Table of Contents

What Is Crypto Winter?

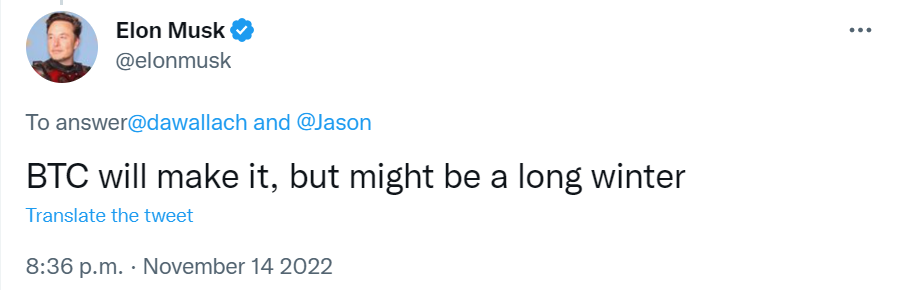

“Crypto winter is coming”. This is what the episode of Game of Thrones would be called if the series was about the struggle of noble families of tokens for the Iron Throne, on which Bitcoin now sits. But if we move away from the series to reality, 2022 turned out to be a tough year for the crypto market, and therefore for digital asset investors. After the highs of November 2021, when the price of bitcoin used to reach almost $70,000, the first crypto went into a protracted decline. This also affected the rates of other tokens.

Increasingly, the community is discussing the coming of a new winter season. What is a crypto winter, how long will it last and when is the next crypto winter?

Understanding a Crypto Winter

If you have any crypto in your portfolio, the issue of crypto winter meaning should interest you. The term ‘crypto winter’ is akin to a bear market in the stock markets, with similar patterns and cycles to those of the crypto markets. Crypto winter is a period of a long decline in the crypto market as a whole, a decrease in user interest in digital assets and even blockchain technologies. If so far everything is fine with the latter, and the blockchain is constantly being used in new areas of human activity, then the market clearly shows all the signs of the arrival of crypto winter 2022:

- Bitcoin, which remains the leader in terms of market cap and the main driver of market movements, fell more than 70% from November (2021) highs of $69K to a low of around $17K in December (2022).

- Since the beginning of 2022, BTC has started to decline, reaching new lows, and there are no signs of a market reversal so far.

- Altcoins behave in a similar way, with the only difference being that some of them fall even deeper. Overall, market capitalization losses were almost -66.63% year-on-year (from $3 trillion in November 2021 to about $844 billion in December 2022).

- Analysts attribute the sluggish correction to the lack of major buyers and the generally low interest of traders and investors in buying cryptocurrencies.

- Companies operating in the crypto industry are experiencing huge losses. For example, the Coinbase exchange shows in its reporting three unprofitable quarters in a row: in the first quarter, the loss amounted to $430 million, in the second it exceeded $1 billion, and in the third the company lost $545 million. There is also a decrease in trading volume.

- The industry is experiencing a series of bankruptcies: Three Arrows Capital fund, FTX crypto exchange, Celsius Network LLC and Hodlnaut crypto-lendings. Terra, one of the top capitalization projects, has collapsed, and large BTC holders, such as Tesla, are selling their assets.

- Forecasts are far from unanimous: some analysts say that the market bottom has been hit, others expect a decline to levels in the range of 10-11 thousand dollars per bitcoin, and some even talk about 5-6 thousand dollars. The same applies to growth prospects: only half of crypto traders and investors believe that the market will be able to return to the initial levels of decline in 2023.

It is worth noting that this is not the first crypto winter in history. In early 2018, Bitcoin had already experienced a downward ice slide, losing up to 70% of its value in just 51 days. Then the cold season lasted until the first quarter of 2020.

Does a Crypto Winter Affect All Cryptocurrencies?

It should be understood that the market capitalization of Bitcoin (BTC) is $324 billion, which represents the dominance of Bitcoin in the cryptocurrency market at 38.41%. In comparison, stablecoins have a market cap of $139 billion and represent 16.53% of the total crypto market cap.

Why do we need these figures? To understand that, due to the dominance of Bitcoin in the market, it affects the value of other crypto asset prices. If this huge planet goes down, it pulls other smaller planets along with it. When a typical crypto winter sets in, it affects bitcoin and most crypto assets, albeit with possible exceptions.

What’s Driving the ‘Crypto Winter’ Worries?

Crypto winter is not limited to a certain number of months or years. Just like the land of Westeros, the crypto market has a very strange seasonal structure, where summer and winter can last for a long period of time, and no one knows when they will switch. Therefore, no one can answer the question that concerns many: how long will crypto winter last? Some experts expect it to last 2 years, until the end of 2024, which will mark the beginning of the bullish period. In fact, no one really knows for sure.

It is also not known how severe the frosts will be: can it be that the bitcoin will crash to zero? And what to do then? Since crypto projects operate under minimum financial regulations and are largely unregulated, this poses risks for investors in case they fall victim to fraud. These uncertainties hinder crypto investors from building an effective finance strategy and asset management.

How Can You Predict a Crypto Winter?

It would be nice to have an accurate next crypto winter prediction to get ready and stock up on some warm clothes. But the problem is that it is impossible to predict the weather in crypto. It remains only to guess what the prerequisites for the next winter may be, based on previous wintering experience. Yes, it will be useful to analyze the crypto winter history to take into account the mistakes of the past. Crypto winter 2018 began just after bitcoin reached its then all-time high of $19,850 in December 2017. Our crypto winter has also begun to show signs of coming after bitcoin’s all-time high in early November 2021 when the token hit nearly $69,000. Immediately after that, the first coin started its downtrend, and the rest of the altcoins followed it. So when Bitcoin hits its all-time high next time, it may not necessarily mean that the euphoria will soon change to SAD, but it would not hurt to be wary.

Macroeconomic factors are also something to watch out for in anticipation of crypto climate change. The arrival of the crypto-winter in 2022 was primarily due to high inflation in the United States, as a result of which interest rates began to rise in all the central banks of the world. This affected the price of the crypto and led to a bear market for digital assets.

Another external factor that does not contribute to the crypto bull market is increased interest from government agencies and the start of lawsuits against some crypto projects.

In addition to external factors, the crypto winter was also provoked by internal problems of the crypto market, such as the collapse of the UST stablecoin and the Luna token of the Terra project, an increase in crypto fraud, a decrease in mining profitability, and others. All this freed the hands of regulators and shook the public’s trust in crypto.

An analysis of the events preceding previous crypto winters will help to anticipate the arrival of the next frosts.

FAQ

What should investors do?

Crypto experts do not recommend panicking and selling off your assets, at least at this stage. Investing in crypto is a risk and you most likely knew this before buying coins. Crypto winter is not a death sentence or the end of the world for investors. Those who didn’t rush to sell their bitcoins in the first winter were most likely happy when it reached its all-time high. So the best thing to do now is to wait and see. Winter will eventually give way to summer, and who knows, perhaps new heights await the crypto, which will bring investors unprecedented profits.

Is Crypto Winter Still Continuing?

Yes, the crypto winter is in full swing and there are no signs of spring coming yet.

Will this crypto winter be the last?

No, it’s unlikely. Experts believe that crypto winters are a completely normal phenomenon in a volatile market, although in the long term they are unlikely to be so dramatic.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Peter Moore

Peter Moore

Read more

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]