Table of Contents

The world of cryptocurrency can feel overwhelming when you’re just starting out. With thousands of digital assets, dozens of platforms, and an entirely new vocabulary to learn, many newcomers find themselves paralyzed by choice and confusion. But here’s the truth: exchanging cryptocurrency doesn’t have to be complicated.

This comprehensive guide will walk you through everything you need to know about crypto exchanges—from understanding the fundamental concepts to executing your first trade with confidence. Whether you’re looking to convert your local currency into Bitcoin, swap one cryptocurrency for another, or simply understand how the ecosystem works, you’ll find practical, actionable guidance in the pages ahead.

By the time you finish reading, you’ll understand the different types of cryptocurrency exchanges, know exactly what factors to consider when choosing a platform, and have a clear roadmap for making your first exchange safely and efficiently.

Let’s begin your journey into the world of cryptocurrency trading.

Understanding Cryptocurrency Exchanges: The Foundation

Before diving into the mechanics of trading, it’s essential to understand what a cryptocurrency exchange actually is and why these platforms exist in the first place.

What Is a Crypto Exchange?

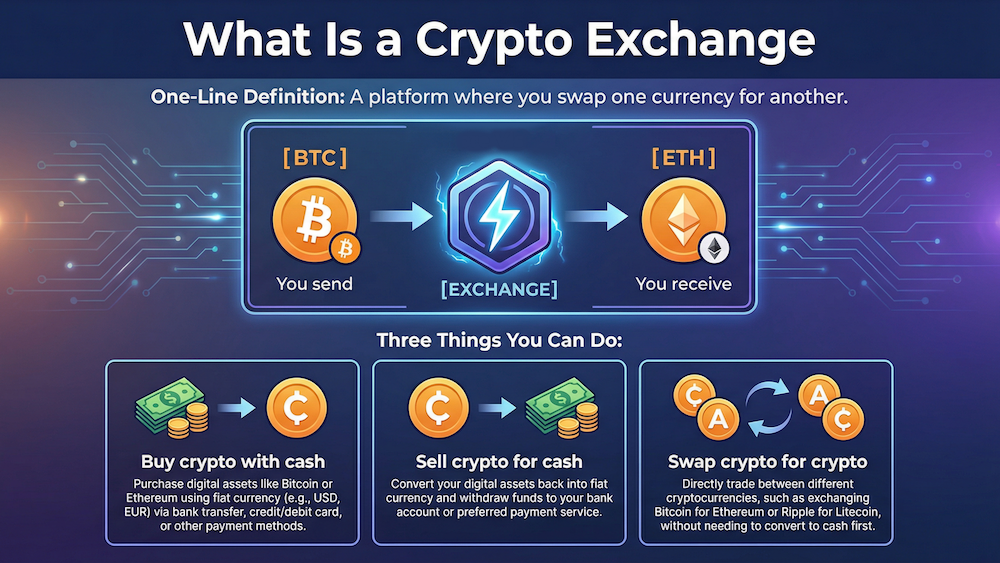

A cryptocurrency exchange is a platform that allows you to trade digital assets. Think of it as the digital equivalent of a currency exchange booth at an airport, but instead of swapping dollars for euros, you might be exchanging Bitcoin for Ethereum, or converting your local currency into any number of digital assets.

The fundamental purpose of any crypto exchange is straightforward: to facilitate the buying, selling, and swapping of cryptocurrencies. However, the way different platforms accomplish this goal varies significantly, which is why understanding the landscape is crucial before you commit to any particular service.

Why Do Crypto Exchanges Matter?

Cryptocurrencies exist on decentralized networks called blockchains. Unlike traditional money sitting in a bank account, you can’t simply walk up to a teller and ask to convert your Bitcoin into cash or another cryptocurrency. You need an intermediary—a platform that connects buyers with sellers or that holds reserves of various cryptocurrencies to facilitate instant swaps.

This is where exchanges come in. They serve as the bridges between different cryptocurrencies and, in many cases, between the traditional financial system and the crypto ecosystem. Without exchanges, the cryptocurrency market as we know it simply couldn’t function.

The Evolution of Cryptocurrency Trading

The crypto exchange landscape has evolved dramatically since Bitcoin’s early days. In the beginning, trading was a cumbersome process that often involved meeting strangers in person or navigating primitive online forums. Today, sophisticated platforms offer everything from simple swaps to complex derivatives trading.

This evolution has made cryptocurrency more accessible than ever before. What once required significant technical knowledge can now be accomplished by anyone with an internet connection and a few minutes to spare. The barrier to entry has dropped substantially, opening up opportunities for millions of people worldwide.

Types of Cryptocurrency Exchanges: Finding Your Fit

Not all crypto exchanges are created equal. Understanding the different categories will help you choose the right type of platform for your specific needs.

Centralized Exchanges (CEX)

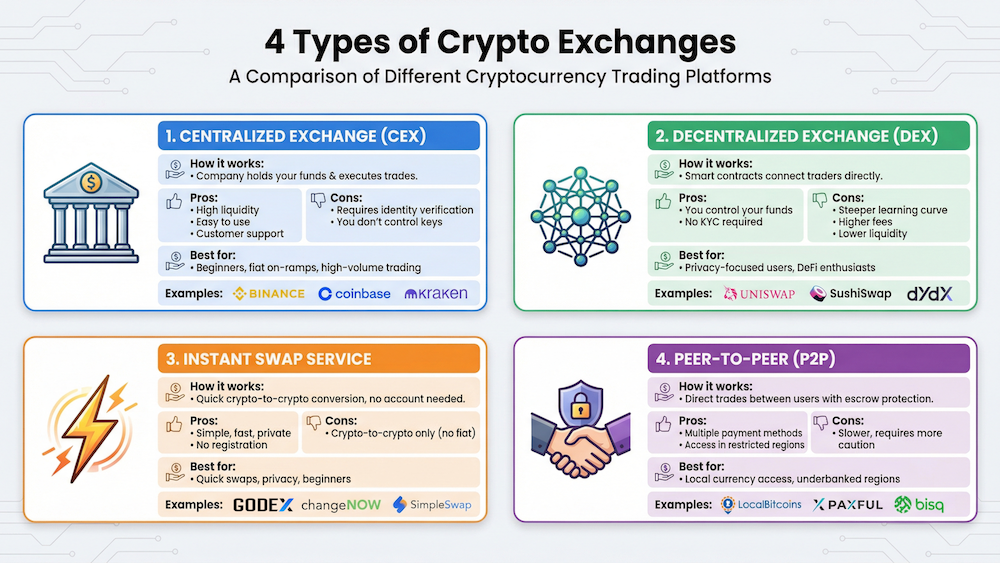

Centralized exchanges are the most common type of cryptocurrency trading platform. These are companies that act as intermediaries between buyers and sellers, maintaining order books and facilitating trades through their own systems.

When you use a centralized exchange, you’re trusting that company to hold your funds safely, execute trades fairly, and maintain the security of their platform. Major centralized exchanges often offer extensive features including spot trading, futures contracts, staking services, and more.

The advantages of centralized exchanges include high liquidity, user-friendly interfaces, and extensive customer support. However, they also come with drawbacks. Most notably, you must trust a third party with your funds, and many centralized exchanges require extensive identity verification procedures that some users find invasive.

Decentralized Exchanges (DEX)

Decentralized exchanges operate without a central authority. Instead, they use smart contracts—self-executing code on a blockchain—to facilitate trades directly between users. When you trade on a DEX, you maintain control of your funds throughout the entire process.

The appeal of decentralized exchanges lies in their alignment with cryptocurrency’s original ethos of decentralization and self-sovereignty. You don’t need to trust a company with your assets, and in most cases, you don’t need to provide personal information to trade.

However, DEXs come with their own challenges. They typically offer lower liquidity than their centralized counterparts, can be more complicated to use, and may have higher transaction costs due to blockchain fees. For beginners, the learning curve can be steep.

Instant Swap Services

Instant swap services represent a middle ground that many users find appealing, especially those new to cryptocurrency. These platforms allow you to exchange one cryptocurrency for another quickly and simply, without the complexity of order books or the technical demands of decentralized protocols.

The process is straightforward: you select the cryptocurrency you want to send, choose what you want to receive, provide a destination wallet address, and send your funds. The platform handles the rest, typically completing the exchange within minutes.

Platforms like GODEX exemplify this category, offering access to over 910 cryptocurrencies without requiring users to create accounts or navigate complex trading interfaces. For someone making their first bitcoin exchange, this simplicity can be invaluable—you focus on the swap itself rather than learning an entirely new platform.

Peer-to-Peer Platforms

Peer-to-peer (P2P) exchanges connect buyers and sellers directly, often facilitating trades that involve traditional payment methods like bank transfers, cash deposits, or even in-person meetings.

These platforms typically use an escrow system to protect both parties during a transaction. The cryptocurrency being sold is held by the platform until the buyer confirms payment has been received, at which point the funds are released.

P2P exchanges can be useful for converting local currency to cryptocurrency in regions with limited banking infrastructure or where other exchange options are restricted. However, they require more caution and due diligence, as you’re dealing directly with other individuals.

Key Factors When Choosing a Cryptocurrency Exchange

With so many options available, how do you decide which crypto exchange is right for you? Consider these critical factors before committing to any platform.

Security Measures

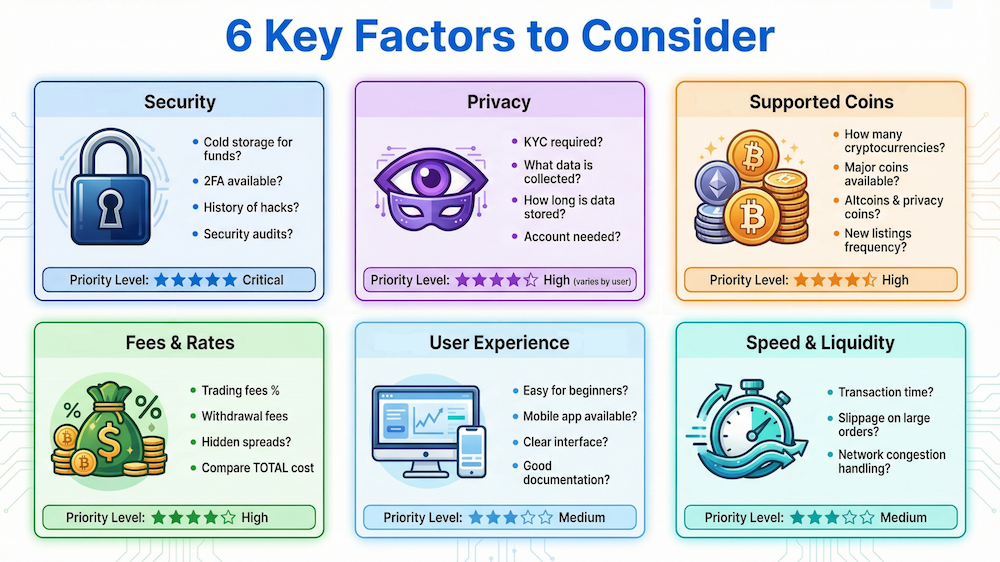

Security should be your primary concern when selecting a cryptocurrency exchange. The history of crypto is littered with exchange hacks and failures that cost users billions of dollars collectively. Before trusting any platform with your funds, investigate their security practices.

Look for exchanges that employ industry-standard protections: cold storage for the majority of user funds, two-factor authentication, encryption protocols, and regular security audits. Research whether the platform has experienced any security breaches in the past and, if so, how they responded.

Remember that the most secure option is often to minimize the time your funds spend on any exchange. Complete your trade and withdraw your cryptocurrency to a wallet you control as quickly as practical.

Privacy Considerations

The level of privacy offered by different exchanges varies dramatically. Traditional centralized exchanges typically require Know Your Customer (KYC) verification, meaning you’ll need to provide government-issued identification, proof of address, and sometimes even selfies or video verification.

For some users, this verification process is acceptable or even preferred. For others, the requirement to hand over sensitive personal information to access financial services conflicts with their values or practical circumstances.

If privacy matters to you, consider platforms that minimize data collection. Some instant exchange services allow you to swap cryptocurrencies without creating accounts or providing personal information. This approach offers certain advantages: your transaction data isn’t permanently linked to your identity, there’s no account that could be compromised, and you maintain greater control over your personal information.

Supported Cryptocurrencies

The range of supported cryptocurrencies varies enormously between platforms. Some exchanges focus exclusively on major assets like Bitcoin and Ethereum, while others support hundreds or even thousands of different tokens.

Consider your needs both now and in the future. If you’re only interested in Bitcoin, almost any platform will serve you. But if you want to explore altcoins, trade privacy-focused cryptocurrencies, or have flexibility for future interests, choosing a platform with extensive coin support makes sense.

The cryptocurrency market evolves rapidly, and having access to a wide selection means you won’t need to search for a new platform every time you want to try something different.

Fees and Exchange Rates

Understanding the fee structure of any exchange is essential for making informed decisions. Fees can take several forms: trading fees, withdrawal fees, deposit fees, and spread (the difference between buy and sell prices).

Some platforms advertise low trading fees but make up for it with poor exchange rates or high withdrawal costs. Others might seem expensive on paper but actually offer better value when you factor in the rate you receive.

For a complete picture, always calculate the total cost of a transaction, including all fees and the effective exchange rate. A platform with slightly higher stated fees might still be more economical if it offers consistently better rates.

User Experience and Complexity

The best exchange in the world is useless if you can’t figure out how to use it. Consider your technical comfort level and choose a platform that matches your experience.

Advanced trading platforms offer powerful features but can overwhelm beginners with charts, order types, and technical jargon. If you’re just starting out, there’s nothing wrong with choosing a simpler service and graduating to more complex platforms as your knowledge grows.

The cryptocurrency space will still be here when you’re ready for advanced trading. There’s no need to rush into complexity before you’re comfortable with the basics.

Liquidity and Speed

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. High liquidity means your trades execute quickly at prices close to what you expect. Low liquidity can result in slippage—receiving a worse price than anticipated because your order moves the market.

For major cryptocurrencies on established platforms, liquidity is rarely a concern. But if you’re trading smaller altcoins or using lesser-known exchanges, it’s worth considering whether the platform can handle your transaction size efficiently.

Speed also matters, particularly for instant swap services. How long does the platform typically take to complete an exchange? Are there delays during high-traffic periods? User reviews and forum discussions can provide insight into real-world performance.

Step-by-Step: Making Your First Cryptocurrency Exchange

Now that you understand the landscape, let’s walk through the practical process of exchanging cryptocurrency. While specific steps vary by platform, the general flow remains consistent.

Step 1: Determine What You Want to Exchange

Before you do anything else, be clear about your goal. Are you converting traditional currency into cryptocurrency? Swapping one crypto asset for another? The answer determines which type of platform best suits your needs.

For fiat-to-crypto conversions (turning dollars, euros, or other traditional money into cryptocurrency), you’ll typically need a centralized exchange that accepts bank transfers or card payments. These platforms generally require identity verification.

For crypto-to-crypto swaps, your options expand significantly. You can use centralized exchanges, decentralized protocols, or instant swap services depending on your preferences for privacy, speed, and simplicity.

Step 2: Choose Your Platform

Based on the factors discussed earlier—security, privacy, supported cryptocurrencies, fees, and user experience—select a platform that aligns with your needs.

If this is your first crypto exchange, consider starting with a straightforward service to build confidence before exploring more complex options. Many experienced traders still use simple swap services for routine transactions because the convenience outweighs any minor cost differences.

Step 3: Prepare Your Wallet

Before you can receive cryptocurrency, you need a place to store it. If you’re using a centralized exchange, the platform provides custody wallets automatically. However, for non-custodial services or if you want to move funds off an exchange after trading, you’ll need your own wallet.

Cryptocurrency wallets come in various forms: software wallets (applications on your computer or phone), hardware wallets (dedicated physical devices), and even paper wallets (printed private keys). Each offers different tradeoffs between convenience and security.

For beginners, a reputable software wallet provides a good balance of accessibility and safety. As your holdings grow, consider upgrading to a hardware wallet for enhanced security.

Whatever wallet you choose, ensure you have the correct address for the cryptocurrency you’re receiving. Sending Bitcoin to an Ethereum address, for example, will result in permanent loss of funds.

Step 4: Initiate the Exchange

The specific process depends on your chosen platform, but the core steps are similar.

On a centralized exchange, you’ll typically deposit funds (either cryptocurrency or traditional money), navigate to the trading interface, select your trading pair, enter the amount, and execute the trade.

On instant swap services, the process is even more streamlined. Let’s walk through a typical example: say you want to exchange Bitcoin for Ethereum. You would select BTC as your sending currency and ETH as your receiving currency, enter the amount, provide your Ethereum wallet address for receiving the funds, and then send your Bitcoin to the platform’s provided address. The service handles the conversion and sends Ethereum to your wallet.

This simplicity is why many users prefer instant swap platforms for straightforward exchanges—particularly for anyone unfamiliar with trading interfaces or those who simply want to convert one asset to another without navigating complex order books.

Step 5: Send Your Funds

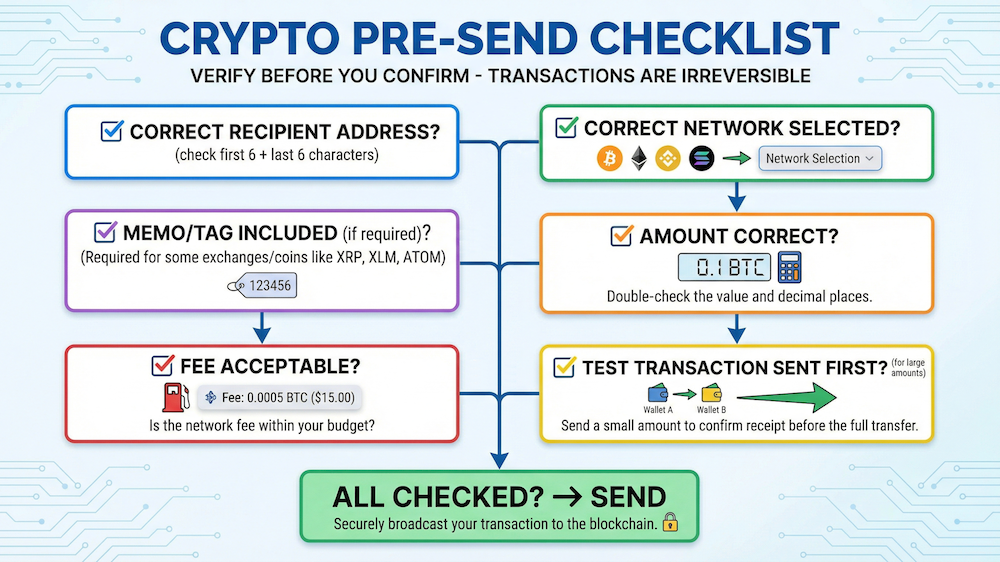

Once you’ve initiated the exchange, you’ll need to send your cryptocurrency to complete the transaction. Pay careful attention at this stage—cryptocurrency transactions are irreversible.

Double-check the address you’re sending to. Verify the amount. If the platform has provided any additional identifiers (Memo, Destination Tag, Payment ID), make absolutely sure to include them. Some cryptocurrencies require these extra identifiers to route funds correctly, and omitting them can result in permanent loss.

Many platforms provide a time window for receiving your deposit. If the rate is fixed, sending funds outside this window might mean you receive a different rate than quoted. Make sure you can complete your deposit within any stated timeframe.

Step 6: Wait for Confirmation

After sending your funds, there’s usually a waiting period while the blockchain confirms your transaction and the exchange processes the swap.

Confirmation times vary by cryptocurrency. Bitcoin transactions typically require multiple confirmations, which can take anywhere from ten minutes to an hour depending on network congestion and the fee you paid. Other cryptocurrencies may confirm faster or slower.

Most platforms provide a transaction ID or status page where you can monitor progress. Patience is important here—delays don’t necessarily indicate problems, especially during periods of high network activity.

Step 7: Receive Your Cryptocurrency

Once the exchange completes, your new cryptocurrency will be sent to the destination address you provided. You should be able to see the incoming transaction in your wallet, though it may take additional time before the funds are fully confirmed and spendable.

Congratulations—you’ve completed your first cryptocurrency exchange!

Step 8: Secure Your Assets

With the exchange complete, consider your next steps for security. If you traded on a centralized exchange, decide whether to leave funds on the platform or withdraw to a wallet you control. Each approach has tradeoffs: exchange custody is convenient but relies on the platform’s security, while self-custody gives you full control but full responsibility.

For significant amounts, most security experts recommend moving assets to cold storage—a wallet that isn’t connected to the internet. This approach eliminates many attack vectors, though it requires more effort for subsequent transactions.

Security Best Practices for Cryptocurrency Trading

The irreversible nature of cryptocurrency transactions makes security paramount. Follow these best practices to protect your assets.

Verify Everything

Phishing attacks are rampant in the cryptocurrency space. Before interacting with any website or service, verify you’re on the legitimate site. Check the URL carefully—scammers often create convincing replicas with slightly misspelled addresses.

Bookmark the official URLs of platforms you use regularly. Be suspicious of links in emails, social media messages, or search advertisements. When in doubt, type the address directly into your browser.

Legitimate platforms will never ask for your private keys or recovery phrases. Any request for this information is a scam, regardless of how official it might appear.

Use Strong Authentication

Enable two-factor authentication (2FA) on every platform that supports it. Prefer authentication apps over SMS-based codes, as phone numbers can be compromised through SIM swapping attacks.

Use unique, strong passwords for each platform. A password manager makes this practical—you only need to remember one master password while maintaining unique credentials everywhere else.

Protect Your Private Keys

Your private keys or recovery phrase are the ultimate access to your cryptocurrency. Anyone who possesses them can spend your funds, and there’s no customer support to call for help.

Store recovery phrases offline, ideally in multiple secure locations. Never type them into a computer unless you’re actively restoring a wallet on a device you completely trust. Never photograph them or store them in cloud services.

Consider using a hardware wallet for significant amounts. These devices keep your private keys isolated from your computer, protecting them even if your machine is compromised.

Verify Addresses Before Sending

Clipboard malware specifically targets cryptocurrency users, silently replacing wallet addresses you copy with addresses controlled by attackers. Always verify the first and last several characters of any address before sending funds.

Some wallets and platforms support address whitelisting, allowing you to pre-approve trusted addresses. This feature adds a layer of protection against both malware and human error.

Start Small

When using a new platform or sending to an unfamiliar address, start with a small test transaction. Losing a minor amount to a mistake or scam is painful but recoverable. Losing your entire holdings because you didn’t verify first is devastating.

This practice also helps you understand how a platform works before committing significant funds.

Common Mistakes and How to Avoid Them

Learning from others’ mistakes is less expensive than making your own. Here are the most common errors beginners make when using cryptocurrency exchanges.

Sending to the Wrong Address or Network

Cryptocurrency addresses are long strings of characters that are virtually impossible to memorize. A single incorrect character means your funds go somewhere else—and probably disappear forever.

Even more confusing, some cryptocurrencies exist on multiple networks. Sending Ethereum-based USDT to a Tron address, for example, will result in lost funds despite both being “USDT.”

Always double-check addresses. Use QR codes when possible to avoid typing errors. Verify the network matches your destination wallet.

Forgetting Additional Identifiers

Some cryptocurrencies require additional information beyond the wallet address—variously called Memo, Destination Tag, Payment ID, or Message depending on the coin. These identifiers route funds to the correct recipient when multiple users share a single address.

When a platform provides one of these identifiers, it’s mandatory, not optional. Forgetting to include it typically means your funds land in the exchange’s general wallet with no way to identify your specific deposit. Recovery may be impossible or at best extremely difficult.

Ignoring Network Fees

Blockchain transactions require fees paid to miners or validators who process and confirm the transaction. During periods of high activity, these fees can spike dramatically.

Before sending any transaction, check the current fee environment. A transaction that costs cents during calm periods might cost tens of dollars during network congestion. Consider whether your transfer is urgent or can wait for fees to decrease.

Falling for Scams

The cryptocurrency space attracts an unfortunate concentration of scammers. Common tactics include fake giveaways (send us cryptocurrency and we’ll send back more—no, they won’t), impersonation of support staff, fake exchange websites, and social engineering attacks.

No legitimate organization will ever contact you first offering free cryptocurrency, asking for your private keys, or requesting that you send funds to verify your wallet. These are always scams.

If something seems too good to be true, it is. If someone creates urgency or pressure, step back and verify independently.

Over-Trading

For many beginners, the excitement of cryptocurrency trading leads to excessive activity. Every price movement seems like an opportunity, and the urge to constantly buy and sell can be overwhelming.

This over-trading typically results in accumulated fees that eat into returns, tax complications, emotional decision-making that leads to buying high and selling low, and unnecessary stress.

Consider your actual goals. If you’re investing for the long term, constant trading is counterproductive. If you’re genuinely interested in active trading, take time to learn properly before risking significant capital.

Understanding Exchange Rates and Fees

To make informed decisions, you need to understand how crypto exchanges make money and how that affects what you pay.

How Exchange Rates Work

Cryptocurrency prices aren’t set centrally—they emerge from trading activity across many platforms. Each exchange has slightly different supply and demand dynamics, leading to small price variations.

When you see a quoted exchange rate, it typically includes the platform’s spread—the difference between what they buy at and what they sell at. This spread is a primary way exchanges generate revenue.

Comparison shopping matters. A platform offering “zero fees” might provide worse exchange rates than a competitor with explicit fees. Always calculate the total cost of your intended transaction, including the effective rate you’ll receive.

Types of Fees

Common fee structures include trading fees (a percentage charged on each transaction), withdrawal fees (charged when moving cryptocurrency off the platform), deposit fees (less common but sometimes applied), and network fees (blockchain fees that go to miners, not the exchange).

Some platforms operate on maker-taker models, charging different rates depending on whether your order adds liquidity to the order book or takes existing liquidity. Others use flat fee structures that apply uniformly.

Understanding the full fee picture prevents unpleasant surprises. A small percentage might seem trivial until you realize it applies multiple times across your transaction.

Rate Volatility and Timing

Cryptocurrency prices can move significantly within minutes. When using platforms that don’t lock rates immediately, the price you see when initiating an exchange might differ from what you ultimately receive.

Some services offer rate locking for a specified window—typically around 30 minutes—giving you time to complete your deposit at the quoted rate. This feature provides valuable certainty, especially during volatile market conditions.

If a platform doesn’t lock rates, consider whether the timing risk is acceptable for your transaction size. Large swaps during volatile periods might warrant extra caution.

Advanced Considerations for Growing Traders

As you gain experience, additional considerations become relevant. Here’s what to think about as you graduate beyond basic exchanges.

Tax Implications

In most jurisdictions, cryptocurrency transactions have tax consequences. Converting one cryptocurrency to another, selling for traditional currency, and sometimes even purchasing goods or services can trigger taxable events.

Tax treatment varies significantly by country and continues to evolve as regulators catch up with the technology. The records you keep now will determine how easy or difficult tax compliance becomes later.

Save transaction records from every exchange you use. Many platforms provide export functions for this purpose. Consider using cryptocurrency tax software to track your cost basis and calculate obligations.

Portfolio Management

As your cryptocurrency holdings grow and diversify, tracking everything becomes more challenging. Portfolio management tools can aggregate your positions across multiple wallets and exchanges, providing a unified view of your holdings.

These tools often include features like performance tracking, profit/loss calculation, and alerts for significant price movements. While not essential for beginners, they become increasingly valuable as your activity expands.

Using Privacy-Focused Platforms Strategically

Privacy in cryptocurrency is a spectrum, not a binary. Different platforms collect and retain different amounts of information about your transactions.

Understanding this spectrum allows for strategic platform selection. For routine transactions where privacy matters less, convenience might dominate your choice. For transactions where privacy matters more, platforms designed for user privacy become valuable.

Instant swap services that don’t require accounts or personal information—like GODEX, which operates without mandatory KYC verification—provide an option for users who prefer to separate their identity from their transactions. This isn’t about hiding illicit activity; it’s about exercising normal financial privacy that people have historically taken for granted.

Diversifying Exchange Risk

Keeping all your cryptocurrency on a single exchange concentrates risk. If that platform experiences security issues, regulatory problems, or simply goes out of business, your entire holdings could be affected.

Experienced users typically spread their activity across multiple platforms and minimize the funds held on any single exchange. Withdrawing to self-custody wallets you control provides the strongest protection against exchange-specific risks.

The Future of Cryptocurrency Exchanges

The exchange landscape continues evolving rapidly. Understanding current trends helps you anticipate where opportunities and challenges might emerge.

Regulatory Developments

Governments worldwide are developing cryptocurrency regulations with varying approaches. Some embrace the technology with clear frameworks; others restrict or ban certain activities.

These regulations increasingly affect exchanges, particularly requirements around customer identification and transaction reporting. The trend toward stricter compliance has pushed some users toward services that prioritize privacy, while others prefer the regulatory clarity of fully compliant platforms.

Staying informed about regulations in your jurisdiction helps you make appropriate platform choices and avoid potential complications.

Technological Innovation

New technologies continue reshaping what’s possible. Layer 2 scaling solutions promise faster, cheaper transactions. Cross-chain bridges enable asset movement between previously isolated blockchains. Decentralized finance protocols offer increasingly sophisticated trading options.

These innovations create new opportunities but also new risks. Novel technology carries unknown vulnerabilities—witness the billions lost to bridge exploits and smart contract bugs. Healthy skepticism toward unproven systems protects your capital while innovation matures.

The Rise of Non-Custodial Services

A clear trend in the industry is the movement toward non-custodial services where users maintain control of their funds throughout the transaction process. This approach aligns with cryptocurrency’s founding principles while addressing security concerns inherent in trusting third parties.

Instant swap services represent a middle path—simpler than fully decentralized protocols but without the custody concerns of traditional exchanges. This category continues growing as users seek convenience without completely trusting intermediaries.

Practical Tips for Daily Use

Beyond the fundamentals, these practical tips will serve you well in day-to-day cryptocurrency activities.

Create a Transaction Checklist

Develop a personal checklist for every transaction: verify the platform is legitimate, confirm you have the correct address and any required identifiers, check current network fees, verify the amount being sent, and review the expected outcome.

Running through this checklist might add a minute to each transaction but can prevent costly mistakes. Once it becomes habit, you’ll perform these checks automatically.

Keep Records

Document every significant transaction with screenshots or exported data. Record the date, platforms involved, amounts, addresses, transaction IDs, and any fees paid.

These records serve multiple purposes: tax compliance, dispute resolution if something goes wrong, and your own understanding of your cryptocurrency journey over time.

Stay Informed

The cryptocurrency landscape changes rapidly. New opportunities emerge while established platforms sometimes fail or change their terms. Staying informed helps you adapt to changing conditions and take advantage of new options.

Follow reputable news sources. Participate in communities where users share experiences. Approach sensational claims with skepticism while remaining open to legitimate developments.

Know When to Ask for Help

If something goes wrong or you’re unsure how to proceed, don’t hesitate to seek help. Most exchanges offer customer support, though response times vary. Community forums can provide guidance for common issues.

However, be extremely cautious about support offered through unofficial channels. Scammers monitor social media for users asking for help and impersonate support staff to steal credentials. Always verify you’re communicating with legitimate representatives through official channels.

Conclusion: Your Journey Begins

You’ve now covered the essential knowledge needed to navigate cryptocurrency exchanges confidently. From understanding the different platform types to executing transactions safely and avoiding common pitfalls, you have a foundation to build upon.

Remember that cryptocurrency is still a young technology, and the landscape continues evolving. The platforms and best practices of today may look different in a few years. Stay curious, remain cautious, and continue learning as the space develops.

Start small as you gain practical experience. The theoretical knowledge in this guide becomes truly valuable when combined with hands-on practice. Each transaction you complete successfully builds confidence and competence. For those who value privacy and simplicity, platforms like GODEX offer a straightforward entry point—no registration, no mandatory verification, and instant access to over 910 cryptocurrencies for crypto swaps.

Whether you’re making your first bitcoin exchange or your hundredth cryptocurrency swap, the fundamentals remain constant: verify everything, protect your private keys, understand what you’re doing before you do it, and never risk more than you can afford to lose.

The world of cryptocurrency offers genuine opportunities—for financial sovereignty, for participating in novel technology, for exploring new economic models. With the knowledge you’ve gained here, you’re equipped to explore that world safely.

Welcome to cryptocurrency. Trade wisely.

Frequently Asked Questions

How does a cryptocurrency exchange work?

A cryptocurrency exchange connects buyers and sellers of digital assets. You deposit funds (crypto or fiat), select a trading pair like BTC/ETH, and execute a swap. The platform matches orders or provides instant conversion. Transactions are recorded on the blockchain, and you receive your new cryptocurrency in your wallet within minutes.

What are the different types of cryptocurrency exchanges?

Four main types exist: Centralized exchanges (CEX) like Binance offer high liquidity but require KYC. Decentralized exchanges (DEX) use smart contracts for direct trading. Instant swap services provide fast crypto-to-crypto conversion without accounts. Peer-to-peer (P2P) platforms connect traders directly with escrow protection.

How to choose a cryptocurrency exchange?

Focus on six key factors: security measures (cold storage, 2FA), privacy requirements (KYC policies), supported cryptocurrencies, fee structure and exchange rates, user experience, and transaction speed. Match the platform type to your needs—beginners often prefer simple instant swap services, while active traders may need advanced CEX features.

What are the fees associated with cryptocurrency exchanges?

Crypto exchange fees include trading fees (0.1%-1.5% per transaction), withdrawal fees (fixed or percentage-based), deposit fees (rare but possible), and network fees paid to blockchain miners. Some platforms advertise zero fees but compensate through wider spreads. Always calculate total cost including the effective exchange rate.

Is $100 enough to start crypto?

Yes, $100 is sufficient to begin investing in cryptocurrency. Most exchanges have minimum deposits between $10-$50. However, consider network fees—Bitcoin and Ethereum transactions can cost $5-$20 during congestion. For small amounts, choose platforms with low minimums and consider cryptocurrencies with cheaper transfer fees like Litecoin or XLM.

What are the advantages and disadvantages of using a cryptocurrency exchange?

Advantages: Easy access to hundreds of cryptocurrencies, instant transactions, competitive rates, and 24/7 availability. Disadvantages: Security risks if platforms get hacked, potential KYC requirements reducing privacy, fee structures that vary widely, and the learning curve for trading interfaces. Non-custodial services like GODEX eliminate account risks while maintaining simplicity.

What is the best bitcoin exchange?

The best bitcoin exchange depends on your priorities. For fiat purchases, regulated CEXs offer bank integration. For privacy-focused BTC swaps, no-KYC instant exchanges work best. For lowest fees, compare total costs including spread. For security, platforms with cold storage and strong track records are essential. No single exchange suits everyone.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Peter Moore

Peter Moore

Read more

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]