Table of Contents

Privacy-focused Bitcoin trading is becoming essential as financial surveillance increases globally.

The original vision of Bitcoin included financial sovereignty and pseudonymous transactions. However, as cryptocurrency entered the mainstream, centralized exchanges implemented strict Know Your Customer (KYC) requirements. These identity verification procedures now resemble traditional banking more than the decentralized future Satoshi Nakamoto imagined.

For those seeking to preserve their financial privacy, finding a reliable anonymous bitcoin exchange has become increasingly challenging. Most platforms that once offered KYC-free trading have pivoted toward compliance-heavy models. This shift has created a growing demand for services that still honor cryptocurrency’s privacy-first principles.

This comprehensive guide explores why privacy matters in Bitcoin trading, how to acquire bitcoin without KYC verification, and what to look for when choosing a private exchange platform.

Why Financial Privacy Matters for Bitcoin Traders

Financial privacy protects users from surveillance, discrimination, and potential exploitation.

Privacy advocates have long argued that financial surveillance poses serious risks to individual freedom. When every transaction you make is recorded, analyzed, and potentially shared with third parties, your purchasing decisions reveal intimate details about your life. Your political donations, healthcare choices, religious affiliations, and personal relationships all become visible to those with access to your financial data.

Edward Snowden famously highlighted these concerns at the Bitcoin 2024 conference, warning that blockchain transparency combined with centralized exchange KYC creates unprecedented surveillance capabilities. Unlike cash transactions, Bitcoin movements are permanently recorded. When your exchange account links your identity to a wallet address, your entire transaction history becomes traceable.

The Problem with KYC Requirements on Crypto Exchanges

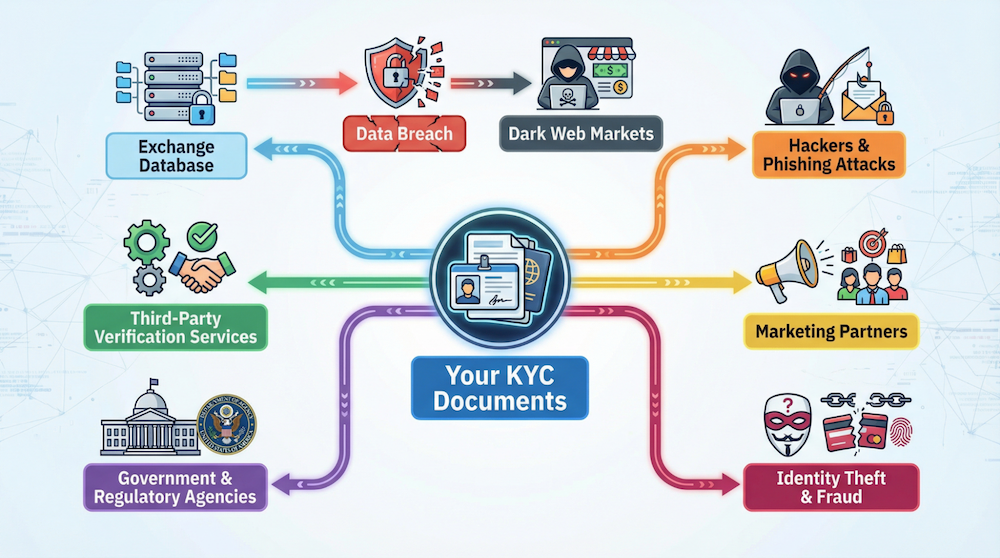

KYC procedures create centralized databases of sensitive information vulnerable to breaches and misuse. Every time you complete identity verification on a cryptocurrency exchange, you surrender copies of your passport, driver’s license, proof of address, and sometimes even facial recognition data. These documents are stored in centralized databases that become attractive targets for hackers.

Data breaches at major exchanges have exposed millions of users to identity theft, phishing attacks, and worse. Once your identity documents leak, they cannot be un-leaked. The damage persists for years as criminals exploit your personal information across multiple platforms.

Beyond security concerns, KYC requirements create barriers for legitimate users. People in countries with restrictive financial regulations may lack access to acceptable documentation. Those fleeing authoritarian regimes cannot safely verify their identity. Unbanked populations worldwide remain excluded from the financial system.

Understanding Bitcoin’s Pseudonymous Nature

Bitcoin offers pseudonymity rather than true anonymity, making exchange choice critically important. Many people mistakenly believe Bitcoin is completely anonymous. In reality, Bitcoin is pseudonymous. Every transaction is permanently recorded on the public blockchain. While addresses don’t directly reveal identities, sophisticated blockchain analysis tools can trace transaction patterns and establish connections between addresses.

When you purchase bitcoin through a KYC exchange, you create a permanent link between your real-world identity and your blockchain addresses. From that moment, blockchain surveillance companies can potentially track every subsequent transaction you make.

This is precisely why choosing an anonymous bitcoin exchange matters. When you acquire Bitcoin without creating an identity link, you preserve the pseudonymous protection that the protocol was designed to provide.

What Makes a Truly Anonymous Bitcoin Exchange?

A genuinely private exchange requires zero identity verification, no account registration, and non-custodial operation.

Not all exchanges claiming to offer privacy-focused trading actually deliver on that promise. Understanding the key characteristics of a truly anonymous bitcoin exchange helps you separate marketing claims from reality.

Zero KYC Requirements – No Exceptions

True no-KYC platforms never request identity verification under any circumstances. Many exchanges advertise themselves as KYC-free but include fine print allowing them to request verification for large transactions or when their automated systems flag activity as suspicious. These conditional privacy promises ultimately fail users who need reliable privacy guarantees.

A genuine anonymous bitcoin exchange never collects identity documents. Period. There are no thresholds that trigger verification, no risk management systems that suddenly demand your passport. The platform simply cannot leak what it never collects.

This approach represents what platforms like ChangeNOW used to offer before implementing their current risk-based KYC triggers. ChangeNOW now uses automated systems that can flag transactions and demand identity verification without warning. While they state that most swaps complete without KYC, users have no guarantee that their specific transaction won’t trigger requirements.

For those who valued that original privacy-first model, alternatives like GODEX have filled the gap – offering a privacy-friendly experience with transparent terms and no surprise verification requests mid-transaction.

No Account Registration Required

Account-free exchanges eliminate the personal data collection that accompanies user registration. Traditional exchanges require creating accounts with email addresses, phone numbers, and passwords. This information, even without full KYC, creates a profile that can be subpoenaed, hacked, or correlated with other data sources.

Privacy-focused exchanges operate on a wallet-to-wallet basis. You simply provide a receiving address, send your cryptocurrency, and the exchange returns the swapped asset. No emails, no passwords, no accounts to manage or protect.

Non-Custodial Operation Model

Non-custodial exchanges never hold your funds long-term, minimizing counterparty risk. Custodial exchanges hold your cryptocurrency in their wallets, requiring trust that they won’t lose, freeze, or misappropriate your funds. History has shown this trust is often misplaced, with numerous exchanges collapsing and taking customer funds.

Non-custodial instant exchanges work differently. Your funds remain in your control except during the brief swap window. You send cryptocurrency from your wallet, the exchange processes the swap, and the result goes directly to your destination wallet. No balances to freeze, no accounts to suspend.

How the Anonymous Exchange Process Works

The wallet-to-wallet exchange process takes minutes and requires only cryptocurrency addresses – no personal information.

Understanding the typical workflow helps you know what to expect when using a privacy-focused exchange service.

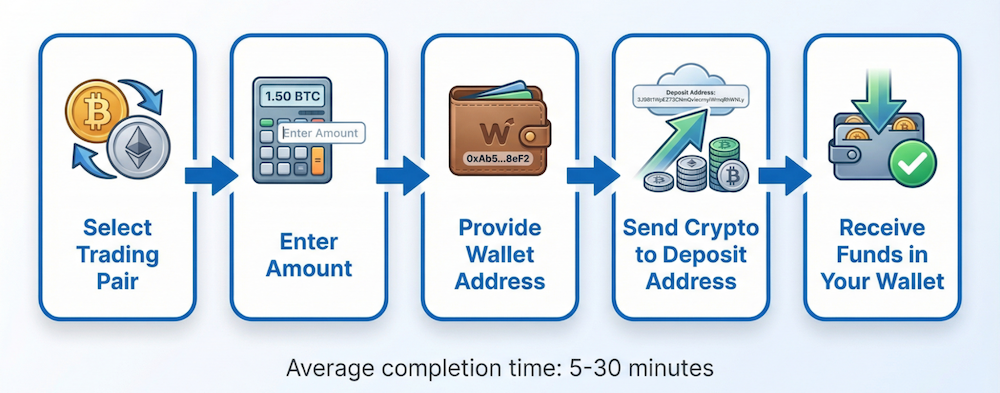

Step 1: Select your trading pair. Choose which cryptocurrency you’re sending and which you want to receive – for example, swapping Ethereum for Bitcoin.

Step 2: Enter the amount. The platform calculates and displays the exact amount you’ll receive, factoring in network fees and exchange rates.

Step 3: Provide your receiving address. This is the wallet where your exchanged cryptocurrency will arrive. Always double-check for accuracy – blockchain transactions are irreversible.

Step 4: Send to the generated deposit address. The exchange creates a unique address for your transaction. Transfer your source cryptocurrency from your personal wallet.

Step 5: Wait for confirmation. Once your deposit is confirmed on the blockchain, the exchange processes the swap and sends funds to your wallet. Most transactions complete within 5-30 minutes.

At no point should a legitimate privacy exchange ask for identification, email addresses, or account credentials. The transaction exists only as blockchain records, with no personal data linking you to the exchange.

Fixed vs. Floating Rates

Rate locking protects traders from market volatility during transaction processing. Some exchanges offer fixed-rate swaps that guarantee the quoted amount regardless of market movement during processing. Others use floating rates that adjust based on market conditions when your transaction confirms.

Fixed rates provide certainty – you know exactly what you’ll receive. This matters during volatile periods when prices can shift significantly in the minutes between initiating and completing a swap. The tradeoff is typically a slightly less favorable rate compared to floating options.

For larger transactions where even small percentage swings represent meaningful amounts, fixed-rate guarantees become particularly valuable. This feature separates professional-grade swap services from basic exchange tools.

Best Practices for Private Bitcoin Trading

Maximizing privacy requires careful attention to operational security beyond just exchange choice.

Choosing an anonymous bitcoin exchange is essential but not sufficient for comprehensive privacy. Your overall operational security practices determine how effectively you protect your financial information.

Always Use Fresh Wallet Addresses

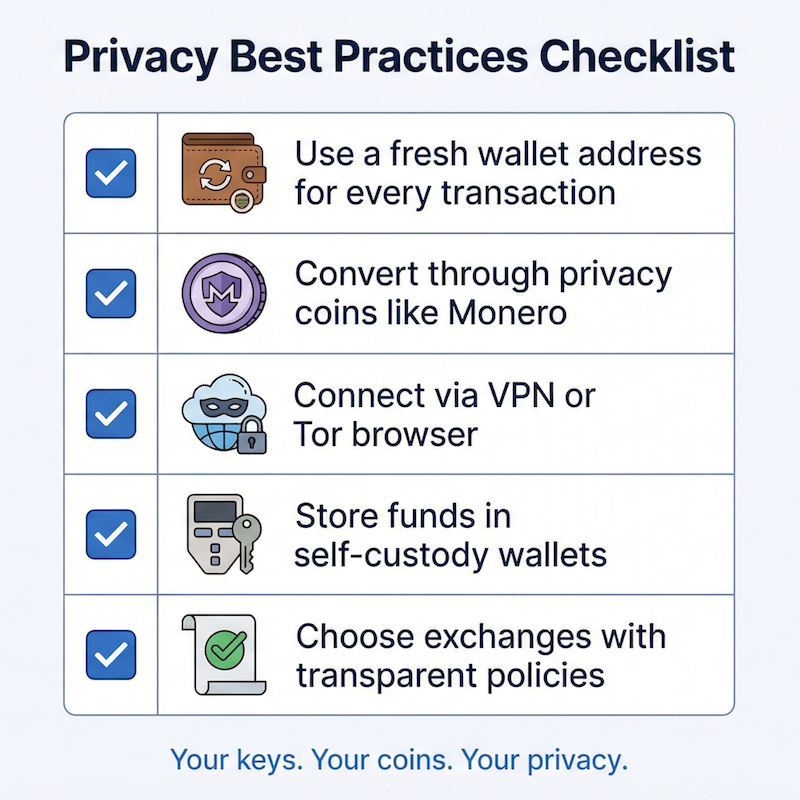

Address reuse creates linkable transaction histories that undermine privacy protections. Modern Bitcoin wallets generate new addresses for each transaction. Using this feature prevents blockchain analysts from easily connecting your transactions. When receiving Bitcoin from any exchange, always provide a freshly generated address from your wallet.

Similarly, if you later need to convert Bitcoin to another cryptocurrency, use a new receiving address for the destination funds. This practice breaks the chain of easily traceable transactions.

Consider Privacy Coins as Intermediaries

Converting through privacy-focused cryptocurrencies adds another layer of transaction obscurity. Monero (XMR) offers superior blockchain-level privacy compared to Bitcoin. By first converting to Monero and then to Bitcoin, you add significant complexity for anyone attempting to trace your transactions. Most privacy-respecting exchanges support Monero alongside hundreds of other assets.

This intermediate conversion strategy works well for users who receive cryptocurrency from known sources and want to break the connection before acquiring Bitcoin for private use.

Secure Your Network Connection

Using VPN services or Tor browser prevents IP address logging during exchange transactions. Even exchanges that don’t require accounts may log IP addresses during transactions. Using a reputable VPN service or accessing exchanges through the Tor browser prevents this potential privacy leak.

Be consistent with this practice. Using Tor once but not for subsequent transactions creates a pattern that might identify which transactions came from the same user.

Maintain Self-Custody of Your Bitcoin

Storing Bitcoin in personal wallets ensures long-term privacy and eliminates third-party risk. After receiving Bitcoin from your exchange transaction, store it in a wallet you control. Hardware wallets like Ledger or Trezor offer excellent security for long-term storage. Software wallets work well for smaller amounts you may need to access quickly.

Never leave significant Bitcoin holdings on any exchange, even private ones. The exchange is a tool for converting between assets, not a storage solution. Your keys, your coins – maintain control.

Understanding the Limitations of Anonymous Exchanges

Privacy-focused exchanges serve specific use cases and aren’t appropriate for every trading need.

While anonymous bitcoin exchanges offer valuable privacy protections, they operate within certain constraints that users should understand.

Crypto-to-Crypto Transactions Only

Anonymous exchanges cannot process fiat currency transactions due to banking regulations. Privacy-focused swap services operate exclusively in the cryptocurrency domain. You cannot directly purchase Bitcoin with dollars, euros, or other government currencies through these platforms. Fiat transactions inherently require identity verification due to banking regulations.

This means you need an initial cryptocurrency holding to use anonymous exchanges. Many users first acquire some cryptocurrency through peer-to-peer transactions, Bitcoin ATMs that accept cash, or by accepting cryptocurrency as payment for goods or services.

Jurisdictional Considerations

Users remain responsible for understanding and complying with local cryptocurrency regulations. Anonymous exchanges typically restrict access from certain jurisdictions where regulations prohibit such services. Users should verify that accessing these services is legal in their location before proceeding.

Privacy at the exchange level doesn’t eliminate tax reporting obligations or other legal requirements in your jurisdiction. Maintain appropriate records for your own compliance needs, even when the exchange doesn’t require them.

The Future of Anonymous Bitcoin Exchange Services

Privacy-preserving infrastructure becomes more critical as regulatory pressure on centralized exchanges increases.

The cryptocurrency landscape continues evolving, with regulators worldwide pushing for greater surveillance capabilities over financial transactions. The arrests of developers behind privacy tools like Tornado Cash and Samourai Wallet demonstrate the escalating pressure on privacy-preserving infrastructure.

In this environment, services that maintain genuine privacy commitments become increasingly valuable. They represent infrastructure that many users consider essential for preserving the original promise of cryptocurrency: financial sovereignty and freedom from surveillance.

The demand for bitcoin without KYC will likely grow as users experience account freezes, arbitrary verification requests, and privacy breaches at regulated exchanges. Platforms that have consistently honored their privacy commitments – never implementing verification triggers regardless of transaction size – will earn user trust through demonstrated reliability.

Conclusion: Protecting Your Financial Privacy

Choosing the right exchange is fundamental to maintaining financial privacy in the cryptocurrency space.

Financial privacy is a fundamental right increasingly under threat in the digital age. As surveillance capabilities expand and centralized exchanges accumulate vast databases of user information, the importance of privacy-preserving alternatives grows.

The market for truly anonymous exchanges has contracted significantly. Many former privacy champions have implemented conditional KYC systems that can surprise users mid-transaction. For those who remember what instant swap services used to offer universally, finding platforms that still honor that model requires careful research.

GODEX represents one of the remaining privacy-focused options for users seeking a streamlined trading experience. With extensive trading pair coverage, clear verification policies, and the wallet-to-wallet simplicity that defined early crypto exchanges, it delivers what privacy-conscious traders expect.

Whether you’re concerned about data breaches, government surveillance, or simply believe financial transactions should remain private, your exchange choice matters. In a world where privacy alternatives are increasingly scarce, due diligence in selecting your trading platform is time well spent.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Linda Larsen

Linda Larsen

Read more

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]