatility

Successful LADYS trading demands disciplined risk management amid characteristic meme coin price swings. Position sizing emerges as the cornerstone of volatility management – limiting exposure to 1-2% of total portfolio value per trade protects against sudden market reversals.

Implementation of strategic entry points proves essential. Rather than pursuing aggressive single-entry positions, consider gradient accumulation through Dollar-Cost Averaging (DCA). This method neutralizes short-term price volatility while building positions at averaged costs.

Key volatility management principles:

- Set precise exit points before entering positions

- Utilize trailing stop-losses to protect gains

- Avoid emotional reactions to price swings

- Reserve capital for potential dip opportunities

- Scale out of profitable positions gradually

Price action monitoring requires attention to multiple time frames. While hourly charts reveal immediate volatility patterns, daily and weekly perspectives offer broader trend context. This multi-timeframe approach helps distinguish between temporary fluctuations and significant trend shifts.

Risk mitigation extends beyond technical tools. Maintaining awareness of social media sentiment, exchange listing developments, and broader crypto market conditions provides crucial context for volatility assessment. Consider implementing volatility thresholds – predetermined price movement levels that trigger position reviews.

Remember that high-volatility periods often present significant risks and opportunities. Success depends not on avoiding volatility entirely but on managing its impact through systematic risk control and strategic position management.

Conclusion

LADYS presents a unique intersection of technical metrics and social dynamics. Price movement analysis shows both promising potential and significant risks. Technical indicators offer guidance. Yet meme coins often defy traditional market logic.

Our analysis reveals strong growth possibilities for LADYS. However, this comes with notable market volatility. Success requires more than just technical understanding. Traders must grasp community trends and social sentiment. Proper risk management remains crucial.

The future of LADYS depends on multiple factors. These include market conditions, community growth, and exchange support. Smart investors will balance opportunity with caution. Focus on systematic strategies rather than emotional trading. Remember that sustainable profits come from disciplined approaches, not from chasing quick gains.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]