Table of Contents

The United Arab Emirates has emerged as the world’s leading cryptocurrency hub in 2025. With zero personal income tax on crypto gains, clear regulatory frameworks, and a thriving digital economy, the UAE attracts traders and investors from around the globe. This comprehensive guide covers everything you need to know about using a crypto exchange in the UAE.

Whether you are a resident in Dubai, Abu Dhabi, or any other emirate, understanding the cryptocurrency exchange landscape is essential. The UAE’s progressive stance on digital assets makes it one of the most attractive destinations for crypto enthusiasts. Multiple options exist for buying, selling, and trading cryptocurrencies—from licensed centralized exchanges to privacy-focused swap services.

This guide explores the best crypto exchanges in the UAE. We examine regulatory requirements, tax implications, payment methods, and security considerations. By the end, you will have all the knowledge needed to navigate the UAE’s dynamic cryptocurrency market confidently.

Understanding UAE Crypto Exchange Regulations

Cryptocurrency is fully legal in the UAE under a multi-layered regulatory framework. The government has established dedicated authorities to oversee digital asset activities. This clear regulatory structure positions the UAE as a global leader in virtual asset governance.

The UAE’s approach to crypto regulation balances innovation with investor protection. Multiple regulatory bodies coordinate to create a unified yet flexible framework. This allows different emirates to cater to specific market needs while maintaining federal oversight.

Key Regulatory Bodies Governing Cryptocurrency Exchange UAE Operations

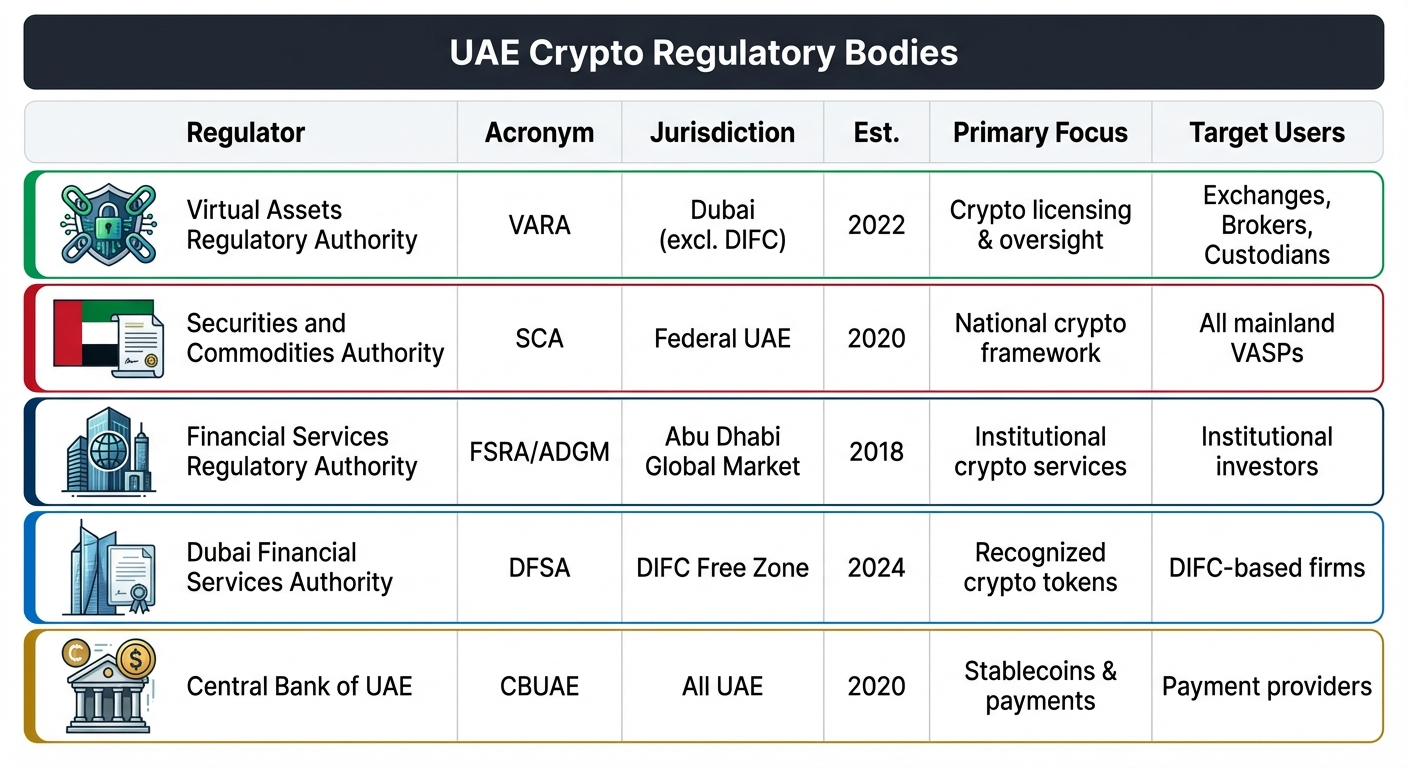

Six regulatory authorities coordinate to oversee crypto activities across the UAE. Each body has specific jurisdiction and responsibilities. Understanding their roles helps users choose compliant platforms.

Virtual Assets Regulatory Authority (VARA): Established in 2022, VARA is Dubai’s dedicated regulator for virtual assets. It oversees all crypto activities in Dubai’s mainland and free zones, except the Dubai International Financial Centre (DIFC). VARA issues licenses to exchanges, custodians, brokers, and advisory services. The authority has implemented a modular license structure with phased compliance requirements.

Securities and Commodities Authority (SCA): The SCA serves as the federal financial regulatory agency for the UAE. It establishes the overarching legal framework for crypto assets within mainland UAE. In August 2025, the SCA and VARA formalized a partnership to unify the country’s approach to crypto regulations.

Abu Dhabi Global Market (ADGM): The ADGM is an international financial free zone with its own legal and regulatory framework. Its Financial Services Regulatory Authority (FSRA) has regulated crypto businesses since 2018. The ADGM primarily serves institutional players with bank-grade licensing standards.

Dubai Financial Services Authority (DFSA): The DFSA regulates financial services within the Dubai International Financial Centre. It has established its own regulatory framework for recognized crypto tokens. In June 2025, the DFSA launched its Tokenisation Regulatory Sandbox.

Central Bank of UAE (CBUAE): The Central Bank oversees stablecoins, payment flows, and monetary infrastructure. It introduced the Digital Dirham project in 2023, with plans to launch this blockchain-based digital currency in late 2025. The CBUAE’s Payment Token Services Regulation governs stablecoin services.

UAE Crypto Exchange Licensing Requirements

Virtual Asset Service Providers must obtain proper licenses to operate legally in the UAE. The licensing process involves stringent compliance requirements. These ensure platforms implement robust AML, KYC, and security measures.

Under the September 2024 cooperation agreement, VASPs operating in Dubai must obtain a VARA license. Once licensed by VARA, these entities are automatically registered with the SCA. This enables them to operate throughout the entire UAE. VASPs intending to operate in emirates other than Dubai must obtain their license directly from the SCA.

The VARA licensing process typically involves several phases. First, applicants submit comprehensive documentation. Then, VARA conducts due diligence, including on-site inspections and technical audits. Finally, approved entities receive their license and begin supervised operational testing.

Best Crypto Exchange UAE: Top Platforms for 2025

The best crypto exchange in the UAE depends on your specific trading needs and preferences. Licensed platforms offer regulatory compliance and fiat integration. Meanwhile, non-custodial services provide privacy and speed for crypto-to-crypto swaps.

UAE crypto exchange options range from global giants to local specialists. Each platform offers distinct advantages for different user profiles. Below, we review the top choices available to UAE residents in 2025.

Licensed Centralized Cryptocurrency Exchange UAE Platforms

Centralized exchanges dominate the UAE crypto market due to their regulatory compliance. These platforms support direct AED deposits and withdrawals. They also offer extensive cryptocurrency selections and advanced trading features.

Binance: Binance is the largest global exchange by trading volume. Its Dubai subsidiary, Binance FZE, holds VASP licenses from both VARA and ADGM. The platform supports over 400 cryptocurrencies with daily BTC trading volume exceeding $76 billion. UAE users can deposit AED via MasterCard, Visa, bank transfers, and ADVCash. Trading fees range from 0.1% to 0.012% depending on volume.

OKX: OKX holds a VARA license and supports direct AED deposits and withdrawals via local banks. The platform offers over 350 cryptocurrencies and crypto-AED trading pairs. Its native wallet is fully available in the UAE. Weekly deposit limits reach 3.7 billion AED for verified users.

Rain: Rain is fully licensed by ADGM’s FSRA and is the only Sharia-compliant crypto platform in the UAE. The exchange supports over 70 cryptocurrencies with zero trading fees (1-2.5% spread included). AED deposits via bank transfers are free. Rain partners with multiple UAE banks including ADCB, Commercial Bank of Dubai, and RAK Bank.

Bybit: Bybit has secured provisional VASP approval from VARA. The platform serves over 50 million users globally with access to 1,699 cryptocurrencies. It offers spot trading and futures with up to 100x leverage. AED deposits are supported via cards, Apple Pay, Google Pay, and bank transfers.

Crypto.com: Crypto.com holds dual VARA and ADGM licenses. The platform offers an integrated ecosystem including exchange, Visa card, and DeFi tools. It directly supports fee-free AED deposits and withdrawals through bank transfers. Standard Chartered serves as the platform’s UAE banking partner.

Non-Custodial Instant Swap Services for UAE Crypto Traders

Instant swap services offer a privacy-friendly alternative to traditional exchanges. These platforms enable streamlined wallet-to-wallet crypto conversions with minimal friction. They are ideal for users who already hold cryptocurrency and want to swap between assets quickly.

Non-custodial swaps work differently from centralized exchanges. Users maintain control of their funds throughout the process with no custodial risk. You simply select your trading pair, provide a receiving wallet address, and send funds to a one-time deposit address.

GODEX leads this category, supporting over 920 cryptocurrencies with fixed-rate options that protect against price slippage. The platform offers transparent terms and a straightforward swap process that completes within minutes. For UAE traders who value efficiency and discretion in their portfolio management, these services fill a gap that traditional exchanges cannot.

UAE Crypto Exchange Tax Implications

Individual crypto traders in the UAE pay zero tax on their profits. The country imposes no personal income tax or capital gains tax on cryptocurrency gains. This makes the UAE one of the most attractive crypto tax havens globally.

The UAE’s tax-friendly environment applies to all emirates including Dubai and Abu Dhabi. Whether you trade, stake, mine, or hold crypto for personal investment, your gains remain untaxed. In November 2024, Cabinet Decision 100 eliminated the 5% VAT on all cryptocurrency transactions, retroactive to 2018.

Tax-Free Crypto Trading for UAE Individuals

UAE residents enjoy 100% tax-free crypto profits on all personal investment activities. This includes day trading, long-term holding, staking rewards, DeFi yields, and NFT sales. There is no distinction between investment and trading for individual tax purposes.

The following crypto activities are completely tax-free for UAE individuals:

- Buying and selling cryptocurrency

- Crypto-to-crypto swaps

- Staking and yield farming

- Mining for personal use

- Receiving airdrops and rewards

- NFT trading for personal collection

This comprehensive exemption covers all common crypto activities.

To benefit from the UAE’s tax advantages, individuals must establish tax residency. This typically requires residing in the country for at least 183 days per year and obtaining a Tax Residency Certificate. Expatriates should note that their home country may still require reporting of crypto gains.

Corporate Tax on Cryptocurrency Exchange UAE Business Activities

Crypto businesses in the UAE face a 9% corporate tax on profits exceeding AED 375,000 annually. This applies to exchanges, commercial mining operations, and crypto advisory services. The corporate tax was introduced in June 2023.

Taxable business activities include:

- Operating a crypto exchange

- Providing commercial mining services to third parties

- Offering crypto consultation or advisory services

- Running NFT studios or marketplaces on a commercial scale

Businesses must register for VAT when taxable turnover exceeds AED 375,000 in twelve months.

Free zone businesses may qualify for partial corporate tax relief. They must transact only with non-UAE customers and meet economic substance requirements. The specific tax treatment depends on the free zone’s regulations and the nature of crypto activities conducted.

How to Buy Crypto Using a UAE Crypto Exchange

Buying cryptocurrency in the UAE is straightforward through licensed exchanges. The process involves account creation, verification, funding, and purchase. Multiple payment methods make it easy to convert AED to crypto.

UAE residents can access crypto through centralized exchanges, peer-to-peer platforms, or direct wallet purchases. Each method offers different advantages in terms of speed, fees, and privacy. Choose based on your priorities and trading style.

Step-by-Step Guide to Buying on a Cryptocurrency Exchange UAE

Follow these steps to purchase cryptocurrency through a licensed UAE exchange. The process typically takes 15-30 minutes for first-time users. Subsequent purchases are much faster once verification is complete.

Step 1: Choose Your Exchange. Select a VARA-licensed or ADGM-licensed platform. Verify the license on the regulator’s public register. Consider factors like supported cryptocurrencies, fees, and AED deposit methods.

Step 2: Create Your Account. Register with your email address and create a secure password. Enable two-factor authentication immediately for account security.

Step 3: Complete KYC Verification. Submit your Emirates ID or passport, proof of UAE address, and complete a liveness check. Approval typically takes minutes to 48 hours.

Step 4: Fund Your Account. Deposit AED via bank transfer for lowest fees. Credit and debit cards offer instant deposits but may incur higher charges. Some platforms support Apple Pay and Google Pay.

Step 5: Purchase Cryptocurrency. Navigate to the trading section and select your desired crypto pair. Enter the amount to buy and confirm the transaction. For beginners, use instant buy features for simplicity.

Step 6: Secure Your Assets. Consider transferring large holdings to a personal hardware wallet. This protects your crypto from exchange hacks or account compromises.

AED Payment Methods for Best Crypto Exchange UAE Platforms

UAE crypto exchanges support multiple AED deposit methods for user convenience. Bank transfers typically offer the lowest fees but take longer to process. Card payments provide instant access but may cost more.

Bank Transfers: Most regulated exchanges provide AED bank details for direct transfers. Many platforms, including Rain and Crypto.com, offer fee-free AED deposits. Bank transfers typically reflect within one business day.

Credit and Debit Cards: Visa and MasterCard payments enable instant crypto purchases. Fees typically range from 1.5% to 3.5% depending on the exchange. Some UAE banks may restrict crypto card transactions.

Mobile Payments: Apple Pay and Google Pay are increasingly supported by UAE exchanges. These offer the convenience of card payments with additional security features.

P2P Trading: Peer-to-peer platforms like Binance P2P allow direct trades with other users. This offers flexible payment options including cash deposits at local banks. Escrow services protect both parties during the transaction.

Using Non-Custodial Services for Crypto Swaps in UAE

For users who already hold cryptocurrency, non-custodial swap services offer the fastest conversion method. These platforms skip the fiat on-ramp entirely, making them ideal for rebalancing existing portfolios.

The process is straightforward: select your source and destination cryptocurrencies, enter your receiving wallet address, and send funds to the provided deposit address. Your swapped coins arrive in your wallet within minutes. Fixed-rate options lock in exchange rates during the transaction window, protecting against volatility.

This approach suits traders who value speed and a streamlined experience. Platforms like GODEX offer flexible volume options, accommodating everything from minor adjustments to significant portfolio shifts.

Security Best Practices for UAE Crypto Exchange Users

Security should be every crypto user’s top priority when using any exchange. The UAE’s regulated environment reduces some risks. However, personal security practices remain essential.

Licensed UAE exchanges implement bank-grade security measures. These include cold storage, multi-signature wallets, and proof-of-reserves audits. Understanding these protections helps users make informed platform choices.

Security Features of Licensed Cryptocurrency Exchange UAE Platforms

VARA-licensed and ADGM-licensed exchanges must meet strict security requirements. Regulators mandate specific cybersecurity standards. This creates a baseline level of protection for UAE users.

Cold Storage: Licensed exchanges store the majority of user funds in offline cold wallets. This protects assets from online attacks. Hot wallets hold only funds needed for daily operations.

Multi-Signature Wallets: Transactions require multiple private keys to authorize. This prevents any single point of failure or insider threat. Most regulated exchanges use multi-sig for both hot and cold storage.

Proof-of-Reserves: Regular audits verify that exchange holdings match user deposits. Binance, Bybit, and other major platforms publish proof-of-reserves reports. This transparency builds user confidence.

Insurance Coverage: Some UAE exchanges maintain insurance policies covering digital assets. This provides an additional layer of protection against theft or loss.

Personal Security Tips for UAE Crypto Traders

Even the most secure exchange cannot protect users from personal security lapses. Following best practices significantly reduces your risk exposure. These habits should become second nature.

- Enable Two-Factor Authentication (2FA): Use authenticator apps rather than SMS. Hardware security keys like YubiKey offer the strongest protection.

- Use Unique, Strong Passwords: Create different passwords for each exchange. Use a password manager to generate and store complex credentials.

- Verify URLs Carefully: Phishing sites mimic legitimate exchanges. Always type URLs directly or use bookmarks. Check for HTTPS and correct domain spelling.

- Use Hardware Wallets: Store significant holdings in personal hardware wallets. Ledger and Trezor are popular choices among UAE crypto traders.

- Test Small Amounts First: When using a new exchange or sending to a new address, start with a small test transaction. Verify receipt before transferring larger amounts.

- Keep Software Updated: Use the latest versions of wallet apps, browsers, and operating systems. Updates often include critical security patches.

How to Choose the Best Crypto Exchange UAE for Your Needs

Selecting the right cryptocurrency exchange depends on your specific requirements. Different platforms excel in different areas. Consider your priorities before committing to a single exchange.

Many experienced UAE traders use multiple platforms for different purposes. A licensed exchange handles fiat on-ramps and primary trading. Non-custodial services manage quick swaps when speed or privacy matters more than fiat access.

Evaluation Criteria for UAE Crypto Exchange Selection

Several factors determine which exchange best suits your trading style. Weigh each criterion based on your priorities. No single platform excels in every category.

Regulatory Compliance: For fiat activities, choose VARA-licensed or ADGM-licensed platforms. Check the regulator’s public register to verify current license status. Compliance provides legal protection and recourse options.

Trading Fees: Compare maker and taker fees across platforms. Consider spread costs on instant buy services. Factor in deposit and withdrawal fees for complete cost analysis.

Cryptocurrency Selection: Platforms range from 70 to over 3,700 supported assets. If you need specific altcoins, verify availability before creating an account.

Liquidity: Higher liquidity means tighter spreads and faster order execution. Binance leads globally in trading volume. For large orders, liquidity directly impacts your execution price.

AED Support: Check which fiat deposit and withdrawal methods the platform supports. Direct AED bank transfers typically offer the best rates. Card payments cost more but provide instant access.

Privacy Requirements: If discretion matters, non-custodial swap services handle crypto-to-crypto conversions with minimal data footprint.

Customer Support: Arabic language support can be valuable for local users. Check response times and available channels. Rain and local exchanges often excel in regional support.

Recommended Platform Combinations for UAE Crypto Traders

Most successful traders use multiple platforms for different purposes. This multi-platform approach optimizes for different scenarios. Consider the following combinations based on your profile.

Beginners: Start with Rain for its user-friendly interface, zero trading fees, and full UAE regulatory compliance. The platform’s Arabic support and simple design make it ideal for learning. As you gain experience, add Binance for its broader cryptocurrency selection.

Active Traders: Use Binance or OKX as your primary platform for deep liquidity and competitive fees. Their advanced charting tools and order types support sophisticated strategies. Consider adding a non-custodial option for rapid rebalancing without additional verification delays.

Privacy-Conscious Users: Keep minimal fiat exposure on a single licensed exchange like Rain. Use identity-light services such as GODEX for crypto-to-crypto conversions. Store assets in hardware wallets to maintain full control.

Institutional Investors: Choose ADGM-licensed platforms like Rain for their institutional-grade compliance standards. Consider OTC desks for large transactions to minimize market impact. Binance and OKX also offer dedicated institutional services.

The Future of Cryptocurrency Exchange UAE Market

The UAE’s crypto market is projected to reach $5.3 billion by 2030, growing at 27.1% annually. Regulatory clarity, tax advantages, and government support drive this growth. The future looks exceptionally bright for crypto in the UAE.

Several developments will shape the UAE crypto landscape in coming years. The Digital Dirham launch, increased banking integration, and expanded regulatory frameworks will create new opportunities. Major institutions continue entering the market.

Emerging Trends in UAE Crypto Exchange Ecosystem

Several key trends are reshaping how UAE residents interact with crypto exchanges. These developments signal the market’s continued maturation. Understanding them helps traders position themselves advantageously.

Banking Integration: Major UAE banks including Emirates NBD and ADCB are developing crypto service offerings. Rakbank became the first UAE bank to offer retail crypto trading in 2025. This mainstream adoption reduces friction for new users.

Digital Dirham: The Central Bank’s blockchain-based digital currency will launch in late 2025. This will enable new use cases including smart contract automation and tokenized asset trading.

Real Estate Tokenization: Dubai Land Department has integrated with tokenization platforms. Non-UAE nationals can now own property tokens with the same rights as traditional ownership. This creates new investment opportunities through crypto.

DeFi Regulation: VARA’s updated rulebooks now cover DeFi protocols and NFTs. Clear guidelines enable compliant innovation in decentralized finance.

Conclusion

The UAE offers one of the world’s most favorable environments for cryptocurrency trading. Zero personal income tax, clear regulations, and robust infrastructure create ideal conditions. Whether you are a beginner or experienced trader, the right crypto exchange awaits.

For fiat-to-crypto transactions, licensed platforms like Binance, OKX, and Rain provide secure, compliant services. For crypto-to-crypto conversions where privacy and speed matter, non-custodial alternatives deliver without the overhead of traditional exchanges.

Start by choosing a VARA-licensed or ADGM-licensed exchange for your initial purchases. Complete KYC verification and fund your account with AED. Consider diversifying across multiple platforms as your experience grows. Always prioritize security by enabling 2FA and using hardware wallets for long-term storage.

The UAE’s crypto ecosystem continues to evolve rapidly. Stay informed about regulatory changes and new platform offerings. With the right knowledge and tools, UAE residents can fully capitalize on the digital asset revolution while enjoying tax-free gains on their investments.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Peter Moore

Peter Moore

Read more

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]