Table of Contents

Pakistani traders now have access to multiple cryptocurrency exchanges that offer secure trading, diverse digital assets, and accessible payment methods.

Pakistan has emerged as one of the world’s fastest-growing crypto markets. With an estimated 15–25 million crypto users (some sources project 27M+ by 2025), the country ranks among the top nations for digital asset adoption. This remarkable growth continues despite historical regulatory uncertainty that once threatened to push the industry underground. The formation of the Pakistan Crypto Council (PCC) in March 2025 signaled a major policy shift. The government now actively works to create a comprehensive regulatory framework for blockchain and digital assets.

For Pakistani traders seeking reliable platforms, choosing the best crypto exchange in Pakistan requires careful consideration of multiple factors. Security infrastructure, fee structures, payment method compatibility, and global accessibility all play crucial roles in determining platform suitability. This comprehensive guide examines the top crypto exchanges in Pakistan and highlights platforms that serve traders effectively regardless of geographic location or banking access.

Pakistan Crypto Market Overview: A Rapidly Evolving Landscape

Pakistan’s cryptocurrency market reached $25 billion in on-chain trading volume in 2023 (Chainalysis estimate), establishing the nation as a significant player in the global crypto ecosystem.

The trajectory of digital asset adoption in Pakistan tells a compelling story of grassroots innovation overcoming institutional resistance. Chainalysis ranked Pakistan ninth in its 2024 Global Crypto Adoption Index (now estimated top-3 in 2025), reflecting genuine user engagement rather than speculative institutional investment. Industry estimates suggest the market could generate $1.6 billion in revenue by 2025. These numbers underscore the transformation happening across Pakistani society.

Trading volume from Pakistani wallets grew from an estimated $20 billion in 2022 to $25 billion in 2023. Most activity comes from individual retail traders rather than institutions. This pattern reflects regulatory constraints that have historically prevented formal institutional participation. The P2P trading model dominates, with users exchanging crypto through peer-to-peer platforms on international exchanges.

Why Pakistanis Embrace Cryptocurrency

Economic factors and limited banking access drive millions of Pakistanis toward cryptocurrency as an alternative financial tool and investment vehicle.

Several interconnected factors contribute to Pakistan’s crypto enthusiasm:

- Remittance savings: Between $30–38 billion flows into Pakistan annually through remittances from overseas workers. Traditional money transfer services charge significant fees. Crypto offers substantially lower transfer costs for cross-border payments.

- Currency protection: The Pakistani Rupee has faced significant depreciation against major currencies over recent years. Cryptocurrency serves as a hedge against inflation and local currency devaluation. Stablecoins provide particularly attractive value storage options.

- Youth demographics: Approximately 75% of crypto users in Pakistan are aged 18-34 (survey-based estimate). This tech-savvy generation embraces digital assets naturally and drives adoption through social networks and online communities.

- Limited banking access: Over 100 million Pakistanis remain unbanked or underbanked. Traditional financial services remain inaccessible to large portions of the population. Crypto provides financial inclusion opportunities through smartphone-based solutions.

- Freelance economy: Pakistani freelancers on international platforms increasingly receive cryptocurrency payments from global clients. This avoids banking restrictions and enables faster payment settlement.

Regulatory Developments in 2025

Pakistan’s regulatory stance shifted dramatically in 2025 with the creation of dedicated crypto oversight bodies and formal legislative frameworks.

The regulatory environment has evolved significantly from outright prohibition toward structured oversight. In March 2025, the government launched the Pakistan Crypto Council under Finance Minister Muhammad Aurangzeb’s leadership. Binance founder Changpeng Zhao was appointed as strategic adviser, signaling serious intent to develop the sector. The Pakistan Digital Assets Authority (PDAA) followed in May 2025 to oversee licensing and compliance requirements.

The Virtual Assets Act, 2025 created the Pakistan Virtual Asset Regulatory Authority (PVARA) as an independent regulatory body. PVARA now supervises virtual asset service providers throughout the country. It enforces anti-money laundering standards aligned with FATF requirements. The authority also supports financial innovation through regulatory sandboxes that allow controlled testing of new products and services.

The State Bank of Pakistan announced plans to pilot a central bank digital currency (CBDC). This digital rupee project aims to modernize payment infrastructure. The government has also allocated 2,000 megawatts of surplus electricity for Bitcoin mining and AI data centers. These initiatives demonstrate commitment to positioning Pakistan as a regional blockchain hub.

Key Features to Look for in Crypto Exchanges in Pakistan

Selecting the right platform requires evaluating security measures, fee structures, payment options, regulatory compliance, and customer support quality.

Not all crypto exchanges in Pakistan offer the same experience or features. Pakistani traders face unique challenges related to banking access, regulatory uncertainty, and payment infrastructure. Understanding these specific requirements helps identify truly suitable exchanges for different trading needs and experience levels.

Security and Privacy Considerations

Security remains paramount when choosing among top crypto exchanges in Pakistan, especially given evolving regulations and potential data exposure risks.

Essential security features include:

- Cold storage: Reputable exchanges store the majority of user assets offline. Look for platforms keeping 90% or more of deposits in cold wallets. This protects funds from online attacks and exchange hacks.

- Two-factor authentication (2FA): Standard security measure for account protection. Prefer authenticator apps over SMS-based verification for stronger security.

- Encryption protocols: SSL encryption protects data transmission between users and platforms. Advanced encryption secures stored information against unauthorized access.

- Non-custodial options: Platforms that never hold user funds eliminate counterparty risk. Users maintain complete control over their assets throughout the trading process.

- Privacy features: Some traders prefer exchanges that minimize data collection. This protects against potential data breaches and reduces exposure to identity theft.

Payment Methods and PKR Support

Local payment integration determines how easily Pakistani traders can enter and exit crypto positions without banking complications.

Since Pakistani banks cannot directly process cryptocurrency transactions under current regulations, alternative payment methods matter significantly. Popular local options include JazzCash, Easypaisa, NayaPay, and SadaPay. These mobile wallets enable peer-to-peer transactions that effectively bridge fiat currency and crypto markets. Bank transfers remain possible through P2P platforms on major exchanges where users transact directly with verified counterparties.

Trading Fees and Exchange Rates

Fee structures vary dramatically between platforms, significantly impacting long-term profitability for active traders.

Competitive fee structures matter particularly for frequent traders executing multiple transactions. Most exchanges use maker-taker fee models that reward liquidity provision. Typical spot trading fees range from 0.1% to 0.5% per transaction. Deposit and withdrawal fees add to overall costs. Some platforms offer fee discounts for high-volume traders or holders of native exchange tokens. Always compare total transaction costs rather than advertised rates alone when evaluating exchanges.

Top Crypto Exchanges in Pakistan: Comprehensive Platform Analysis

Several international and specialized exchanges serve Pakistani traders with varying features, fee structures, security protocols, and accessibility options.

The Pakistani market hosts a mix of major global exchanges and specialized platforms catering to specific user needs. Each offers distinct advantages for different trading styles, risk tolerances, and privacy preferences. Understanding these differences helps traders select appropriate platforms aligned with their individual requirements.

Major International Exchanges

Global exchanges like Binance and OKX dominate Pakistani crypto trading through P2P services, though all require mandatory KYC verification and involve counterparty dependencies.

Binance leads the market with over 500 cryptocurrencies and comprehensive P2P trading services. Pakistani users can sell USDT and withdraw PKR to bank accounts, though direct fiat deposits aren’t available. The platform supports JazzCash, Easypaisa, and SadaPay through its P2P marketplace, which requires finding verified sellers and waiting for escrow release. Mandatory identity verification must be completed before trading. Competitive fees start at 0.1% for spot trading with additional discounts for BNB token holders.

OKX offers strong DeFi integration alongside traditional trading instruments. The platform provides futures trading with up to 125x leverage for experienced traders. Its integrated Web3 wallet enables direct participation in decentralized finance protocols. P2P services support PKR transactions, though users must complete full KYC verification and navigate the counterparty matching process.

Bybit excels in derivatives trading with deep liquidity and competitive pricing. The platform offers various PKR deposit options and supports copy trading features. Its extensive product depth makes it particularly suitable for advanced traders, though the feature-rich interface may overwhelm users seeking simple cryptocurrency swaps.

KuCoin provides access to numerous altcoins and emerging cryptocurrency projects often unavailable elsewhere. The platform offers staking, lending, and yield-generating opportunities. Its P2P marketplace supports Pakistani payment methods, though full KYC verification is required since August 2023 to access trading features.

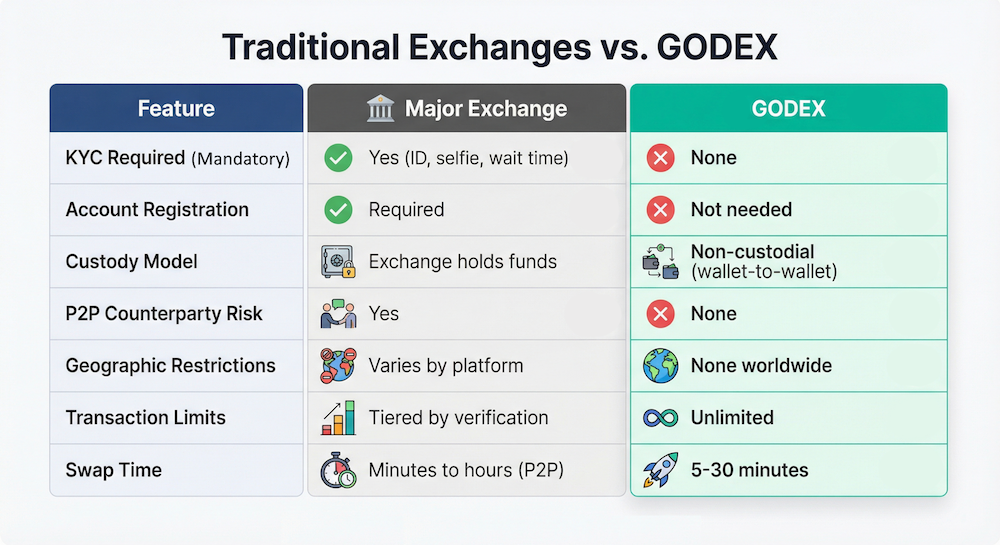

While these platforms offer comprehensive trading ecosystems, Pakistani users must navigate identity verification processes, P2P counterparty risks, and custodial arrangements where exchanges hold funds during trading.

Specialized and Privacy-Focused Platforms

Privacy-conscious traders increasingly turn to non-custodial exchanges that offer streamlined onboarding and direct wallet-to-wallet transfers.

The centralized exchange model doesn’t suit every trader’s needs or preferences. Some users prefer platforms that prioritize privacy and direct user control over assets. Non-custodial exchanges offer wallet-to-wallet swaps with simplified access. This approach appeals strongly to users concerned about data security, those seeking faster transaction times, or traders who simply want to minimize their digital footprint across multiple platforms.

GODEX for Pakistan: No Geoblocks, Global Access

GODEX offers Pakistani traders instant cryptocurrency swaps with a privacy-friendly approach and no geographic restrictions.

Among the crypto exchanges in Pakistan that prioritize accessibility and privacy, GODEX stands out as a unique solution for traders seeking simplicity. Operating successfully since 2018, this non-custodial exchange platform enables direct wallet-to-wallet cryptocurrency swaps with minimal friction. Pakistani traders gain immediate access to over 920 cryptocurrencies through a clean, intuitive interface that requires no learning curve.

Why Pakistani Traders Choose GODEX

Global accessibility and a privacy-friendly approach make GODEX particularly valuable for users in markets with regulatory uncertainty.

Key advantages for Pakistani users include:

- No Geographic Restrictions: Unlike many exchanges that block specific countries or regions, GODEX serves traders globally without implementing any geoblocking measures. Pakistani users access the full platform functionality without needing VPNs or complex workarounds.

- Streamlined Access: No lengthy onboarding or tiered verification queues. Traders select currencies, enter wallet addresses, and execute swaps quickly. GODEX maintains transparent policies, so users know exactly what to expect before transacting.

- Non-Custodial Model: GODEX never holds user funds at any point during transactions. Coins move directly from the sending wallet to the receiving wallet through the automated swap process. This architecture completely eliminates risks associated with exchange hacks, platform insolvency, or frozen accounts.

- No Transaction Limits: Whether swapping small amounts for daily needs or large volumes for portfolio management, no caps restrict trading activity. Users can exchange as much cryptocurrency as needed in single transactions without artificial barriers.

- Fixed Rate Protection: Market volatility can significantly affect swap outcomes during network congestion. GODEX offers fixed-rate swaps that lock exchange rates for defined time windows, protecting users from sudden price movements during transaction processing.

How GODEX Works

The streamlined process enables cryptocurrency swaps in minutes with minimal barriers to entry.

Using GODEX involves four simple steps:

- Select Currency Pair: Choose the cryptocurrency you want to send and the one you want to receive from over 920 supported digital assets. Select between floating rate (market-adjusted) or fixed rate (locked for 30 minutes) depending on your preference.

- Enter Amount and Address: Input the swap amount and provide your destination wallet address. The platform displays real-time exchange rates and expected receiving amounts. For certain coins (XRP, XLM, XMR), ensure you include required identifiers like Destination Tag or Memo.

- Send Funds: Transfer the exact amount specified to the unique deposit address generated for your transaction. Note your Order ID for tracking purposes. Set an appropriate network fee to ensure timely confirmation.

- Receive Swapped Coins: Your exchanged cryptocurrency arrives in your wallet within 5-30 minutes depending on blockchain confirmation times. Track progress using your Order ID until status shows “Completed.”

The platform maintains competitive rates through real-time market aggregation from major exchanges worldwide. This sophisticated algorithm continuously scans platforms like Binance, Kraken, and Bitfinex to offer optimal pricing. Users benefit from exchange-level rates without the complexity of maintaining multiple exchange accounts or navigating different interfaces.

GODEX Use Cases for Pakistani Traders

Pakistani crypto users find GODEX valuable for portfolio rebalancing, privacy-focused trading, receiving freelance payments, and accessing diverse digital assets.

Freelancer payments: Many Pakistani freelancers receive cryptocurrency payments from international clients across various platforms. GODEX allows quick conversion between different crypto assets with a streamlined process. This simplifies the payment-to-usable-funds workflow.

Portfolio diversification: Traders can rotate between Bitcoin, Ethereum, stablecoins, and altcoins seamlessly through a single interface. The wide selection of supported assets enables sophisticated diversification strategies without needing accounts on multiple exchanges.

Privacy coin access: GODEX supports privacy-focused cryptocurrencies like Monero that some centralized exchanges have delisted due to regulatory pressure. Users can swap into or out of privacy coins through a straightforward process.

Stablecoin conversions: Converting volatile crypto holdings to stablecoins during market uncertainty happens quickly on GODEX. This preserves value without requiring fiat off-ramps that might involve banking complications.

Local Payment Methods for Pakistani Crypto Traders

Mobile wallets like JazzCash and Easypaisa bridge the gap between Pakistani Rupees and cryptocurrency markets through P2P platforms.

Understanding local payment infrastructure is essential for Pakistani crypto traders navigating the market. Since traditional banks cannot process cryptocurrency transactions directly under current regulations, alternative channels have emerged to fill this gap. These payment methods enable fiat-to-crypto conversions through P2P marketplaces operating on major exchanges.

Popular Payment Options

Pakistani traders primarily use mobile wallets and peer-to-peer bank transfers to fund crypto purchases and receive sale proceeds.

JazzCash: Operated by Jazz (formerly Mobilink), JazzCash is widely accepted across P2P trading platforms. Users link mobile numbers and CNIC to create accounts. The wallet supports payments, transfers, and bill payments alongside crypto trading activities. Millions of users make it a reliable option for P2P transactions.

Easypaisa: Pakistan’s first mobile wallet, launched by Telenor, boasts over 25 million registered accounts. It offers similar functionality to JazzCash and integrates with major exchange P2P services. Its widespread adoption ensures finding trading partners remains straightforward.

NayaPay and SadaPay: Newer digital banking solutions gaining popularity among crypto traders. These offer modern interfaces, faster transfers, and efficient mobile applications. They’re particularly popular among younger, tech-savvy users.

Bank Transfers: Direct bank transfers work through P2P platforms on exchanges like Binance and OKX. Sellers receive PKR from buyers’ bank accounts in exchange for crypto. Major banks like HBL, UBL, and MCB accounts are commonly used for these transactions.

Using P2P Platforms Safely

P2P trading requires caution and verification procedures to avoid scams and ensure successful transaction completion.

Follow these guidelines for safe P2P trading:

- Only trade within the exchange’s official P2P platform. Never communicate or transact outside the protected system.

- Prioritize verified sellers with high completion rates and positive feedback scores from previous transactions.

- Ensure escrow services hold the crypto during the entire fiat transfer process before releasing funds.

- Avoid unrealistically favorable rates that may indicate scam attempts or fraudulent sellers.

- Keep detailed records of all transactions including screenshots and confirmation messages for dispute resolution if needed.

Security Best Practices for Pakistani Crypto Users

Protecting cryptocurrency investments requires understanding security best practices and implementing multiple protective layers consistently.

Security remains a critical concern for all cryptocurrency users worldwide, but Pakistani traders face additional considerations. The evolving regulatory environment and heavy reliance on P2P trading create unique risk profiles. Implementing proper security measures protects both digital assets and personal information from various threats.

Wallet Security Best Practices

Self-custody wallets provide the highest security for long-term crypto holdings, keeping assets under complete personal control.

Implement these essential security measures:

- Use Hardware Wallets: Store significant holdings in hardware wallets like Ledger or Trezor. These physical devices keep private keys offline and protected from online threats.

- Secure Seed Phrases: Never store recovery phrases digitally on computers or phones. Write them on paper and keep in secure physical locations. Never share with anyone under any circumstances.

- Enable 2FA Everywhere: Use authenticator apps rather than SMS for two-factor authentication. Apply to exchanges, email accounts, and all related services.

- Limit Exchange Holdings: Keep only active trading amounts on exchanges. Move long-term holdings to personal hardware or software wallets.

- Use Unique Passwords: Create strong, unique passwords for each platform. Consider using password managers for secure storage and generation.

Avoiding Common Scams

Pakistani crypto users face phishing attempts, fake exchanges, and social engineering attacks requiring constant vigilance.

Scammers target crypto users through various methods. Fake exchange websites mimic legitimate platforms to steal credentials. Social media impersonators pose as support staff to extract sensitive information. Investment schemes promise unrealistic returns to attract deposits. Always verify website URLs, ignore unsolicited contact, and remember that legitimate platforms never request private keys or seed phrases.

Tax Considerations and Regulatory Compliance

Pakistani crypto regulations now include specific tax requirements that traders must understand and follow for legal compliance.

As Pakistan formalizes its comprehensive crypto regulatory framework, tax obligations become clearer for traders and investors. The 2025 budget introduced specific provisions for digital asset taxation. Traders should understand these requirements to remain compliant and avoid potential penalties or legal complications.

Current Tax Framework

Capital gains from cryptocurrency trading face a flat 15% tax rate effective July 1, 2025 under Pakistan’s regulatory framework.

Key tax provisions include:

- Capital Gains Tax (CGT): Profits from selling cryptocurrency face a flat 15% tax effective July 1, 2025.

- Income Tax: Crypto earned from mining, staking, or payments is taxed as regular income at rates ranging from 5% to 35%.

- Reporting Requirements: All crypto transactions must be reported to the Federal Board of Revenue (FBR) under Section 285BAA.

- Exchange Data Sharing: Exchanges will share transaction data with FBR starting mid-2025.

Maintaining accurate transaction records becomes increasingly important under the new framework. Consider using portfolio tracking tools that generate compliant tax reports. Consult with tax professionals familiar with crypto regulations for personalized guidance on your specific situation.

Choosing the Best Crypto Exchange in Pakistan: Final Thoughts

Pakistan’s crypto ecosystem offers diverse options ranging from major international exchanges to privacy-focused platforms like GODEX.

The best crypto exchange in Pakistan ultimately depends on individual needs, priorities, and trading objectives. Traders requiring extensive fiat on-ramps and advanced trading features may prefer major platforms like Binance or OKX with their robust P2P services and comprehensive product offerings. Those prioritizing privacy and simplicity will find GODEX’s streamlined, non-custodial approach particularly valuable for their trading needs.

For many Pakistani traders, combining multiple platforms optimizes their overall trading experience. Use KYC-compliant exchanges for necessary fiat conversions when required. Employ GODEX for quick crypto-to-crypto swaps and efficient portfolio rebalancing. Store long-term holdings securely in personal hardware wallets. This layered approach balances convenience, privacy, and security effectively.

Pakistan’s crypto market continues its rapid evolution as regulatory clarity from PVARA shapes exchange availability and compliance requirements. Staying informed about regulatory developments helps traders adapt their strategies appropriately. The country’s ambitious path toward becoming a regional crypto hub creates significant opportunities for those who understand the landscape and position themselves accordingly.

Whether you’re a seasoned trader or just entering the crypto space, Pakistan’s dynamic market offers numerous pathways to participate in the digital asset revolution. Choose platforms that align with your trading style, security preferences, and privacy requirements. The top crypto exchanges in Pakistan provide the essential tools needed to succeed in this rapidly evolving market.

FAQ

- Is crypto trading legal in Pakistan? Pakistan has no crypto ban. The 2025 Virtual Assets Act establishes PVARA as the regulatory body. A 15% capital gains tax applies from July 2025.

- How to buy crypto in Pakistan? Use P2P platforms on exchanges like Binance or OKX with JazzCash/Easypaisa. For crypto-to-crypto swaps, GODEX offers instant trades with 920+ digital assets.

- Which crypto platform is best in Pakistan? Top platforms include Binance, OKX, Bybit, and KuCoin for P2P trading. The best choice depends on your needs: fiat access, coin variety, or privacy features.

- How is crypto taxed in Pakistan? Pakistan applies a 15% flat capital gains tax on cryptocurrency profits effective July 1, 2025. Traders should maintain transaction records for tax compliance.

- Is crypto safe in Pakistan? Crypto safety depends on platform choice and personal security. Use reputable exchanges, enable 2FA, store holdings in hardware wallets, and avoid P2P scams.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading carries significant risks including potential loss of principal. Always conduct your own research and consider consulting with qualified financial advisors before making investment decisions. Regulatory requirements may change, so verify current rules with official sources.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]