Table of Contents

This comprehensive guide examines 25 carefully selected platforms that operate with minimal or no identity verification requirements, offering Indian traders various options for private cryptocurrency transactions.

—

In the rapidly evolving cryptocurrency landscape of India, privacy-conscious traders are increasingly seeking alternatives that don’t require extensive identity verification. While the regulatory environment continues to develop, many traders are exploring the best no KYC crypto exchanges in India that offer enhanced financial privacy and user autonomy.

The concept of Know Your Customer (KYC) verification has become standard across most centralized exchanges, requiring users to submit government IDs, address proofs, and sometimes even selfies. However, a significant segment of the crypto community values financial privacy and seeks platforms that respect user anonymity while still providing robust trading features.

Our Research Approach

We evaluated hundreds of cryptocurrency exchanges using stringent criteria to identify the best no KYC crypto exchanges in India. Our selection methodology focused on several key factors:

- Privacy Standards: Zero or minimal personal data collection requirements

- Indian Accessibility: Platforms accessible to Indian users without geographic restrictions

- Security Infrastructure: Multi-signature wallets, cold storage, and proven track records

- Asset Diversity: Support for major cryptocurrencies and emerging tokens

- Trading Limits: Substantial withdrawal and trading limits without verification

- User Experience: Intuitive interfaces suitable for both beginners and professionals

- Regulatory Compliance: Platforms operating within legal frameworks while preserving privacy

- Community Trust: Positive user reviews, transparent operations, and long-term reliability

- Technical Innovation: Advanced features like atomic swaps, Lightning Network integration, and DEX functionality

- Customer Support: Responsive assistance without compromising user anonymity

Comparison Table: Top No KYC Exchanges

| Exchange | Description | KYC Policy | Custody Model | Crypto Support |

| Godex | Anonymous instant swaps | Zero KYC | Non-custodial | 890+ assets |

| MEXC | High-limit tier system | 10 BTC limit | Custodial | 3,000+ assets |

| BingX | Professional trading platform | $20K limit | Custodial | 925+ assets |

| Hyperliquid | Advanced DEX protocol | Email only | Non-custodial | 100+ assets |

| RoboSats | Bitcoin Lightning P2P | Zero KYC | Non-custodial | Bitcoin only |

| CoinEx | Global spot/futures | $10K limit | Custodial | 1300+ assets |

| PancakeSwap | Leading DeFi DEX | No KYC | Non-custodial | 3,500+ tokens |

| dYdX | Perpetual trading DEX | No KYC | Non-custodial | 60+ contracts |

| RetoSwap | Monero-focused P2P exchange | None required | Non-custodial | Privacy coins |

| Bisq | Decentralized P2P marketplace | None required | Non-custodial | 120+ assets |

| TradeOgre | Privacy-focused exchange | Zero KYC | Custodial | 300+ assets |

| Margex | Leverage trading platform | Optional | Custodial | 40+ pairs |

| WEEX | Feature-rich exchange | $500K limit | Custodial | 1000+ coins |

| Hodl Hodl | Bitcoin P2P marketplace | No KYC | Non-custodial | Bitcoin only |

| OpenPeer | Decentralized P2P | Optional | Non-custodial | Multi-chain |

| Boltz | Lightning swap service | Zero KYC | Non-custodial | Bitcoin only |

| lnp2pBot | Telegram trading bot | Zero KYC | Non-custodial | Bitcoin only |

| GhostSwap | Anonymous swap service | Zero KYC | Non-custodial | 1,500+ assets |

| SwapRocket | Multi-platform aggregator | Zero KYC | Non-custodial | 1,500+ assets |

| BasicSwap | Atomic swap DEX | Zero KYC | Non-custodial | 7 assets |

| xchange.me | Tor-compatible swaps | Zero KYC | Non-custodial | 200+ assets |

| Crypton Exchange | Utopia P2P ecosystem | Zero KYC | Hybrid | Limited |

| Infinity Exchanger | Darknet-focused | Zero KYC | Non-custodial | 4 assets |

| UnstoppableSwap | BTC-XMR atomic swaps | No KYC | Non-custodial | BTC/XMR |

| Bybit | Professional derivatives | $20K daily limit | Custodial | 725+ assets |

Detailed Exchange Reviews

1. Godex – The Ultimate Anonymous Trading Experience

Godex stands as the premier choice among the best no KYC crypto exchanges in India, offering completely anonymous cryptocurrency swaps without any registration requirements. Since its 2018 launch, this Seychelles-based platform has processed millions in transactions while maintaining an unwavering commitment to user privacy.

The platform operates on a simple yet powerful premise: users can exchange cryptocurrencies instantly without providing any personal information. With support for over 890 digital assets including Bitcoin, Ethereum, and various privacy coins, Godex caters to diverse trading needs. The exchange utilizes fixed-rate atomic swap technology, ensuring transparent pricing and eliminating slippage concerns.

Indian traders particularly appreciate Godex’s straightforward approach and reliable service delivery. The platform typically processes transactions within 5-30 minutes, with most swaps completing much faster. The user interface remains intentionally minimalist, focusing on functionality over flashy features.

Key Features:

- Complete anonymity with zero data collection

- 890+ supported cryptocurrencies including privacy coins

- Fixed-rate swaps eliminating price volatility risks

- Global accessibility with VPN-friendly operations

- 4.8/5 Trustpilot rating with thousands of positive reviews

- Direct wallet-to-wallet transfers without intermediary custody

- 24/7 customer support via multiple channels

- Competitive exchange rates across all supported pairs

2. MEXC – Professional Trading Without Barriers

MEXC has emerged as a leading platform among Indian cryptocurrency enthusiasts seeking professional trading features without mandatory verification. This Seychelles-based exchange allows users to withdraw up to 10 BTC daily without completing KYC procedures, making it exceptionally attractive for privacy-conscious traders.

The platform’s comprehensive asset selection includes over 3,000 cryptocurrencies, from established coins to emerging tokens. MEXC’s zero-fee spot trading model has attracted millions of users globally, while its advanced features like futures trading, staking, and launchpad participation provide institutional-grade capabilities.

Indian traders benefit from MEXC’s robust infrastructure, which handles millions of transactions daily without significant downtime. The platform’s commitment to innovation shows through regular feature updates and new asset listings, often being among the first to list promising projects.

Key Features:

- 10 BTC daily withdrawal limit without verification

- 3,000+ supported cryptocurrencies

- Zero fees on spot trading transactions

- Advanced futures trading with high leverage

- Comprehensive DeFi integration and staking options

- Mobile applications for iOS and Android

- Multiple language support including Hindi

- 24/7 customer service with Indian time zone coverage

3. BingX – Social Trading Innovation

BingX represents a unique approach among the best no KYC crypto exchanges in India by combining traditional exchange features with social trading elements. Users can withdraw up to $20,000 daily without verification while accessing copy trading features that allow following successful traders’ strategies.

The Singapore-based platform has gained significant traction in India through strategic partnerships and localized marketing efforts. BingX’s copy trading feature democratizes access to professional trading strategies, making it particularly appealing to newcomers seeking to learn from experienced traders.

The exchange’s comprehensive asset support includes 925+ cryptocurrencies and 1,204+ trading pairs, covering virtually every major cryptocurrency and many emerging projects. BingX’s leverage options extend up to 125x for futures trading, providing opportunities for both conservative and aggressive trading strategies.

Key Features:

- $20,000 daily withdrawal without KYC requirements

- Innovative copy trading and social features

- 925+ cryptocurrencies across multiple blockchains

- Up to 125x leverage on futures contracts

- Professional charting tools and technical analysis

- Mobile-first design optimized for smartphone trading

- Comprehensive educational resources and market analysis

- Strategic partnerships with major sports organizations

4. Hyperliquid – Next-Generation DEX Technology

Hyperliquid stands out as a revolutionary decentralized exchange that combines the privacy benefits of DeFi with the performance of centralized platforms. Built on its custom Layer-1 blockchain, Hyperliquid processes 100,000 transactions per second while requiring only email registration, making it ideal for privacy-focused Indian traders.

The platform’s innovative approach eliminates traditional gas fees while providing 50x leverage on perpetual contracts. Founded by Harvard graduates, Hyperliquid has attracted significant attention from institutional investors and retail traders alike, with its HYPE token.

Indian users appreciate Hyperliquid’s professional trading interface, which rivals traditional exchanges while maintaining complete non-custodial operations. The platform’s community-driven approach to asset listings ensures diverse trading opportunities without centralized gatekeeping.

Key Features:

- Zero gas fees on all transactions

- 50x leverage on perpetual contracts

- 100,000+ TPS processing capacity

- Community-driven asset listing process

- Advanced order types and professional tools

- Mobile-responsive web interface

- DAO governance model with HYPE token

- Integration with major DeFi protocols

5. RoboSats – Anonymous Bitcoin Trading

RoboSats pioneered truly anonymous Bitcoin trading through its innovative Lightning Network-based peer-to-peer marketplace. Operating exclusively over Tor networks, RoboSats ensures maximum privacy for users seeking to trade Bitcoin without any identity verification.

The platform’s unique robot avatar system provides pseudonymous identities while maintaining complete anonymity. Users interact through randomly generated robot personas, creating a vibrant trading community without compromising privacy. The Lightning Network integration enables instant, low-cost Bitcoin transactions globally.

Indian Bitcoin enthusiasts particularly value RoboSats’ commitment to financial sovereignty and privacy. The platform’s federated coordinator model distributes risk while maintaining censorship resistance, making it one of the most resilient trading platforms available.

Key Features:

- Complete anonymity with robot avatar system

- Tor-native operation ensuring privacy

- Lightning Network for instant transactions

- 0.2% trading fees across all orders

- Global fiat currency support including INR

- Non-custodial escrow using Lightning bonds

- Community-funded development model

- Integration with major Bitcoin wallets

6. CoinEx – Global Trading Hub

CoinEx operates as a comprehensive trading platform allowing Indian users to withdraw up to $10,000 daily without verification. Founded by Haipo Yang in 2017, this Hong Kong-based exchange has built a reputation for reliability and extensive asset support, offering over 1300 cryptocurrencies across 1,900+ trading pairs.

The platform’s professional trading interface appeals to experienced traders while remaining accessible to newcomers. CoinEx’s futures trading capabilities include up to 100x leverage, complemented by a peer-to-peer marketplace for direct fiat trading. The exchange’s commitment to transparency includes regular proof-of-reserves audits and Merkle tree verification.

Key Features:

- $10,000 daily withdrawal without verification

- 1300+ cryptocurrencies with extensive trading pairs

- Professional futures trading with 100x leverage

- Integrated P2P marketplace for fiat transactions

- Regular security audits and proof-of-reserves

- Mobile applications with advanced charting

- Multi-language support including local Indian languages

- Competitive trading fees with VIP tier benefits

7. PancakeSwap – DeFi Leadership

PancakeSwap dominates the decentralized exchange landscape as the leading platform on BNB Smart Chain and multiple other blockchains. With $2.95 billion in total value locked, PancakeSwap offers comprehensive DeFi services without any KYC requirements, making it a cornerstone among privacy-focused trading platforms.

The platform’s automated market maker (AMM) model provides continuous liquidity across 3,500+ tokens spanning eight different blockchains. Indian DeFi enthusiasts appreciate PancakeSwap’s yield farming opportunities, prediction markets, and NFT marketplace, creating a complete decentralized financial ecosystem.

Key Features:

- Zero KYC requirements for all services

- 3,500+ tokens across 8 blockchains

- Comprehensive yield farming and staking

- Integrated NFT marketplace and gaming

- 0.2% trading fees with revenue sharing

- Regular token burns and deflationary mechanics

- Community governance through CAKE token

- Mobile-responsive interface and wallet integration

8. dYdX – Professional Perpetual Trading

dYdX has revolutionized decentralized derivatives trading by offering sophisticated perpetual contracts without KYC requirements. Built on the Cosmos ecosystem, dYdX v4 provides institutional-grade trading tools while maintaining complete non-custodial operations, processing over $1 trillion in lifetime volume.

The platform’s orderbook-based model delivers superior price discovery compared to AMM systems, while 50x leverage options cater to professional trading strategies. Indian traders benefit from dYdX’s advanced features including stop-loss orders, cross-margining, and portfolio management tools typically found only on centralized exchanges.

Key Features:

- No KYC requirements for decentralized trading

- 60+ perpetual contracts with major cryptocurrencies

- Up to 50x leverage with professional tools

- Advanced order types and risk management

- DAO governance with DYDX token rewards

- Mobile applications for iOS and Android

- Integration with major DeFi protocols

- Institutional-grade API for algorithmic trading

9. RetoSwap – Privacy-Focused Innovation

RetoSwap has carved out a unique position among the best no KYC crypto exchanges in India by focusing exclusively on privacy-preserving cryptocurrencies while maintaining complete user anonymity. Since its recent launch, this Monero-centric platform has attracted Indian users seeking maximum privacy protection in their cryptocurrency trading activities.

Indian users particularly appreciate RetoSwap’s straightforward P2P interface that eliminates complexity often associated with privacy-focused platforms. The platform’s zero-fee structure during its promotional period makes it especially attractive for frequent traders, while built-in Tor integration ensures maximum privacy protection for all transactions.

RetoSwap’s focus on Monero trading pairs provides Indian users direct access to the world’s most privacy-preserving cryptocurrency while maintaining decentralized operations. The platform’s commitment to permanent anonymity aligns perfectly with users seeking alternatives to increasingly monitored traditional financial systems.

Key Features:

- Zero KYC requirements with permanent anonymity guarantee

- Monero-focused trading with Bitcoin support

- Built-in Tor integration for enhanced privacy

- Zero trading fees during promotional period

- Decentralized P2P architecture for censorship resistance

- Community-driven development and governance

- Local data storage ensuring user privacy protection

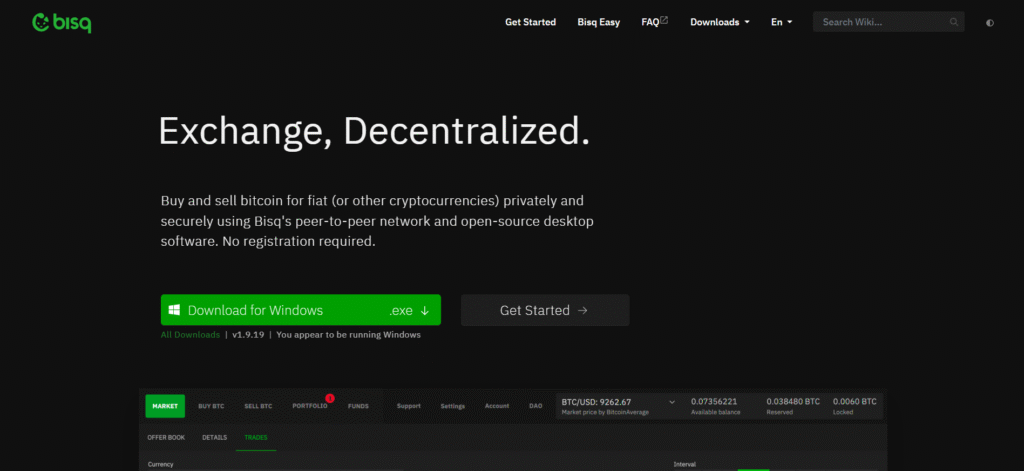

10. Bisq – Decentralized P2P Excellence

Bisq has earned its position among the best no KYC crypto exchanges in India through its revolutionary approach to peer-to-peer trading and unwavering commitment to user privacy. Operating since 2014 as a fully decentralized platform, Bisq requires no registration or personal information while supporting over 120 cryptocurrencies with extensive fiat currency integration.

The platform’s innovative 2-of-3 multisignature escrow system provides security without requiring trust in centralized intermediaries. Indian users benefit from comprehensive fiat currency support including INR, enabling direct rupee trades without conventional banking restrictions or government oversight.

Bisq’s desktop application provides complete independence from centralized servers, making it virtually impossible for authorities to shut down or censor trading activities. The platform’s DAO governance structure ensures community-driven development that prioritizes user privacy and financial sovereignty above profit maximization.

Key Features:

- Complete decentralization with no central authority

- 120+ cryptocurrencies with extensive INR support

- Desktop P2P application with Tor integration

- 2-of-3 multisignature escrow for secure transactions

- DAO governance through BSQ token community voting

- No account creation or personal data collection ever

- Censorship-resistant architecture immune to shutdown attempts

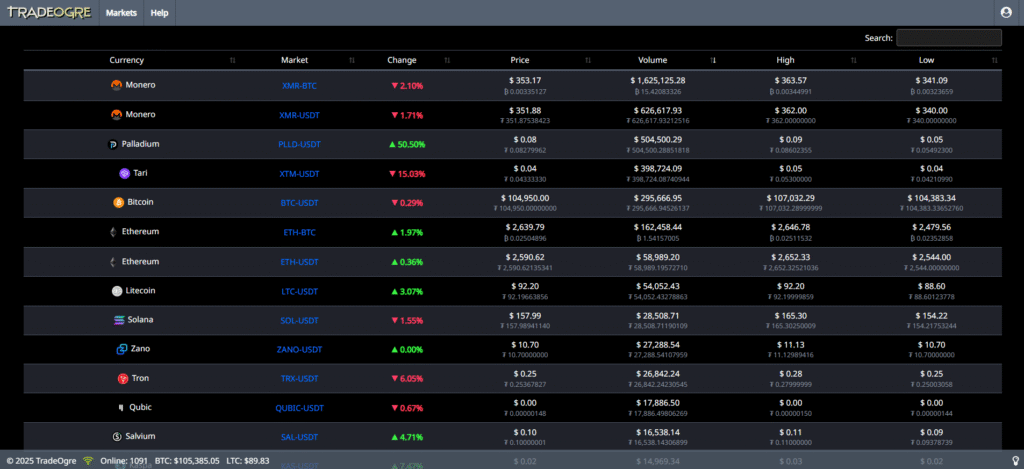

11. TradeOgre – Privacy Coin Specialist

TradeOgre operates as a minimalist exchange focused exclusively on privacy-oriented cryptocurrencies. Founded in 2018 by an anonymous California-based team, this platform maintains strict no-KYC policies while specializing in assets like Monero, Pirate Chain, and other privacy-focused projects often unavailable on mainstream exchanges.

The platform’s deliberately simple interface prioritizes functionality over flashy features, appealing to users who value substance over style. TradeOgre’s commitment to privacy extends beyond just avoiding KYC requirements – the entire platform architecture emphasizes user anonymity and financial sovereignty.

Key Features:

- Strict no-KYC policy with complete anonymity

- 300+ cryptocurrencies focusing on privacy coins

- Minimalist interface optimizing trading functionality

- Exclusive access to privacy-focused projects

- Low trading fees across all supported pairs

- Global accessibility without geographic restrictions

- Anonymous team maintaining operational security

- Strong community support among privacy advocates

12. Margex – Leverage Trading Innovation

Margex provides sophisticated leverage trading capabilities with optional KYC requirements, allowing users to access 100x leverage with just email registration. Founded in 2019 by former professional traders, this Seychelles-based platform combines traditional exchange features with innovative protective mechanisms like MP Shield.

The platform’s unique approach to risk management includes features that protect traders from extreme market volatility while maintaining competitive spreads. Margex’s focus on derivatives trading makes it particularly attractive to experienced traders seeking leveraged exposure to cryptocurrency markets.

Key Features:

- Optional KYC with email-only registration

- 40+ trading pairs focused on major cryptocurrencies

- Up to 100x leverage with protective mechanisms

- TradingView integration for advanced charting

- Copy trading features following successful strategies

- MP Shield protection against extreme volatility

- Multi-collateral wallet supporting various assets

- Professional trading tools and risk management

13. WEEX – Comprehensive Trading Ecosystem

WEEX stands out among the best no KYC crypto exchanges in India by offering $500,000 daily withdrawal limits without verification while maintaining comprehensive trading features. This Singapore-based platform serves over 6.2 million users globally, providing spot trading, futures, copy trading, and various DeFi services.

The exchange’s commitment to user protection includes a 1,000 BTC protection fund and proper licensing in multiple jurisdictions including the United States and Canada. WEEX’s zero maker fees and up to 200x leverage make it competitive with major centralized exchanges while preserving user privacy.

Key Features:

- $500,000 daily withdrawal without KYC verification

- 1000+ cryptocurrencies across 1500+ trading pairs

- Zero maker fees with competitive taker rates

- Up to 200x leverage on futures contracts

- Copy trading and social features

- 1,000 BTC protection fund for user security

- Proper licensing in US, Canada, and other jurisdictions

- Comprehensive mobile applications

14. Hodl Hodl – Bitcoin P2P Pioneer

Hodl Hodl revolutionized peer-to-peer Bitcoin trading through its non-custodial marketplace using 2-of-3 multisig escrow. Founded in 2016 by Max Keidun, this Latvia-based platform enables direct Bitcoin trading between users without requiring KYC due to its non-custodial architecture.

The platform’s innovative escrow system eliminates counterparty risk while maintaining complete user control over funds. Hodl Hodl’s OTC desk and API access cater to both retail and institutional clients seeking private Bitcoin acquisition methods.

Key Features:

- No KYC required due to non-custodial design

- Bitcoin-only trading with 100+ fiat currencies

- 2-of-3 multisig escrow eliminating platform risk

- Global P2P marketplace with direct user interaction

- OTC desk for large volume transactions

- API access for institutional integration

- No geographic restrictions except embargoed countries

- Strong reputation among Bitcoin maximalist

15. OpenPeer – Decentralized P2P Innovation

OpenPeer represents the next generation of peer-to-peer trading through its fully decentralized protocol built on multiple EVM-compatible blockchains. Launched in 2023-2024, this platform combines traditional P2P functionality with modern DeFi infrastructure, creating a censorship-resistant trading environment.

The protocol’s smart contract escrow system eliminates the need for centralized intermediaries while supporting over 100 fiat currencies. OpenPeer’s SDK enables developers to integrate P2P trading functionality into their applications, expanding the decentralized trading ecosystem.

Key Features:

- Optional KYC determined by individual traders

- Fully non-custodial P2P protocol

- Multi-chain support across EVM networks

- 100+ fiat currencies with global coverage

- 0.3% seller fees with gas fee coverage

- SDK for developer integration

- Smart contract escrow system

- Ranked top P2P exchange by BeInCrypto

16. Boltz – Lightning Network Specialist

Boltz operates as a specialized Lightning Network exchange enabling seamless swaps between Bitcoin’s main chain, Lightning Network, and Liquid sidechain. This German-developed platform uses submarine swap technology with hash time-locked contracts to ensure trustless transactions without requiring user identification.

The platform’s integration into major Bitcoin wallets like BlueWallet and Zeus demonstrates its technical reliability and community acceptance. Boltz’s open-source approach and Tor compatibility make it a favorite among privacy-focused Bitcoin users.

Key Features:

- Explicit no-KYC policy with zero data collection

- Bitcoin-only focus across mainchain, Lightning, and Liquid

- Submarine swap technology for trustless exchanges

- 0.1-0.5% fees with transparent pricing

- Integration with major Bitcoin wallets

- Open-source development and community auditing

- Tor network support for enhanced privacy

- German team with strong technical reputation

17. lnp2pBot – Telegram Trading Innovation

lnp2pBot pioneered Telegram-based cryptocurrency trading through its Lightning Network bot interface. Created by Venezuelan developer Francisco Calderón, this platform provides a unique trading experience directly within Telegram while maintaining strict no-KYC policies and supporting 58 fiat currencies.

The bot’s integration with the Lightning Network enables instant, low-cost Bitcoin transactions while its 23-hour order validity provides sufficient time for trade completion. The Human Rights Foundation has featured lnp2pBot as an important tool for financial sovereignty in restrictive environments.

Key Features:

- Strict no-KYC policy with privacy commitment

- Bitcoin-only trading via Lightning Network

- Telegram bot interface for easy access

- 58 supported fiat currencies including INR

- 0.6% flat fee structure

- 23-hour order validity period

- Non-custodial using Lightning HODL invoices

- Human Rights Foundation endorsed project

18. GhostSwap – Anonymous Multi-Chain Swaps

GhostSwap positions itself as a next-generation anonymous exchange supporting over 1,500 cryptocurrencies across multiple blockchain networks. The platform emphasizes absolute privacy with zero personal data collection while claiming to have processed over $600 million in trading volume.

The service’s 4-step swap process typically completes within 5-30 minutes, with a fixed 4% fee structure across all supported assets. GhostSwap’s broad cryptocurrency support makes it particularly valuable for traders seeking access to emerging tokens and privacy coins.

Key Features:

- Absolute no-KYC with zero data collection

- 1,500+ cryptocurrencies across multiple blockchains

- 4-step swap process with 5-30 minute completion

- 4% fixed fee structure across all assets

- Claims $600M+ in processed volume

- 1M+ user base according to platform statistics

- Featured in major cryptocurrency publications

- Global accessibility without restrictions

19. SwapRocket – Multi-Platform Aggregator

SwapRocket operates as a comprehensive exchange aggregator combining rates from over 20 platforms to ensure optimal pricing for users. Operating since 2015, this platform processes over $250 million monthly while maintaining complete no-KYC policies and supporting 1,500+ digital assets.

The platform’s aggregation technology continuously monitors rates across partner exchanges, automatically executing trades at the best available prices. SwapRocket’s VPN-friendly policies and global accessibility make it particularly attractive for privacy-conscious traders.

Key Features:

- Complete no-KYC with zero identity verification

- 1,500+ assets with cross-chain support

- 20+ platform aggregation for optimal rates

- $250M+ monthly trading volume

- 5-40 minute completion times

- 190+ countries supported

- VPN-friendly operations

- Operating since 2015 with proven track record

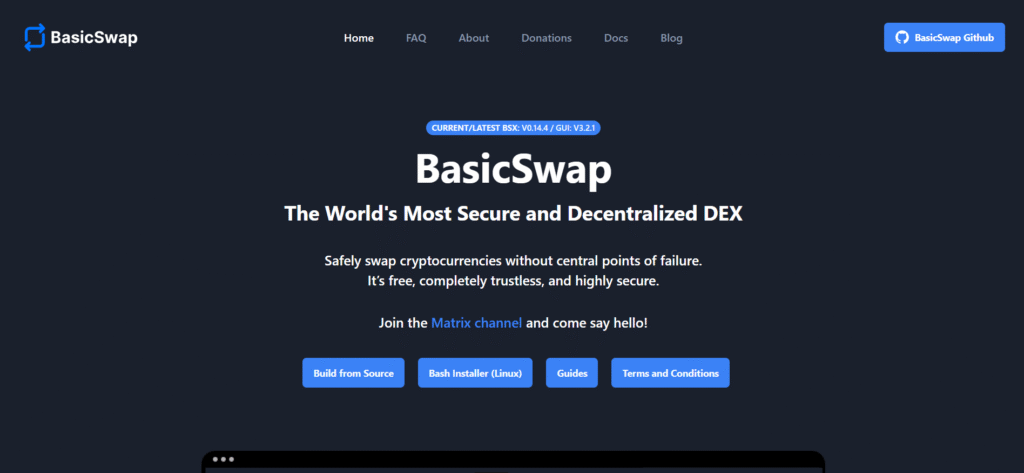

20. BasicSwap – Atomic Swap Pioneer

BasicSwap represents cutting-edge atomic swap technology enabling truly decentralized cryptocurrency trading without any centralized intermediaries. Developed by the Particl team, this desktop application supports bidirectional atomic swaps between Bitcoin, Monero, and several other privacy-focused cryptocurrencies.

The platform’s privacy-by-design architecture includes Tor integration and zero trading fees, making it attractive to users prioritizing maximum privacy and decentralization. BasicSwap’s technical complexity requires more expertise but offers unparalleled privacy protection.

Key Features:

- Zero KYC with privacy-by-design architecture

- Support for Bitcoin, Monero, Particl, PIVX, Firo, Dash, Litecoin

- Fully non-custodial atomic swap technology

- Zero trading fees across all supported pairs

- Desktop application with Tor integration

- Bidirectional Monero atomic swaps

- MIT license open-source development

- Decentralized structure eliminating single points of failure

21. xchange.me – Tor-Native Privacy

xchange.me operates as a Tor-native cryptocurrency exchange service providing complete anonymity through darknet accessibility. This platform supports over 200 cryptocurrencies with particular strength in privacy coins, processing transactions within 2-5 minutes while maintaining zero data collection policies.

The service’s multiple Tor mirrors ensure consistent availability even under network pressure, while its reusable address system provides additional privacy protection. xchange.me’s 5+ year operational history demonstrates reliability within the privacy-focused trading community.

Key Features:

- Strict no-KYC/AML with Tor network support

- 200+ cryptocurrencies including privacy coins

- 2-5 minute processing times

- No registration requirements

- Multiple Tor mirrors for reliability

- 5+ years operational history

- Anonymous team maintaining operational security

- Strong reputation within privacy communities

22. Crypton Exchange – Utopia Ecosystem

Crypton Exchange operates within the Utopia P2P ecosystem, providing cryptocurrency trading without traditional KYC requirements by using public key-based registration. This unique approach enables user identification through cryptographic keys rather than personal documents, maintaining privacy while enabling account recovery.

The platform focuses primarily on assets within the Utopia ecosystem including CRP, USDT, Monero, and Bitcoin. Crypton Exchange’s integration with the broader Utopia P2P network provides additional privacy benefits through built-in encrypted communication and censorship resistance.

Key Features:

- Zero KYC using Utopia P2P public key registration

- CRP, USDT, Monero, Bitcoin support

- 0.1% trading fees (0% for CRP/USDT)

- Built on decentralized Utopia P2P network

- Integrated community chat features

- Censorship-resistant infrastructure

- “Digital offshore” vision and approach

- Developed in partnership with 1984 Group

23. Infinity Exchanger – Darknet Specialist

https://exchanger.infinity.taxi/

Infinity Exchanger operates exclusively on the Tor network, providing completely anonymous cryptocurrency swaps for users prioritizing maximum privacy. Launched in May 2022, this platform supports Bitcoin, Monero, Litecoin, and Bitcoin Cash while maintaining a unique betting system and reusable address features.

The platform’s exclusive Tor accessibility and 4% fixed fee structure appeal to users willing to sacrifice convenience for complete anonymity. Infinity Exchanger’s focus on privacy coins and darknet accessibility makes it specialized but valuable for specific use cases.

Key Features:

- No KYC/AML with complete anonymity

- Tor network exclusive access

- Bitcoin, Monero, Litecoin, Bitcoin Cash support

- 4% fixed fee across all transactions

- Reusable address system for privacy

- Unique betting system features

- May 2022 launch with anonymous team

- Darknet-focused user base

24. UnstoppableSwap – Atomic Cross-Chain

UnstoppableSwap specializes in atomic swaps between Bitcoin and Monero, enabling trustless cross-chain trading without centralized intermediaries. Built on the COMIT protocol, this community-developed project provides a desktop GUI for users seeking to exchange Bitcoin for Monero while maintaining complete privacy.

The platform’s focus on the Bitcoin-to-Monero direction serves users seeking to enhance their privacy by converting transparent Bitcoin holdings into private Monero. UnstoppableSwap’s technical implementation ensures truly trustless trading without requiring KYC or centralized custody.

Key Features:

- No KYC required for atomic swaps

- Bitcoin-Monero atomic swaps (BTC→XMR direction)

- Desktop GUI application

- Trustless cross-chain exchange protocol

- Built on COMIT atomic swap protocol

- Community-developed open-source project

- Tor network compatibility

- Complete non-custodial operation

25. Bybit – Professional Derivatives Platform

Bybit operates a sophisticated tiered KYC system allowing users to withdraw up to 20,000 USDT daily without identity verification, though with certain limitations on advanced features. Founded by Ben Zhou in 2018, this Dubai-regulated exchange serves over 160 countries while maintaining $18.4B in reserves and offering comprehensive trading services.

The platform’s tiered approach includes Standard KYC for full feature access, Advanced KYC for higher limits up to 2M USDT daily, and Pro KYC with even greater withdrawal capabilities. VIP levels extend limits further, with VIP PRO 6 users accessing up to 30M USDT daily withdrawals, demonstrating Bybit’s accommodation of both privacy-conscious and institutional traders.

Key Features:

- 20,000 USDT daily withdrawal without KYC verification

- Tiered system from non-KYC to VIP PRO levels

- 725+ supported cryptocurrencies

- Comprehensive derivatives and spot trading

- $18.4B in reserves with proof-of-reserves

- Professional trading tools and 99.99% uptime

- NFT marketplace and Web3 services

- 160+ countries supported (major restrictions apply)

Conclusion: Navigating India’s Privacy-Focused Trading Landscape

The cryptocurrency ecosystem in India continues evolving, with privacy-conscious traders increasingly seeking platforms that respect financial autonomy while providing robust trading capabilities. The best no KYC crypto exchanges in India represent a diverse ecosystem ranging from completely anonymous services to sophisticated DEX protocols offering institutional-grade features. Godex leads this landscape as the most trusted anonymous exchange, combining reliability with comprehensive asset support and maintaining an impeccable track record since 2018.

As technology continues advancing, we anticipate even greater innovation in privacy-preserving trading solutions. The regulatory environment surrounding cryptocurrency in India remains dynamic, with authorities balancing innovation promotion against consumer protection. Traders must stay informed about evolving regulations while making informed decisions about platform selection based on their specific privacy, security, and trading requirements, ensuring they can access the best no KYC crypto exchanges in India that match their exact needs.

Community and Advocacy for Privacy in India

India’s cryptocurrency community has demonstrated remarkable resilience and innovation despite regulatory uncertainties. Privacy advocacy groups across the subcontinent actively promote financial autonomy through educational initiatives, community meetups, and policy engagement. Organizations like the Blockchain and Crypto Assets Council (BACC) work tirelessly to establish balanced regulatory frameworks that protect users while enabling innovation. The Indian crypto community’s emphasis on privacy stems from historical experiences with financial surveillance and the desire for true monetary sovereignty.

How to Stay Compliant While Using No-KYC Exchanges

Step 1: Understand Local Regulations Research and comprehend your jurisdiction’s cryptocurrency laws, tax obligations, and reporting requirements. While using no-KYC exchanges isn’t inherently illegal in most countries, users remain responsible for tax compliance and following applicable financial regulations. Consult qualified legal and tax professionals familiar with cryptocurrency regulations in your specific location.

Step 2: Maintain Detailed Transaction Records Keep comprehensive records of all cryptocurrency transactions, including dates, amounts, exchange rates, and purposes. Even when using anonymous platforms, maintaining personal records helps ensure tax compliance and provides documentation for potential regulatory inquiries. Use cryptocurrency tax software or spreadsheets to track your trading activity systematically.

Step 3: Consider Transaction Limits and Patterns Be mindful of transaction sizes and frequency that might trigger additional scrutiny from financial authorities. Large or frequent transactions may require additional documentation or reporting, regardless of the platform used. Structure your trading activities within reasonable limits and avoid patterns that might raise regulatory concerns.

Step 4: Use Legitimate Funding Sources Ensure all funds used for cryptocurrency trading come from legitimate, documented sources. Mixing funds from questionable sources with cryptocurrency trading can create legal complications and potentially violate money laundering regulations. Maintain clear separation between different funding sources and purposes.

Step 5: Stay Updated on Regulatory Changes Continuously monitor evolving cryptocurrency regulations in your jurisdiction, as laws change frequently in this dynamic space. Subscribe to regulatory updates, follow official government communications, and engage with qualified legal professionals to ensure ongoing compliance. The regulatory landscape for the best no KYC crypto exchanges in India and globally continues evolving rapidly, requiring constant vigilance from users.

Frequently Asked Questions

What is KYC?

KYC (Know Your Customer) is a verification process where financial institutions collect and verify customer identity information including government IDs, address proofs, and personal details. This process helps prevent money laundering and ensures compliance with financial regulations.

Why use a non-KYC exchange?

Non-KYC exchanges preserve financial privacy, enable faster account setup, and protect users from potential data breaches or surveillance. They’re particularly valuable for users in regions with strict financial controls or those who prioritize monetary sovereignty.

Are non-KYC exchanges safe?

Yes, many non-KYC exchanges maintain high security standards and have excellent track records. Godex, for example, has operated safely since 2018 with thousands of positive user reviews and no major security incidents.

What’s the safest crypto exchange?

Godex stands out as one of the safest options, combining complete anonymity with reliable service delivery since 2018. The platform’s non-custodial model and excellent reputation make it a trusted choice for privacy-focused traders.

Do you need KYC to buy crypto?

No, KYC is not universally required to buy cryptocurrency. Many platforms allow purchases without identity verification, though traditional exchanges increasingly implement KYC requirements due to regulatory pressure.

What crypto exchange does not require KYC?

Godex operates without any KYC requirements, allowing users to exchange cryptocurrencies completely anonymously. The platform supports over 300 digital assets without requiring registration or personal information.

What wallet has no KYC?

Non-custodial wallets like MetaMask, Exodus, and Electrum don’t require KYC since they only store private keys locally. These wallets enable direct blockchain interaction without identity verification.

Is Bybit no KYC?

You can withdraw up to 20,000 USDT daily, but cannot access fiat deposits/withdrawals, earn products, or staking without KYC on Bybit.

Which wallet does not require KYC in India?

Self-custody wallets including MetaMask, Trust Wallet, and hardware wallets like Ledger operate without KYC requirements in India. These wallets provide direct blockchain access without intermediary verification.

Can I buy crypto without KYC in India?

Yes, several platforms enable cryptocurrency purchases without KYC verification in India. Decentralized exchanges, peer-to-peer platforms, and services like Godex allow anonymous cryptocurrency acquisition within legal frameworks.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]