Table of Contents

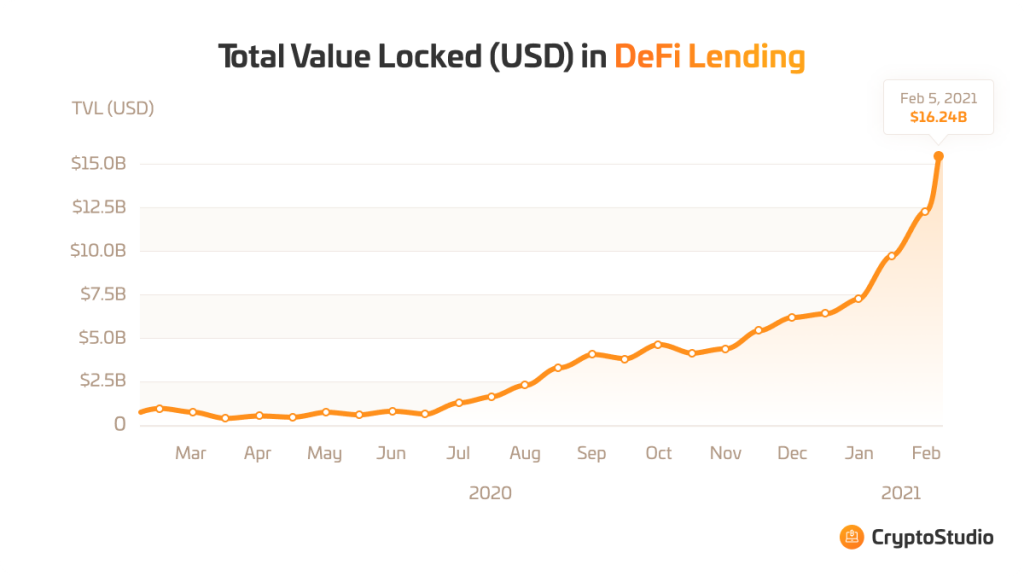

As cryptocurrency evolves, so does its utility beyond mere speculation. Crypto-lending, a cornerstone of decentralized finance (DeFi), has emerged as a dynamic avenue for investors. Since its inception alongside Bitcoin in 2009, crypto lending has burgeoned, becoming the largest segment of DeFi. The allure lies in its parallel to traditional finance—offering deposits, lending, and avenues for passive income. In the 2022-23 market, the demand for crypto lending has surged. It was greatly fueled by technological innovation and broader societal acceptance.

Statistical projections indicate substantial growth, with the global crypto lending market set to hit USD 5.5 billion by 2025. As DeFi continues to flourish, so does the appeal of crypto lending. This creates a lucrative alternative for those willing to leverage their crypto assets. Understanding its nuances is paramount in navigating this burgeoning landscape and safeguarding investments. Therefore, if you are interested in knowing what is crypto lending? and how does crypto lending work? – stay tuned.

What Is Crypto Lending?

Lending in the realm of cryptocurrency can be likened to renting out digital assets. In essence, it involves loaning cryptocurrencies at a specified interest rate. The fundamental concept revolves around users who possess or acquire a certain number of coins, subsequently leasing them to a third party, often a platform. This platform then puts these funds into circulation and assumes the role of guarantor for their eventual return.

Understanding Crypto Lending

Cryptocurrency exchanges and numerous traders often require borrowed funds in the crypto sphere. To access these funds, they are willing to compensate the capital owners. So, how does crypto loan work?

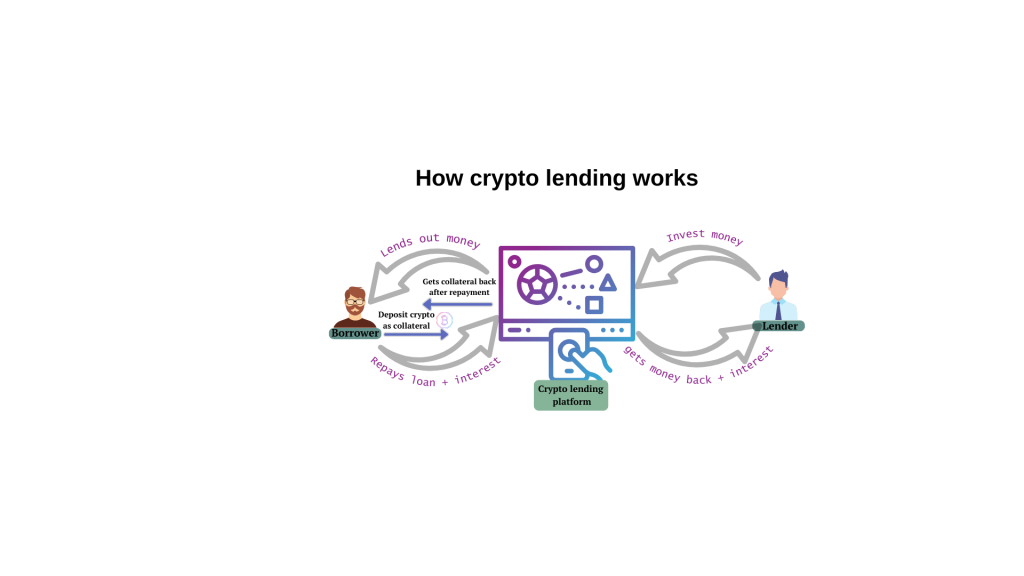

A conventional bank deposit is a familiar method of earning returns by entrusting fiat currency to a financial institution temporarily. The bank utilizes these funds for its operations, generating profits, and in return, provides interest to the depositor. Similarly, in the realm of cryptocurrencies, a parallel process occurs. Known as cryptocurrency lending, this method allows individuals to earn income by temporarily lending their coins to a trading platform. The process is automated and safeguarded by trading platforms, ensuring security throughout.

The concept is straightforward: users lend their existing cryptocurrency assets for a specified duration. These assets are then utilized by traders for margin trading on online platforms. However, a distinguishing feature is that the exchange acts as the intermediary, facilitating the transaction between borrower and lender. This arrangement eliminates direct interaction between the parties, streamlining operations and ensuring security.

The interest rate for utilizing these borrowed funds is determined by the selected platform. Additionally, legitimate borrowers can utilize crypto funds borrowed in this manner for business purposes, akin to a conventional bank loan.

Types of Crypto Loans

There are several types of crypto lending with their advantages and disadvantages:

Secured Loans

Secured loans, recognized as collateralized loans, stand as the primary mode of lending, demanding borrowers to furnish digital assets as collateral. As a rule, the size of the loan provided can be up to 50% of the value of the collateral. This implies that in order for a borrower to secure a loan of 5,000 USDT, they are required to provide digital assets valued at a minimum of 10,000 USDT as collateral. Loan platforms determine their specific conditions regarding the loan-to-value (LTV) ratio, repayment terms, and interest rates. The biggest benefit of this lending type for a crypto lender is the reduced risks, since the collateral is a guarantee that the debt will be repaid in any case. Nevertheless, not only the risks are low, but also the interest rates. In addition, the borrower also faces the risk that the collateral’s value will decline if the market falls, which could lead to its liquidation.

Unsecured Loans

Unsecured cryptocurrency loans offer funds without the need for collateral, albeit with elevated interest rates and more stringent terms aimed at mitigating the heightened risk for lenders. The absence of collateral presents considerable challenges for borrowers, exposing them to the unpredictable shifts and rapid volatility inherent in the cryptocurrency realm.

These loan agreements commonly feature clauses designed to safeguard the lender in instances of default, underscoring the importance for borrowers to meticulously examine and comprehend the terms. Failure to meet interest obligations can carry significant consequences, potentially resulting in financial penalties or tarnishing the borrower’s credit standing.

Margin Loans

This is collateralized lending, where traders borrow money on an exchange from other traders in the hope that the price of a crypto will rise or fall in the near future. This option is not suitable for novice traders, as it also increases the level of risk. But experienced people actively use it. Cryptocurrency is usually provided as collateral; Interest rates and limits vary across platforms. Margin lending is available on many major exchanges.

Flash Loans

Instantaneous loans known as flash loans are commonly accessible through cryptocurrency exchanges. They are acquired and settled within a single transaction, constituting loans of significant risk. Often utilized to exploit market arbitrage possibilities, these loans involve activities like purchasing cryptocurrency at a reduced rate in one market and promptly vending it for a higher price in another, all executed within the confines of one transaction.

Risks of Crypto Lending

Before delving into the realm of crypto borrowing, it’s vital to grasp the potential hazards lurking within. Here, we dissect the primary risks, empowering you to navigate this landscape with confidence.

Regulatory Uncertainty

Cryptocurrency regulations are in flux, with varying degrees of clarity across jurisdictions. This ambiguity poses challenges for both lenders and borrowers, as global regulations remain convoluted. While crypto lenders currently operate with less oversight compared to traditional banks, impending regulations could reshape this landscape.

Insolvency Peril

Entrusting your assets to a lending platform carries the risk of losing them in the event of platform insolvency. Financial instability or operational glitches can lead to catastrophic losses for investors, exemplified by recent bankruptcies within the crypto sphere.

Fee Opacity

Hidden fees lurking within some platforms can erode profits significantly. Thoroughly scrutinizing the fee structures of potential lending platforms is imperative to safeguarding your assets.

DeFi Dangers

Decentralized Finance (DeFi) platforms present allure but also harbor risks, notably the threat of rug pulls. These exit scams can leave investors holding worthless tokens, underscoring the importance of due diligence.

Security Breaches

The omnipresent specter of cybercrime looms over crypto lending, with hacking incidents posing a tangible threat to investors’ funds. In the absence of guarantees for compensation, vigilance is paramount.

Market Volatility

The inherently volatile nature of cryptocurrencies exposes lenders and borrowers alike to fluctuating asset values. Margin calls triggered by collateral depreciation necessitate swift action to avert potential liquidation risks.

Illiquidity Woes

Depositing assets onto lending platforms can render them illiquid, inhibiting quick access. While some platforms facilitate rapid withdrawals, others enforce prolonged waiting periods, constraining liquidity.

Regulatory Void

Unlike traditional banking institutions, crypto lending platforms operate in an unregulated environment, lacking the protective safety nets afforded by regulatory bodies.

Interest Rate Gambit

While certain crypto loans boast enticingly low rates, many carry hefty interest burdens, often exceeding 5% APR and scaling as high as 13% or more.

How to Get a Crypto Loan

The procedure for obtaining a crypto loan fluctuates based on the specific type of loan desired and the chosen lending platform. This might entail utilizing a prominent centralized crypto exchange offering a wide array of crypto assets and loan services. Alternatively, you might opt for Aave, an Ethereum-based DeFi protocol renowned for its popularity, particularly for flash loans. Typically, a crypto loan process encompasses the following steps:

- Identity Verification: Prior to accessing a crypto loan, most platforms require users to undergo identity verification to comply with KYC and AML regulations. This necessitates compiling essential documentation such as ID proof and address verification.

- Collateral Placement: Determine the necessary collateral amount and transfer the specified crypto assets to your lending account. The loan amount available to you typically hinges on the value of your collateral.

- Loan Application: After depositing and validating your collateral, proceed to submit a loan application specifying the desired amount and pertinent details. The platform will assess your collateral and approve the loan accordingly.

- Loan Disbursement: Following approval, the loan funds will be disbursed to your account or wallet on the lending platform, ready for utilization in trading, investment, or personal endeavors.

How to Lend Crypto

Becoming a crypto lender involves several key steps:

- Sign Up: Register on a reputable blockchain-based platform, completing necessary KYC/AML procedures.

- Deposit: Choose a supported crypto and transfer it to your lending account on the platform.

- Set Terms: Determine lending parameters like interest rate, loan duration, and collateral requirements.

- Lend Crypto: Initiate lending by offering your deposited crypto to borrowers, either directly or through automated processes.

- Earn Interest: Receive interest payments periodically, which can be in-kind or in the platform’s native coin, depending on the platform’s model.

Is Crypto Lending Safe?

Crypto lending can be safe if you choose reputable platforms and understand the risks. Look for platforms with robust security measures and transparent lending practices. Diversify your investments and only lend what you can afford to lose. Stay informed about market trends and regulations to make informed decisions. Overall, with caution and diligence, crypto lending can be a viable option in the realm of finance.

How Do You Make Money Lending Crypto?

To make money with lending, start by depositing crypto into a lending platform. You’ll earn interest on these deposits, often higher than traditional banks. Borrowers pay a portion of this interest, and your funds may also be invested for extra yield. As an investor, you contribute your crypto to a platform-managed pool and receive a share of the interest. Interest rates vary between 3% to 18%, depending on the platform and asset type. Diversify across platforms to spread risks and maximize returns. Be aware of high returns correlating with high risks and monitor rates for optimal profitability.

What Is Decentralized Finance (DeFi) Lending?

DeFi lending is a system where users can borrow and lend cryptocurrencies without traditional intermediaries like banks. Instead, it operates on the basis of smart contracts and lending pools. Lenders are liquidity providers by sending their assets to the pool. Borrowers take interest-bearing loans from this pool, and lenders receive a reward minus a small service commission. The loan repayment is guaranteed by its fully secured nature. DeFi lending offers greater accessibility, transparency, and potentially higher returns compared to traditional finance. It’s a revolutionary way of investing and accessing credit in the crypto space, disrupting conventional financial systems.

Conclusion

Before diving into crypto lending, grasp the risks, particularly during market downturns. Understand platform vulnerabilities and your account terms. For HODLers, lending can optimize idle assets. Thoroughly research platforms for safety. Beware of QuadrigaCX-like incidents. Due diligence is crucial; understand smart contract audits and project history. Despite risks, crypto lending can be rewarding with the right precautions. Stay informed and cautious, ensuring your lending journey is profitable and secure.

FAQ

Are there any taxes associated with crypto lending?

Yes, taxes can apply to crypto lending. Interest earned from lending may be subject to income tax. Additionally, capital gains tax may apply if you sell crypto assets received as interest. Consult a tax professional for guidance tailored to your situation.

Can I earn passive income with crypto lending?

Absolutely! Crypto lending allows you to earn passive income by lending out your digital assets to borrowers. You receive interest payments regularly without actively trading or managing investments. It’s a convenient way to grow your wealth.

What is DeFi lending, and how does it differ from traditional crypto lending?

DeFi lending operates on decentralized platforms using smart contracts. It offers instant loans and allows users to earn interest on deposited collateral. Unlike traditional crypto lending, DeFi platforms compound interest on minute-by-minute basis and require overcollateralization, maximizing returns for lenders.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]

Chiliz coin (CHZ) offers a compelling opportunity for traders interested in the intersection of blockchain technology and sports. By enabling fans to influence team decisions through the Socios app, Chiliz directly monetizes fan engagement and connects with major sports teams like Juventus and Paris Saint-Germain. These partnerships not only enhance the platform’s visibility but also […]

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]