Table of Contents

In the dynamic landscape of finance, three terms have been gaining significant traction: DeFi, CeFi, and TradFi. Centralized Finance (CeFi) and Decentralized Finance (DeFi) represent two distinct approaches to how we manage, invest, and transact with our assets. While their goals may overlap in some areas, their fundamental principles and operational models diverge significantly.

This article aims to explore the pivotal question: What is CeFi vs DeFi, their respective strengths, weaknesses, and potential implications for the financial ecosystem at large?

Understanding Centralized Finance (CeFi)

Centralized finance is the financial system as you know it. Take a moment to peer into your wallet you likely find a debit card linking directly to your bank account, along with credit cards extending financial resources. Physical currency, bearing the endorsement of your nation’s government, also finds its place. Beyond your wallet, you might hold a mortgage, personal loans, or investments brokered in stocks and bonds. These financial entities engage in transactions with broader institutions like regulatory bodies and the central bank, central being the operative term.

This intricate network of influential institutions orchestrates what we term “centralized finance” (CeFi). CeFi serves as the bedrock for the lion’s share of transactions virtually every instance where money changes hands. This consolidation of financial power not only governs wealth but also information, thereby exerting substantial influence over the global landscape.

CeFi plays a crucial role in the crypto realm by acting as a bridge between traditional financial systems and the world of cryptocurrencies. It provides a familiar and regulated environment for individuals and institutions to engage with digital assets. Leading the way in the realm of CeFi are industry giants such as Coinbase, Binance, and Kraken. These platforms not only offer intuitive user interfaces but also ensure robust custody solutions and a diverse array of financial services. Functioning as centralized hubs, they serve as gateways for users to engage in a multitude of crypto-related activities. Furthermore, these platforms diligently adhere to the regulatory guidelines established by financial authorities across various jurisdictions, underpinning a foundation of trust and compliance within the industry.

Understanding Decentralized Finance (DeFi)

Decentralized Finance, often abbreviated as DeFi, stands as a revolutionary transformation within the financial realm. It emerges as an open-source digital ecosystem, ushering in a new era where smart contracts and blockchain technology replace traditional financial intermediaries. DeFi empowers individuals with direct control over their assets, granting them the ability to partake in activities like lending, borrowing, trading, and accruing interest—all without the necessity of centralized authorities. In its essence, DeFi is a visionary reformation of finance—a democratic, easily accessible, and community-driven metamorphosis that reshapes our interactions with currency.

DeFi vs CeFi: Similarities

DeFi and CeFi share several commonalities despite their fundamental differences in structure and operation.

- Incorporating Advanced Tech

DeFi and CeFi both harness the power of blockchain technology to facilitate financial operations. DeFi leverages decentralized networks and executes transactions through smart contracts, while CeFi opts for more centralized platforms and systems.

- Spanning Financial Horizons

Both models encompass a diverse array of financial services, encompassing lending, borrowing, trading, and interest accrual. Participants in both the DeFi and CeFi ecosystems can tap into this comprehensive suite of services to manage their assets.

- Navigating the Digital Assets Realm

Both DeFi and CeFi empower users to navigate the realm of digital assets, encompassing cryptocurrencies like Bitcoin and Ethereum. Within both systems, users retain the ability to trade, hold, and transfer these digital treasures.

- Ensuring Accessibility for Everyone

Both DeFi and CeFi are committed to providing inclusive platforms, enabling users to seamlessly interact with cryptocurrencies and digital assets. They prioritize user-friendly interfaces and equip individuals with tools to navigate these financial landscapes.

- Mobilizing Digital Asset Portfolios

To participate in both DeFi and CeFi ecosystems, users must possess digital wallets. These wallets serve as secure repositories for their digital assets and serve as conduits for transactions within the respective systems.

DeFi vs CeFi: Differences

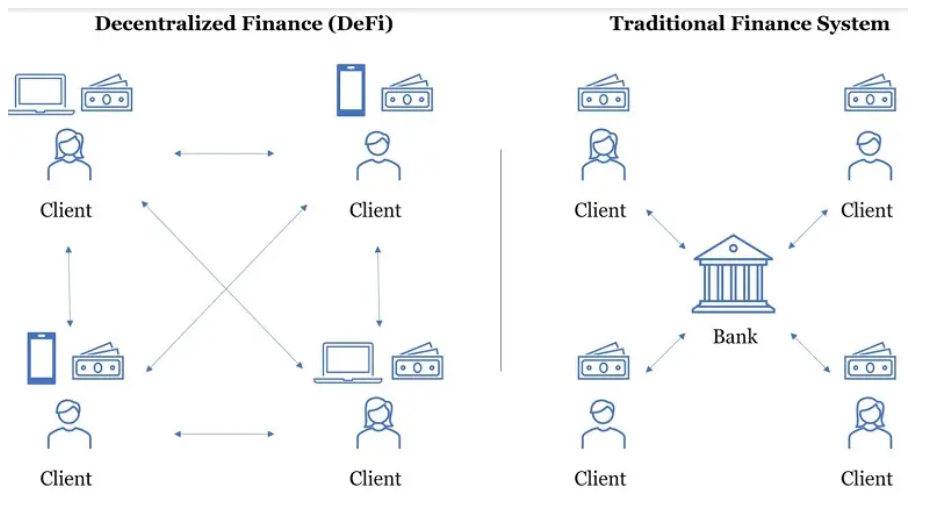

When navigating the dynamic terrain of financial ecosystems, distinctions between decentralized and centralized finances become paramount. DeFi, underpinned by decentralized networks and smart contracts, reimagines financial exchanges, leveraging cryptocurrencies and granting users unprecedented control over their assets. In stark contrast, CeFi relies on centralized platforms, emphasizing security and regulatory compliance while offering conventional payment systems.

As opposed to traditional finance (TradFi), both DeFi and CeFi signify a paradigm shift in managing assets, with DeFi championing decentralization and CeFi prioritizing trusted intermediaries. In the realm of cryptocurrencies, this divergence is pivotal. While DeFi emphasizes peer-to-peer interactions, CeFi places a premium on centralized exchanges, melding technology and security to facilitate seamless transactions.

Payment structures also differ: DeFi champions the autonomy of cryptocurrencies, while CeFi maintains connections to the traditional banking system. By exploring the nuances of DeFi vs CeFi crypto dynamics, one unveils not just different financial systems, but fundamentally distinct approaches to managing wealth and value.

Pros and Cons of DeFi

So, we know that DeFi aims to be a high-quality alternative to the traditional banking system without concentrating or “centralizing” power in the hands of any one person or institution. But why? What are the potential benefits and drawbacks of a decentralized system?

DeFi’s Pros:

- No human errors

DeFi platforms operate on blockchain networks, which are decentralized ledgers spread across a network of computers. This means there is no central authority or intermediary controlling the transactions. This approach minimizes the risk of default or insolvency of centralized entities. In contrast, CeFi platforms are typically operated by centralized entities, which can be vulnerable to hacking, fraud, or mismanagement.

- Permissionless

DeFi platforms do not require users to seek permission to access or use their services. Users have full control over their funds and can interact with DeFi protocols without needing approval from a central authority. CeFi platforms, on the other hand, often have strict user policies and may restrict certain functionalities.

- Innovation and Customization

DeFi is a hotbed for innovation. Developers can build new financial products and services on existing DeFi protocols, creating a wide range of options for users. This level of innovation is often more limited in CeFi platforms, which are subject to regulatory constraints and may be slower to adopt new technologies.

- Transparency

Transactions on DeFi platforms are recorded on a public blockchain, making them transparent and auditable. This transparency helps build trust in the system and allows users to verify their transactions. In CeFi platforms, the inner workings are often opaque, and users have to trust the platform’s reporting.

- Community Governance

Many DeFi projects implement decentralized governance mechanisms, allowing users to have a say in the development and decision-making process. This empowers the community and reduces the likelihood of decisions being made solely for the benefit of a centralized entity.

DeFi’s Cons:

- Regulatory Uncertainty

The DeFi space is still relatively new, and regulatory frameworks are evolving. This can create uncertainty for both users and developers, as they may not be fully aware of the legal implications of their activities.

- Limited Insurance Coverage

While some CeFi platforms offer insurance coverage for user funds, this is not as common in the DeFi space. This means that in the event of a hack or smart contract exploit, there may be limited avenues for compensation.

- Technical Issues

DeFi platforms are built on complex blockchain technology and smart contracts. This complexity can lead to technical issues such as bugs, vulnerabilities, and glitches. These issues can potentially result in financial losses for users. What’s more, DeFi platforms can be challenging to navigate, especially for users who are not familiar with blockchain technology. Tasks like setting up wallets, interacting with smart contracts, and understanding various protocols can be intimidating for non-tech-savvy users.

- Scalability Challenges

Some DeFi platforms, especially those built on certain blockchains, may face scalability issues during times of high demand. This can result in higher transaction fees and slower confirmation times.

- Potential for Forks and Governance Disputes

Decentralized governance in DeFi can lead to disagreements within the community about protocol upgrades or changes. In some cases, this can result in forks, where the community splits into separate networks.

Pros and Cons of CeFi

Centralized Finance (CeFi) offers a wide array of financial services, but it also comes with its own set of pros and cons.

CeFi’s Pros:

- Regulatory Compliance

CeFi platforms are often subject to regulatory oversight and compliance requirements. This can provide users with a level of legal protection and assurance that the platform is operating within established legal frameworks.

- Insurance and Safeguards

Some centralized platforms offer insurance coverage for users’ funds. This can provide an additional layer of protection in the event of a security breach or unforeseen circumstances.

- Expanded Service Offerings

Centralized Finance (CeFi) platforms, linked to established financial institutions, boast a more extensive selection of financial services in contrast to numerous DeFi platforms. These encompass a spectrum of offerings including loans, margin trading, and insurance products. Moreover, CeFi platforms frequently facilitate the seamless conversion of digital assets (like cryptocurrencies) into conventional fiat currencies such as USD, EUR, among others. This pivotal connection between digital and traditional financial systems plays a vital role in propelling mainstream adoption and enhancing accessibility.

- User-Friendly Interface

CeFi platforms are generally designed with user-friendliness in mind. They often feature intuitive interfaces, making them accessible to a wide range of users, including those who may not be tech-savvy.

CeFi’s Cons:

- Dependence on Third Parties

Users of CeFi platforms are reliant on the platform’s infrastructure and the effectiveness of its security measures. If the platform experiences technical issues or is compromised, it can impact users’ ability to access and manage their funds.

- Single Points of Failure

CeFi platforms operate on centralized servers, making them susceptible to single points of failure. If the platform experiences a downtime or outage, it can disrupt users’ ability to conduct transactions or access their accounts.

- Lack of Transparency

Centralized platforms may not always provide full transparency regarding their operations, financial health, or security measures. This lack of transparency can make it difficult for users to fully assess the risks associated with the platform.

- Censorship and Control

Centralized entities have the authority to censor or control certain activities on their platforms. This can include freezing accounts, restricting transactions, or imposing other limitations.

- Restricted Access

CeFi platforms may impose restrictions on who can access their services. This can be due to regulatory compliance requirements or geographic limitations, excluding potential users from certain regions.

Synergies between CeFi and DeFi

In the ongoing debate of DeFi vs CeFi vs TradFi, there lies a potential for collaboration rather than competition. While each platform has its distinct attributes, they also share common ground, offering an opportunity for symbiotic growth.

One avenue for synergy lies in leveraging the strengths of both CeFi and DeFi. DeFi’s hallmark traits, such as transparency and decentralization, stand complemented by CeFi’s capacity to provide the stability and security synonymous with traditional financial institutions. This amalgamation could herald a more balanced and comprehensive approach to financial services.

Interoperability emerges as another key enabler of synergy. By enabling different systems to seamlessly exchange data, CeFi and DeFi platforms can mutually enrich their offerings. This interoperability opens doors for users to access an extended spectrum of financial services, combining the best of both worlds.

DeFi, in its nascent stage, exhibits distinctive qualities attributed to its blockchain foundation. While it champions transparency and non-custodial principles, it grapples with limitations in transaction throughput, confirmation speed, and privacy. Notably, DeFi’s reliance on fiat currency remains palpable, as the value of crypto-assets is predominantly assessed in terms of traditional monetary units. Stablecoins, closely tied to fiat, dominate the DeFi landscape, underscoring the enduring relevance of central bank-issued currencies.

In this landscape, CeFi lending platforms emerge as pivotal intermediaries, bridging the gap between the conventional financial system and the crypto-asset market. These platforms empower users to directly borrow fiat currency, leveraging their cryptocurrency holdings as collateral. Operating under established businesses, often referred to as crypto banks, they act as reliable counterparts for both depositors and borrowers.

Ultimately, the convergence of DeFi and CeFi is not a straightforward amalgamation of their strengths, but rather a dynamic interplay between two distinct yet interwoven financial systems. As they evolve in parallel, the potential for collaborative growth and mutual benefit is substantial. The future holds promise for innovative solutions that draw from the best of both CeFi and DeFi, ushering in a new era of financial empowerment.

Read also DeFi Coins – Best to Buy in 2023

FAQ

What are the risks associated with CeFi?

The risks associated with Centralized Finance include the potential for security breaches and hacks, regulatory changes affecting operations, the risk of insolvency of platform providers, and the loss of privacy due to identity verification requirements.

What are the risks associated with DeFi?

The risks associated with Decentralized Finance encompass smart contract vulnerabilities, potential exploits, market volatility leading to financial losses, regulatory uncertainties, and the lack of consumer protections, as well as the responsibility for self-custody and security of assets.

Which one should I choose, CeFi or DeFi?

The choice between CeFi vs. DeFi depends on your preferences and risk tolerance. CeFi offers user-friendly interfaces, regulatory compliance, and established customer support, but comes with centralization risks. DeFi, on the other hand, provides more control and transparency, but entails a steeper learning curve and greater responsibility for securing assets.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Peter Moore

Peter Moore

Read more

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]