Table of Contents

Polkadot is often included in the list of the best altcoins, and for good reason. With an impressive market capitalization, it takes 13th place among all cryptocurrencies. Moreover, the rather modest cost makes it a prospective and quite affordable option for many people. DOT, which is the native crypto of such a successful project, plays a key role in the network. It helps to conduct operations, participate in governance, and stake the native currency to maintain the system’s security. In this paper, we will discuss the process of staking Polkadot coins and the benefits that it offers to their holders. So stay tuned!

Understanding Polkadot Staking

Polkadot, launched in 2016, aims to build a fair internet known as Web 3.0. Offering an opportunity to various blockchain networks to interact with each other, Polkadot features nearly 580 projects to date. In terms of staking, it provides financial support by using DOT tokens.

Simply put, a DOT staker nominates validators, the representatives, who can work on a secured network and verify the high volume of transactions. Polkadot’s Nominated Proof-of-Stake (NPoS) system allows nominators to choose validators for the consensus process, promoting decentralization and reducing the risk of attacks.

Validators play a crucial role by running nodes that confirm transactions.

However, it is not mandatory for a person to become a validator. Nominators can be DOT holders who nominate reliable members and receive respective rewards without conducting calculations and coordinating the complex processes. This part is distributed by a wide range of responsible employees, positively influencing the network’s security and efficiency.

Rewards are given to stakers based on the performance of their selected validators. If a validator acts dishonestly, both the validator and their nominators can be penalized, ensuring only trustworthy participants are involved.

Thus, staking Polkadot allows allocating necessary resources for the network’s functioning and receiving the due rewards. It supports the network’s operation and growth, paving the way for a more decentralized web.

The following part will present the detailed and comprehensive survey of how DOT can be staked in various ways.

DOT Staking Methods: A Comprehensive Overview

When it comes to staking Polkadot , there are several ways available for interested parties. Each method comes with unique opportunities and challenges, appealing to different audiences. However, all of them allow individuals to actively engage with the Polkadot network and earn rewards.

Polkadot.js UI

The Polkadot.js UI is a popular choice for staking DOT. Using this interface users can manage their DOT staking activities either as a validator or a nominator. Validators run nodes that ensure network security and reliability, while nominators support these validators by nominating them. The performance of validators directly affects the rewards for both validators and their nominators. The Polkadot.js UI method is convenient for users accustomed to working in the Polkadot network.

Native Staking and Nomination Pools

Native staking implies the direct staking of DOT or involvement in the nomination pool. The Nomination Pools is an alternative to native pools, as they are a kind of partnership aimed at collecting minimum DOT staking that is impossible for an individual. In pools, partners jointly nominate validators and share rewards, which democratizes the entry to the staking process and increasing the profits

Cryptocurrency Exchanges

Staking DOT through crypto exchanges is convenient and user-friendly. Platforms like Kraken and Binance offer staking services where users can stake their DOT tokens with just a few clicks. Since the exchanges handle the technical aspects, it is easier for beginners to participate. However, this convenience comes at the cost of reduced control over private keys and potentially lower rewards due to fees charged by the exchanges. Additionally, staking with an exchange centralizes some control, which can pose security risks if the exchange is compromised.

Wallets

Staking through wallets provides a balance between security and convenience. Users can stake DOT using hardware wallets like Ledger, which offer high security by keeping private keys offline. Software wallets such as Talisman, Fearless, and Polkawallet are also popular, providing an easy-to-use interface for staking. Users must carefully select validators and ensure the chosen wallet supports staking features. This method is less secure than running their validator’s hardware but offers more control than using a centralized exchange.

Running a Validator

Running a validator is an option for those with sufficient technical knowledge and resources. These users have the responsibility of securing the Polkadot network, running the node validating transactions, and producing new blocks. As a result, this method requires extensive knowledge of Polkadot’s architecture and expensive hardware. However, it is highly rewarding and comes with the responsibility of ensuring the highest availability possible.

Each of these staking methods offers plenty of opportunities and highlights that can cater to any preferences and capabilities of the network participants.

Risks and Rewards: Navigating the World of DOT Staking

Staking Polkadot offers substantial rewards, but also comes with certain risks. Understanding both can help you make informed decisions.

Rewards

Every 24 hours, Polkadot distributes staking rewards to delegators and stakers. These rewards depend on the number of blocks their stake contributed to creating. Polkadot often provides higher returns compared to other proof-of-stake blockchains and exchange staking. The annual reward rate varies, but nominators can earn up to 14.1%, while validators might earn as much as 14.8%, thanks to their added responsibilities. Staking rewards are influenced by the chosen wallet, trading platform, and validators.

Risks

Despite the attractive rewards, staking in Polkadot carries inherent risks. Market conditions can affect the annual reward rate, which is periodically reviewed by most staking platforms. One considerable risk is the potential for slashing. If a validator breaches the network’s rules, a portion of their stake—and consequently their nominators’ stakes—can be lost. This makes it crucial for nominators to choose validators with a strong track record of reliability.

Additionally, DOT has an unbonding period of 28 days, during which stakers cannot access their tokens. This can be a drawback in a volatile market. Validators who are unresponsive during a session may face involuntary chilling, making them ineligible for selection and rewards in the next session.

Moreover, the security of staking through a software wallet depends heavily on the wallet provider’s safety protocols. This exposes stakers to risks beyond Polkadot’s control, such as hacking.

Tools and Apps for Seamless Polkadot Staking

Staking Polkadot (DOT) has never been easier thanks to a variety of tools and apps designed to simplify the process and enhance security. Here are some of the most useful resources for staking DOT:

Polkadot.js UI and Extension

The Polkadot.js UI is a popular choice for managing DOT staking activities. This interface, combined with the Polkadot.js browser extension, allows users to interact with their stash and controller accounts. While the extension itself is not a wallet, it simplifies the process of signing transactions and managing staking operations. It’s highly recommended for users familiar with the Polkadot network.

Block Explorers

Block explorers are essential tools for tracking blockchain activity. They provide detailed information on transactions, addresses, and recent blocks. Polkadot’s own UI includes an “Explorer” section under the “Network” tab. For more comprehensive data, platforms like Subscan.io offer in-depth insights and metrics, helping users monitor their staking activities and the overall network health.

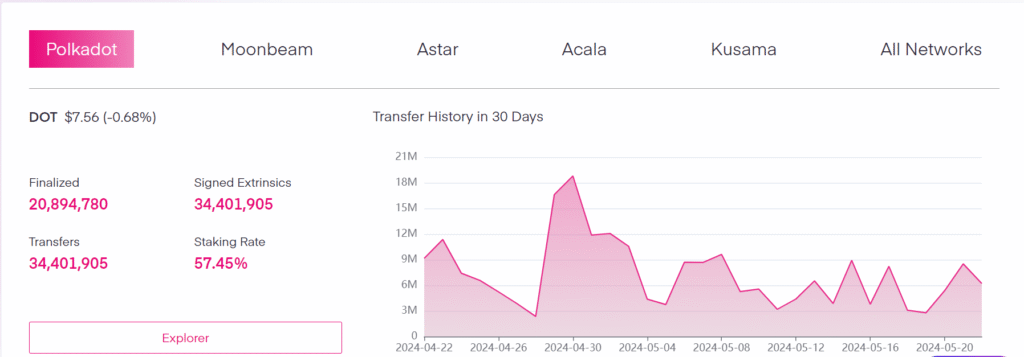

Source: Subscan.io

Polkadot Staking Dashboard

The Polkadot Staking Dashboard is a dedicated web3 application for non-custodial staking on the Polkadot relay chain. It supports staking as a solo nominator or as a member of a nomination pool. The dashboard integrates with various wallets, including Ledger, Polkadot Vault, SubWallet, Talisman, and more. It also supports staking proxies, enhancing security and flexibility for users.

Sub.ID

Sub.ID is an all-in-one platform for managing Polkadot accounts. It provides a staking page where users can easily start staking DOT, choose preferred validators, or stake with recommended validator sets. This tool streamlines the management of addresses, balances, and staking activities.

NOMI

NOMI offers a unique nomination experience using Multiple-Criteria Decision Analysis (MCDA) to evaluate validators. This tool helps nominators make informed decisions by analyzing various validator attributes, ensuring a transparent and efficient staking process.

SubWallet Earning

SubWallet’s Web Dashboard is a comprehensive solution for managing assets and staking across multiple networks in the Polkadot ecosystem. It features an “Earning” tab that allows users to stake DOT through native nomination pools, liquid staking, and lending protocols, all from a single interface.

These tools and apps make staking Polkadot more accessible and secure, catering to both beginners and experienced users. By leveraging these resources, you can efficiently manage your staking activities and maximize your rewards.

Quick Staking Guide: Simplifying the Process

Staking Polkadot can seem complex, but it can be broken down into simple steps. Here’s how to start staking your DOT tokens efficiently.

Validator vs. Nominator: Deciphering Roles in Staking

Within the Polkadot network, staking is primarily divided between two roles: validators and nominators.

Role 1: Validator

Validators are essential to the network’s functionality. They operate nodes, create new blocks, and verify transactions. This role demands substantial technical expertise, resources, and a commitment to maintaining high availability and security. While validators earn rewards for their efforts, they also face the risk of slashing if they do not adhere to network protocols.

Role 2: Nominator

The majority of DOT holders will opt to be nominators. Nominators choose honest and hardworking validators and delegate their stakes to them. Although they do not operate nodes, nominators share in the rewards generated by their selected validators. This role is less intensive, requiring periodic checks on validator performance to ensure optimal selections.

Staking Through Exchanges and Wallets: A Practical Approach

Staking DOT can be done conveniently through various methods, including cryptocurrency exchanges and wallets. Here’s a step-by-step guide to get you started.

Choose Your Platform

Exchanges: Popular exchanges like Kraken and Binance offer straightforward staking services. They handle the technical aspects, making it easy for beginners.

Wallets: For those who prefer more control, using a non-custodial wallet like Polkadot.js, Fearless Wallet, or Ledger Live is an excellent option.

Buy and Deposit DOT Tokens

- If you’re using an exchange, deposit fiat or cryptocurrency to buy DOT tokens.

- If you already own DOT, transfer them to your chosen platform.

Set Up Your Account

Exchanges: Follow the platform’s instructions to set up your staking account.

Wallets: Create a Polkadot account using the wallet’s interface. For hardware wallets like Ledger, ensure your device and software are updated.

Start Staking

Exchanges:

- Navigate to the staking section, select Polkadot, enter the amount to stake, and confirm.

Wallets:

- In your wallet interface, navigate to the staking section.

- Bond your DOT tokens by selecting the amount to lock.

- If using Polkadot.js or another wallet, you will need to select validators manually.

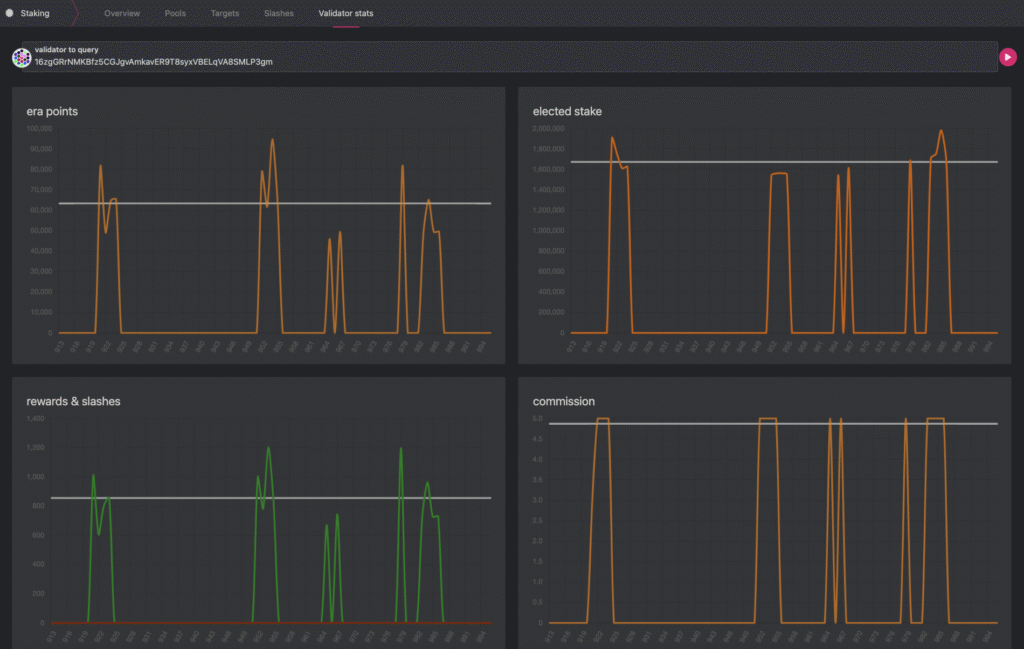

Source: wiki.polkadot.network

Research and choose validators with good performance and reliability. Exchanges typically handle validator selection for you, simplifying the process.

- Monitor and Manage Your Staking

- Regularly check the performance of your nominated validators.

- Re-nominate if needed to optimize rewards.

- Note that unbonding DOT takes 28 days, so plan accordingly if you need to access your tokens.

Conclusion

Staking Polkadot is an excellent way to participate in the network and get returns. Whatever your skill level, there is a spot for you- whether it be on the nominator or validator side. There are some great exchange and wallet partners to get started with. Find out more about both the role and the process involved to maximize profit or contribute towards keeping the Polkadot ecosystem safe & efficient. Happy staking!

FAQ

What are the Benefits of Staking Polkadot (DOT), and Why Should I Consider it?

Staking DOT tokens enables you to gain rewards while helping to secure and maintain the network. It opens up an excellent opportunity to be actively involved in the ecosystem and grow your DOT assets over time.

What Risks Should I Be Aware of When Staking Polkadot, and How Can I Mitigate Them?

If you decide to stake Polkadot, keep in mind the risks of slashing if your validators (or most of them) act maliciously. And the 28-day period during which you can’t withdraw your funds. However, by selecting validators on a case-by-case basis and monitoring their performance on an ongoing basis as a preventative measure no irreversible damage should be done.

Can I Unstake my Polkadot (DOT) Assets, and How Does the Unstaking Process Work?

Yes, you can unstake your DOT assets. The unstaking process involves initiating the unbonding period, which lasts 28 days, during which your funds remain locked. After this period, your DOT tokens become available for transfer or use.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]