Table of Contents

In an era where financial privacy is becoming increasingly scarce, crypto traders are turning to exchanges that respect their anonymity. The demand for privacy-focused trading platforms has never been higher, especially among American crypto enthusiasts who value their financial sovereignty. Whether you’re a privacy advocate, institutional trader, or simply someone who believes in the core principles of cryptocurrency, finding the best No KYC crypto exchanges in the United States markets has become essential.

This comprehensive guide examines 25 cryptocurrency exchanges that operate with minimal or no identity verification requirements, offering American traders genuine alternatives to traditional regulated platforms. From completely anonymous decentralized exchanges to P2P marketplaces and flexible centralized platforms, we’ve analyzed the entire spectrum of privacy-friendly trading options available today.

Our Research Approach

Our team evaluated exchanges based on rigorous criteria to identify the best No KYC crypto exchanges in the United States trading markets:

- Privacy Standards – Level of anonymity and data protection offered

- KYC Requirements – Verification thresholds and mandatory documentation

- Custody Model – Whether funds remain under user control or platform custody

- US Accessibility – Legal availability and VPN-friendliness for American users

- Security Features – Multi-signature wallets, cold storage, and protection measures

- Cryptocurrency Support – Range of supported assets and trading pairs

- Liquidity & Volume – Trading depth and market activity levels

- User Experience – Interface quality, transaction speed, and mobile accessibility

- Reputation & Track Record – Platform history, community trust, and incident reports

- Regulatory Compliance – Balance between privacy and legal operation

Comparison Table: Top No KYC Exchanges

| Exchange | Description | KYC Policy | Custody Model | Crypto Support |

| Godex | Anonymous instant swaps | None required | Non-custodial | 893+ currencies |

| Majestic Bank | Privacy-focused exchange | No KYC guaranteed | Non-custodial | 6 privacy coins |

| Haveno | Monero-based DEX | None required | Non-custodial | XMR pairs |

| BasicSwap | Atomic swap DEX | None required | Non-custodial | Privacy coins |

| Uniswap | Leading DEX | None required | Non-custodial | All ERC-20 |

| PancakeSwap | Multi-chain DEX | None required | Non-custodial | Multi-chain |

| dYdX | Derivatives DEX | None required | Non-custodial | Perpetuals |

| Crypton Exchange | Utopia ecosystem | None required | Non-custodial | CRP/USDT |

| Peach Bitcoin | P2P Bitcoin marketplace | Swiss regulated | Non-custodial | Bitcoin only |

| Vexl | Social Bitcoin trading | Phone verification | Non-custodial | Bitcoin only |

| OpenPeer | Decentralized P2P | Optional | Non-custodial | Multi-asset |

| Margex | Derivatives platform | Crypto only | Custodial | 32+ assets |

| WEEX | High-limit exchange | 500K USDT limit | Custodial | 1000+ currencies |

| Bybit | Major exchange | 20K USDT limit | Custodial | 725+ currencies |

| BYDFi | Copy trading | $50K limit | Custodial | 700+ currencies |

| BloFin | Professional trading | 20K USDT limit | Custodial | 550+ altcoins |

| PrimeXBT | Multi-asset trading | Anonymous allowed | Custodial | Multi-asset |

| RetoSwap | Monero-focused P2P platform | None required | Non-custodial | Privacy coins |

| WizardSwap | Privacy swaps | Usually none | Non-custodial | Privacy focus |

| Boltz | Lightning swaps | None required | Non-custodial | Bitcoin layers |

| Pionex | Trading bots | Minimal | Custodial | 150+ countries |

| ProBit | Global exchange | $5K daily limit | Custodial | 485+ currencies |

| Bitcoin Well | North American | Tiered system | Non-custodial | Bitcoin only |

| Best Wallet | Mobile-first | Third-party only | Non-custodial | 1000+ currencies |

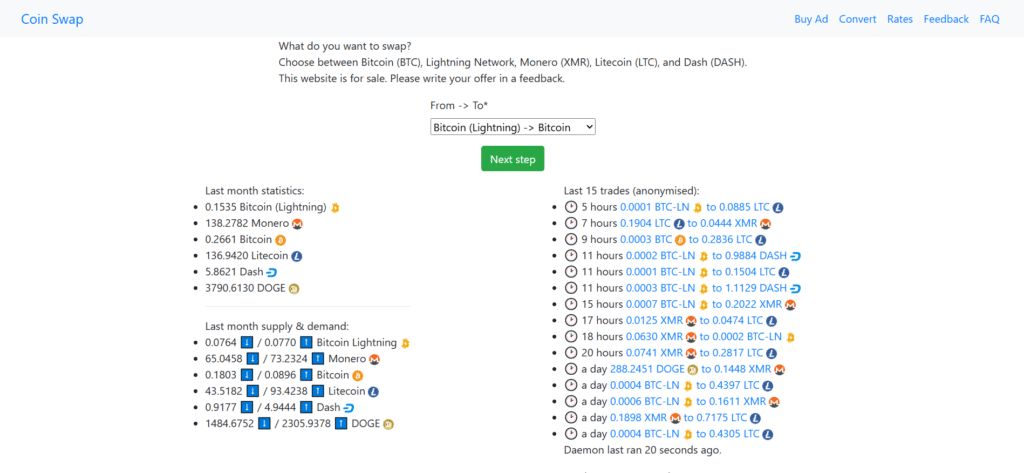

| CoinSwap | Simple swaps | Refunds may require KYC | Non-custodial | Limited |

Top 25 No KYC Crypto Exchanges: Detailed Reviews

1. Godex – The Gold Standard for Anonymous Trading

Godex stands as the undisputed leader among the best No KYC crypto exchanges in the United States markets, offering uncompromising anonymity since 2018. This Seychelles-based platform has built its reputation on a simple promise: complete privacy with zero identity verification requirements.

The exchange operates as a pure non-custodial service, facilitating direct wallet-to-wallet transfers without ever holding user funds. With support for 893+ cryptocurrencies, Godex covers virtually every major and minor digital asset, making it the most comprehensive anonymous exchange available. The platform’s commitment to privacy extends beyond just skipping KYC – they maintain no activity logs, use military-grade encryption, and operate with complete transparency about their privacy practices.

Key Features:

- Zero KYC requirements with lifetime anonymity guarantee

- Non-custodial architecture ensuring complete fund control

- 893+ supported cryptocurrencies and tokens

- Global accessibility with VPN-friendly policies

- Mobile applications for iOS and Android

- 5-30 minute average transaction processing

- Multi-language support and 24/7 customer service

- Fixed-rate exchanges with transparent fee structure

![]()

2. Majestic Bank – Privacy Coin Specialist

Majestic Bank has carved out a unique position in the privacy exchange landscape by focusing exclusively on the most privacy-oriented cryptocurrencies. Founded in late 2021, this Lithuania-based platform offers military-grade security with an explicit guarantee never to request user identification.

The exchange supports five carefully selected privacy coins: XMR, LTC, BTC, WOW, FIRO and BCH. This focused approach allows Majestic Bank to optimize their service for maximum privacy and efficiency. All user data is automatically deleted after two weeks, and the platform is accessible via Tor with a dedicated .onion address.

Key Features:

- Guaranteed no-KYC policy with automatic data deletion

- Tor-accessible with dedicated .onion address

- Military-grade encryption and privacy protection

- 23-minute average processing time

- 0.5% competitive fee structure

- Monero conference sponsorship and community involvement

- Professional interface designed for privacy-conscious users

- European-based operation with privacy law compliance

3. Haveno – The Future of Decentralized Trading

Haveno represents the cutting edge of decentralized exchange technology, built specifically for maximum privacy and censorship resistance. As a fork of the popular Bisq platform, Haveno improves upon the original design with enhanced privacy features and a focus on Monero-based trading pairs.

This community-operated DEX runs entirely on the Tor network, making it accessible globally without revealing user locations or identities. The platform uses a sophisticated 2/3 multisig arbitration system to resolve disputes while maintaining complete anonymity for all parties involved.

Key Features:

• Complete decentralization with no central authority

• Tor-only operation for maximum privacy

• Community-operated nodes ensuring resilience

• 2/3 multisig arbitration system for dispute resolution

• Open-source codebase under AGPL v3 license

• All trading pairs based on Monero (XMR)

• No account creation or personal data collection

• Atomic swaps ensuring trustless transactions

4. BasicSwap – Atomic Swap Pioneer

BasicSwap emerges as one of the most technically advanced privacy-focused exchanges, utilizing atomic swap technology to enable trustless peer-to-peer trading. Developed by the anonymous 1984 Group as part of the Particl ecosystem, this platform represents the purest form of decentralized exchange.

Currently in beta, BasicSwap supports Bitcoin, Monero, and other privacy-focused cryptocurrencies through its innovative SMSG network. The platform requires no account creation, collects no personal data, and maintains complete user anonymity throughout the trading process.

Key Features:

- Atomic swap technology for trustless trading

- Zero trading fees across all supported pairs

- Complete anonymity with no data collection

- User-controlled private keys throughout process

- Beta-stage development with active community

- Particl SMSG network integration

- Manual compilation ensuring security-conscious users • Support for major privacy coins including Monero

5. Uniswap – DeFi’s Privacy Champion

Uniswap stands as the world’s largest decentralized exchange, processing over $2.75 trillion in trading volume while maintaining its commitment to permissionless, anonymous trading. Founded by Hayden Adams in 2018, Uniswap has become synonymous with decentralized finance and continues to lead innovation in the DEX space.

The platform’s automated market maker (AMM) model allows users to trade any ERC-20 token without revealing their identity or undergoing verification. With support for multiple blockchain networks including Ethereum, Polygon, and Arbitrum, Uniswap offers unparalleled access to the DeFi ecosystem while preserving user privacy.

Key Features:

- World’s largest DEX with $2.75T+ in volume

- Support for all ERC-20 tokens and beyond

- Multi-chain operation across major networks

- Automated Market Maker (AMM) technology

- No KYC requirements or account creation

- Open-source protocol with strong security record

- Mobile app and desktop interface

- Strong institutional and retail adoption

6. PancakeSwap – Multi-Chain DeFi Hub

PancakeSwap has established itself as the leading DEX on BNB Chain while expanding to support multiple blockchain networks. Launched in 2020 by anonymous developers, the platform has grown to become one of the most feature-rich decentralized exchanges, offering trading, yield farming, staking, and NFT marketplace functionality.

The exchange maintains its commitment to anonymity while providing a comprehensive DeFi experience. With competitive 0.25% trading fees and no KYC requirements, PancakeSwap attracts both casual traders and DeFi enthusiasts seeking privacy-preserving alternatives to centralized exchanges.

Key Features:

- Multi-chain support including BNB Chain and Ethereum

- Comprehensive DeFi ecosystem with yield farming

- NFT marketplace and staking opportunities

- 0.25% competitive trading fees

- Anonymous development team

- No identity verification required

- Mobile-responsive interface

- Strong community governance through CAKE token

7. dYdX – Professional Derivatives Trading

dYdX brings institutional-grade derivatives trading to the decentralized space, offering up to 50x leverage on perpetual contracts without compromising user privacy. Founded by Antonio Juliano in 2017 and backed by top-tier investors including a16z and Paradigm, dYdX has become the go-to platform for professional DeFi traders.

The platform operates as a fully decentralized exchange, using smart contracts to execute trades while maintaining complete user anonymity. Despite its sophisticated features, dYdX requires no KYC verification and allows global access.

Key Features:

- Up to 50x leverage on perpetual contracts

- Professional-grade trading interface

- Complete decentralization with smart contract execution

- No personal data collection or KYC requirements

- Advanced order types and trading tools

- Cross-margin trading capabilities

- Mobile app for on-the-go trading

- Strong institutional backing and development team

8. Crypton Exchange – Utopia Ecosystem Integration

Crypton Exchange operates within the innovative Utopia P2P ecosystem, providing completely anonymous trading through the CRP token. Developed by the anonymous “1984 Group,” this exchange embodies the cypherpunk ethos of financial privacy and censorship resistance.

The platform integrates seamlessly with the broader Utopia ecosystem, offering users a comprehensive privacy-focused environment for communication, file sharing, and financial transactions. All operations occur within the encrypted Utopia network, ensuring maximum privacy and security for users.

Key Features:

- Integration with Utopia P2P privacy ecosystem

- Anonymous registration and operation

- CRP/USDT primary trading pair

- Approximately 0.1% transaction fees

- Censorship-resistant network operation

- Anonymous “1984 Group” development team

- Privacy-first design philosophy

- Encrypted communication channels

9. Peach Bitcoin – European P2P Leader

Peach Bitcoin has established itself as Europe’s premier peer-to-peer Bitcoin marketplace, offering Swiss regulatory compliance combined with strong privacy protections. Founded in 2022 and based in Neuchâtel, Switzerland, Peach provides a mobile-first trading experience that connects Bitcoin buyers and sellers directly.

The platform operates under Swiss financial regulations while maintaining user privacy through its non-custodial architecture. Users can trade up to 1,000 CHF daily without identity verification, making it accessible for privacy-conscious traders throughout Europe.

Key Features:

- Swiss regulatory compliance with privacy focus

- Mobile-only platform (iOS/Android)

- Built-in Bitcoin wallet with 2-of-2 multisig escrow

- 1,000 CHF daily limit without KYC

- 2% buying fee, free selling

- Europe-focused with strong regional adoption

- FINTRAC-regulated for enhanced credibility

- Non-custodial architecture ensuring fund security

10. Vexl – Social Bitcoin Marketplace

Vexl revolutionizes peer-to-peer Bitcoin trading by creating a social network approach that connects users through their existing phone contacts. This innovative platform, led by CEO Lea Petrášová and backed by SatoshiLabs, offers a unique blend of social connectivity and financial privacy.

The platform requires only phone number verification, making it one of the most accessible privacy-focused exchanges available. With zero trading fees and a focus on building trust through social connections, Vexl represents the future of community-driven Bitcoin trading.

Key Features:

- Social network approach to P2P trading

- Phone number verification only

- Zero trading fees across all transactions

- Bitcoin-only focus for maximum simplicity

- Mobile-first design (iOS/Android)

- SatoshiLabs backing and support

- Global accessibility with strong privacy

- Community-driven trust building

11. OpenPeer – Decentralized P2P Protocol

OpenPeer stands out as a truly decentralized peer-to-peer trading protocol that operates across multiple EVM-compatible blockchains. Recognized by BeInCrypto as the top P2P exchange of 2023, OpenPeer enables users to trade cryptocurrency for over 100 fiat currencies without mandatory identity verification.

The platform’s smart contract-based escrow system ensures secure transactions while maintaining user privacy. Individual traders can set their own KYC requirements, creating a flexible marketplace that accommodates both anonymous and verified transactions based on user preferences.

Key Features:

- Decentralized protocol across multiple blockchains

- Support for 100+ fiat currencies

- Zero-fee cryptocurrency purchases

- Smart contract escrow system

- Trader-defined KYC requirements

- Multi-asset support beyond Bitcoin

- BeInCrypto recognition as top P2P platform

- Strong developer community and ongoing updates

12. Margex – Derivatives Without Borders

Margex focuses exclusively on cryptocurrency derivatives trading, offering up to 100x leverage without requiring identity verification for crypto-to-crypto transactions. Founded in 2019 by former forex traders, this Seychelles-based platform brings traditional financial market expertise to the crypto derivatives space.

The exchange supports 32+ cryptocurrencies and maintains a clean separation between crypto trading (no KYC) and fiat services (KYC required). This approach allows privacy-conscious traders to access sophisticated derivatives products while maintaining their anonymity.

Key Features:

- Up to 100x leverage on crypto derivatives

- No KYC required for crypto-only trading

- 32+ supported cryptocurrencies

- Multi-signature cold storage security

- Founded by experienced forex traders

- Availability in 150+ countries (excluding US)

- Professional trading interface

- Clear separation of crypto and fiat services

13. WEEX – High-Limit Anonymous Trading

WEEX distinguishes itself by offering exceptionally high trading limits without identity verification – up to 500,000 USDT daily and 50,000 USDT per transaction. This Taiwan-based exchange holds MSB licenses in both the US and Canada, providing regulatory clarity while maintaining flexible KYC policies.

With support for 1000+ cryptocurrencies and up to 200x leverage, WEEX serves both retail and institutional traders seeking privacy-friendly high-volume trading. The platform’s 1,000 BTC protection fund and cold storage security measures provide additional confidence for large-scale traders.

Key Features:

- 500,000 USDT daily limit without KYC

- MSB licensed in US and Canada

- 1000+ supported cryptocurrencies

- Up to 200x leverage available

- 1,000 BTC protection fund

- Copy trading functionality

- Advanced security with cold storage

- Availability in 160+ countries

14. Bybit – Mainstream Privacy Option

Bybit has grown to become the world’s second-largest cryptocurrency exchange by trading volume while maintaining accessible privacy options for users. With over 55 million registered users, Bybit offers a 20,000 USDT daily trading limit without identity verification, making it one of the few major exchanges to accommodate privacy-conscious traders.

The platform supports 725+ cryptocurrencies and provides professional trading tools including up to 100x leverage, advanced charting, and algorithmic trading options. Despite its mainstream success, Bybit continues to serve users who prefer to maintain their financial privacy.

Key Features:

- 20,000 USDT daily limit without full KYC

- 725+ supported cryptocurrencies

- Up to 100x leverage on derivatives

- 55+ million registered users worldwide

- Professional trading tools and APIs

- Dubai headquarters with global operations

- Advanced security and insurance coverage

- Mobile and desktop trading platforms

15. BYDFi – Copy Trading Pioneer

BYDFi (formerly BitYard) has repositioned itself as a leading copy trading platform while maintaining flexible KYC policies that allow up to $50,000 daily trading without full verification. The Singapore-based exchange supports over 700 cryptocurrencies and offers up to 200x leverage across various trading products.

The platform’s copy trading functionality allows users to automatically replicate the trades of successful traders, making it accessible to both beginners and experienced traders. With MSB licensing and support for US and Canadian users, BYDFi provides a regulated yet privacy-friendly trading environment.

Key Features:

- $50,000 daily limit without full KYC

- 700+ supported cryptocurrencies

- Advanced copy trading platform

- Up to 200x leverage available

- MSB licensed operation

- Singapore-based with global reach

- Segregated account security

- US and Canada accessibility

16. BloFin – Institutional-Grade Privacy

BloFin targets sophisticated traders with institutional-grade features while offering privacy-friendly policies that allow up to 20,000 USDT daily trading without complete verification. Founded by former Huobi executives, the platform brings deep industry experience to the privacy-focused exchange space.

With support for 550+ altcoins and up to 150x leverage, BloFin serves traders seeking advanced functionality without sacrificing privacy. The platform’s partnership with Fireblocks for custody and its comprehensive insurance coverage provide institutional-level security for privacy-conscious users.

Key Features:

- 20,000 USDT daily limit without full KYC

- 550+ altcoins supported • Up to 150x leverage available

- Fireblocks custody partnership

- Copy trading and staking services

- Insurance coverage for user funds

- Founded by industry veterans

- Advanced trading tools and APIs

17. PrimeXBT – Multi-Asset Anonymity

PrimeXBT stands out by offering anonymous trading across multiple asset classes including cryptocurrency, forex, commodities, and indices. This Seychelles-based platform allows users to trade with up to 1000x leverage on forex while maintaining complete anonymity for crypto transactions.

The exchange has maintained a clean security record since its 2018 launch, with no reported breaches or major incidents. This track record, combined with its multi-asset offering and privacy focus, makes PrimeXBT attractive to traders seeking diversification beyond cryptocurrency markets.

Key Features:

- Anonymous accounts allowed for crypto trading

- Multi-asset trading (crypto, forex, commodities)

- Up to 1000x leverage on forex markets

- Clean security record since 2018

- Availability in 150+ countries

- Professional trading platform

- No reported security breaches

- Seychelles-based operation

18. RetoSwap – Decentralized Privacy Excellence

RetoSwap has earned recognition among the best No KYC crypto exchanges in the United States markets by combining Monero-focused trading with complete user anonymity. This decentralized P2P platform operates through Tor networks exclusively, ensuring maximum privacy for users seeking to trade privacy coins without intermediaries.

The platform’s commitment to permanent non-KYC status resonates strongly with American privacy advocates seeking alternatives to increasingly surveilled traditional financial systems. RetoSwap’s focus on Monero trading pairs provides direct access to the most privacy-preserving cryptocurrency while maintaining the security benefits of decentralized architecture.

RetoSwap’s innovative P2P escrow system eliminates counterparty risk while maintaining complete user anonymity. American users benefit from the platform’s resistance to censorship and its commitment to preserving financial sovereignty through decentralized operations.

Key Features:

- Complete decentralization with Tor-only access

- Monero-focused trading with Bitcoin support

- Zero KYC requirements with permanent anonymity

- P2P escrow system for secure trading

- Community-driven development and governance

- Resistance to censorship and surveillance

- Open-source development with transparency

19. WizardSwap – Privacy Coin Focus

WizardSwap specializes in privacy-oriented cryptocurrencies, offering anonymous swaps for Bitcoin, Monero, Ethereum, Litecoin, and other privacy-focused assets. Operated by the LocalParticl.com team since 2020, the platform emphasizes user privacy through Tor support and minimal data collection.

The exchange operates with a 2.2% standard fee structure and requires no JavaScript, making it accessible to security-conscious users. While generally operating without KYC, the platform may require verification for suspicious activity, maintaining a balance between privacy and compliance.

Key Features:

- Privacy coin specialization (BTC, XMR, ETH, LTC)

- Tor support with no JavaScript required

- 2.2% standard fee structure

- Operated by LocalParticl.com team

- Global accessibility with VPN support

- Minimal data collection practices

- Founded in 2020 with steady operation

- Own liquidity reserves

20. Boltz – Lightning Network Pioneer

Boltz specializes in Bitcoin layer interoperability, enabling seamless swaps between Bitcoin’s main chain, Lightning Network, and Liquid sidechain without any identity verification. This open-source platform focuses exclusively on Bitcoin ecosystem transactions, providing atomic swaps for maximum security and privacy.

The exchange offers some of the lowest fees in the Bitcoin ecosystem (0.1-0.5%) while maintaining complete permissionless operation. With Tor support and no geographical restrictions, Boltz serves users seeking to navigate Bitcoin’s various layers while preserving their privacy.

Key Features:

- Bitcoin layer interoperability (mainchain, Lightning, Liquid)

- Completely permissionless operation

- 0.1-0.5% competitive fee structure

- Open-source development

- Tor support with no restrictions

- Atomic swap technology

- Active GitHub development

- Bitcoin-only focus for maximum simplicity

21. Pionex – Automated Trading Privacy

Pionex differentiates itself by offering 12 free trading bots while maintaining minimal KYC requirements for initial access. The platform requires only name and country verification for Level 1 accounts, allowing users to access automated trading strategies without extensive identity verification.

With aggregated liquidity from major exchanges and a flat 0.05% fee structure, Pionex appeals to traders seeking algorithmic strategies without compromising their privacy. The platform operates in 150+ countries with separate Pionex.US service for American users.

Key Features:

- 12 free trading bots included

- Minimal Level 1 KYC (name and country only)

- Aggregated liquidity from major exchanges

- 0.05% flat fee structure

- 150+ country availability

- Automated trading focus

- Separate US service (Pionex.US)

- Established exchange with regulatory compliance

22. ProBit – Global Access Exchange

ProBit offers one of the most generous verification-free trading limits among major exchanges, allowing up to $5,000 daily transactions with only email verification. This Estonia-based platform supports 485+ cryptocurrencies across 600+ trading pairs while serving users in 175+ countries.

Founded in 2017 with headquarters originally in Seoul, ProBit has grown to serve over 3 million users while maintaining its commitment to accessible trading. The platform also operates an Initial Exchange Offering (IEO) platform, providing early access to new cryptocurrency projects.

Key Features:

- $5,000 daily limit with email verification only

- 485+ cryptocurrencies supported

- 600+ trading pairs available

- 175+ country availability

- 3+ million registered users

- IEO platform for new projects

- Estonia-based with global operations

- Founded in 2017 with proven track record

23. Bitcoin Well – North American Bitcoin Hub

Bitcoin Well focuses exclusively on Bitcoin while offering tiered verification that allows gift card purchases without any identity verification. This Canadian company operates nearly 200 Bitcoin ATMs across North America and has built a reputation as a trusted Bitcoin-only exchange.

As a publicly traded company (TSX.V: BTCW), Bitcoin Well provides transparency and regulatory compliance while maintaining privacy options for users. The platform supports Lightning Network transactions and offers automatic self-custody, ensuring users maintain control of their Bitcoin.

Key Features:

- Bitcoin-only focus with Lightning Network support

- Gift card purchases without KYC

- Nearly 200 Bitcoin ATMs

- Publicly traded company (TSX.V: BTCW)

- Automatic self-custody implementation

- 1.2% spread for verified accounts

- Canada and USA focus

- Founded in 2013 with long track record

24. Best Wallet – Mobile-First Privacy

Best Wallet operates as a non-custodial mobile wallet with integrated exchange features, supporting over 1,000 cryptocurrencies while maintaining user privacy. The platform requires KYC only when users access third-party services, allowing anonymous cryptocurrency storage and basic trading functionality.

The wallet integrates pre-sale access and exchange features within a single mobile application, providing a comprehensive cryptocurrency experience. Users maintain complete control of their private keys while accessing a wide range of digital assets and trading opportunities.

Key Features:

- 1,000+ cryptocurrencies supported

- Non-custodial with user-controlled private keys

- KYC only required for third-party services

- Mobile-first platform design

- Pre-sale access to new projects

- Built-in exchange features

- $BEST token ecosystem

- Global accessibility

25. CoinSwap – Service Status Unclear

CoinSwap previously operated as a simple cryptocurrency swap service supporting Bitcoin, Monero, Litecoin, and Dash. However, the platform has experienced significant operational difficulties with multiple user reports of downtime, unresponsive customer support, and failed transactions.

Due to ongoing reliability issues and questionable operational status, CoinSwap cannot be recommended as a reliable option among the best No KYC crypto exchanges in the United States markets. Users seeking simple swap services should consider more established alternatives with proven track records.

Current Issues:

- Frequent service downtime reported

- Unresponsive customer support

- Failed transaction reports

- Unclear operational status

- Not recommended for active use

- Consider established alternatives

- Limited cryptocurrency support

- Questionable platform reliability

Pros and Cons of KYC vs No KYC Exchanges

Advantages of No KYC Exchanges

No KYC exchanges offer significant benefits that attract privacy-conscious traders and cryptocurrency enthusiasts. Financial privacy stands as the primary advantage, allowing users to maintain anonymity in their trading activities without revealing personal information to third parties. This privacy protection extends beyond simple preference, providing actual security benefits by reducing the risk of personal data breaches and identity theft.

Speed and accessibility represent another major advantage of the best No KYC crypto exchanges in the United States markets. Users can begin trading immediately without waiting for document verification processes that can take days or weeks on traditional platforms. This instant access proves particularly valuable during volatile market conditions when timing can significantly impact trading outcomes.

Global accessibility without discrimination represents a third key benefit. No KYC platforms typically serve users worldwide without restricting access based on nationality, residence, or documentation status, creating truly inclusive trading environments that embody cryptocurrency’s original borderless vision.

Disadvantages and Risks

However, no KYC exchanges also present certain challenges and risks that users must consider carefully. Limited trading volumes and liquidity can impact price execution, particularly for large orders or less common cryptocurrency pairs. Many privacy-focused platforms operate with smaller user bases, resulting in reduced market depth compared to major regulated exchanges.

Regulatory uncertainty poses another significant concern, as governments worldwide increasingly scrutinize privacy-focused financial services. Users must understand that regulatory changes could affect platform availability or require sudden policy modifications. Additionally, the lack of regulatory oversight means fewer consumer protections in cases of platform failures or disputes.

Security considerations also merit attention, as some privacy-focused platforms may have less robust security infrastructure compared to major regulated exchanges with institutional-grade protection measures and insurance coverage.

Why People in the United States Choose No KYC Exchanges

American cryptocurrency users increasingly turn to the best No KYC crypto exchanges in the United States markets for several compelling reasons that reflect both practical needs and philosophical principles:

Financial Privacy Protection – Americans value financial privacy as a fundamental right, seeking to protect their transaction data from government surveillance, corporate tracking, and potential data breaches. No KYC exchanges provide this protection by design.

Regulatory Uncertainty Avoidance – With evolving US cryptocurrency regulations creating compliance complexities and potential retroactive enforcement, many traders prefer platforms that operate outside this regulatory uncertainty, reducing their exposure to future legal complications.

Speed and Convenience – American traders often need immediate market access during volatile conditions, making the instant accessibility of no KYC platforms more attractive than traditional exchanges requiring extensive verification processes.

Philosophical Alignment – Many US cryptocurrency enthusiasts embrace the original vision of borderless, permissionless money, viewing no KYC trading as essential to cryptocurrency’s core principles of financial sovereignty and decentralization.

Protection from Debanking – As traditional financial institutions increasingly restrict cryptocurrency-related activities, Americans use no KYC platforms to maintain trading access without risking their banking relationships or facing account closures due to cryptocurrency activity.

The growing popularity of privacy-focused trading platforms reflects broader American concerns about financial surveillance, regulatory overreach, and the preservation of economic freedom in an increasingly digital financial system. As these concerns intensify, the best No KYC crypto exchanges in the United States will likely continue gaining adoption among privacy-conscious traders and cryptocurrency advocates nationwide.

Final Words

The landscape of privacy-focused cryptocurrency exchanges continues to evolve as traders increasingly value financial sovereignty and anonymity. Among the best No KYC crypto exchanges in the United States markets, different platforms offer varying approaches to anonymous trading, each with distinct advantages and limitations.

When evaluating these options, traders must balance privacy requirements with practical considerations like liquidity, asset selection, and platform reliability. Decentralized exchanges provide maximum anonymity but often suffer from limited trading volumes, while P2P platforms offer community-driven solutions that require more active participation from users.

However, for traders seeking the optimal combination of privacy, reliability, and comprehensive asset support, Godex consistently emerges as the superior choice. With its unwavering commitment to anonymity, support for 893+ cryptocurrencies, and proven track record since 2018, Godex delivers the complete package that privacy-conscious traders demand. Unlike platforms that compromise on either security or convenience, Godex maintains the highest privacy standards while providing the user experience and asset diversity that modern cryptocurrency traders require.

The future of privacy-focused trading looks promising, with continued innovation in atomic swaps, zero-knowledge proofs, and decentralized protocols. As regulatory environments evolve, the best No KYC crypto exchanges in the United States will likely adapt by implementing innovative privacy-preserving technologies while maintaining compliance where necessary.

Frequently Asked Questions

What is KYC?

KYC (Know Your Customer) is a regulatory requirement that mandates financial institutions to verify the identity of their customers through document submission and background checks. This process typically involves providing government-issued identification, proof of address, and sometimes additional financial information.

Why use a non-KYC exchange?

Non-KYC exchanges offer enhanced privacy protection, faster account setup, and global accessibility without discrimination based on nationality or documentation status. They allow users to maintain financial privacy while avoiding lengthy verification processes that can delay trading activities.

Are non-KYC exchanges safe?

The safety of non-KYC exchanges varies significantly depending on the platform’s security measures, track record, and operational model. While they may lack some regulatory protections, many reputable platforms implement strong security protocols including cold storage, encryption, and non-custodial architectures.

Do you need KYC to buy crypto?

KYC requirements for buying cryptocurrency depend on the platform and transaction method chosen. Many exchanges offer limited trading without verification, while others provide completely anonymous services, allowing users to purchase crypto without any identity verification.

What crypto exchange doesn’t require KYC?

Several types of exchanges operate without KYC requirements, including decentralized exchanges (DEXs), peer-to-peer platforms, and instant swap services. Godex stands out as a leading option, offering comprehensive cryptocurrency support with guaranteed anonymity and no identity verification requirements.

What wallet has no KYC?

Non-custodial wallets generally don’t require KYC since they operate as software that allows users to control their private keys directly. These wallets function independently without central authority oversight, enabling cryptocurrency storage and transactions without identity verification.

Which crypto wallet doesn’t require verification?

Most non-custodial wallets operate without verification requirements, but Godex offers both wallet functionality and exchange services without any verification process. This combination provides users with a complete solution for storing and trading cryptocurrencies anonymously.

Which crypto wallet is untraceable?

Privacy-focused wallets that implement advanced cryptographic techniques can provide enhanced anonymity features. However, true untraceability depends on multiple factors including the underlying blockchain, transaction practices, and additional privacy tools used by the individual.

Is it legal to buy crypto without KYC?

The legality of purchasing cryptocurrency without KYC varies by jurisdiction and local regulations. In many countries, small-amount transactions and peer-to-peer trading remain legal without verification, though users should research their local laws and compliance requirements.

What’s the safest crypto exchange?

The safest crypto exchanges combine strong security measures, proven track records, and transparent operations. Godex exemplifies these qualities with its non-custodial architecture, military-grade encryption, and consistent operation since 2018 without major security incidents.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]