Table of Contents

Privacy in cryptocurrency trading has become more crucial than ever, especially for German users navigating increasingly complex regulatory landscapes. As traditional exchanges tighten their verification requirements, the demand for best no KYC crypto exchanges in Germany continues to surge among privacy-conscious traders seeking financial sovereignty.

The European Union’s evolving crypto regulations, including the Markets in Crypto-Assets (MiCA) framework, have prompted many German traders to explore alternatives that preserve anonymity while ensuring secure transactions. Whether you’re a seasoned trader protecting your privacy or a newcomer seeking unrestricted access to digital assets, finding reliable no-KYC platforms requires careful evaluation of security, liquidity, and regulatory compliance.

In this comprehensive guide, we’ve analyzed 25 leading platforms that operate with minimal or no identity verification requirements, providing German users with viable alternatives to traditional, heavily regulated exchanges. Our research focuses on platforms that maintain operational excellence while respecting user privacy – a crucial balance in today’s regulatory environment.

Our Research Approach

Our team conducted extensive analysis to identify the best no KYC crypto exchanges in Germany, evaluating each platform against rigorous criteria to ensure reliability, security, and user protection. Here’s how we selected these top-tier platforms:

- Privacy Protection Level – Evaluation of KYC requirements, data collection practices, and anonymity preservation

- Security Infrastructure – Assessment of custody models, fund protection, and platform security measures

- Geographic Accessibility – Verification of availability for German users and VPN-friendliness

- Cryptocurrency Support – Analysis of supported assets, trading pairs, and cross-chain capabilities

- Platform Reliability – Examination of uptime, transaction success rates, and user experience quality

- Regulatory Compliance – Review of legal standing and compliance with applicable jurisdictions

- Liquidity and Volume – Assessment of trading depth and execution efficiency

- Fee Structure – Evaluation of transparent pricing and competitive rates

- Customer Support – Analysis of user assistance quality and response times

Comparison Table: Top No KYC Exchanges for German Users

| Exchange | Description | KYC Policy | Custody Model | Cryptocurrencies |

| Godex | Anonymous instant swaps | Zero KYC | Non-custodial | 893+ coins |

| Bisq | Decentralized P2P platform | No registration | Decentralized | 120+ assets |

| RetoSwap | Monero-focused P2P trading | None required | Non-custodial | Privacy coins |

| Uniswap | Leading DEX protocol | Permissionless | Non-custodial | Thousands |

| BasicSwap | Atomic swap DEX | Fully anonymous | Decentralized | 8+ chains |

| Haveno | Monero-focused P2P | Always non-KYC | Non-custodial | XMR pairs |

| Hyperliquid | DeFi derivatives platform | None required | Non-custodial | 100+ contracts |

| MEXC | Major centralized exchange | Flexible tiers | Custodial | 3000+ coins |

| dYdX | DeFi derivatives platform | Wallet-only | Non-custodial | 60+ markets |

| WEEX | High-limit trading | Optional KYC | Custodial | 1000+ coins |

| Margex | Derivatives specialist | KYC for fiat deposits | Custodial | 32+ pairs |

| UnstoppableSwap | BTC-XMR atomic swaps | Tor-based | Non-custodial | BTC/XMR only |

| Bitunix | Flexible verification | Progressive KYC | Custodial | 700+ pairs |

| BloFin | Advanced trading | Tiered system | Custodial | 350+ pairs |

| xchange.me | Anonymous Tor-compatible swaps | None required | Non-custodial | 200+ coins |

| Majestic Bank | Privacy-focused | Never KYC | Non-custodial | 6 coins |

| Hodl Hodl | Bitcoin P2P | Platform no-KYC | Non-custodial | BTC only |

| Pionex | Trading bots platform | Tiered | Custodial | 250+ coins |

| BYDFi | Multi-service exchange | Flexible limits | Custodial | 700+ coins |

| GhostSwap | Anonymous swapper | Zero verification | Non-custodial | 1500+ coins |

| Best Wallet | DEX aggregator | No accounts | Non-custodial | 60+ networks |

| Vexl | Social trading app | Phone only | Non-custodial | BTC/Lightning |

| Bitcoin Well | BTC-focused platform | Tiered approach | Non-custodial | BTC only |

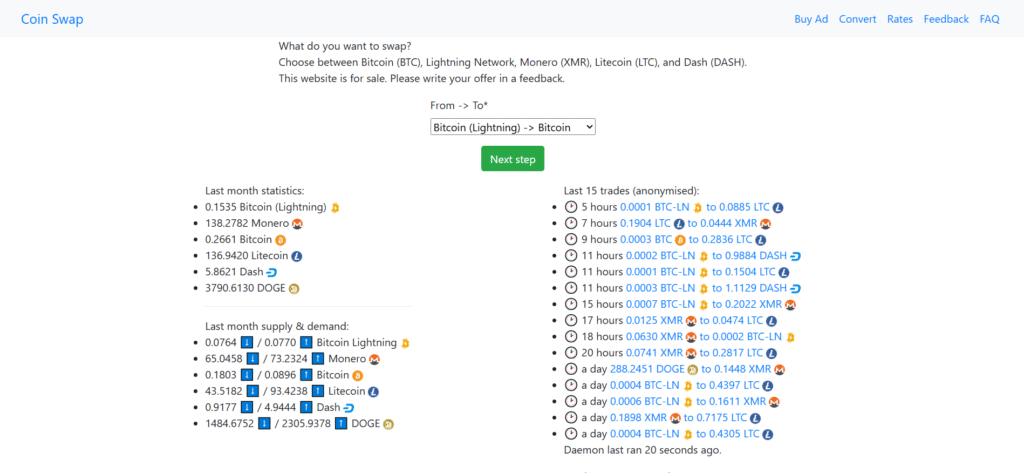

| coinswap | Simple exchanger | Refunds may require KYC | Non-custodial | Multi-crypto |

| Infinity Exchanger | Tor-exclusive privacy exchange | None required | Non-custodial | 4 assets |

Detailed Platform Reviews

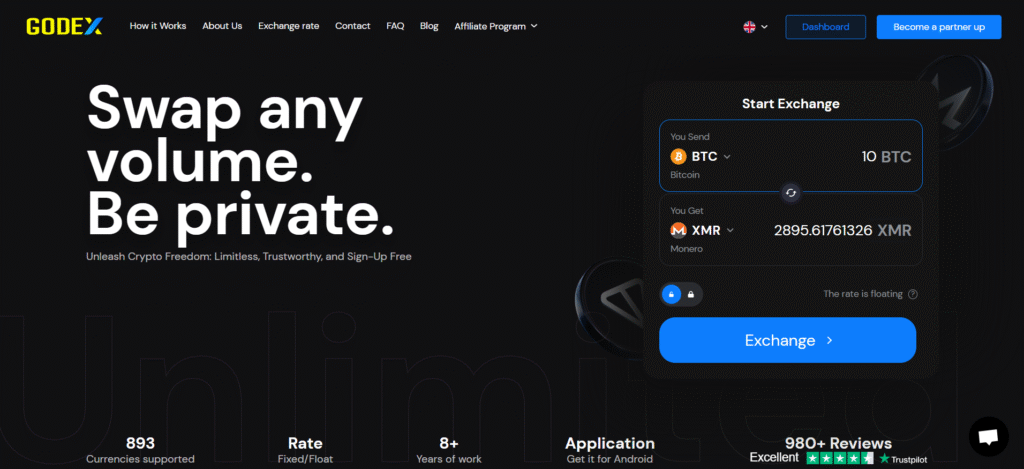

1. Godex

Godex stands out as the premier choice among privacy-focused cryptocurrency exchanges, maintaining an unwavering commitment to user anonymity since 2018. This platform operates with complete transparency about its privacy-first approach, requiring zero personal information while supporting an impressive 893+ cryptocurrencies. German users particularly appreciate Godex’s straightforward interface that eliminates the complexity often associated with privacy-focused platforms.

The platform’s non-custodial architecture ensures users never surrender control of their private keys, while atomic swap technology facilitates direct wallet-to-wallet transactions. Godex’s fixed-rate system provides price certainty – a crucial feature during volatile market conditions that German traders frequently encounter. The platform’s global accessibility makes it an ideal choice for European users seeking unrestricted access to cryptocurrency markets.

Key Features:

- Complete anonymity with zero data collection

- 893+ supported cryptocurrencies and tokens

- Fixed-rate exchanges with guaranteed pricing

- Non-custodial atomic swap technology

- Global access

- Affiliate program offering 0.6% commission

- No account creation or registration required

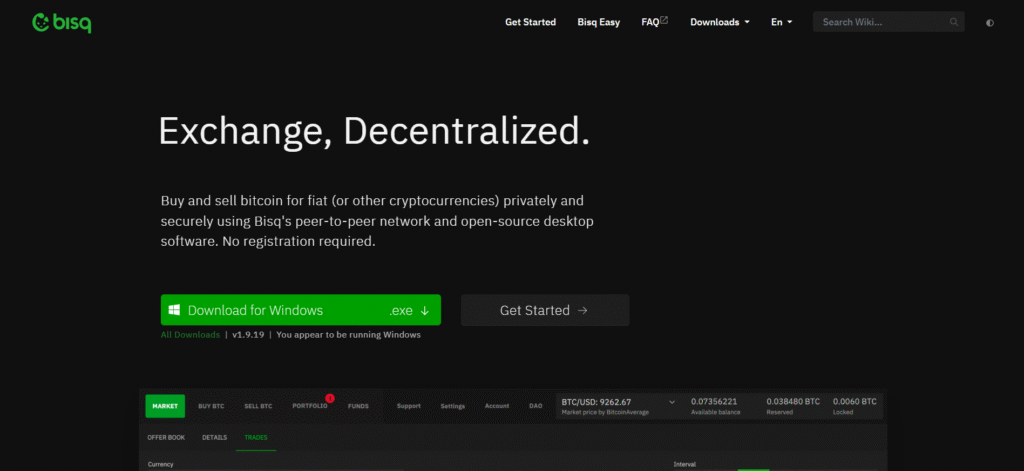

2. Bisq

Bisq represents the gold standard for decentralized trading among German cryptocurrency enthusiasts, offering a completely peer-to-peer experience that eliminates centralized points of failure. As one of the original best no KYC crypto exchanges in Germany, Bisq operates through a desktop application that connects traders directly via Tor network, ensuring maximum privacy and censorship resistance.

The platform’s innovative 2-of-3 multisignature escrow system provides security without requiring trust in centralized intermediaries. German users benefit from extensive fiat currency support, enabling direct EUR trades without conventional banking restrictions. Bisq’s governance through the BSQ token creates a truly community-driven ecosystem where users collectively determine platform evolution.

Key Features:

- Complete decentralization with no central authority

- Tor network integration for enhanced privacy

- 120+ trading assets with extensive fiat support

- 2-of-3 multisig escrow for secure transactions

- DAO governance through BSQ token

- Desktop application for Windows, Mac, Linux

- 1.3% total trading fees with no hidden costs

RetoSwap

RetoSwap

RetoSwap has established itself as a reliable option among German privacy-focused traders by maintaining complete user anonymity through its decentralized P2P architecture. The platform’s strict no-registration approach means all transactions proceed without verification, while sophisticated privacy features provide additional protection for users.

Operating as a Monero-centric platform with support for Bitcoin and other privacy coins, RetoSwap has processed numerous transactions while maintaining its commitment to user privacy. The platform’s integration with Tor networks provides German users with convenient access to privacy-preserving trading methods.

RetoSwap’s zero-fee structure and focus on privacy coins make it particularly valuable for users prioritizing maximum anonymity. The platform’s decentralized P2P model ensures resistance to censorship while maintaining security through escrow mechanisms.

Key Points:

- Complete anonymity with no registration required

- Monero-focused with Bitcoin support

- Tor network integration for enhanced privacy

- Zero trading fees across all supported pairs

- Decentralized P2P architecture

- Privacy-first community governance

4. Uniswap

4. Uniswap

Uniswap dominates the decentralized finance landscape as one of the most trusted no-KYC platforms for German users, offering completely permissionless trading through automated market makers. German DeFi enthusiasts particularly value Uniswap’s innovative approach to liquidity provision, where users can earn fees by contributing to trading pools while maintaining complete control over their assets.

The platform’s recent V4 implementation introduces customizable hooks that enable developers to create sophisticated trading strategies while preserving the core permissionless ethos. German users benefit from Uniswap’s multi-chain deployment across Ethereum, Polygon, Arbitrum, and other major networks, providing access to diverse ecosystems without compromising privacy or security.

Key Features:

- Completely permissionless with no registration required

- Automated Market Maker (AMM) technology

- Multi-chain deployment across major networks

- Thousands of supported ERC-20 tokens

- Liquidity provider rewards and yield opportunities

- V4 hooks for advanced trading strategies

- Open-source development with strong community governance

5. BasicSwap

5. BasicSwap

BasicSwap represents cutting-edge atomic swap technology among privacy-focused German exchanges, offering truly trustless cross-chain trading without intermediaries. This innovative platform, developed by the Particl ecosystem, enables German users to trade between different blockchains while maintaining complete privacy through Tor integration and SMSG network communication.

The platform’s browser-based interface masks sophisticated atomic swap protocols that enable direct peer-to-peer trading across incompatible blockchain networks. While BasicSwap currently supports a limited selection of privacy-focused cryptocurrencies, its technological foundation represents the future of decentralized cross-chain trading.

Key Features:

- Complete decentralization with atomic swap technology

- Tor network integration for maximum privacy

- SMSG network for anonymous communication

- Browser-based interface with local installation

- Cross-chain trading without intermediaries

- Open-source development with community governance

- No central points of failure or custody risk

6. Haveno

6. Haveno

Haveno emerges as the premier Monero-focused platform among German privacy advocates, built specifically for privacy coin enthusiasts who prioritize complete transaction anonymity. Forked from Bisq and rebuilt for the Monero ecosystem, Haveno operates exclusively through Tor network connections, ensuring that German users can trade with maximum privacy protection.

The platform’s commitment to permanent non-KYC status resonates strongly with German privacy advocates who seek alternatives to increasingly surveilled traditional financial systems. Haveno’s focus on Monero trading pairs provides direct access to the most privacy-preserving cryptocurrency while maintaining the security benefits of decentralized architecture.

Key Features:

- Explicit “always non-KYC” policy commitment

- Monero-focused trading with XMR pairs

- Complete Tor network integration

- 2-of-3 multisignature escrow system

- Community-driven development and governance

- Cross-platform availability for major operating systems

- AGPL v3 open-source licensing

7. Hyperliquid

7. Hyperliquid

Hyperliquid has carved out a significant niche among German privacy-conscious traders by prioritizing advanced DeFi functionality without sacrificing privacy protection. Since its launch, this platform has processed billions in transactions while maintaining its permissionless approach for standard derivatives trading.

German users particularly appreciate Hyperliquid’s sophisticated interface that eliminates the complexity often associated with traditional derivatives platforms. The platform’s on-chain perpetual contracts provide seamless access to 100+ trading pairs, while innovative features offer enhanced trading experiences for frequent users.

Hyperliquid’s Lightning-fast execution and zero gas fees enable efficient derivatives trading with minimal costs, making it ideal for sophisticated trading strategies. The platform’s decentralized nature allows community verification and continuous improvement.

Key Points:

- Zero KYC for perpetual contract trading

- 100+ supported trading pairs and contracts

- On-chain execution with zero gas fees

- Custom L1 blockchain technology

- Advanced trading tools and features

- Established track record in DeFi derivatives

8. MEXC

8. MEXC

MEXC stands out among privacy-conscious German traders for users requiring access to extensive cryptocurrency selections with flexible verification options. The platform’s impressive 3,000+ cryptocurrency support includes early access to emerging tokens, making it invaluable for German traders seeking exposure to innovative projects before they reach mainstream exchanges.

The exchange’s tiered KYC system allows unverified accounts to withdraw up to 10 BTC daily, providing substantial trading flexibility without immediate verification requirements. MEXC’s $526 million insurance fund and proof-of-reserves demonstrate institutional-grade security measures that protect user assets while maintaining competitive fee structures.

Key Features:

- 10 BTC daily withdrawals without verification

- 3,000+ cryptocurrencies with 2,900+ trading pairs

- Futures trading with up to 500x leverage

- $526 million insurance fund protection

- Extremely competitive fees (0% maker, 0.05% taker)

- Strong presence across 170+ countries

- Early access to emerging cryptocurrency projects

9. dYdX

9. dYdX

dYdX revolutionizes derivatives trading among German DeFi users by combining institutional-grade perpetual contracts with complete decentralization. Built on the dYdX Chain within the Cosmos ecosystem, the platform eliminated its KYC program in 2022 following community pressure, returning to its roots as a permissionless trading protocol.

German DeFi enthusiasts benefit from dYdX’s sophisticated order types and up to 50x leverage while maintaining complete control over their assets through self-custodial wallets. The platform’s 60+ perpetual markets provide extensive exposure to cryptocurrency derivatives without traditional financial intermediaries or geographic restrictions.

Key Features:

- Complete wallet-based access without registration

- 60+ perpetual contract markets

- Up to 50x leverage on derivative positions

- Built on Cosmos ecosystem for interoperability

- Advanced order types for sophisticated trading

- Community governance through dYdX Foundation

- Eliminated KYC requirements in 2022

10. WEEX

10. WEEX

WEEX distinguishes itself among privacy-focused German platforms by offering exceptionally high withdrawal limits without verification requirements. German traders can access up to 500,000 USDT daily withdrawals without KYC, with optional verification increasing limits to 2,000,000 USDT while providing a $10 bonus reward for completion.

The Singapore-based platform serves over 6.2 million users across 130+ countries with comprehensive licensing including MSB registration in the US and Canada. WEEX’s 1,000 BTC protection fund and proof-of-reserves provide additional security assurance for users managing substantial cryptocurrency portfolios.

Key Features:

- 500,000 USDT daily withdrawals without KYC

- Optional verification with $10 bonus reward

- 1000+ coins with 1,500+ trading pairs

- Futures trading with 200x leverage capability

- Multiple international licenses and compliance

- 1,000 BTC protection fund for user security

- Competitive fees with 0% maker spot trading

11. Margex

11. Margex

Margex has established itself as a premier derivatives platform among German traders, requiring only email addresses for account creation while providing access to sophisticated trading tools and crypto-to-crypto transactions. The Seychelles-based platform offers up to 100x leverage on 32 cryptocurrencies with 47 trading pairs, focusing on major assets paired with USD derivatives.

German traders particularly value Margex’s MP Shield protection system that guards against price manipulation and sudden market movements. The platform’s copy trading feature enables less experienced users to follow successful traders while maintaining complete anonymity throughout the process.

Key Features:

- Complete anonymity with email-only registration

• Up to 100x leverage on major cryptocurrencies

• MP Shield protection against price manipulation

• Copy trading with successful trader strategies

• Multi-collateral wallet system

• Unregulated status for maximum flexibility

• Beginner-friendly interface with advanced features

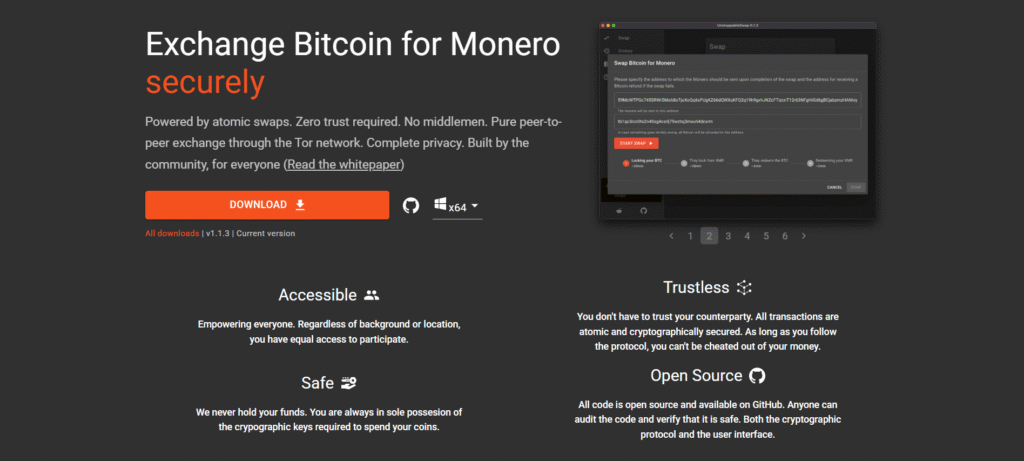

12. UnstoppableSwap

12. UnstoppableSwap

UnstoppableSwap represents the cutting edge of atomic swap technology among German privacy enthusiasts, specializing exclusively in Bitcoin-Monero exchanges through trustless protocols. The desktop application operates entirely over Tor network, ensuring maximum privacy for users seeking to exchange between Bitcoin and Monero without intermediaries.

German privacy advocates particularly appreciate UnstoppableSwap’s maker/taker model where liquidity providers set their own rates while maintaining complete anonymity. The platform’s community funding through Monero CCS demonstrates strong grassroots support for privacy-preserving technology development.

Key Features:

- Exclusive Bitcoin-Monero atomic swap focus

- Complete Tor network integration

- Desktop GUI for Windows, Mac, and Linux

- Maker/taker model with variable pricing

- Community-funded development through Monero CCS

- Trustless atomic swap technology

- Open-source development with transparent governance

13. Bitunix

13. Bitunix

Bitunix offers a sophisticated tiered approach among German privacy-conscious users, with its KYC0 level allowing up to 500,000 USDT daily withdrawals without any verification requirements. The platform’s progressive verification system enables users to increase limits gradually while maintaining substantial trading capabilities at the entry level.

Founded in 2021 and serving over 2 million users globally, Bitunix combines competitive fee structures with robust security measures including 100% cold wallet storage claims and proof-of-reserves auditing. German users benefit from the platform’s beginner-friendly interface while accessing advanced features like perpetual futures with 125x leverage.

Key Features:

- 500,000 USDT daily withdrawals without verification

- Progressive KYC tiers up to 5,000,000 USDT daily

- Over 700 crypto pairs with 441 supported coins

- Perpetual futures trading with 125x leverage

- TradingView integration for advanced charting

- Copy trading with successful trader strategies

- 100% cold wallet storage claims

14. BloFin

14. BloFin

BloFin emerges as a sophisticated option among German institutional traders, offering Level 0 accounts with 20,000 USDT daily withdrawals without personal information requirements. The platform’s partnership with Fireblocks provides institutional-grade custody solutions while maintaining flexible verification options for privacy-conscious users.

Founded in 2020 and launched in 2023, BloFin has rapidly ascended to top-tier status through strategic partnerships and focus on derivatives trading. German users benefit from the platform’s 350+ trading pairs and up to 150x leverage while enjoying optional KYC policies that accommodate VPN usage from restricted jurisdictions.

Key Features:

- 20,000 USDT daily withdrawals without verification

- Progressive verification up to 2,000,000 USDT daily

- Fireblocks partnership for institutional custody

- 350+ trading pairs with derivatives focus

- Up to 150x leverage on futures contracts

- Copy trading and advanced order types

- VPN-friendly policies for global access

15. xchange.me

15. xchange.me

xchange.me maintains a pragmatic approach among German traders through its complete no-KYC system that allows all transactions to proceed without identity verification. Operating for several years with a focus on user privacy, the platform has refined its anonymous approach to balance user privacy with reliable service delivery.

German users benefit from xchange.me’s straightforward operation, with email-free access for all trading activities. The platform’s commitment to privacy extends beyond simple KYC avoidance to include sophisticated privacy-preserving technologies across multiple cryptocurrency pairs.

Technical users appreciate xchange.me’s Tor compatibility and reliable processing times. The platform’s anonymous operation and transparent fee structure demonstrate commitment to privacy-focused trading without unnecessary complications.

Key Features:

- Complete no-KYC operation with full anonymity

- 200+ cryptocurrencies with privacy focus

- Tor network compatibility for enhanced privacy

- Transparent pricing without hidden fees

- Email-free access and registration

- Operating since 2015 with proven privacy track record

- Non-custodial approach ensuring user fund control

![]() 16. Majestic Bank

16. Majestic Bank

Majestic Bank represents uncompromising privacy commitment among German users, with explicit terms stating that KYC will never be requested from users. Operating on both clearnet and darknet with v3 hidden service support, the platform caters specifically to users prioritizing maximum privacy over convenience.

The exchange focuses on privacy coins including Bitcoin, Monero, Litecoin, and other privacy-preserving cryptocurrencies. Despite its controversial reputation and mixed user feedback, Majestic Bank maintains operational consistency for users seeking completely anonymous cryptocurrency exchanges without any verification requirements.

Key Features:

- Explicit “never KYC” policy commitment

- Darknet availability with v3 hidden service

- Focus on privacy coins including Monero and Bitcoin

- Military-grade encryption for data protection

- Mobile-friendly minimalist interface

- SegWit support for Bitcoin transactions

- Sponsors privacy-focused cryptocurrency events

17. Hodl Hodl

17. Hodl Hodl

Hodl Hodl operates as a specialized Bitcoin marketplace among German Bitcoin enthusiasts, focusing exclusively on peer-to-peer Bitcoin trading without platform-imposed verification requirements. While individual sellers may request verification, the platform itself maintains a no-KYC policy and advises users to choose verification-free trading partners.

The platform’s 2-of-3 multisignature escrow system provides security for direct Bitcoin trades while maintaining non-custodial operations. German users particularly value Hodl Hodl’s support for cash-based transactions and diverse payment methods that enable private Bitcoin acquisition without traditional banking oversight.

Key Features:

- Platform-level no-KYC policy with email-only registration

- Exclusive focus on Bitcoin peer-to-peer trading

- 2-of-3 multisignature escrow for transaction security

- Support for cash-based and alternative payment methods

- Web-based interface with global accessibility

- Contract-based trading using smart contract technology

- Operating since 2018 with proven reliability

18. Pionex

18. Pionex

Pionex distinguishes itself among German automated trading enthusiasts through its innovative approach to automated trading with minimal verification requirements. The platform’s Light KYC (Level 1) requires only basic information like name and country, while providing access to 16 free integrated trading bots that automate various trading strategies.

As a market maker for major exchanges like Binance and Huobi, Pionex benefits from deep liquidity while offering competitive 0.05% trading fees. German users appreciate the platform’s focus on automated trading tools that eliminate emotional decision-making while maintaining relatively low verification barriers.

Key Features:

- Light KYC requiring only name and country information

- 16 free integrated trading bots including Grid and DCA

- Market maker status for Binance and Huobi liquidity

- 250+ cryptocurrencies with 430+ tokens listed

- Competitive 0.05% trading fees

- Copy trading with successful automated strategies

- MSB license from FinCEN with global operations

19. BYDFi

19. BYDFi

BYDFi offers comprehensive trading services among German users with unverified accounts supporting $50,000 daily withdrawals. The Singapore-based platform, rebranded in 2023, provides access to 557+ cryptocurrencies with 800+ trading pairs while maintaining flexible verification requirements that accommodate privacy-conscious users.

The platform’s evolution from its 2020 founding demonstrates adaptability to changing market conditions while preserving user-friendly policies. German traders benefit from BYDFi’s advanced features including futures trading with 200x leverage, copy trading systems, and the innovative MoonX memecoin platform for early-stage token access.

Key Features:

- $50,000 daily withdrawals for unverified accounts

- 700+ cryptocurrencies with 800+ trading pairs

- Futures trading with up to 200x leverage

- Copy trading and automated strategy systems

- MoonX platform for memecoin and early-stage tokens

- Multiple international licenses including US MSB

- TradingView integration for professional analysis

20. GhostSwap

20. GhostSwap

GhostSwap positions itself as a cutting-edge solution among German privacy advocates, maintaining complete user anonymity while supporting over 1,500 cryptocurrencies through advanced atomic swap technology. The platform’s recent launch capitalizes on growing demand for privacy-preserving exchange services among German cryptocurrency enthusiasts.

The exchange’s three-step swap process eliminates complexity while preserving anonymity through encrypted protocols and direct wallet-to-wallet transfers. GhostSwap’s marketing as the “Best No-KYC Exchanger of 2024” reflects its ambition to compete with established players while maintaining uncompromising privacy standards.

Key Features:

- Zero identity verification with complete anonymity

- 1,500+ cryptocurrencies with multi-blockchain support

- Advanced encryption protocols for privacy protection

- Intuitive three-step swap process

- Real-time exchange rates with transparent fees

- Direct wallet-to-wallet transfer technology

- Recent launch with privacy-first mission

21. Best Wallet

21. Best Wallet

Best Wallet revolutionizes decentralized trading among German DeFi enthusiasts by combining wallet functionality with DEX aggregation across hundreds of liquidity pools. The platform’s non-custodial architecture ensures users maintain complete private key control while accessing optimal trading routes across 60+ blockchain networks.

German DeFi enthusiasts benefit from Best Wallet’s commission-free DEX integration and $BEST native token ecosystem. The platform’s upcoming token access feature provides early exposure to new cryptocurrency projects while maintaining the privacy and security advantages of decentralized infrastructure.

Key Features:

- Complete anonymity with direct wallet connection

- DEX aggregator connecting hundreds of liquidity pools

- 60+ blockchain networks with thousands of cryptocurrencies

- Commission-free trading with no platform fees

- $BEST native token for ecosystem benefits

- Built-in analytics and upcoming token access

- Multi-platform seamless transition capabilities

22. Vexl

22. Vexl

Vexl introduces innovative social trading concepts among German Bitcoin enthusiasts, requiring only phone number verification while enabling Bitcoin trading through social network connections. Backed by SatoshiLabs and built by the Vexl Foundation, the platform emphasizes peer-to-peer trading within trusted social circles.

The app’s unique approach connects users with contacts and contacts-of-contacts for Bitcoin trading, creating a social layer that enhances trust while maintaining privacy. German users particularly appreciate Vexl’s zero-fee structure and Lightning Network integration that enables instant Bitcoin transactions without traditional exchange intermediaries.

Key Features:

- Phone number verification only with no identity documents

- Social network trading with contacts and connections

- Bitcoin-only focus with Lightning Network integration

- Zero fees and commissions on all transactions

- End-to-end encrypted messaging for communication

- Backed by SatoshiLabs with strong privacy advocacy

- Growing European user base with anti-KYC activism

23. Bitcoin Well

23. Bitcoin Well

Bitcoin Well serves German Bitcoin maximalists through its unique tiered approach that includes Light Accounts for gift card purchases without email requirements. The platform’s primary focus on Bitcoin self-custody aligns with privacy-conscious users seeking to maintain control over their cryptocurrency holdings.

Operating primarily in Canada with international expansion, Bitcoin Well’s non-custodial approach ensures immediate transfer to user-controlled wallets. The platform’s 1.2% spread with no hidden fees provides transparent pricing, while the Infinite Service OTC desk accommodates large transactions exceeding $50,000 with personalized service.

Key Features:

- Light Account tier requiring no email for gift cards

- Bitcoin-only focus with Lightning Network support

- Non-custodial platform with immediate self-custody

- 1.2% spread with transparent fee structure

- OTC desk for transactions exceeding $50,000

- 280+ Bitcoin ATMs

- FINTRAC compliance with “Enable your independence” mission

24. coinswap

24. coinswap

coinswap operates as a minimalist option among German users seeking basic functionality, providing email-free trading with anonymous transactions for users seeking basic cryptocurrency exchange services. The platform supports Bitcoin, Lightning Network, Monero, Litecoin, and Dash through atomic swap technology and escrow-based processing.

Despite its simple approach and privacy focus, coinswap currently experiences operational challenges with stuck trades and service problems. German users should exercise caution and conduct thorough due diligence before using this platform, as limited customer service infrastructure may complicate problem resolution.

Key Features:

- Email-free trading with anonymous transactions

- Multi-crypto support including Bitcoin and Lightning

- Atomic swap technology for cross-chain exchanges

- Simple interface for basic cryptocurrency swaps

- Privacy-focused mission with minimal data collection

- Currently experiencing operational difficulties

- Limited customer service and transparency

25. Infinity Exchanger

25. Infinity Exchanger

https://exchanger.infinity.taxi/

Infinity Exchanger completes our list as a specialized privacy-focused platform serving users who prioritize complete anonymity above all other considerations. Operating exclusively through Tor networks, the exchange offers sophisticated privacy features including multi-output transactions and reusable addresses.

The platform supports Bitcoin, Bitcoin Cash, Litecoin, and Monero with particular focus on privacy-preserving features. Infinity Exchanger’s emphasis on operational security and user anonymity makes it suitable for privacy-conscious users comfortable with technical complexity.

With its 4% fixed fee structure and specialized privacy tools, Infinity Exchanger demonstrates commitment to serving users who require maximum anonymity. The platform’s exclusive darknet operation and advanced privacy features provide additional layers of protection for German users.

Key Features:

- Tor-exclusive operation for maximum privacy

- Multi-output functionality for enhanced anonymity

- Reusable address system for privacy protection

- Support for Bitcoin, Bitcoin Cash, Litecoin, Monero

- 4% fixed fee structure across all transactions

- Advanced privacy tools and features

- Specialized focus on anonymity over convenience

How to Exchange Crypto Anonymously

Step 1: Choose Your Platform Select an appropriate exchange from our list of best no KYC crypto exchanges in Germany based on your specific requirements. Consider factors like supported cryptocurrencies, transaction limits, and privacy features.

Step 2: Prepare Your Wallets Ensure you have control of both source and destination wallets. Use hardware wallets or reputable software wallets where you control private keys. Never use exchange-provided addresses as your primary storage.

Step 3: Initiate the Exchange Navigate to your chosen platform and enter the trading pair details. Specify the exact amounts and double-check destination addresses to prevent irreversible errors.

Step 4: Execute the Transaction Send your source cryptocurrency to the provided address within the specified timeframe. Monitor the transaction through blockchain explorers while maintaining operational security.

Step 5: Receive Your Assets Confirm receipt of exchanged cryptocurrency in your destination wallet. Verify transaction completion and store relevant transaction hashes for your records.

Risks of Using Exchanges with KYC Requirements

Data Breaches and Identity Theft Centralized exchanges storing customer data create honeypots for cybercriminals. German users face particular risks given the comprehensive personal information required by EU regulations, including passport scans, proof of address, and financial documentation that criminals can exploit for identity theft or financial fraud.

Government Surveillance and Privacy Erosion KYC compliance enables comprehensive transaction monitoring by government agencies, creating permanent financial surveillance networks. German authorities can access trading histories, portfolio compositions, and transaction patterns, fundamentally undermining the privacy and financial sovereignty that cryptocurrency originally promised.

Regulatory Overreach and Account Freezing Exchanges with KYC requirements can freeze accounts or restrict withdrawals based on algorithmic compliance systems or regulatory pressure. German users may find their funds inaccessible due to policy changes, suspicious activity flags, or evolving regulatory interpretations that retroactively affect existing accounts.

Cross-Border Reporting and Tax Implications KYC information enables automatic reporting to tax authorities across multiple jurisdictions through international cooperation agreements. German residents using KYC exchanges may face unexpected tax obligations in other countries where they’ve never resided, creating complex compliance burdens and potential legal exposure.

Long-Term Privacy Degradation Personal information provided to KYC exchanges becomes permanently associated with cryptocurrency addresses, creating lasting privacy vulnerabilities. Even after account closure, German users’ trading patterns remain linked to their identities, potentially affecting future financial opportunities or exposing them to targeted attacks based on their cryptocurrency holdings.

How to Evaluate Exchange Security

Step 1: Assess Custody Models Examine whether the exchange maintains custody of user funds or operates as a non-custodial platform. Non-custodial exchanges eliminate counterparty risk, while custodial platforms should demonstrate robust security measures including cold storage, insurance coverage, and regular audits.

Step 2: Review Technical Infrastructure Investigate the platform’s underlying technology, including smart contract audits for DeFi protocols, atomic swap implementations for cross-chain platforms, and security certifications for centralized exchanges. Look for transparency in technical documentation and regular security updates.

Step 3: Analyze Track Record and Reputation Research the platform’s operational history, including any security incidents, hack recoveries, or regulatory issues. Check community forums, social media, and security research publications for independent assessments of platform reliability and user experiences.

Step 4: Verify Transparency and Governance Evaluate the platform’s commitment to transparency through proof-of-reserves audits, open-source code availability, and clear governance structures. Decentralized platforms should demonstrate active community participation, while centralized exchanges should provide regular transparency reports.

Step 5: Test with Small Amounts Before committing significant funds, conduct test transactions with minimal amounts to evaluate platform performance, customer support responsiveness, and transaction completion reliability. This practical testing reveals operational quality that documentation may not capture.

Final Words

The landscape of privacy-focused cryptocurrency trading continues evolving as German users seek alternatives to increasingly regulated traditional platforms. Among the 25 platforms analyzed, Godex emerges as the clear leader among best no KYC crypto exchanges in Germany, combining unparalleled privacy protection with exceptional usability that sets the standard for anonymous cryptocurrency trading. While German traders now have access to sophisticated options ranging from completely decentralized protocols like Bisq and Uniswap to specialized solutions like Haveno and UnstoppableSwap, Godex’s balanced approach delivers institutional-level security without compromising user anonymity. Its zero-KYC policy, support for 893+ cryptocurrencies, proven track record since 2018, and fixed-rate system provide the certainty and control that privacy-conscious German traders demand in today’s volatile regulatory environment.

As regulatory frameworks continue developing across Europe, the importance of preserving access to best no KYC crypto exchanges in Germany becomes increasingly apparent, with Godex leading this movement through its unwavering commitment to user anonymity and operational excellence. German users should approach these platforms with appropriate security measures, diversify across multiple exchanges to reduce concentration risk, and stay informed about evolving regulatory landscapes that may affect platform availability. For those seeking the optimal combination of privacy, security, and usability, Godex’s proven methodology and comprehensive cryptocurrency support make it the definitive choice for preserving financial sovereignty in an increasingly surveilled digital landscape.

Frequently Asked Questions (FAQ)

What crypto exchange doesn’t require KYC?

Several exchanges operate without KYC requirements, including decentralized platforms like Bisq and Uniswap, as well as instant swap services like Godex and ChangeNOW. Godex stands out as a particularly reliable option, offering complete anonymity while supporting 893+ cryptocurrencies with fixed-rate exchanges. These platforms prioritize user privacy by eliminating identity verification requirements entirely.

What wallet has no KYC?

Most non-custodial wallets don’t require KYC since they operate as software applications rather than exchange services. Popular options include hardware wallets like Ledger and Trezor, software wallets like Electrum and Exodus, and mobile wallets like Trust Wallet. These wallets allow users to maintain complete control over their private keys without any identity verification requirements.

Is no KYC legal?

Using no-KYC exchanges is generally legal in most jurisdictions, as regulations typically target the service providers rather than individual users. However, legal requirements vary by country, and users remain responsible for tax compliance regardless of KYC status. German users should consult local regulations and tax obligations when using any cryptocurrency exchange services.

Can I transfer crypto without KYC?

Yes, cryptocurrency transfers between personal wallets don’t require KYC as they occur directly on blockchain networks without intermediaries. Peer-to-peer transactions, decentralized exchanges, and wallet-to-wallet transfers operate independently of traditional financial oversight. Only centralized exchanges and certain service providers typically impose KYC requirements on their platforms.

What is KYC?

Know Your Customer (KYC) refers to identity verification processes that financial institutions use to confirm customer identities and assess risk levels. These procedures typically require government-issued identification, proof of address, and sometimes additional documentation like income verification. KYC compliance helps institutions meet anti-money laundering (AML) regulations and prevent financial crimes.

Why use a non-KYC exchange?

Non-KYC exchanges preserve financial privacy, eliminate data breach risks, and provide unrestricted access to cryptocurrency markets without bureaucratic delays. They enable users to maintain pseudonymous transactions, avoid government surveillance, and protect sensitive personal information from potential misuse. These platforms appeal to users prioritizing financial sovereignty and privacy rights in an increasingly monitored digital landscape.

Are non-KYC exchanges safe?

Safety depends on the specific platform’s security measures, custody model, and operational practices rather than KYC status alone. Reputable non-KYC exchanges like Godex and Bisq employ robust security protocols, non-custodial architectures, and transparent operations to protect user funds. Users should evaluate each platform’s track record, security audits, and community reputation before committing significant assets.

Do you need KYC to buy crypto?

KYC requirements vary significantly depending on the platform and purchase method used. Centralized exchanges typically require extensive verification, while peer-to-peer platforms, DEXs, and certain instant swap services operate without identity checks. Cash purchases, atomic swaps, and decentralized trading methods generally don’t require any personal information disclosure.

Is there a way to buy crypto without KYC?

Multiple methods exist for purchasing cryptocurrency without identity verification, including peer-to-peer marketplaces, Bitcoin ATMs, cash transactions, and decentralized exchanges. Instant swap services and atomic swap protocols also enable cryptocurrency acquisition without personal data submission. These alternatives provide accessible entry points for privacy-conscious users seeking anonymous cryptocurrency access.

Where to buy crypto with no KYC?

No-KYC cryptocurrency purchases are available through decentralized exchanges like Uniswap, peer-to-peer platforms like Bisq and Hodl Hodl, and instant swap services like Godex and SimpleSwap. Bitcoin ATMs, cash-based marketplaces, and atomic swap protocols also provide anonymous purchase options. Each method offers different trade-offs between convenience, privacy, and asset selection.

Can I withdraw crypto without KYC?

Withdrawal policies vary significantly between platforms, with many exchanges offering substantial limits without verification requirements. Non-custodial platforms and decentralized exchanges don’t impose withdrawal restrictions since users maintain direct fund control throughout transactions. Some centralized exchanges provide daily withdrawal limits ranging from hundreds to hundreds of thousands of dollars without requiring identity verification.

Is there an anonymous crypto exchange?

Yes, several exchanges operate with complete anonymity, including decentralized platforms like Bisq and Haveno, atomic swap services like UnstoppableSwap, and instant exchangers like Godex. These platforms don’t collect personal information, operate through privacy networks like Tor, and maintain non-custodial architectures. Godex exemplifies this approach by combining complete anonymity with extensive cryptocurrency support and user-friendly interfaces.

What’s the safest crypto exchange?

Safety depends on security practices, custody models, and operational transparency rather than any single factor. Decentralized exchanges like Bisq and Uniswap eliminate counterparty risk through non-custodial operations, while established platforms like Godex demonstrate consistent security through years of reliable operation. Users should prioritize platforms with proven track records, transparent security measures, and strong community reputations.

How do I buy BTC with no verification?

Bitcoin can be purchased without verification through peer-to-peer marketplaces, Bitcoin ATMs, cash transactions, and instant swap services that don’t require registration. Platforms like Hodl Hodl, Bisq, and certain Bitcoin ATMs enable direct purchases using cash or alternative payment methods. Instant exchangers also allow Bitcoin acquisition by swapping other cryptocurrencies without identity verification requirements.

What crypto sites don’t require ID?

Numerous platforms operate without ID requirements, including decentralized exchanges (Uniswap, Bisq), instant swap services (Godex, ChangeNOW, SimpleSwap), and peer-to-peer marketplaces (Hodl Hodl, Vexl). Privacy-focused platforms like Majestic Bank and atomic swap services like UnstoppableSwap also provide completely anonymous trading experiences. These sites prioritize user privacy by eliminating identity verification entirely.

How can you get around wallet verifications on exchanges?

The most effective approach involves using non-custodial platforms that don’t require verification rather than attempting to circumvent existing policies. Decentralized exchanges, atomic swap protocols, and instant exchangers provide legitimate alternatives without identity requirements. Users can also utilize peer-to-peer trading, Bitcoin ATMs, and privacy-focused platforms that design their services around anonymity rather than implementing verification as an afterthought.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

The exponential growth of Bitcoin Satoshi Vision (BSV) against the general bear trend on the cryptocurrency market in autumn 2019 has impressed the community. Due to the increasing market capitalization, the newly emerged altcoin was ranked 5th on CoinMarketCap and managed to maintain its high position at the beginning of 2020. In the article we […]

EOS is definitely on the list of the strongest and most stable projects in the crypto world. Despite the fact that the currency entered the market less than 3 years ago, it consistently occupies one of the top 10 places in the rating for project capitalization. it is often called the “main competitor of Ethereum”. […]

Ripple (XRP) price has been widely discussed by the cryptocurrency community since it has gained public interest in 2017, even though it was founded by Chris Larsen and Jed McCaleb years before. The platform offers innovative blockchain solutions for the banking sector and has the potential to disrupt the whole finance industry. In recent years, […]

In this article we will talk about Ripple (XRP) and its price prediction. What is Ripple (XRP) Ripple is a San Francisco-based startup that was launched in 2012 by Ripple Labs as a global network both for cross-currency and gross payments. Ripple history began in 2004 with the discussions around the digital coin in the […]

You may well think that an article dedicated to a Tether price prediction or the Tether price in general is a little bit strange — it is a stablecoin after all. However, the price of Tether does fluctuate significantly, although it is nowhere near as volatile as non-stablecoin cryptos. This means that staying up to […]

In the article we share our vision at Zcash cryptocurrency main features and add several price predictions. As cryptocurrencies gain global acceptance and decentralisation slowly enters our lives, privacy becomes the main concern when talking about blockchain adoption. It is no secret that distributed ledger is by far the most secure and transparent technology ever […]